Tech Entrepreneurship, Economics, Life Philosophy and much more!

Tech Entrepreneurship, Economics, Life Philosophy and much more!

Internet entrepreneurs and investors

In 2019 I moved to Turks & Caicos and decided to sell my apartment in New York. I love my hybrid life where I split my time between New York and the Caribbean. It allows me to spend a month in New York where I am intellectually, socially, professionally and artistically stimulated beyond my wildest dreams. I meet countless extraordinary people, host intellectual dialoging salons and enjoy all of New York’s entertainment options. But after a month, I admit I am exhausted, and the constant doing takes time away from thinking. That’s why I then love spending a month in the Caribbean where I can work during the day, kite, and play tennis and really take the time to read, be reflective and recharge my batteries.

I decided to leave the Dominican Republic in 2018, and had to ponder where I should go. My real estate travails from 2012 to 2018 meant that for 7 years I did not have a real home or the playground with all the activities I adore. It’s not as though those are life essentials and I was deprived. Quite the contrary, I had amazing life experiences in asset light living (see The Very Big Downgrade & Update on the Very Big Downgrade). I traveled extensively and went on many adventures, but I must admit I do miss the convenience of being able to play tennis and padel every day or just to have my friends come over for a LAN party.

In hindsight, I should have just bought an already built house that I could just move in, in a stable country where I could buy inexpensive nearby land to build my playground and call it a day. It would not fulfill my grandiose vision of building a “Necker Island 2.0” to invite a community of entrepreneurs, artists, spiritual leaders and intellectuals to hang out, nor would it have my specific aesthetic preferences, but it would have the convenience of being immediately useful and to play the role of gathering point for friends, family and colleagues.

This led me to buy Triton in Turks & Caicos. Turks is very built out and does not have the raw authenticity of Cabarete. There are fewer days of wind for kiting, and it’s insanely expensive. However, it has the most beautiful water in the world. The weather is fantastic all year long. The flights are only three hours from New York. It’s English speaking and uses the dollar as its currency. The safety, flat water and gorgeous beaches, not to mention the absence of Zika, Chikungunya and dengue make it appealing for all my friends and their families, and not just my adventurous friends who liked the rougher conditions of my Cabarete dwelling with its massive spiders, rats and cockroaches.

Having gleaned some lessons from my prior experiences, I decided to buy a house on Providenciales on Long Bay Beach where I can kite directly from the house and play tennis at the house. I opted not to buy on the other islands despite significantly lower prices and the availability of more land, because the lack of infrastructure makes things way more complicated and expensive. It’s also inconvenient to go for a few days if upon landing you need to be driven to a boat to get to your destination. I will now buy a little bit of inexpensive non-beachfront property to build the missing elements of my playground starting with the all-important padel court.

At the same time the never-ending travails with my New York apartment made me decide that the time had come to move on. In 5 years, I have not been able to enjoy the apartment properly and the water damage has been such that I have been living in hotels and Airbnbs for the last 18 months. As the building is badly built, the management intractable and the building broke, I suspect that even if I ended up rebuilding it as my dream apartment, problems would keep popping up. In hindsight, I undervalued the benefit of being in a well-managed building with the financial means to address issues, nor did I realize the downside of having by far the best apartment in an otherwise relatively small and poor building. Having moved dozens of times in the last 18 months, I intend to rent an apartment March 2020 onwards.

These travails have also cured me of home ownership. I would much rather rent and have the owner deal with whatever issues arise rather than having to deal with them myself. It means I won’t have the apartment of my dreams, but as life keeps highlighting: the best is the enemy of the good. I look forward to having a place in New York I can call home for the next few years bringing a modicum of stability to my life.

I keep being surprised by the amount of work and costs involved with real estate ownership and how illiquid an asset class it really is. The maintenance required highlights that it is a depreciating asset that requires constant work. When you take into consideration property taxes, insurance, maintenance and the constant renovations, the net yield is negligible. Despite historically low interest rates it makes much more sense to rent. This is especially true in New York right now as the glut of high-end apartments makes it a renter’s market. I can’t wait to be rid of all the real estate I own, though the pace of divestiture has been glacial.

In an ideal world I would not have bought the house in Turks, but it was unfortunately not available for long term rental. The limited housing stock on the island, almost none of which is available for long term renting, forced my hand. I do not consider it to be an investment. It’s consumption, pure and simple: a place to call home.

Having found my new home in Turks, allowed me to have an amazing year on both the personal and professional fronts. I brought my friends and family to visit countless times. I started learning to kite foil and had countless adventures.

Highlights were:

I also spent time visiting my family in Nice. It felt amazing to be back in my hometown enjoying the amazing food, playing tons of padel and spending time with my nephew.

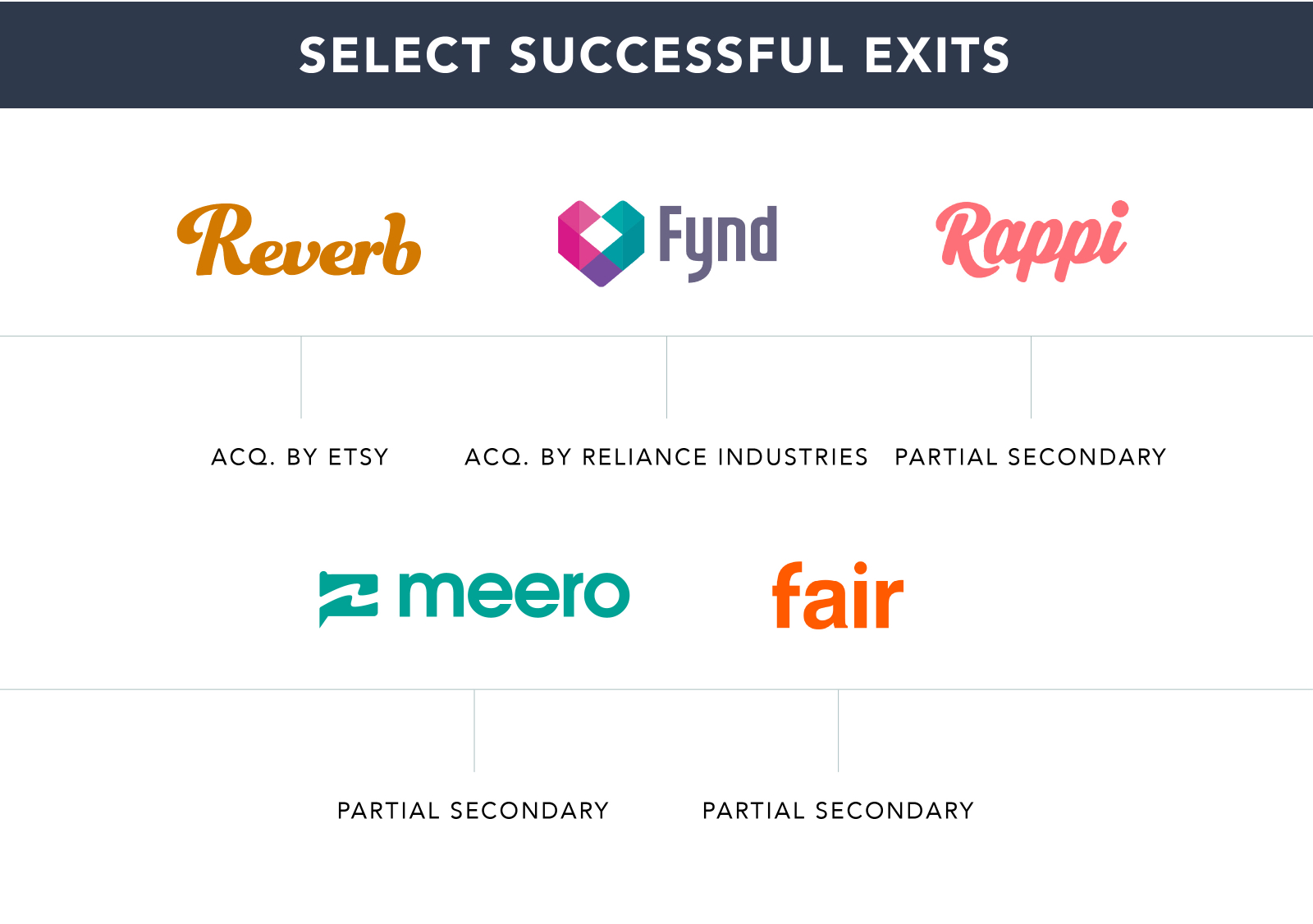

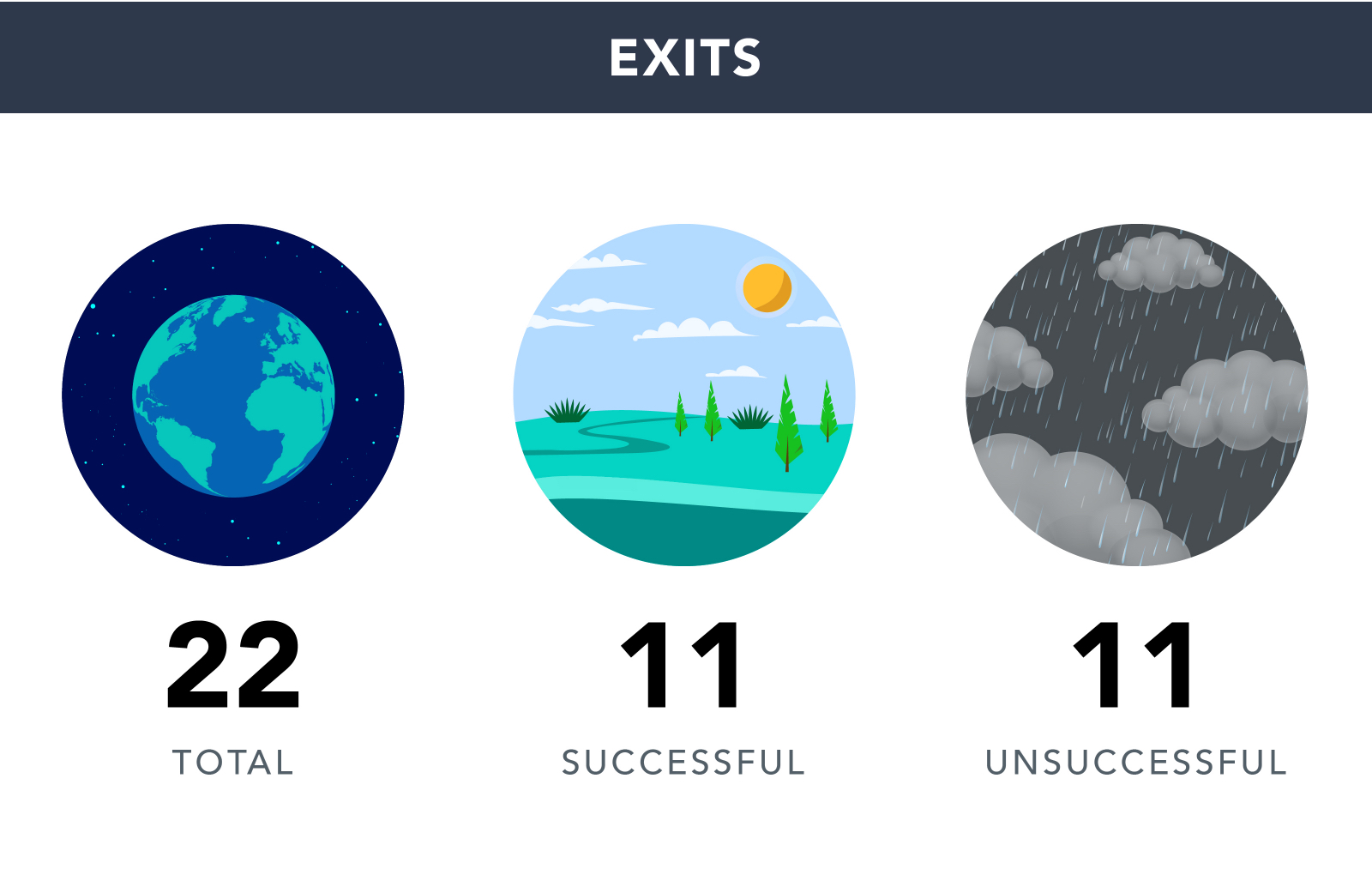

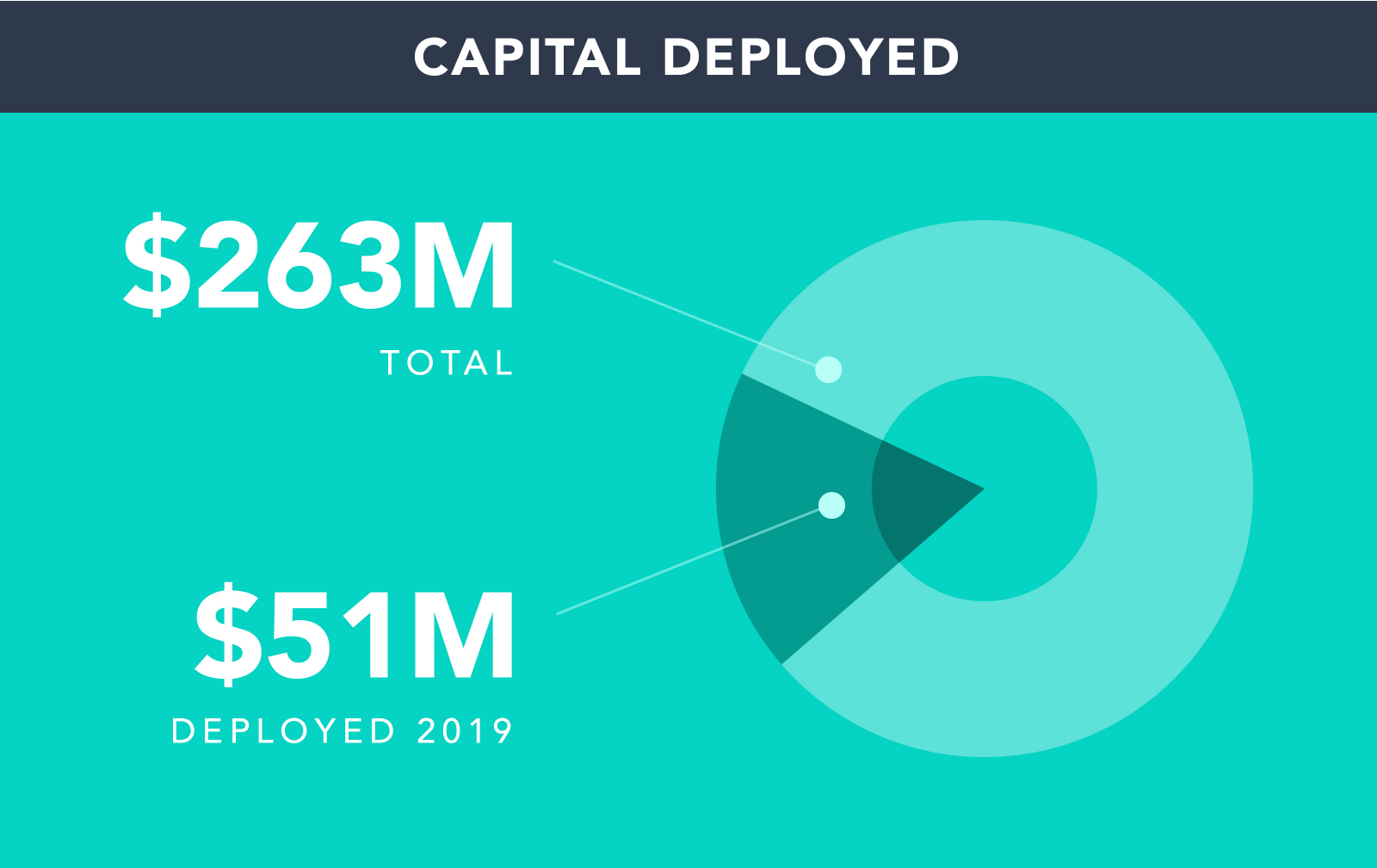

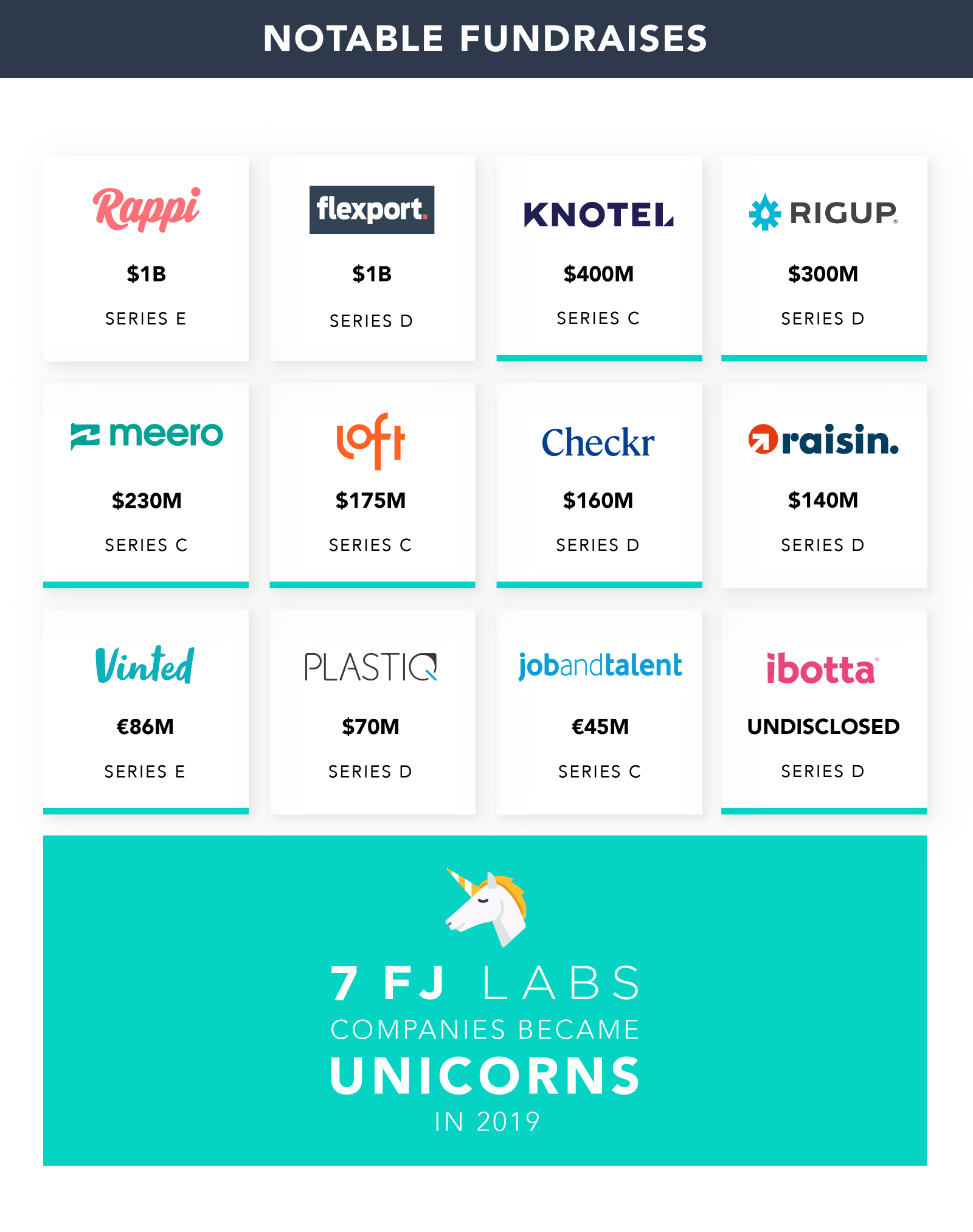

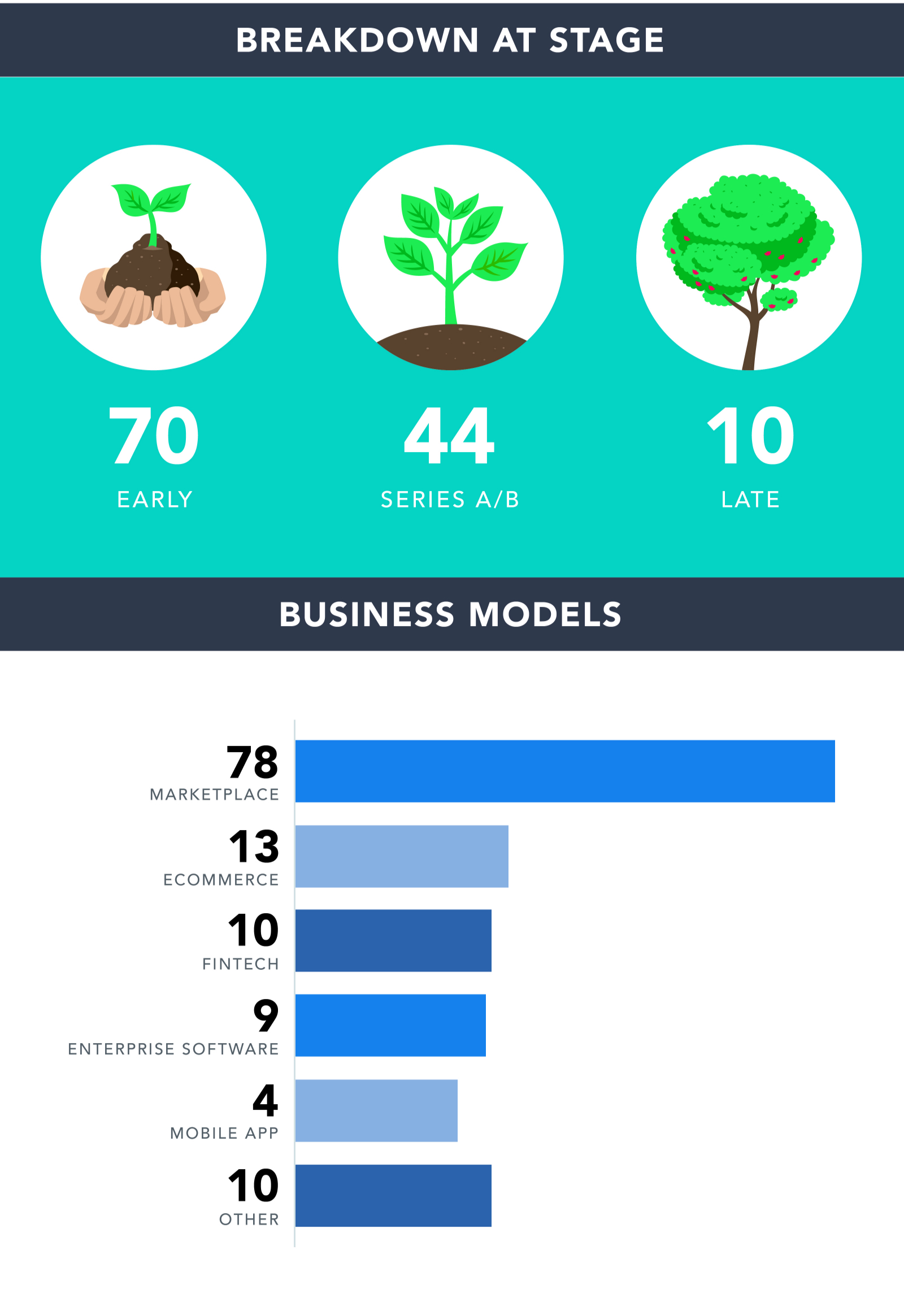

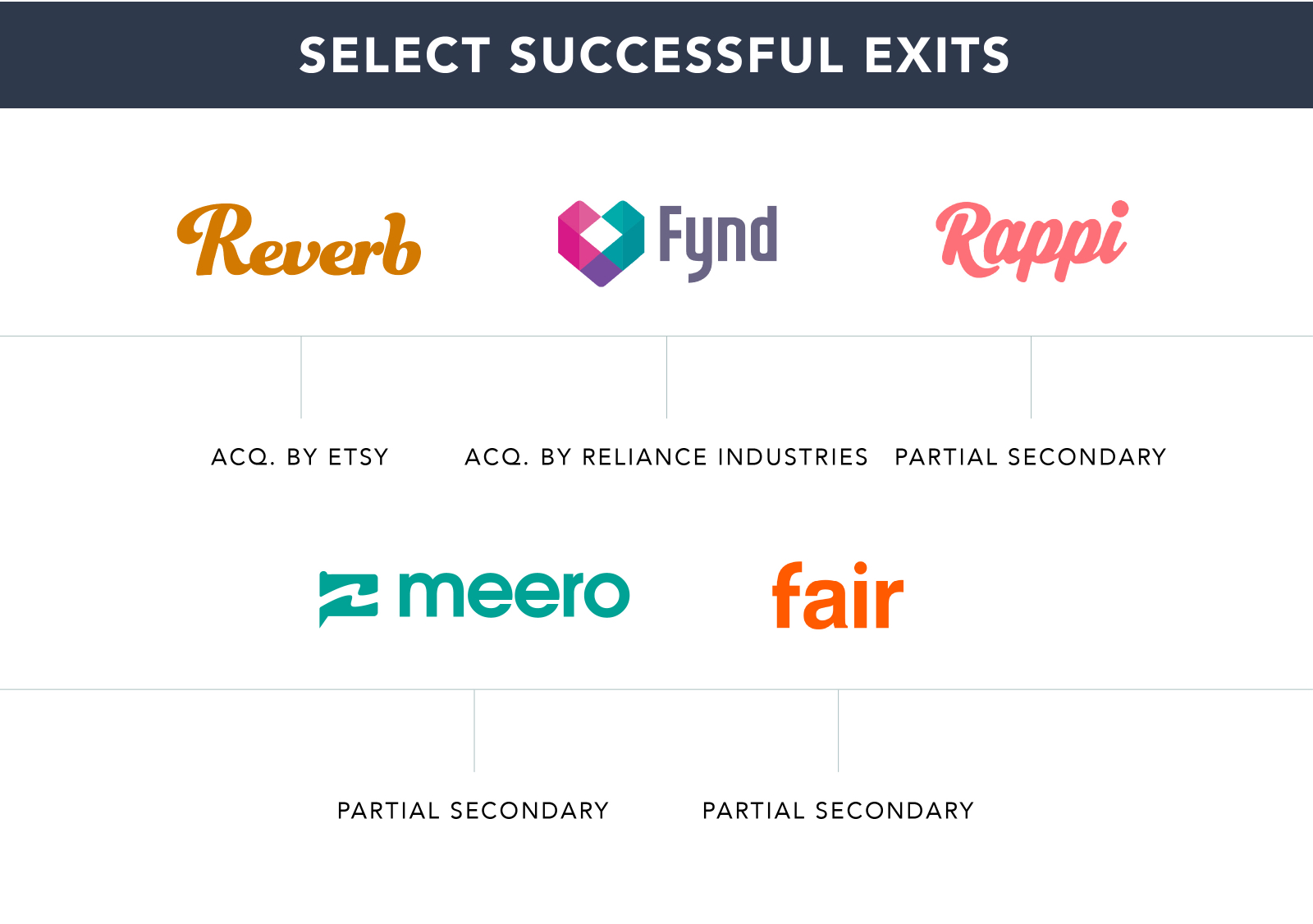

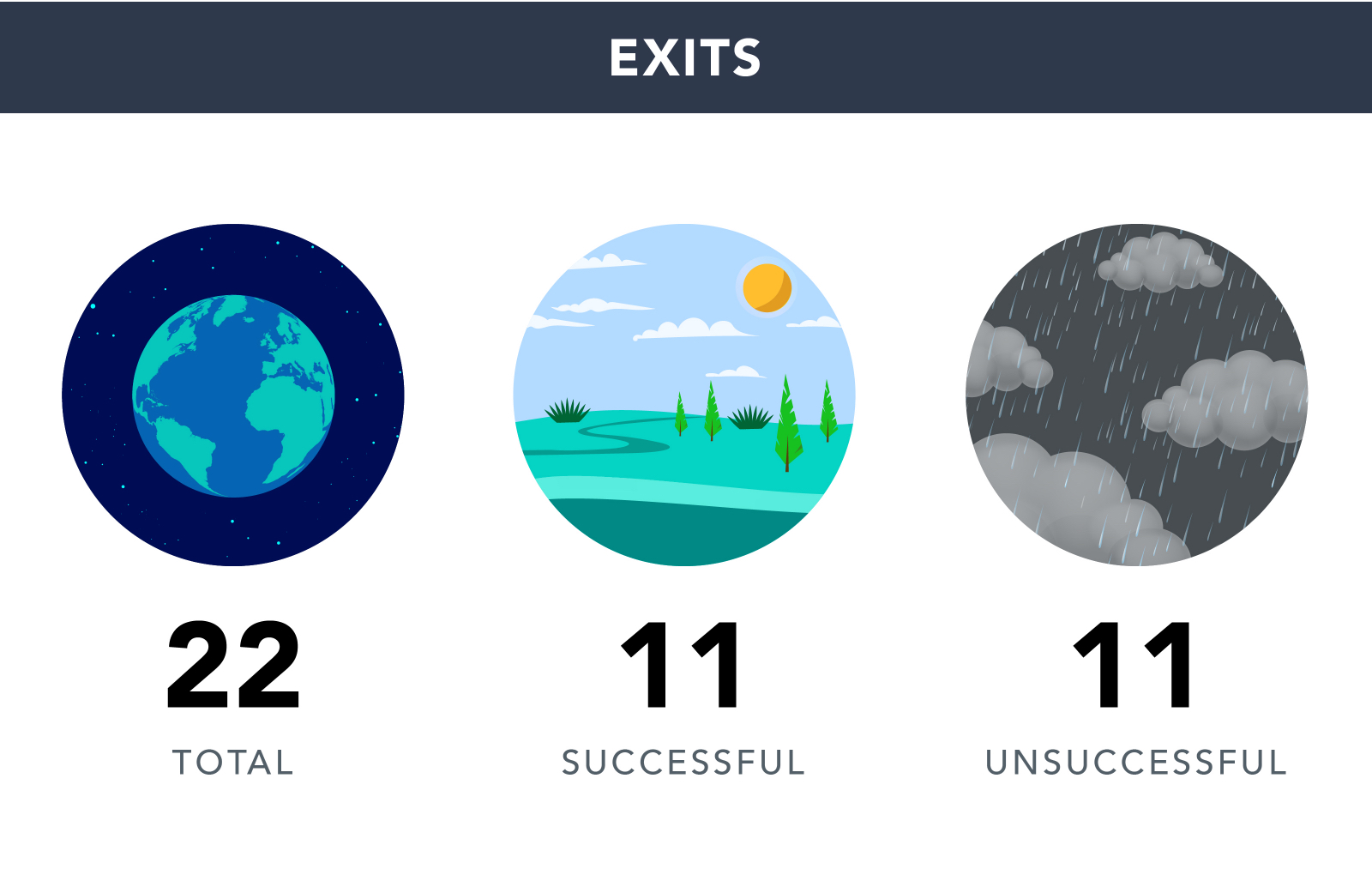

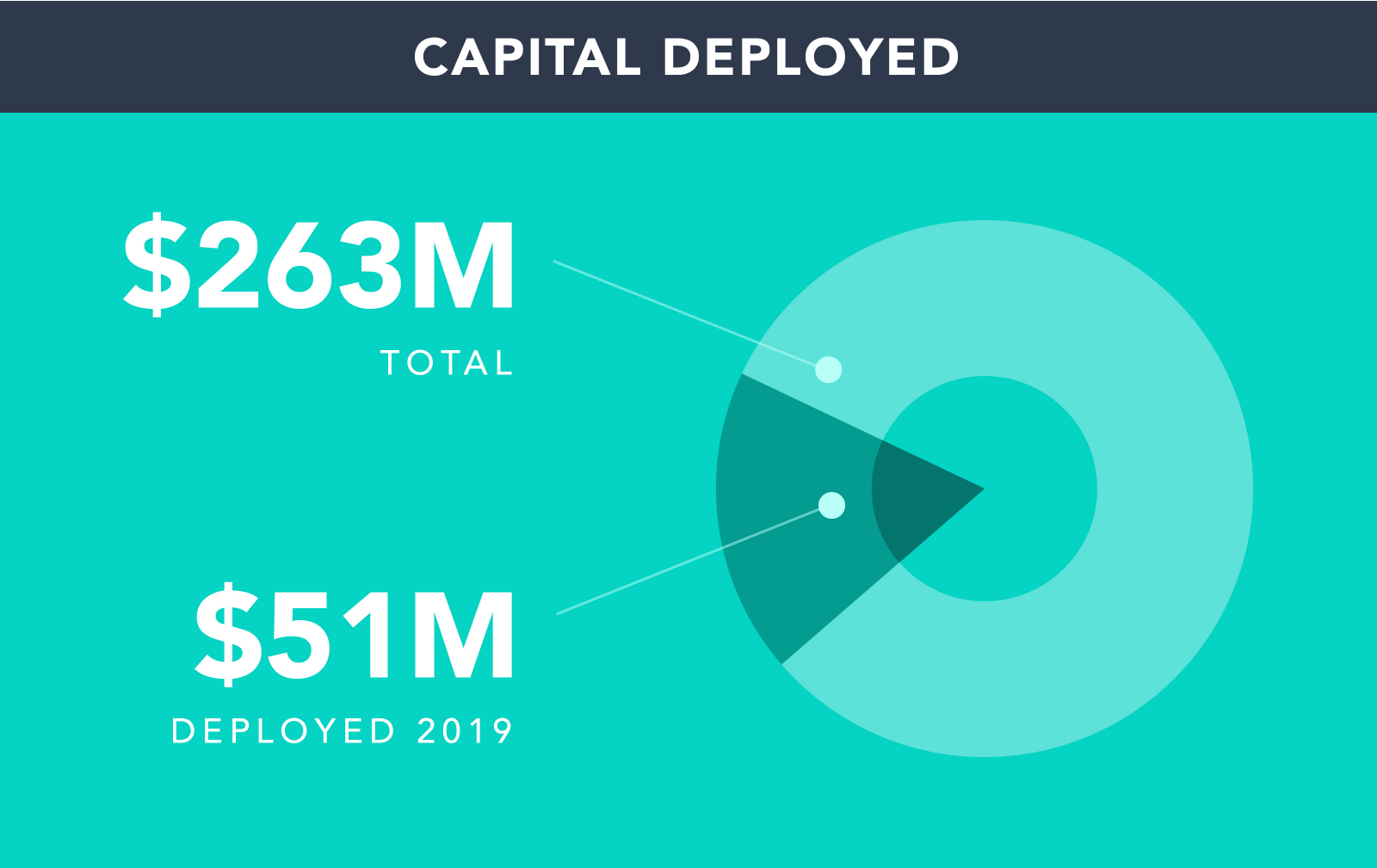

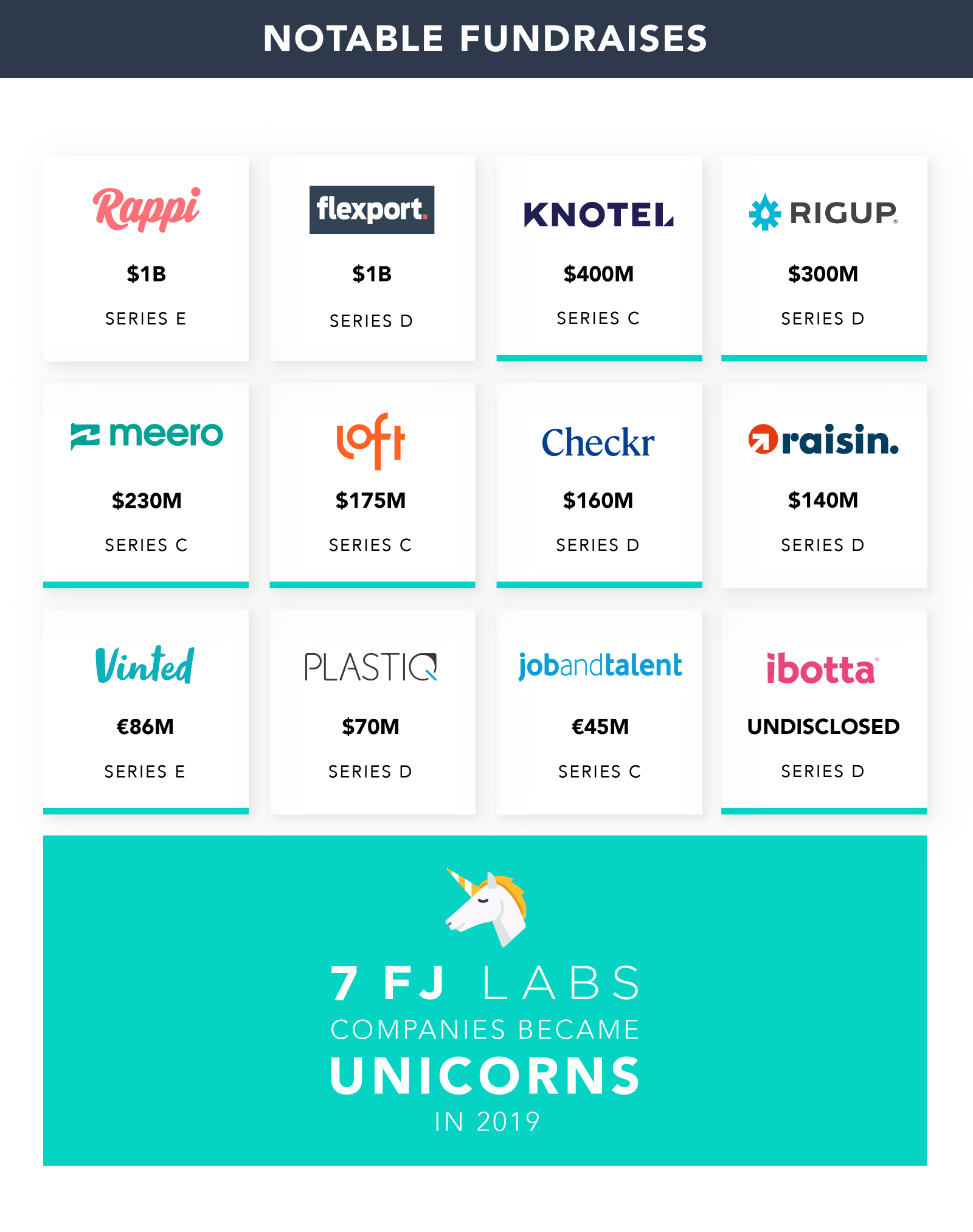

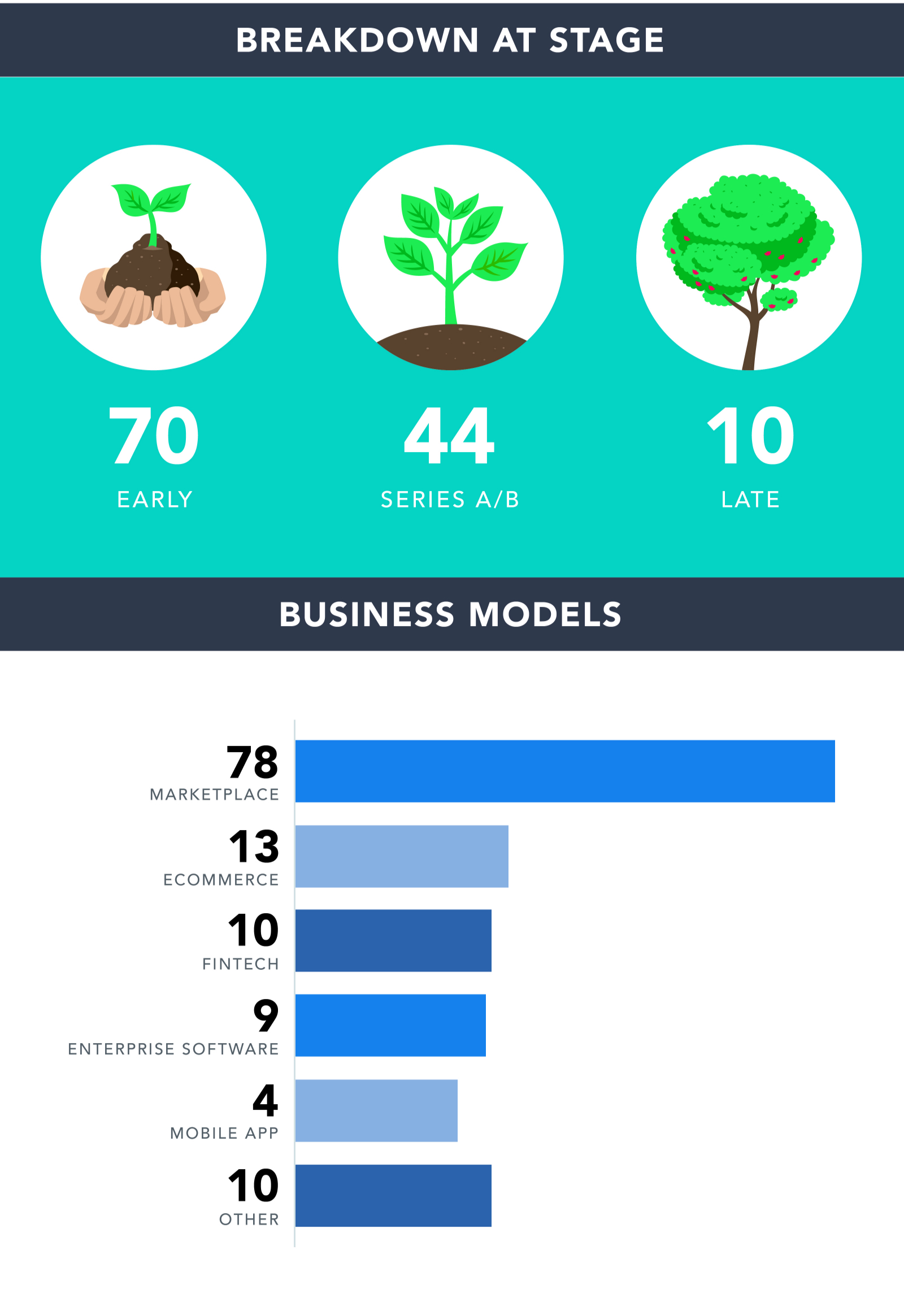

FJ Labs continued to rock. In 2019, the team grew to 26 people. We deployed $51M. We made 124 investments, 83 first time investments and 41 follow-on investments. We had 22 exits, of which 11 were successful including the acquisition of Reverb by Etsy and the acquisition of Fynd by Reliance Industries.

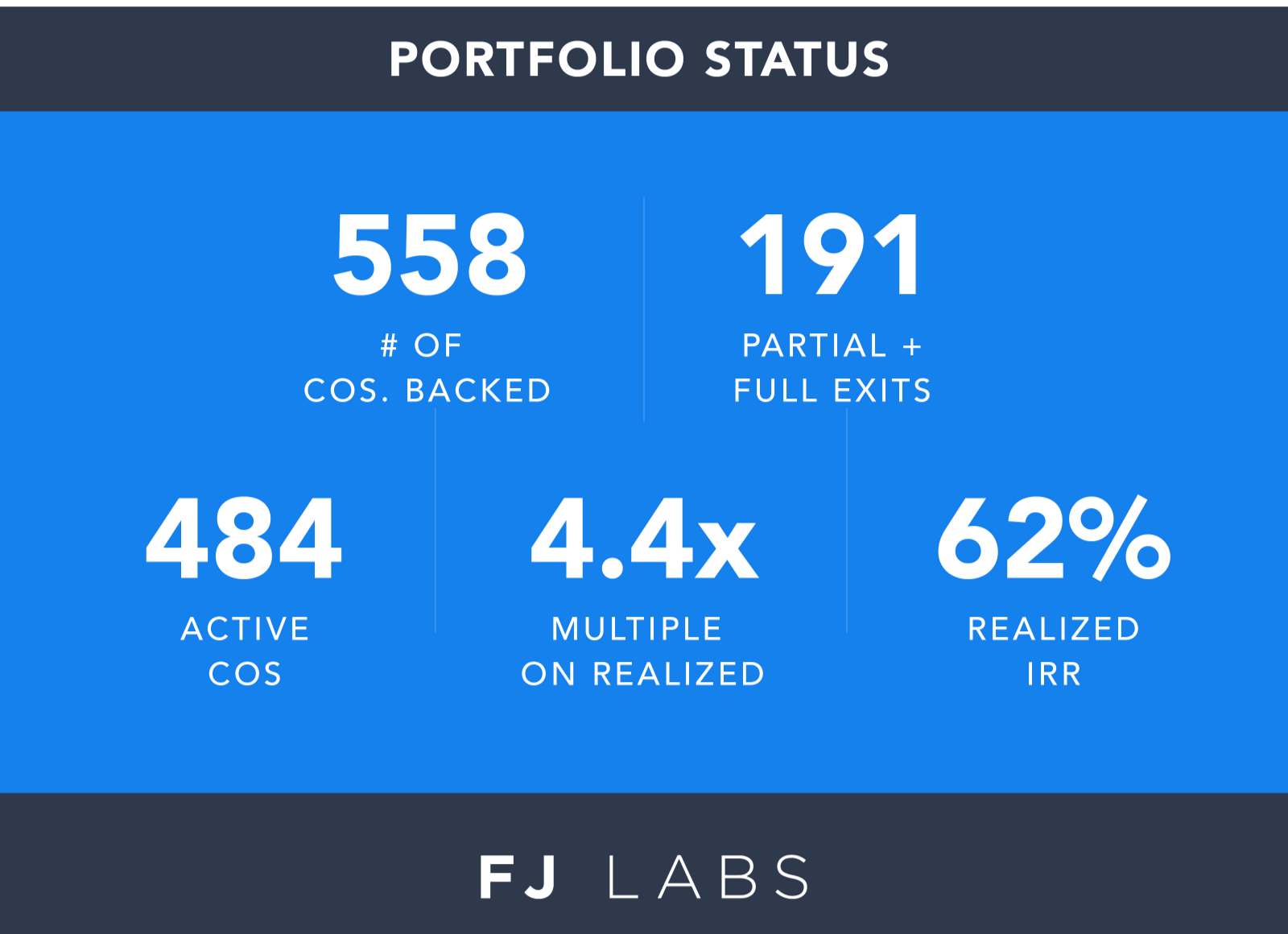

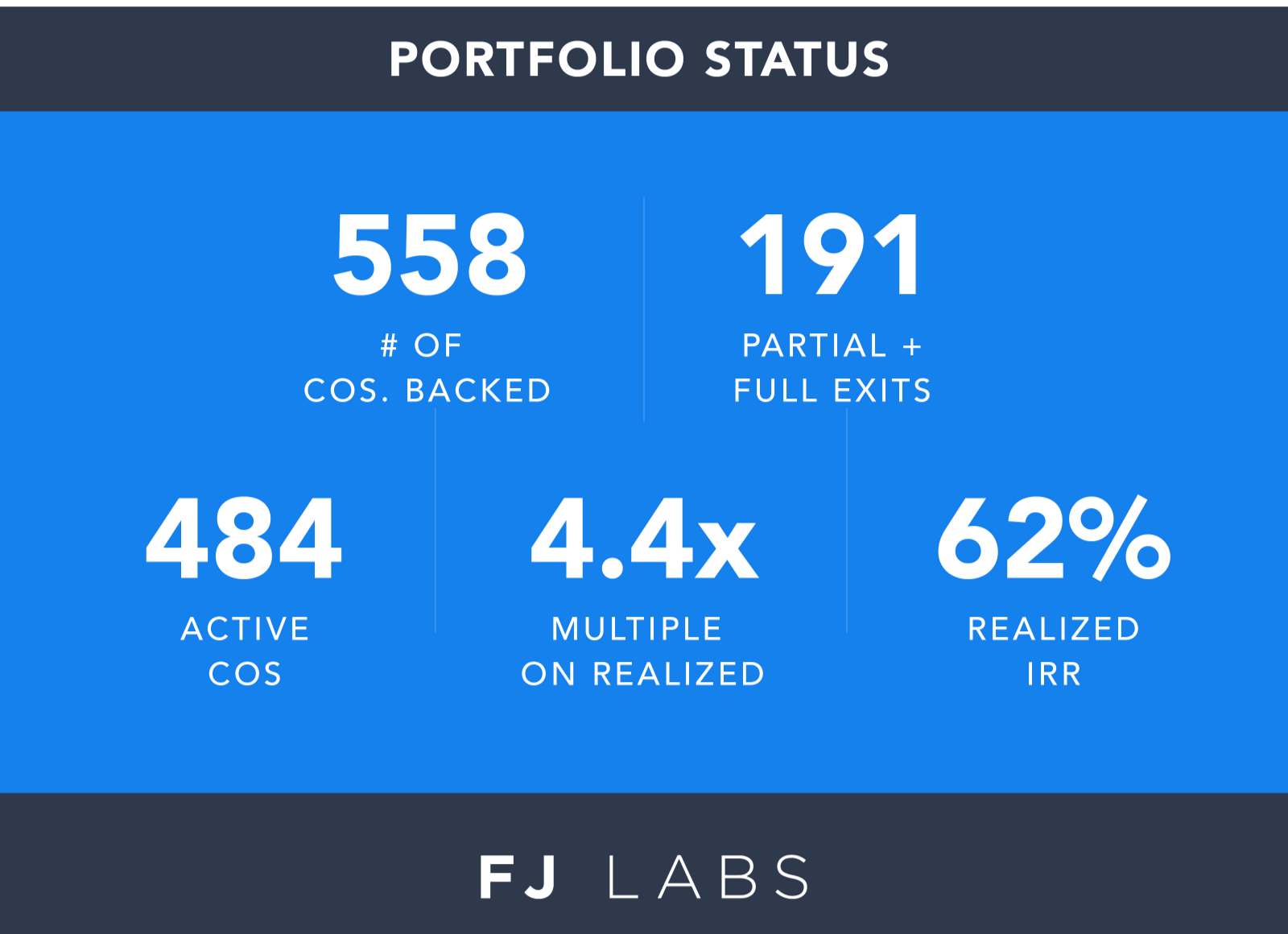

Since our inception, we invested in 558 unique companies, had 191 exits (including partial exits where we more than recouped our cost basis), and currently have 484 active investments. We’ve had realized returns of 62% IRR and a 4.4x average multiple.

I spent some time thinking about the latest trends in marketplaces.

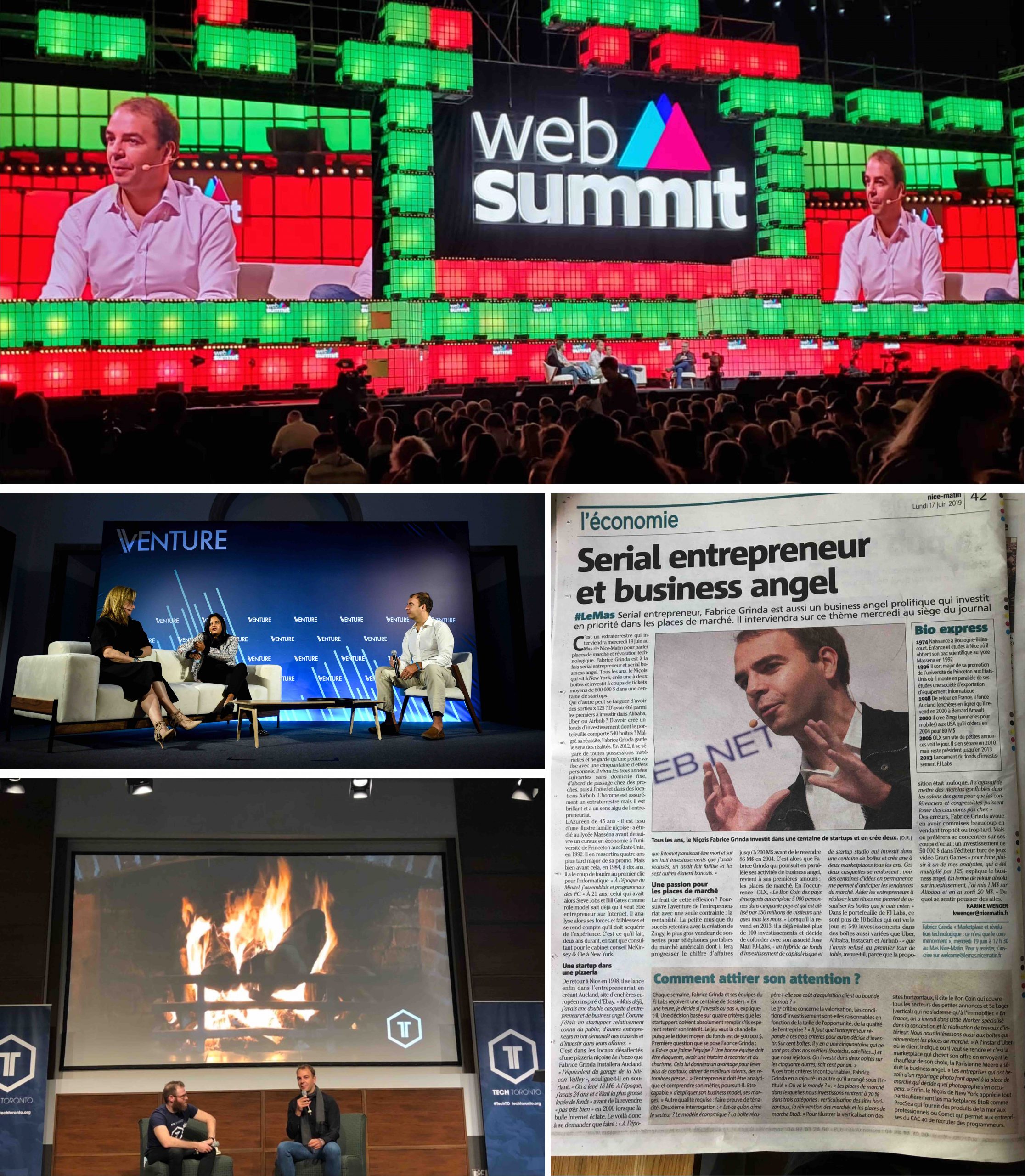

I also shared a lot of my entrepreneurial lessons learned in a series of keynotes, fireside chats, podcasts and video interviews:

It was fun to get a full page in the local newspaper just as I came to visit my family in Nice and to be covered in Les Echos around the French Tech conference.

In terms of writing, I finished my framework for making important decisions in life:

I also reviewed Why We Sleep given that I made significant life changes post reading the book and wrote a packing list for Burning Man to help virgins and grizzled veterans alike.

My economic predictions for 2019 were correct: the US economy did well. We are now in the longest expansion on record, and tech remained the sector to be in. While we are late in the economic cycle, the US may very well continue to do well until the end of 2020. We are at full employment and presidential election years typically have loose fiscal and monetary policies.

The main recession risk seems geopolitical given the current slew of world “leaders.” I suspect that the largest risk to the world economy is a budget crisis in Italy. It would put the Euro project at risk and lead to a massive flight to safety, creating the next global recession.

The current political climate keeps reinforcing my decision to avoid following and reading news be it in newspapers, online or on TV. It’s sensationalist negative entertainment that misses the real technology-led improvements that happen slowly, but inexorably transform our lives for the better.

Despite the implosion of WeWork and the travails at Softbank, I remain very bullish on early stage venture capital. We are still at the very beginning of the technology revolution. Only 15% of commerce is online. Online penetration remains negligible in the sectors that account for most of GDP: education, health care, and public services. The way we build homes is still artisanal. Synthetic biology is in its infancy. The emerging trend of no-code, which allows non-programmers to build complex fully functional websites, is unleashing a massive wave of innovation. It democratizes startup creation and innovation allowing people from all walks of life and every educational background to partake in the Internet revolution.

We are meeting more extraordinary entrepreneurs than ever before. There are still billions of capital on the sidelines in later stage funds like Sequoia and Insight that need to be put to work in the next few years. I suspect that even if some of these funds disappoint, most will still be able to raise their next fund. The current low rate environment, with no end in sight, will continue to lead to yield chasing. All that to say Seed and Series A funded startups will have access to plenty of capital. The technology sector remains the engine of productivity and economic growth and will continue to do well in 2020.

Happy new year!

我的朋友们似乎都决定来纽约过节。 由于他们已经游览了纽约的典型景点(大都会博物馆、自然历史博物馆、MOMA、自由塔、狮子王),因此他们要求提供更多独特的推荐。

这个淫秽的综艺节目无所不包:杂技、滑稽戏和疯狂表演。 令人惊叹的是,一些表演者的业余表演更增添了它的魅力。 你还能结识布什威克年轻、有趣、火热的 “火人 “人群。

一般是每隔几个周三晚上 8 点开始。 下一次是 1 月 29 日

吞噬

如果布什威克(Bushwick)和 “是的房子”(House of Yes)的裸露对你来说过于激进,那么 “吞噬”(The Devouring)应该是你的菜。 这是 Studio 54 的 Ian Schrager、House of Yes 和米其林星级厨师 John Fraser 合作的成果。 这就是 “肮脏马戏团”,如果它有钱,有专业表演者,有精美的餐点,它就会是这样。 这是一曲人类经历的颂歌,也是一场令人眼花缭乱的新芭蕾舞盛宴。 这是一场现代歌舞表演,一场盛宴,一场对生命的赞美。

德伦-布朗秘密

该剧的演出将于 1 月4 日结束,请抓紧时间前往观看! 德伦-布朗是世界上最好的心理学家。 他的节目融合了读心术、说服和心理幻觉,重点是引导我们生活的故事和信念。

如果你不能来,一定要在 Youtube 和 Netflix 上观看他的节目。

游牧民族的魔术师

这是我看过的最好的魔术表演。 它的特色是在一个狭小、阴暗和私密的环境中表演各种小把戏:漂浮术、纸牌魔术和精神魔术。 如果你是魔术迷,那就一定要看这场表演!

每晚,表演者都会听取观众的建议,并将其转化为即兴创作和完整的音乐片段。 每场演出都是一次自由式、嘻哈、即兴、前所未见的喜剧之旅,《汉密尔顿》的联合创作人之一林-曼纽尔-米兰达(Lin-Manuel Miranda)经常会意外客串。

我是Woom 中心的忠实粉丝,尤其是 David 和 Elian 的声音体验。 这种冥想以集体发声、全息呼吸(自然地模仿迷幻药对大脑的影响)和优美的泛音为特色,带你进入高度的意识状态。

我向每个人推荐这本书,尤其是冥想新手,他们一定会有脱胎换骨的感觉。 每周五晚上 7:30。 不要被三小时的时长吓到,因为每次都感觉 20 分钟就过去了!

VR 世界

VR 还没有发展到我建议人们拥有一台设备的阶段。 与 PS4、Xbox 和 PC 上的图形相比,它显得苍白无力,延迟仍然会导致晕动症。 不过,如果能花几个小时使用几十种顶级 VR 设备,并为每款游戏或体验进行精确设置,那也是非常有趣的。 一定要和几个朋友一起去,因为一起玩或对战都非常有趣。

零空间

零空间是一个身临其境的互动式数字艺术游乐场。 它给人一种迷幻的感觉,确实令人心潮澎湃。 该剧有点简单化,但绝对值得一看,因为它预示着未来的发展方向,尽管我们离真正的《星际迷航》级别的天文台还有几十年的时间。

不再沉睡 》开创了沉浸式剧场的先河,但如果说有什么批评意见的话,那就是你的体验可能会因为你在剧场里最终做了什么和跟了谁而大相径庭。 为了解决这个问题,《她坠落了》创造了一种身临其境的戏剧体验,每场演出只有 15 名观众。 因此,您始终是行动的一部分。

演出在威廉斯堡的一栋三层楼建筑中进行,该建筑经过精心改造,酷似一家精神病院,展示了刘易斯-卡罗尔的作品和生活,尤其是他与爱丽丝-利德尔的关系,爱丽丝-利德尔是他创作《爱丽丝梦游仙境》和《透过望远镜》的缪斯。 它亲切、引人入胜,是迄今为止我参加过的最有趣、最引人入胜、最有意思的沉浸式戏剧体验。

喜剧酒窖是一个机构,也是世界上最棒的喜剧俱乐部。 这里总是有一个非常棒的阵容,其中既有非常知名的漫画家,也有崭露头角的漫画家。 一些行业巨星有时会不请自来。 我和罗宾-威廉姆斯、克里斯-洛克以及无数其他人一起经历过!

如果你曾认为博物馆是枯燥乏味的,那么这就是体验博物馆的方式。 这些节目节奏明快,内容丰富,但却十分搞笑。 这绝对是体验大都会博物馆和自然历史博物馆的最佳方式。

周一夜魔法

周一魔术夜 “是一场有趣、便宜、适合儿童观看的魔术表演。 它的特色是由当周恰好在纽约的最佳魔术师进行各种表演,为观众带来耳目一新的体验。

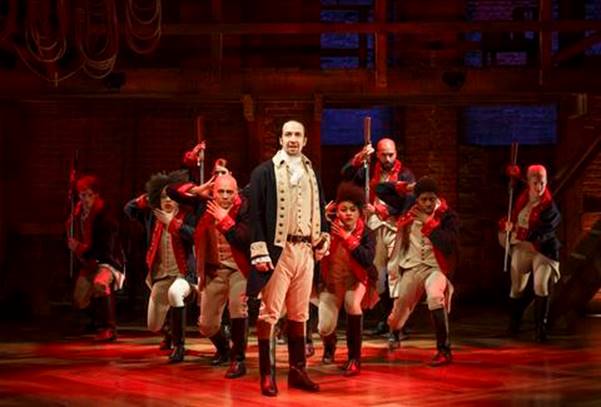

这可能是有史以来最好的音乐剧。 我非常偏爱亚历山大-汉密尔顿,因为他是我学习的榜样之一,我也是罗恩-切尔诺(Ron Chernow)所著的他的传记的忠实粉丝,而这部音乐剧正是根据他的传记改编的。 然而,这部疯狂的嘻哈音乐剧是一部巡回演出,也是唯一一部让我嚎啕大哭的音乐剧。 你一定要看看!