我有一个非常棒的家庭,这个家庭既包括我拥有的家庭,也包括我选择的家庭(非常棒的朋友,他们也可能是我的家人)。 我们是 Grindaverse,我有幸成为其中一员。 我们相互支持,共同创造充满欢笑、喜悦和无条件的爱的美好回忆和经历。

2022 不断强调这个家庭的重要性,不要认为这是理所当然的。 从 3 月到 6 月,我暂时搁置了生活,搬到尼斯帮助父亲准备和应对癌症治疗。 我很高兴地告诉大家,多亏了他顽强的生命力、爱他的家人、守护天使以及神奇的免疫疗法,他完全康复了。

大大小小的一般健康问题困扰着我的家人。 这很好地提醒了我们要陪伴他们,与他们共度美好时光。 我也很高兴地向大家报告,他们的情况都有所好转。 我确实利用在家乡尼斯逗留的时间(这是我多年来第一次这样做),与当地的亲朋好友度过了一段有意义的时光。

在那期间,我和弟弟奥利维尔在索菲亚安蒂波利斯的穆拉托格鲁网球学院接受了两周的训练,训练过程充满乐趣和挑战,也是我们兄弟之间增进感情的美好时光。 我们还参加了几次乒乓球比赛,甚至还赢了一次。 我们还一起开心地玩并完成了《艾尔登指环》。

在普罗旺斯,我还有机会与凯文-莱恩的家人结识。 这是我今年的亮点之一,也是我在处理家人健康问题时非常需要的喘息时刻。 他的家人如此欢迎我,我感激不尽。

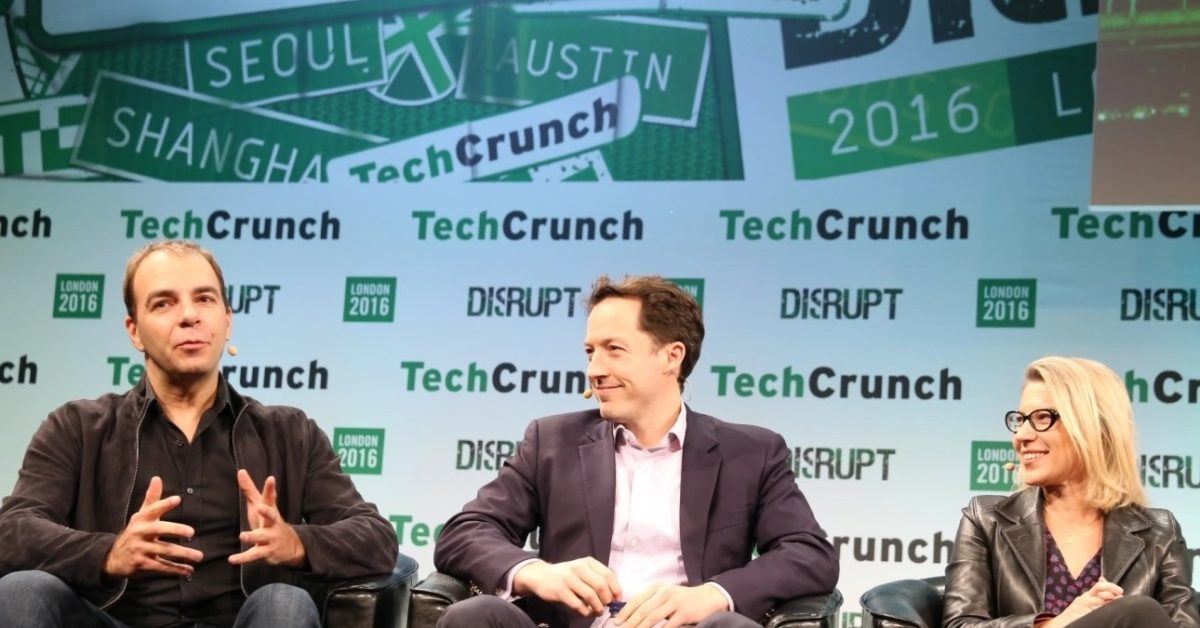

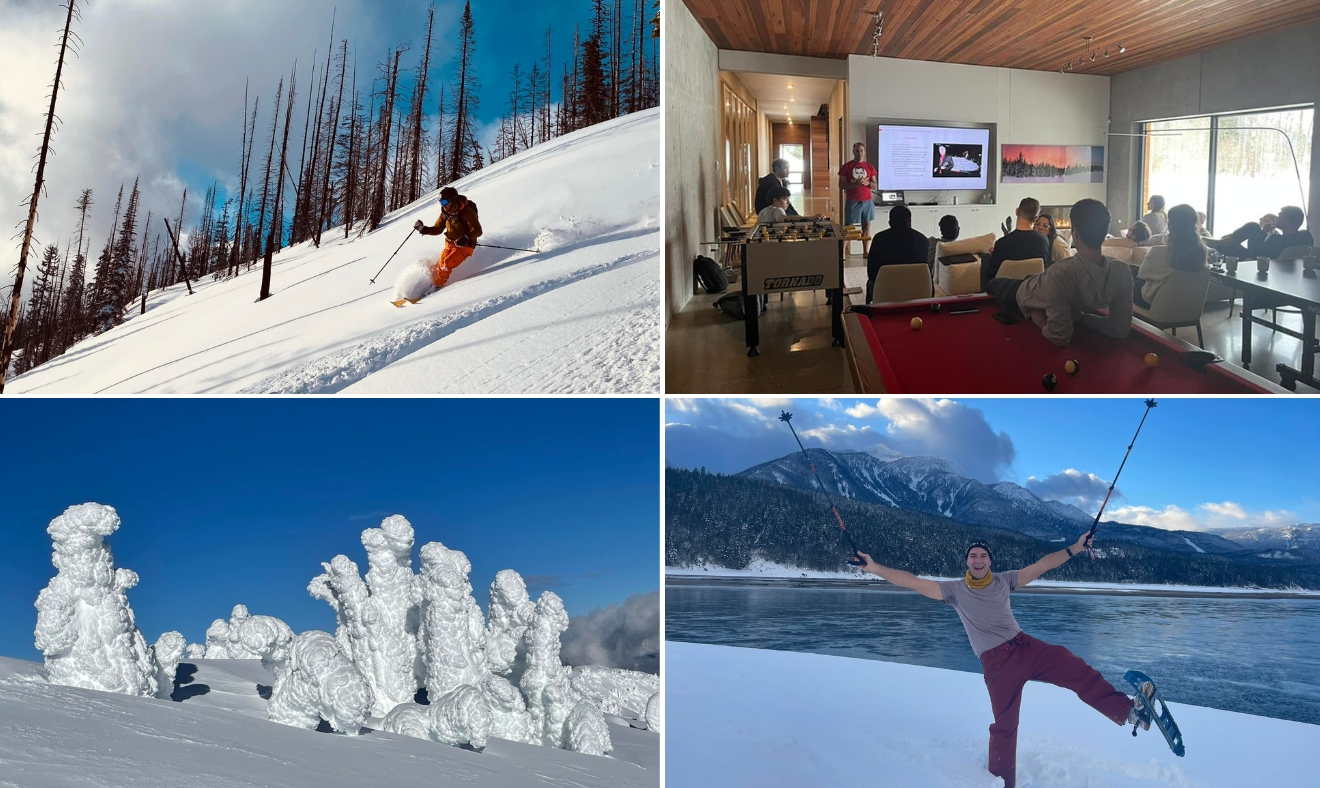

在我去法国之前,今年的开局非常好。 我刚刚通过 FaceTime 在雷夫斯托克(Revelstoke)买了一间小屋,我在《2021 年,有史以来最好的一年!》一文中已经解释过了:有史以来最好的一年!》一书中介绍的那样,我在那里度过了今年的头两个月。 我在那里接待了无数滑雪好友,疯狂地玩直升机滑雪,甚至还在那里举办了 FJ 实验室一年两次的头脑风暴。

之后,我前往挪威,为即将于 2023 年 1 月在南极洲进行的极地探险进行训练。 凯文-瑞安邀请我和他一起赞助 “INSPIRE 22“探险队,这是一支在冰上从海岸到极点历时 50 多天的研究探险队,从大力神湾徒步 1,100 公里到达南极点。 他们正在研究极端条件下性别和饮食的影响。 作为赞助商,我们可以参加最后 10 天的行程。

我前往挪威芬斯进行训练。 我必须承认,这与我以前做过的任何事情都不一样。 虽然我在热带地区接受过很多生存训练,但与寒冷打交道给我带来了全新的体验。 我不得不购买数量惊人的专用装备。 然后,我必须学会使用它:

- 把帐篷、睡袋、食物、用来融雪取水的丙烷罐和所有装备装进我的滑车(雪橇)。

- 用带有半滑雪板的特制滑雪板拉动 130 磅重的滑轮。

- 在零下 30 度的条件下,戴着手套迎风搭建帐篷。

- 融化积雪,用作饮用水和烹饪补水餐。

- 一般都是在非常陌生的环境中应对寒冷和大雪。

在该地区期间,我决定跳到瑞典尼科湖(Niekhu)进行直升机滑雪。 途中,我在基律纳的冰旅馆过了一夜。 弗朗索瓦非常喜欢这两种体验,他对直升机滑雪情有独钟,我滑得越快,他就越高兴。 只有在我减速或停车时,他才会表示不满。

我夏天在山里呆的时间并不多。 鉴于我已经到了法国,我决定去看看圣莫里茨美丽的群山,并去凡尔登峡谷(Gorges du Verdon)玩溪降。 之后,我前往雷夫史托克,想看看夏天的雷夫史托克到底怎么样。 我很喜欢,打算每年八月再去。 这是一次长达一个月的多种运动探险活动,包括激烈的山地自行车、徒步旅行、立式桨板冲浪和全地形车,环境优美。 虽然感觉像新兵训练营,但我玩得非常开心。

我很高兴 “火人节 “在中断两年后于 2022 年再次到来。 今年对我来说很特别,因为我和弟弟奥利维耶一起去,对他来说这是第一次。 我很喜欢向他传授技巧,徜徉在艺术的海洋中,总之,我很喜欢和他进一步交流。

我终于在 9 月份搬回了我在纽约的公寓,在此之前,我的公寓因水渍而进行了多年的翻修。 我很高兴能把这件事抛在脑后,终于可以回家了。 公寓给我的感觉就像家一样,在我的工作/生活平衡方面发挥着重要作用,让我能够在纽约紧张的知识、社交、专业和艺术生活与特克斯和凯科斯群岛和雷夫斯托克的运动和精神生活之间取得平衡。 能够再次举办知识沙龙绝对是一件令人高兴的事情,我有幸接待了丹尼尔-卡尼曼、乔-斯蒂格利茨和尼古拉斯-汤普森等了不起的人物。 让我非常高兴的是,Padel 终于来到了纽约。 我在距离我家 12 分钟路程的Padel Haus度过了无数个小时。

11 月和 12 月,我回到特克斯,和一群超级有趣的轮换角色一起放风筝、打乒乓球、打网球,总之就是尽情欢乐。 12 月 10 日,我的父母、叔叔、中间的弟弟克里斯和表兄弟们开始陆续抵达 Grindaverse,12 月 16 日开始,其他家庭成员也带着孩子们陆续抵达。 尽管这是我们第三年开展这项活动,但今年感觉很特别。 难得的是,在 30 人的聚会中,没有闹剧,取而代之的是感激和爱。 看到每个人都健康快乐,这让我又过了一年,希望明年能有更多的 Grindaverse 成员来到这里!

在写关于家庭重要性的博文时,我不能不提到弗朗索瓦在我生命中的存在以及看着他成长的过程是多么令人惊喜。 我以为我不会享受他生命中的头两年,因为他不会有太多的互动。 事实并非如此。 我喜欢这每一分钟:看到他学会爬行,迈出第一步,开始疯狂地跑来跑去,以惊人的速度学习新单词和新概念,所有这一切。 他还非常善于沟通和表达,很容易准确理解他想要什么。 我可以花几个小时和他在一起,只是在我们之间滚动一辆车,或者看他玩耍。 我想这也是因为我似乎中了 “婴儿彩票”。 他非常讨人喜欢,从不哭闹,一觉睡到天亮,看起来总是很开心。

在职业方面,2022 年依然异常繁忙。 我们在 2021 年正确地判断出泡沫正在膨胀,并在那一年花了大量时间寻找退出机会。 2022 年,当其他人都在缩减开支时,我们决定逆势而为,积极投资。

总体而言,FJ 实验室继续保持着强劲的发展势头。 2022 年是我们有史以来产量最高的一年。 团队人数增至 32 人,增加了投资者关系主管和投资组合主管等重要职位。 我们部署了 1 亿美元。 我们进行了 308 项投资,其中 182 项为首次投资,126 项为后续投资。 我们有 33 次退出,其中 16 次成功,包括Animoca和Clearco 的二次销售,以及 eBay 对TCGPlayer、Despegar 对Viajanet和 Victoria’s Secret 对AdoreMe的收购。 对我们来说,AdoreMe 是一家特殊的公司,因为它是我们正式孵化的第一家公司,也是我们 EIR(驻场企业家)计划的起源。

自从我和何塞 24 年前开始天使投资以来,我们投资了 989 家公司,有 266 家公司退出(包括部分退出),目前有 749 家公司在积极投资。 我们实现了 39% 的内部收益率和 4.0 倍的平均回报率。 我们总共投入了 5.3 亿美元,其中 1.73 亿美元由何塞和我提供。

在 2022 年,我常常感到写作的灵感。 当我们进入一个宏观胜过微观的时期时,我重新关注宏观经济问题。 我还写了我做许多事情的原因。 我写得最好的文章是

在法国照顾父亲期间,我没有流媒体设备,因此《玩转独角兽》的产量较低。 不过,我喜欢深入研究印度的金融科技生态系统。 我还与我的朋友奥斯卡-哈特曼进行了一次精彩的对话。

和往常一样,我的阅读量非常大。 我最喜欢的书是

科幻肥皂剧系列《后院星舰》是我今年的 “罪恶之乐”。

我对 2022 年的预测有失偏颇。我正确预测了晚期科技公司的估值将得到修正,而艺术品新媒体的泡沫将破裂。 我认为加密货币会受到美国宏观经济环境和内生冲击的影响,但担心的是 Tether 而不是 Terra 和 FTX。

我还对乌克兰发生战争的可能性打了折扣。 我写道,”中国在台湾或俄罗斯在乌克兰发生事故的可能性虽然很低,但仍然是有可能的”,但我并不认为这会发生。

2021 年底,我曾想过,看跌的共识是否意味着我们实际上无法在控制通胀的同时保持低失业率。 不过,我在这一年中做了一次艰难的中枢调整,得出的结论是共识不够看跌。 正如我在《凛冬将至》一书中强调的,目前有九个因素促使我看跌:

- 房价上涨的时间可能会超出人们的预期。

- 强势美元正在新兴市场制造主权债务危机。

- 高昂的天然气价格将导致德国经济衰退。

- 一场新的欧元危机正在逼近。

- 银行危机一触即发。

- 房地产价格即将下跌。

- 乌克兰和俄罗斯的持续冲突将使谷物、天然气和石油价格居高不下。

- 中国不再是经济增长和通货紧缩的动力。

- 地缘政治风险在结构上更高

这九个因素中的任何一个都足以造成全球经济衰退。 令我担忧的是,这些问题正在同时发生和演变,这表明 2007-2008 年的大衰退可能会重演。

我通常是房间里最乐观的人,自 2006 年以来,我从未如此看跌。 我仍然从概率的角度思考问题,但现在我认为严重衰退的概率高于轻微衰退的概率,而轻微衰退又高于任何乐观的结果。

为了完整起见,值得一提的事情是,这些事情会让我重新评估我的概率权衡,从而得出更乐观的结果。 如果乌克兰和俄罗斯之间的冲突明确结束,通货膨胀得到控制,我会变得更加乐观。

短期内,我也极度看跌加密货币。 虽然 2022 年是恐怖的一年,但仍有几把达摩克利斯之剑悬在加密货币头上:

- Genesis 的潜在破产及其对 DCG 和 GBTC 的影响。

- Binance 在监管或经济上的可行性。

- 继续关注 Tether。

我们仍然非常看好区块链技术的发展潜力,但目前仍在观望,等待上述一些问题的明朗化和宏观形势的稳定,然后再更积极地进入市场。 在 2021 年 11 月至 2022 年 1 月期间,我们正确地退出了大部分仓位,目前我们的加密货币策略持有 96% 的现金。 我认为,一旦我所担心的一些问题得到解决,利率开始下降,并且随着 2024 年中期下一次比特币减半的临近,我们将重新进入比特币市场。

尽管我普遍看空宏观经济,但我却非常看好处于早期阶段的初创企业。 估值合理。 创始人都在关注自己的单位经济效益。 他们正在限制现金消耗,以便至少在两年内不必进入市场。 初创企业面临着较低的客户获取成本和更少的竞争。 与过去几年相比,退出会推迟,退出倍数也会降低,但这应该会被较低的入市价格和赢家将赢得整个类别的事实所弥补。

对这些初创企业来说,重要的宏观环境是 6-8 年后他们寻求退出时的宏观环境,而不是当前的环境。 目前,最重要的是他们能筹集到足够的现金,并发展壮大,以获得下一次筹款。

逆势而为,在别人都在缩减投资时进行投资,是值得的。 过去十年中最好的初创企业投资是在 2008 年至 2011 年间进行的(Uber、Airbnb、Whatsapp、Instagram),我猜测 2020 年代最有趣的投资将在 2022 年至 2024 年间进行。

此外,我们仍处于技术革命的初期。 让我感到兴奋的是,我们有能力将技术的通货紧缩力量运用到迄今为止尚未被技术革命触及的领域:B2B、教育、医疗保健和公共服务,同时继续降低可再生能源的成本和可行性,以应对气候危机。

我非常感谢我所度过的这一年。 我非常高兴,因为我的每一位家人都很健康,我还能去进行奇妙的冒险,做有意义的工作,还能让 Grindaverse 一起过节。

我对 2023 年充满期待。 今年的开头应该是轰轰烈烈的,因为我将踏上前往南极的旅程,这将使我在两周的时间里与整个世界完全断绝联系,这是我一生中从未做过的事情。 我希望这将是一次身体上的挑战、精神上的唤醒,既是一次与自己的思想独处的美妙时光,也是一次与队友们增进感情的经历。 除此之外,我还计划带母亲去 “火人节”,我相信她一定会喜欢的。 我只需要造一辆合适的艺术车,带她到处走走。 我还期待着与弗朗索瓦一起进行更多疯狂的冒险。 目前,我正在想办法在我玩风筝冲浪的时候把他绑在我的背上,我相信这一定会吓坏他的祖母。 除此之外,我还打算学习翼装飞行。 我还希望 Grindaverse 至少能增加一名新成员,因为我希望在 2023 年春天终于能迎来一只白色的德国牧羊犬 Angel。

年末应该再举行一次家庭聚会。 这一次,我的特克斯之旅不会因为极地探险而缩短。 我将把Triton保留到一月份,这样可以让更多有孩子的家庭成员从欧洲赶来。 我期待着为他们播放一部关于家族历史的电影。 奥利维尔和我委托制作了这部电影,作为送给家人的礼物。 这部电影除了是写给父母、弟弟克里斯托弗和整个家族的情书外,还将介绍我们著名的祖先。 这既是对他们所做贡献的颂扬,也是我们对他们在帮助我们成长过程中所起作用表示感谢的一种方式。

预祝 2023 年一切顺利。 新年快乐