Tech Entrepreneurship, Economics, Life Philosophy and much more!

Tech Entrepreneurship, Economics, Life Philosophy and much more!

Internet entrepreneurs and investors

In 2019 I moved to Turks & Caicos and decided to sell my apartment in New York. I love my hybrid life where I split my time between New York and the Caribbean. It allows me to spend a month in New York where I am intellectually, socially, professionally and artistically stimulated beyond my wildest dreams. I meet countless extraordinary people, host intellectual dialoging salons and enjoy all of New York’s entertainment options. But after a month, I admit I am exhausted, and the constant doing takes time away from thinking. That’s why I then love spending a month in the Caribbean where I can work during the day, kite, and play tennis and really take the time to read, be reflective and recharge my batteries.

I decided to leave the Dominican Republic in 2018, and had to ponder where I should go. My real estate travails from 2012 to 2018 meant that for 7 years I did not have a real home or the playground with all the activities I adore. It’s not as though those are life essentials and I was deprived. Quite the contrary, I had amazing life experiences in asset light living (see The Very Big Downgrade & Update on the Very Big Downgrade). I traveled extensively and went on many adventures, but I must admit I do miss the convenience of being able to play tennis and padel every day or just to have my friends come over for a LAN party.

In hindsight, I should have just bought an already built house that I could just move in, in a stable country where I could buy inexpensive nearby land to build my playground and call it a day. It would not fulfill my grandiose vision of building a “Necker Island 2.0” to invite a community of entrepreneurs, artists, spiritual leaders and intellectuals to hang out, nor would it have my specific aesthetic preferences, but it would have the convenience of being immediately useful and to play the role of gathering point for friends, family and colleagues.

This led me to buy Triton in Turks & Caicos. Turks is very built out and does not have the raw authenticity of Cabarete. There are fewer days of wind for kiting, and it’s insanely expensive. However, it has the most beautiful water in the world. The weather is fantastic all year long. The flights are only three hours from New York. It’s English speaking and uses the dollar as its currency. The safety, flat water and gorgeous beaches, not to mention the absence of Zika, Chikungunya and dengue make it appealing for all my friends and their families, and not just my adventurous friends who liked the rougher conditions of my Cabarete dwelling with its massive spiders, rats and cockroaches.

Having gleaned some lessons from my prior experiences, I decided to buy a house on Providenciales on Long Bay Beach where I can kite directly from the house and play tennis at the house. I opted not to buy on the other islands despite significantly lower prices and the availability of more land, because the lack of infrastructure makes things way more complicated and expensive. It’s also inconvenient to go for a few days if upon landing you need to be driven to a boat to get to your destination. I will now buy a little bit of inexpensive non-beachfront property to build the missing elements of my playground starting with the all-important padel court.

At the same time the never-ending travails with my New York apartment made me decide that the time had come to move on. In 5 years, I have not been able to enjoy the apartment properly and the water damage has been such that I have been living in hotels and Airbnbs for the last 18 months. As the building is badly built, the management intractable and the building broke, I suspect that even if I ended up rebuilding it as my dream apartment, problems would keep popping up. In hindsight, I undervalued the benefit of being in a well-managed building with the financial means to address issues, nor did I realize the downside of having by far the best apartment in an otherwise relatively small and poor building. Having moved dozens of times in the last 18 months, I intend to rent an apartment March 2020 onwards.

These travails have also cured me of home ownership. I would much rather rent and have the owner deal with whatever issues arise rather than having to deal with them myself. It means I won’t have the apartment of my dreams, but as life keeps highlighting: the best is the enemy of the good. I look forward to having a place in New York I can call home for the next few years bringing a modicum of stability to my life.

I keep being surprised by the amount of work and costs involved with real estate ownership and how illiquid an asset class it really is. The maintenance required highlights that it is a depreciating asset that requires constant work. When you take into consideration property taxes, insurance, maintenance and the constant renovations, the net yield is negligible. Despite historically low interest rates it makes much more sense to rent. This is especially true in New York right now as the glut of high-end apartments makes it a renter’s market. I can’t wait to be rid of all the real estate I own, though the pace of divestiture has been glacial.

In an ideal world I would not have bought the house in Turks, but it was unfortunately not available for long term rental. The limited housing stock on the island, almost none of which is available for long term renting, forced my hand. I do not consider it to be an investment. It’s consumption, pure and simple: a place to call home.

Having found my new home in Turks, allowed me to have an amazing year on both the personal and professional fronts. I brought my friends and family to visit countless times. I started learning to kite foil and had countless adventures.

Highlights were:

I also spent time visiting my family in Nice. It felt amazing to be back in my hometown enjoying the amazing food, playing tons of padel and spending time with my nephew.

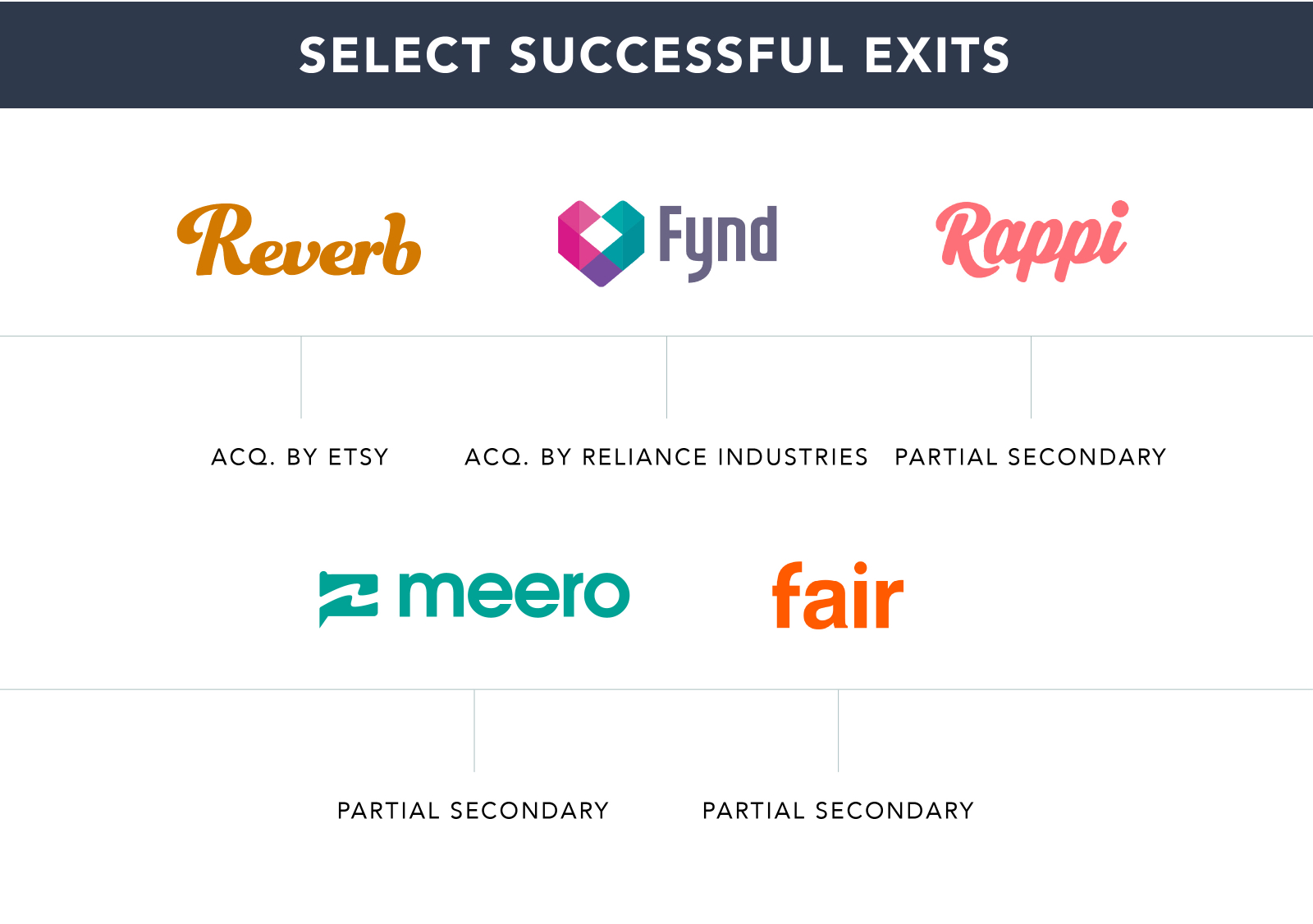

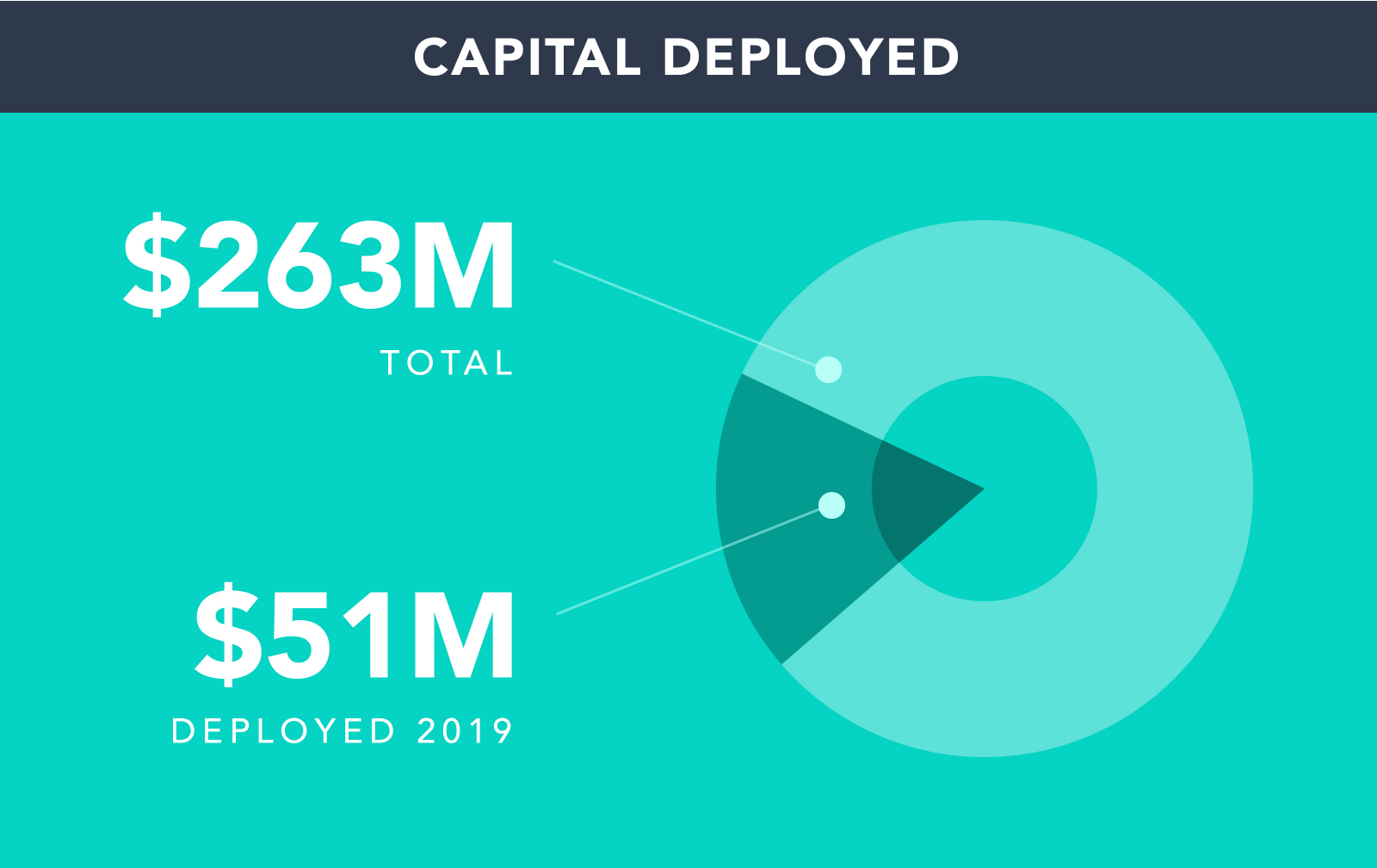

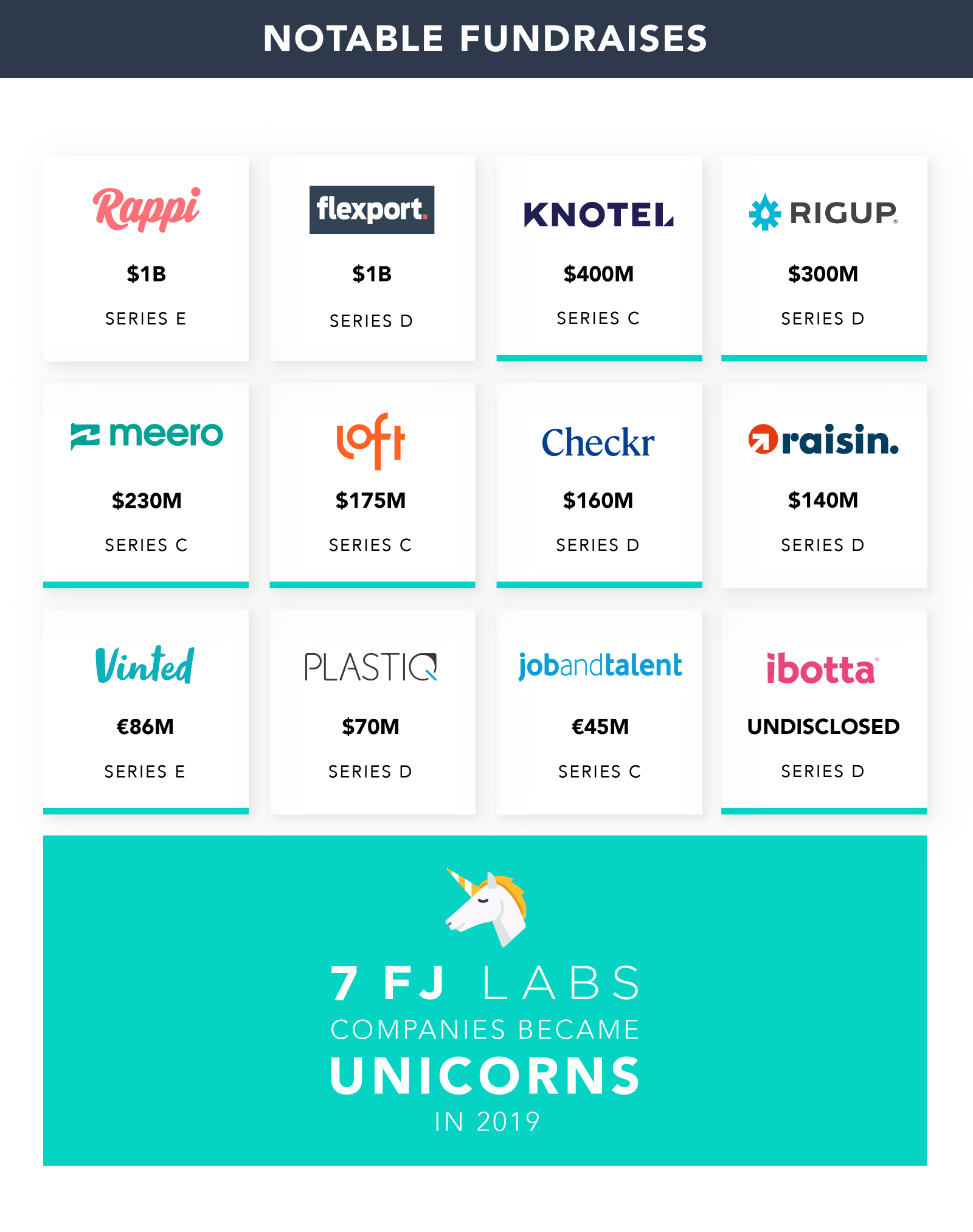

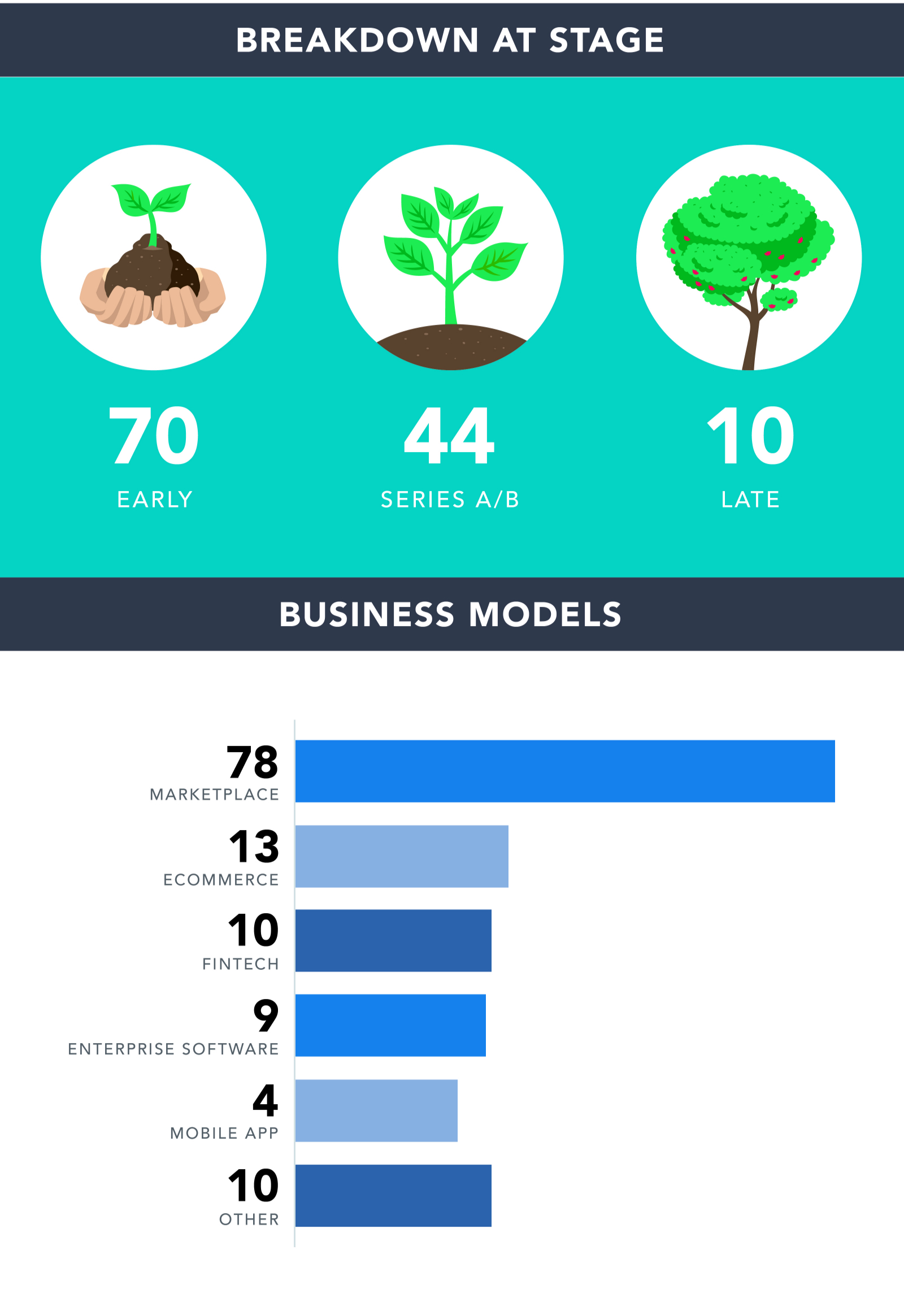

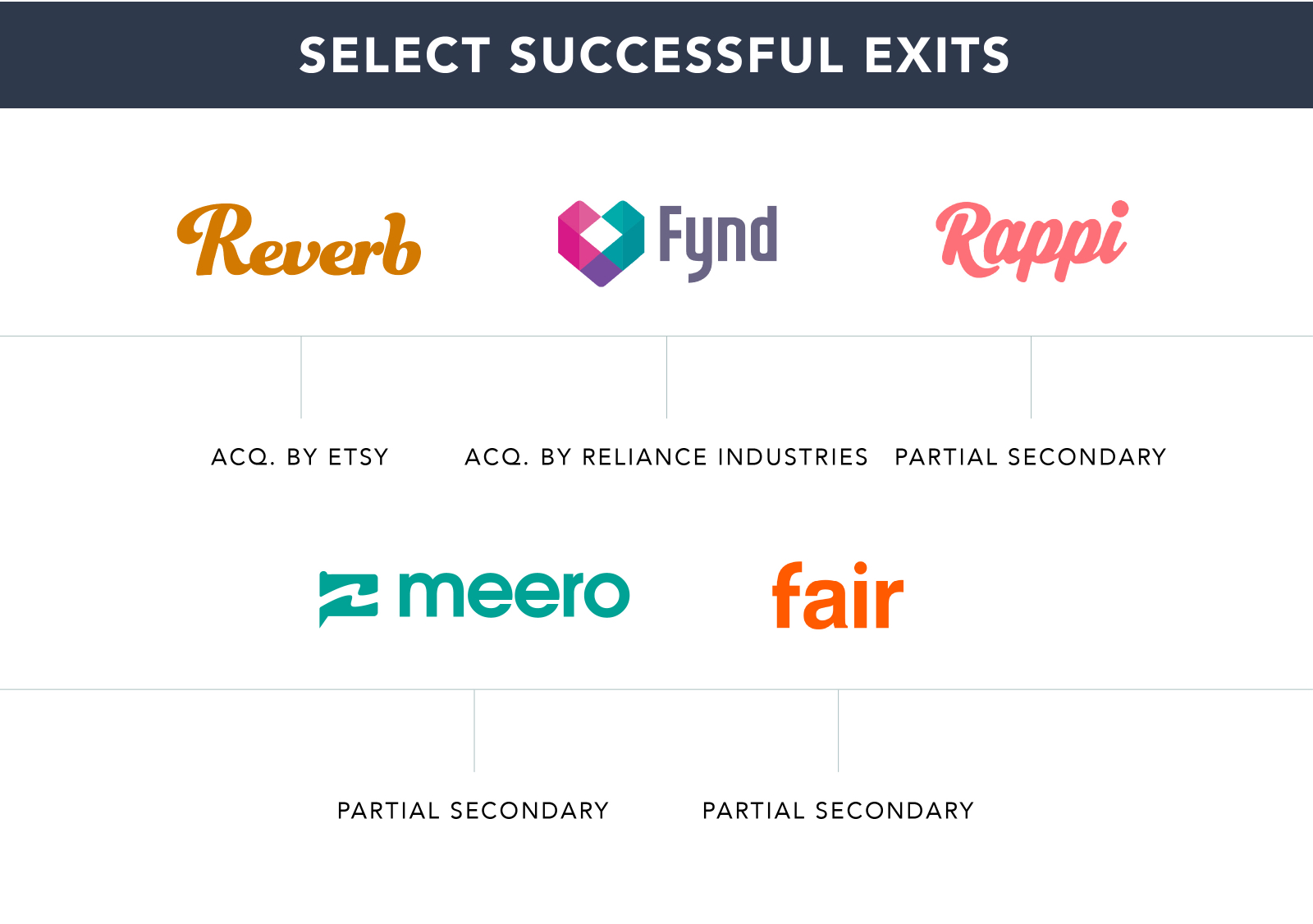

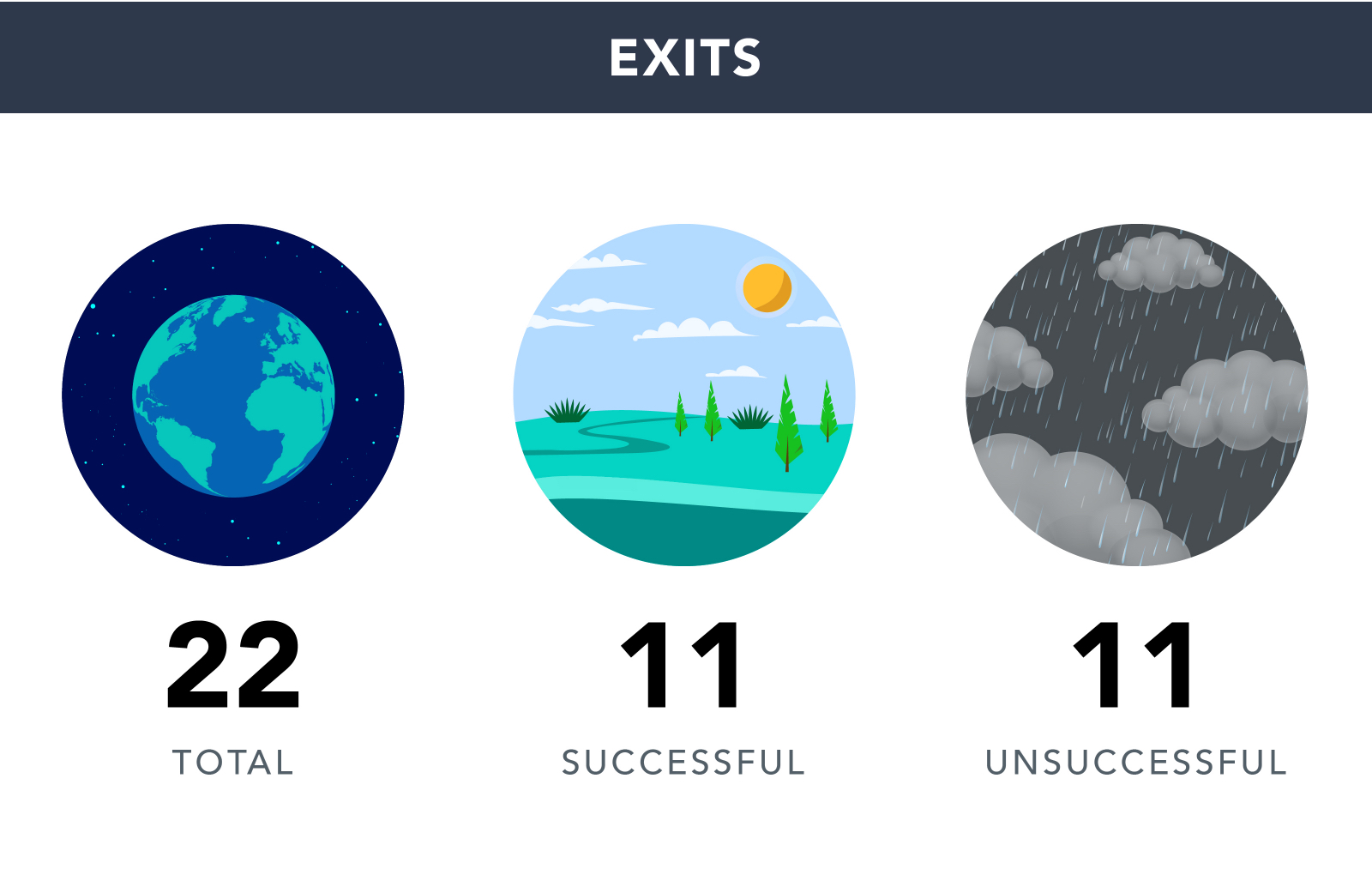

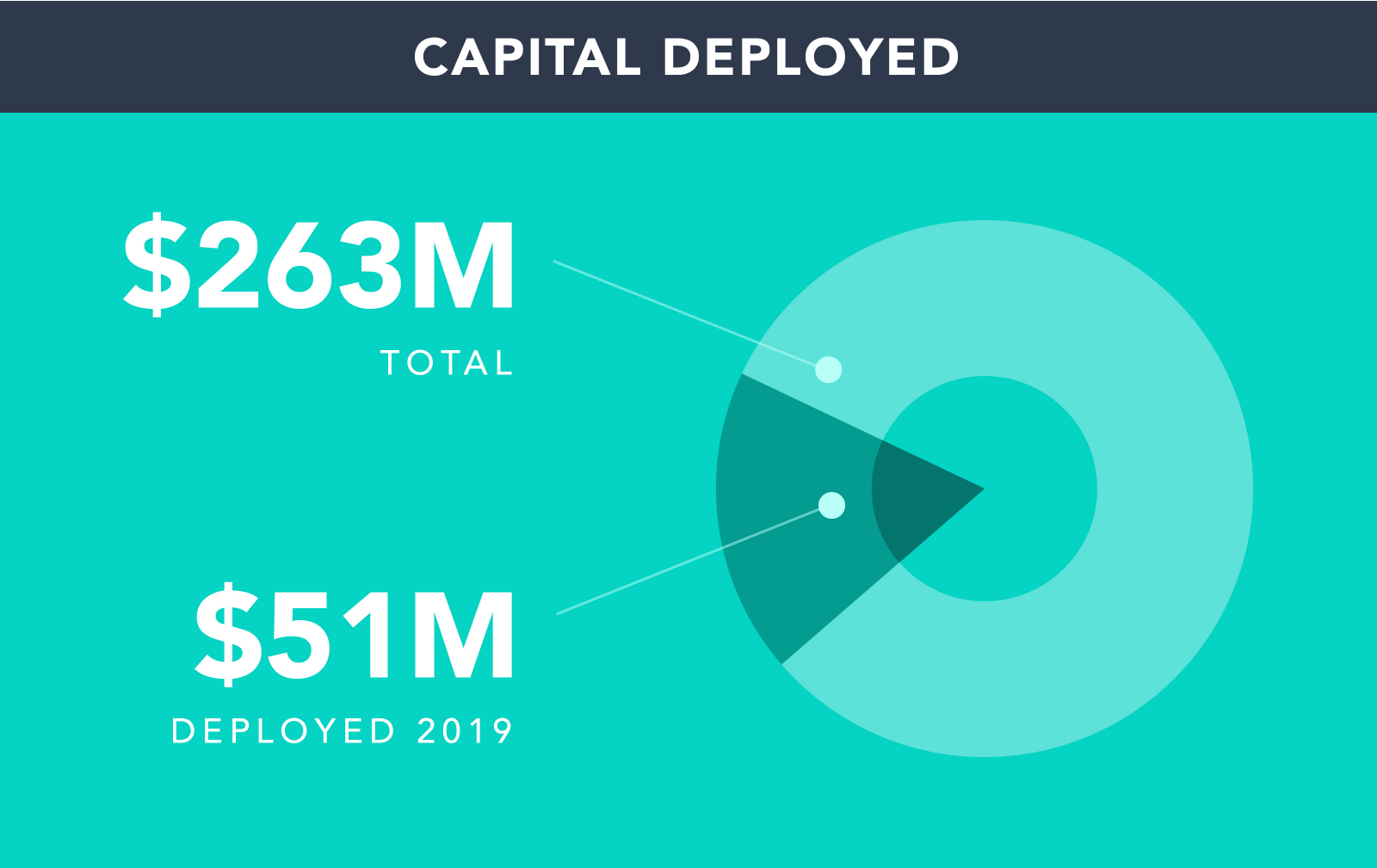

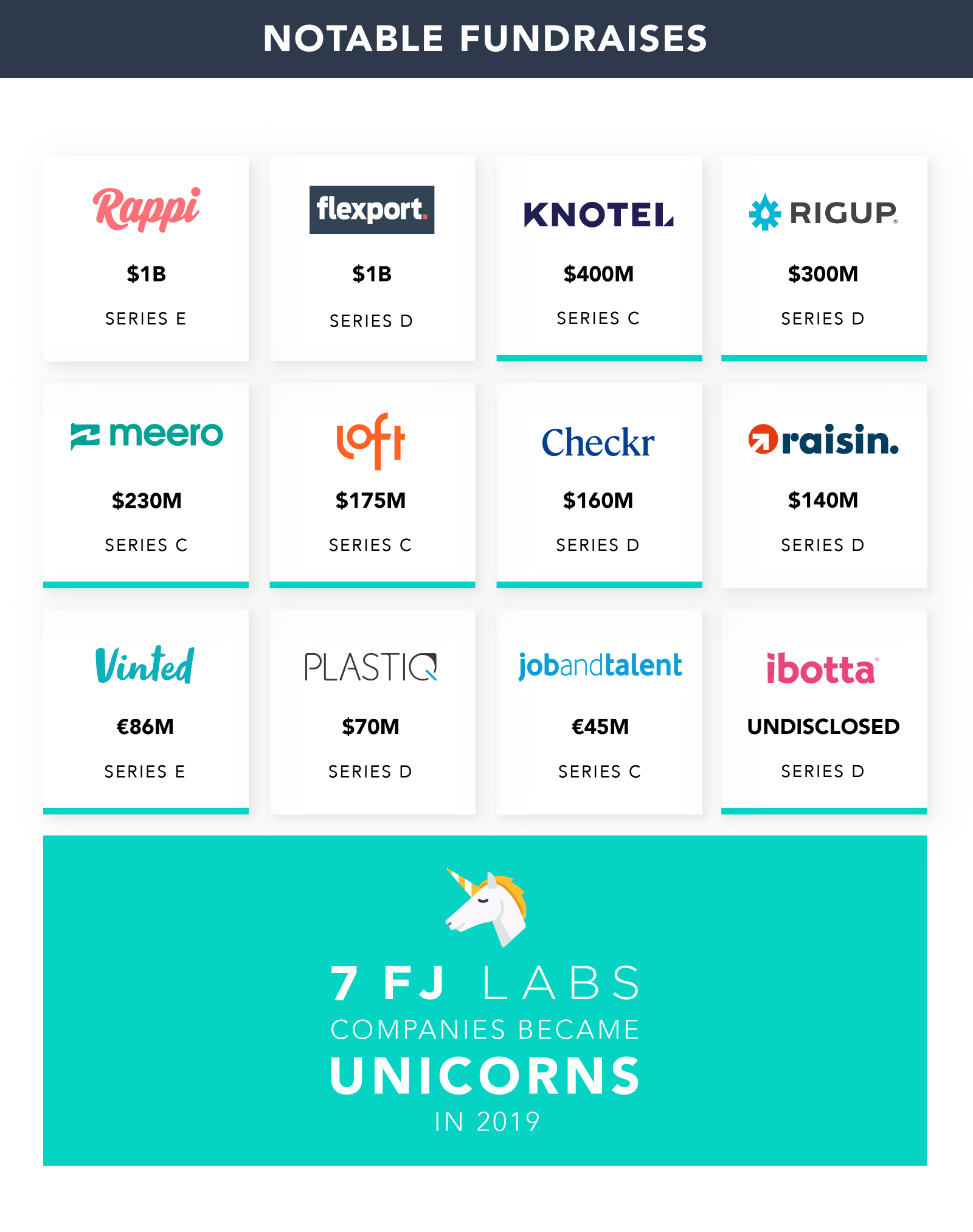

FJ Labs continued to rock. In 2019, the team grew to 26 people. We deployed $51M. We made 124 investments, 83 first time investments and 41 follow-on investments. We had 22 exits, of which 11 were successful including the acquisition of Reverb by Etsy and the acquisition of Fynd by Reliance Industries.

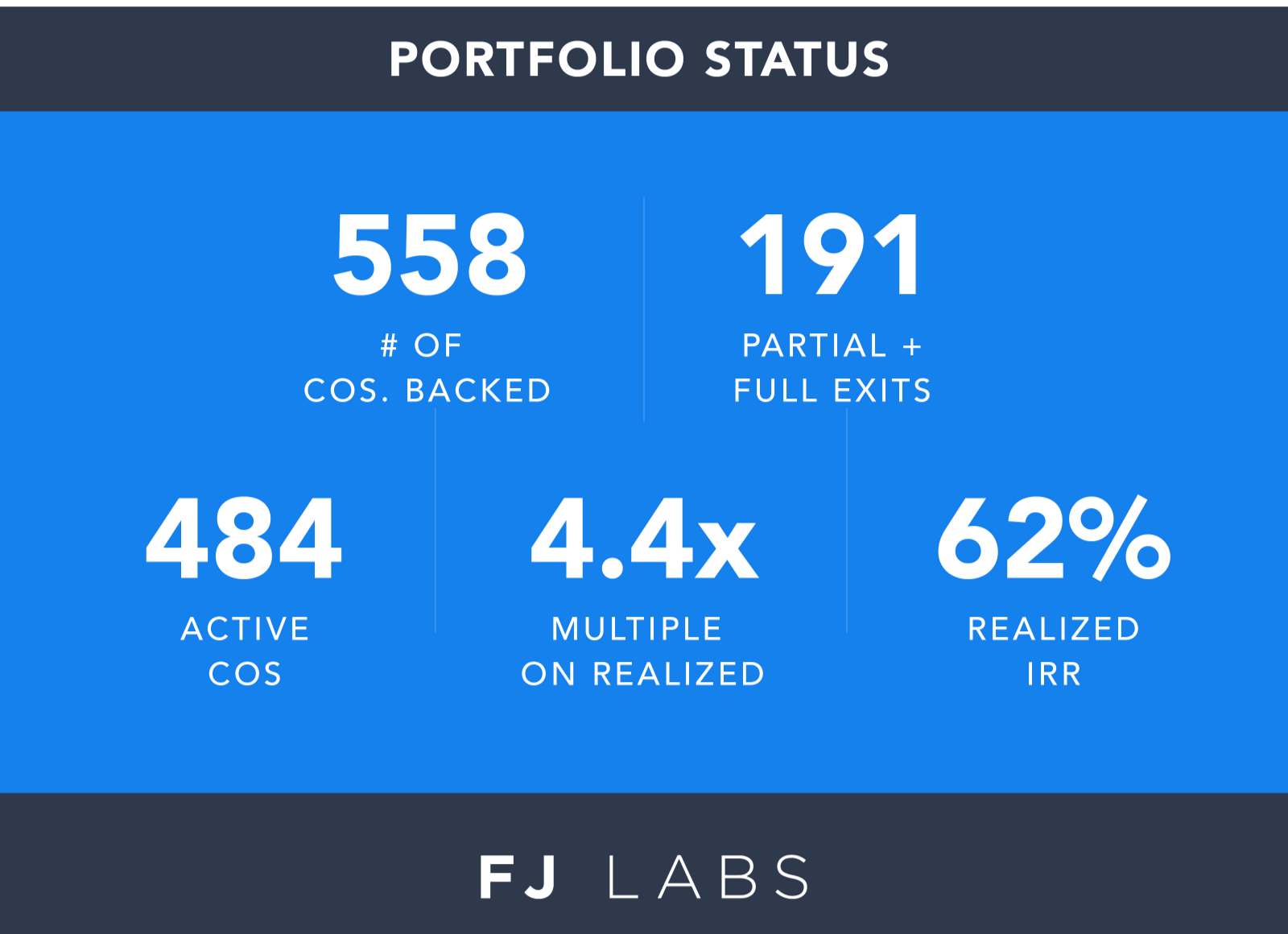

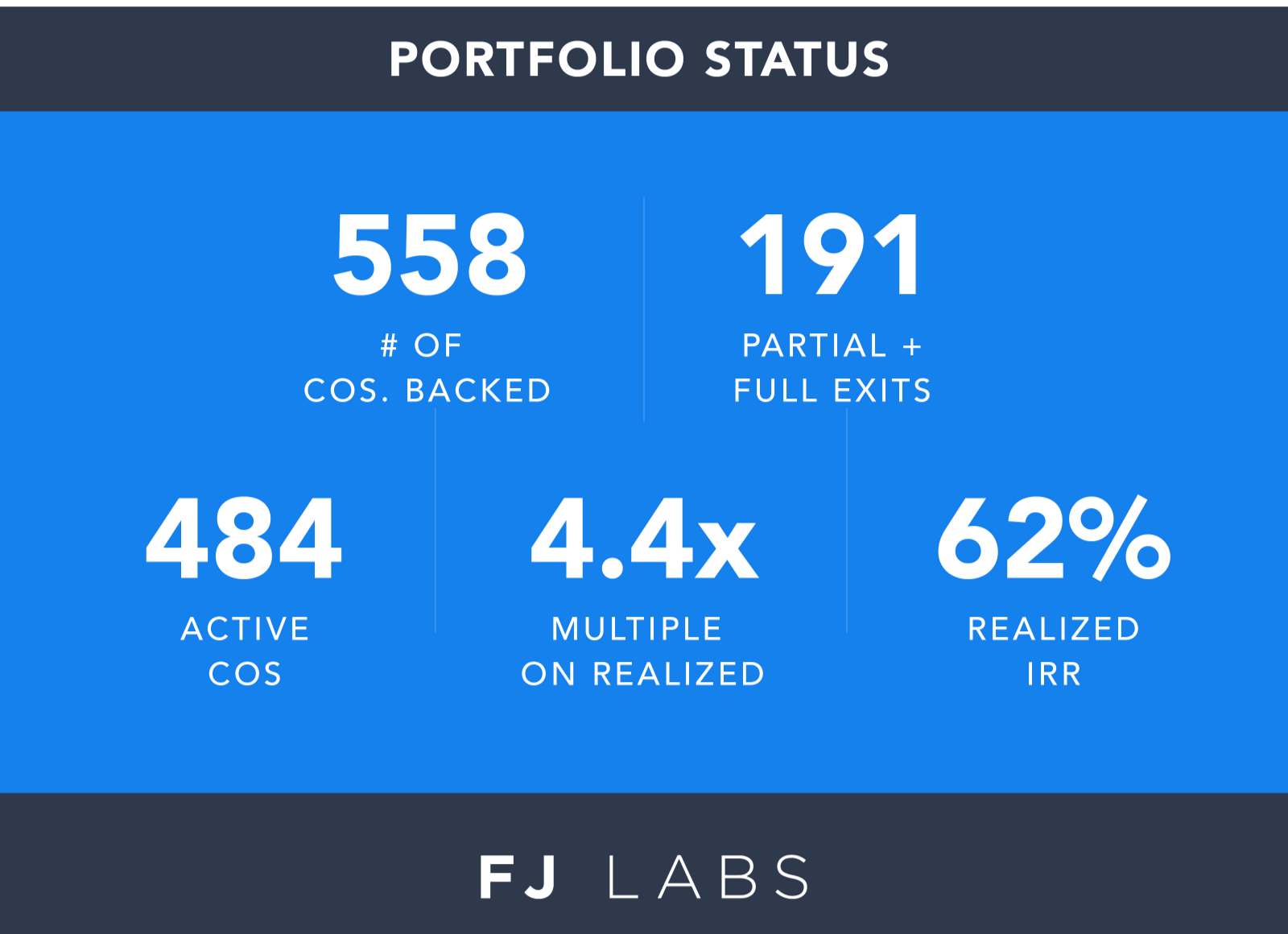

Since our inception, we invested in 558 unique companies, had 191 exits (including partial exits where we more than recouped our cost basis), and currently have 484 active investments. We’ve had realized returns of 62% IRR and a 4.4x average multiple.

I spent some time thinking about the latest trends in marketplaces.

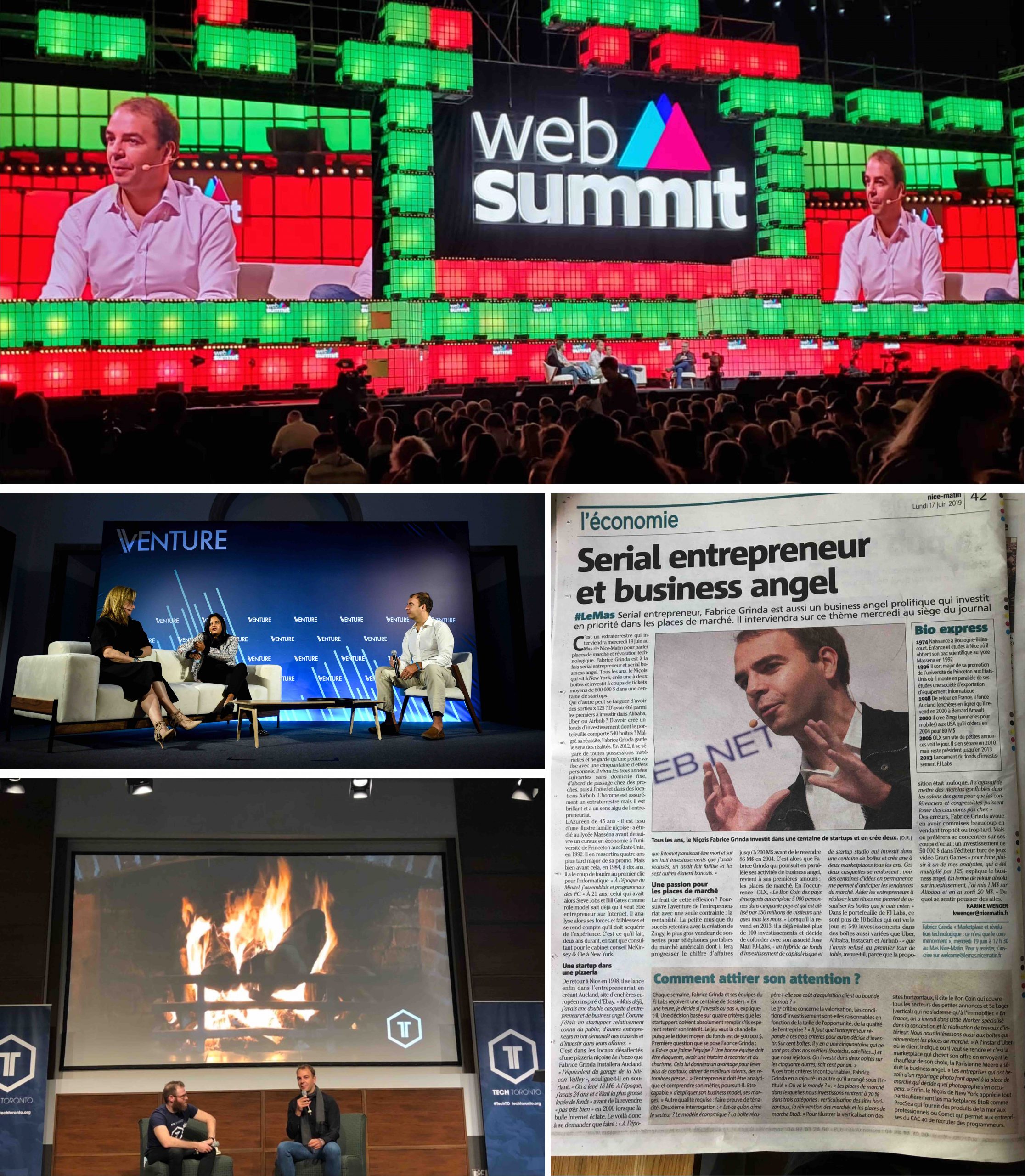

I also shared a lot of my entrepreneurial lessons learned in a series of keynotes, fireside chats, podcasts and video interviews:

It was fun to get a full page in the local newspaper just as I came to visit my family in Nice and to be covered in Les Echos around the French Tech conference.

In terms of writing, I finished my framework for making important decisions in life:

I also reviewed Why We Sleep given that I made significant life changes post reading the book and wrote a packing list for Burning Man to help virgins and grizzled veterans alike.

My economic predictions for 2019 were correct: the US economy did well. We are now in the longest expansion on record, and tech remained the sector to be in. While we are late in the economic cycle, the US may very well continue to do well until the end of 2020. We are at full employment and presidential election years typically have loose fiscal and monetary policies.

The main recession risk seems geopolitical given the current slew of world “leaders.” I suspect that the largest risk to the world economy is a budget crisis in Italy. It would put the Euro project at risk and lead to a massive flight to safety, creating the next global recession.

The current political climate keeps reinforcing my decision to avoid following and reading news be it in newspapers, online or on TV. It’s sensationalist negative entertainment that misses the real technology-led improvements that happen slowly, but inexorably transform our lives for the better.

Despite the implosion of WeWork and the travails at Softbank, I remain very bullish on early stage venture capital. We are still at the very beginning of the technology revolution. Only 15% of commerce is online. Online penetration remains negligible in the sectors that account for most of GDP: education, health care, and public services. The way we build homes is still artisanal. Synthetic biology is in its infancy. The emerging trend of no-code, which allows non-programmers to build complex fully functional websites, is unleashing a massive wave of innovation. It democratizes startup creation and innovation allowing people from all walks of life and every educational background to partake in the Internet revolution.

We are meeting more extraordinary entrepreneurs than ever before. There are still billions of capital on the sidelines in later stage funds like Sequoia and Insight that need to be put to work in the next few years. I suspect that even if some of these funds disappoint, most will still be able to raise their next fund. The current low rate environment, with no end in sight, will continue to lead to yield chasing. All that to say Seed and Series A funded startups will have access to plenty of capital. The technology sector remains the engine of productivity and economic growth and will continue to do well in 2020.

Happy new year!

我的朋友們似乎都決定來紐約度假。 由於他們已經看到了典型的紐約景點(大都會博物館、自然歷史博物館、現代藝術博物館、自由塔、獅子王),他們要求提供更獨特的建議。

這個不修邊幅的綜藝節目什麼都有:雜技、滑稽戲和一般的瘋狂。 這真是太神奇了,不知何故,一些行為的業餘性只會增加它的魅力。 您還可以見到布希維克年輕、有趣和炙手可熱的火人節人群。

通常每隔幾個星期三從晚上 8 點開始。 下一次是在 1 月 29 日

吞噬

如果 Bushwick 和 House of Yes 的裸體對你來說太咄咄逼人了,那麼 The Devouring 應該就在你的小巷裡。 這是Studio 54的Ian Schrager、House of Yes和米其林星級廚師John Fraser合作的成果。 如果骯髒的馬戲團在一頓精緻的飯菜中擁有金錢和專業表演者,它就會是什麼樣子。 這是對人類經驗的頌歌,也是一場令人眼花繚亂的新滑稽盛會。 這是一場現代歌舞表演,一場盛宴,也是一場對活著的慶祝。

Derren Brown:秘密

這個節目的運行將於1月4日 結束,所以趕快去看吧! Derren Brown’s 是世界上最好的心理醫生。 他的節目是讀心術、說服力和心理幻覺的混合體,專注於指導我們生活的故事和信念。

如果您無法做到,請務必在Youtube和 Netflix 上觀看他的節目。

遊牧民族的魔術師

這是我見過的最好的魔術表演。 它什麼都有一點:懸浮、紙牌技巧、在一個小、黑暗和親密的環境中的心理主義。 如果你是魔術迷,這就是值得一看的節目!

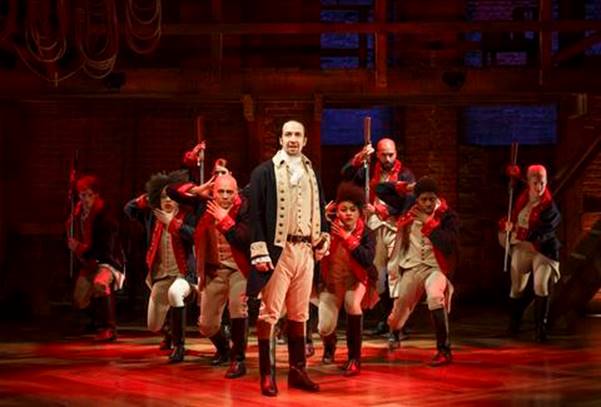

每天晚上,表演者都會聽取觀眾的建議,並將它們旋轉成即時即興演奏和完整的音樂數位。 每場演出都是自由式、嘻哈、即興、前所未見的喜劇之旅,漢密爾頓成名的林-曼努埃爾·米蘭達(Lin-Manuel Miranda)經常出人意料地客串演出,他是該節目的共同創作者之一。

我是 Woom Center 的忠實粉絲,尤其是 David & Elian 的聲音體驗。 這種冥想的特點是集體發聲、全息呼吸(自然地模仿LSD對大腦的影響)和優美的泛音,帶你踏上進入高度意識狀態的旅程。

我向所有人推薦它,尤其是冥想新手會感到轉變。 每週五晚上 7:30。 不要讓三個小時的持續時間嚇到你,因為每次都感覺它在 20 分鐘內過去了!

VR世界

VR還沒有達到我建議人們擁有設備的階段。 與 PS4、Xbox 和 PC 上的圖形相比,圖形相形見絀,延遲仍然會導致暈動症。 然而,花幾個小時使用數十種頂級 VR 設備,併為每個遊戲或體驗提供完全正確的設置,這很有趣。 確保你和幾個朋友一起去,因為一起玩或互相對抗都很有趣。

零空間

Zero Space 是一個身臨其境的互動數位藝術遊樂場。 它本質上感覺迷幻,真的很令人興奮。 這個節目有點簡單,但絕對值得一看,因為它預示著即將發生的事情,儘管我們距離擁有一個合適的星際迷航級別的全息甲板還有幾十年的時間。

Sleep No More 開創了沉浸式戲劇的先河,但如果有一個批評可以針對它,那就是你的體驗可能會因你最終做什麼以及你最終在劇院裡追隨誰而有很大差異。 然後,She Fell 通過創造一種沉浸式劇院體驗來解決這個問題,每場演出只有15名觀眾。 因此,您始終是行動的一部分。

該節目發生在威廉斯堡的一棟三層樓建築中,該建築經過精心改造,類似於精神病院,展示了路易斯·卡羅爾的工作和生活,尤其是他與愛麗絲·利德爾的關係,愛麗絲·利德爾是他在 《愛麗絲夢遊仙境 》和 《鏡中夢遊仙境》中的繆斯女神。 這是親密的,引人入勝的,是迄今為止我參加過的最有趣,最引人入勝和最有趣的沉浸式戲劇體驗。

喜劇酒窖是一個機構,也是世界上最大的喜劇俱樂部。 總有一個夢幻般的陣容,混合了非常知名和嶄露頭角的漫畫。 該行業的一些超級巨星有時會在未經通知的情況下加入。 我和羅賓·威廉姆斯(Robin Williams)、克裡斯·洛克(Chris Rock)和無數其他人一起去過那裡!

如果您曾經認為博物館很無聊,那麼這就是體驗它們的方式。 這些都是快節奏和搞笑的,儘管資訊量非常大。 這絕對是體驗大都會博物館和自然歷史博物館的方式。

週一魔術之夜

Monday Night Magic 是一個有趣、便宜、適合兒童的魔術表演。 它以最好的魔術師的各種表演為特色,他們恰好在那一周在紐約,創造了新鮮的體驗。

這可能是有史以來最好的音樂劇。 我非常偏頗,因為亞歷山大·漢密爾頓是我的榜樣之一,我是他的傳記的忠實粉絲,這部音樂劇就是根據羅恩·切爾諾 (Ron Chernow) 改編的。 然而,這部瘋狂的嘻哈音樂劇是一部巡迴演出,也是唯一一部讓我大開眼界的音樂劇。 你一定要看到它!