A year ago, in Welcome to the Everything Bubble, I argued that an unprecedented combination of loose monetary and fiscal policies was fueling a bubble in every asset class. We were seeing frothiness in equities, crypto, real estate, land, commodities, and bonds with a full-on speculative bubble in SPACs. Unusual behavior like retail driven short squeezes and extraordinary volatility all suggested we were at or near the top of the market.

At FJ Labs, we were of course massive beneficiaries of the bubble as all our investments were being marked up insanely rapidly. We were keenly aware that while we think we do a good job at picking investments, we were also benefiting from the frothy environment. In a bubble we all look like geniuses. We took my macro concerns to heart and sold secondaries in some of our high-flying winners. This is not because we did not believe in them, quite the contrary, but they are typically the only positions we can get some liquidity in. Plus, we usually sell only 50% of our position.

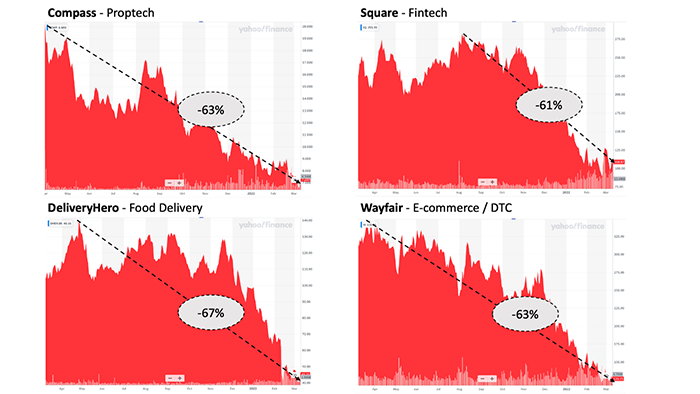

Since then, the market has corrected especially for tech stocks and crypto. 40% of Nasdaq stocks are down over 50% peak to trough in every tech sector.

Multiples have significantly compressed for public tech companies. SaaS multiples are now back below the long-term median.

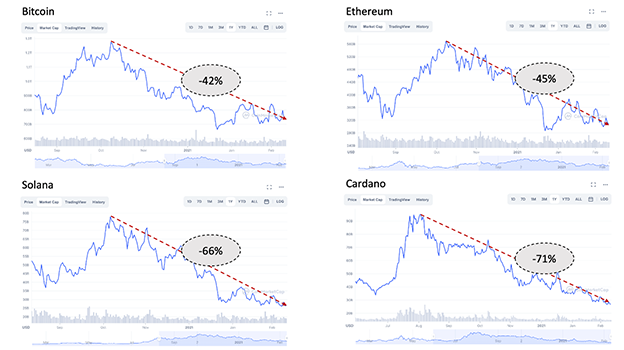

Most crypto assets are also down over 50%.

This begs the question of what we should do now. Therein lies the problem as where we go from here is extremely uncertain. In the past I had more certainty and clarity of thought. In the late 1990s, I published articles that explained we were in a tech bubble, and that while it would burst, it would also lay the foundations for the growth to come. In the mid-2000s, I argued on this very blog that people should rent rather than buy given inflated real estate prices. As discussed above, a year ago I suggested every asset class was becoming overvalued. Now I can make reasonable arguments for why things could recover, why they will go sideways, and why we could have a lot more downside.

An Uncertain Macro and Geopolitical Environment

A. The Optimistic Case

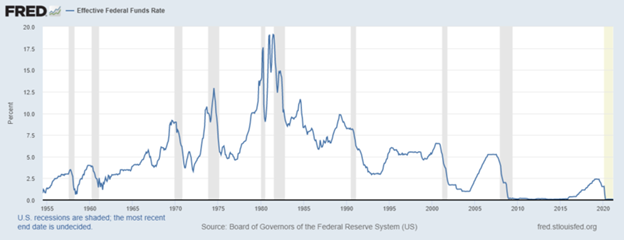

I wanted to start with the optimistic case because in this time of doom and gloom hardly anyone believes in it. The consumer price index climbed 7.9% in the 12 months to February 2022, the largest 12-month gain in 40 years. To prevent runaway inflation, the Fed is expected to raise rates 5 times this year by at least 1.5% cumulatively. Historically, most rapid increases in rates by the Fed have led to a recession.

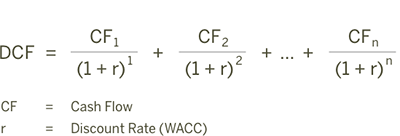

The reason public markets pulled back, especially for risk assets like tech stocks and crypto, is the expected rise in US interest rates. The reason rate increases affect risk assets more is that risk assets have more of their value driven by cash flows in the distant future. The value of a company is the net present value of future discounted cash flows.

Imagine a tech startup expected to throw off $1 billion in cash flow in 10 years. If the discount rate is 0%, then that future cash flow increases the valuation of the company by $1 billion. However, if the discount rate is 10%, the same $1 billion of cash flow ten years downstream only increases the current valuation of the company by $385 million. When we start at very low rates, it does not take a large change in interest rates to have large impacts on valuations, especially for companies where most of the cash flows are coming in the relatively distant future.

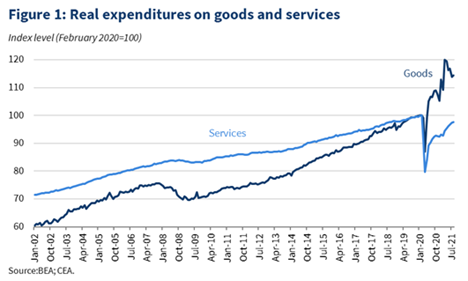

Now, a large portion of the increase in inflation has been due to the supply chain crunch caused by a massive increase in the demand for goods. This in turn was due to a decrease in the demand for services as consumers could no longer travel, go to restaurants, the movies etc.

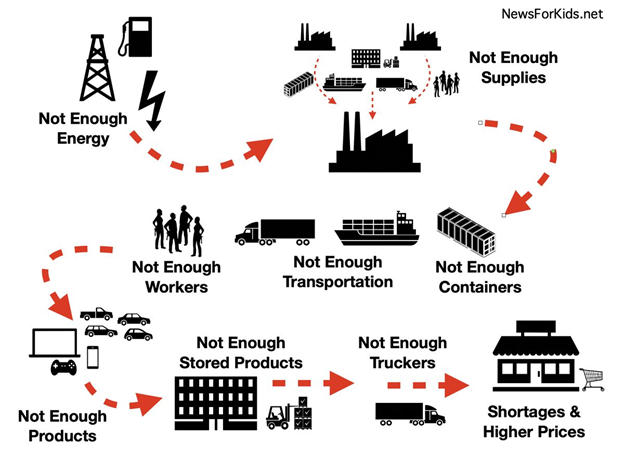

With all this extra disposable income on their hands consumers took to online shopping. It turns out, our infrastructure is not made to scale this fast. The number of container ships in the world, the number of containers available, the throughput of our ports, the availability of trucks and truck drivers, the availability of chassis (the trailers that haul containers around), all got overwhelmed which clogged the system. We simply don’t have enough of these essential supply chain elements, or resilient systems that are agile enough to shift the supply of these assets to where they are needed.

On top of that e-commerce logistics networks are fundamentally different in their geographical and physical space than those of traditional retail. They are more complicated because you are edge caching your inventory to be closest to your users instead of positioning everything in a distribution center in a single hub. Companies must position their warehouses all over the United States, making it exponentially more complicated. As a result, the more people bought things online, the more these systems were overloaded.

This is being exacerbated by the war in Ukraine that is pushing up energy prices and further disrupting supply chains.

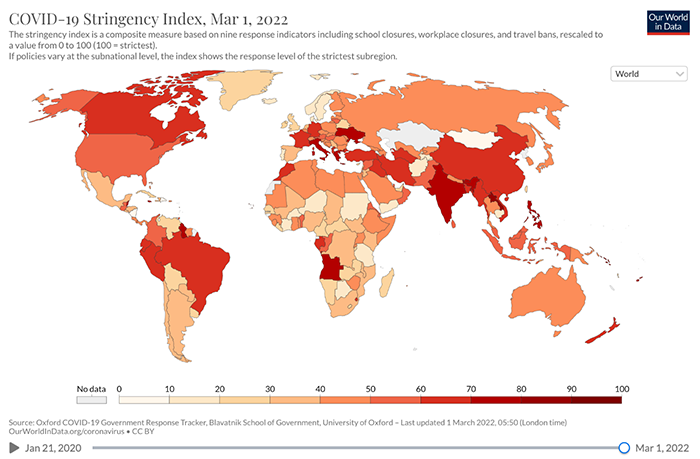

Let me now articulate how an optimistic outcome could play out. The shift in purchases from services to goods was driven by stringent COVID restrictions.

Imagine that now that everyone has had COVID because of Omnicron and/or is triple vaxed, COVID finally becomes endemic. While it may be with us for a long time, we learn to live with it and states end all restrictions, following the lead set by Denmark and the UK. Consumers revert to their ex-ante consumption patterns. This should allow supply chains to unclog and have a deflationary effect on the economy as logistics costs decrease significantly.

On top of that, the end of COVID relief checks should eliminate some of the excess demand that was being pumped into the economy. If this happens quickly enough such that inflation expectations are not entrenched and asking for 7% pay raises annually does not become the norm, the inflation bump should prove temporary, allowing the Fed to increase rates slower than anticipated by the markets.

We are also at peak uncertainty with the war in Ukraine negatively impacting sentiment. Should it come to a resolution in the coming weeks or months, it should eliminate a lot of geopolitical risk overhanging on the economy. I am also hopeful that the difficulties Putin is encountering in Ukraine and the severity of the economic sanctions have given second thoughts to Xi Jinping with regards to a possible invasion or annexation of Taiwan.

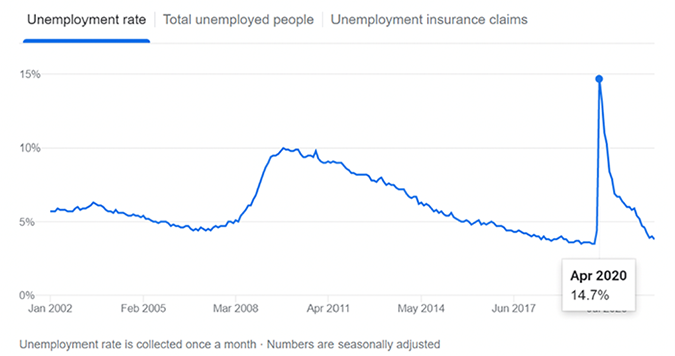

Should inflation and geopolitical tensions abate, the economy would be well positioned to continue to do well and for markets to recover. Companies are in good financial shape relative to other periods when a recession was brewing in terms of cash positions and indebtedness. We are at full employment with US unemployment at 3.8%. The fiscal deficit is dropping sharply as Congress is not considering further relief packages, and the additional infrastructure and social packages will be much smaller than the recent relief packages.

In the long run, technology should also help deal with inflation. Technology is deflationary and provides better user experiences at lower costs. COVID has led to rapid technology adoption in sectors of the economy heretofore barely touched by the technology revolution: health care, education, B2B, and even public services. Economists like Tyler Cowen who first described the “Great Stagnation” are now predicting a re-acceleration of technology-driven growth.

In Q4 of last year I would have ascribed a 50% probability to the optimistic scenario playing out. Right now, I would say it’s about 33%, but unfortunately declining by the day.

B. The Stagnation Case

The optimistic case requires inflation to be transient and to return to the status quo ante allowing the Fed to raise less than expected. The issue is that the longer inflation stays above trend (say 2 – 2.5%), the more likely it is that inflation expectations get entrenched. The private-sector average hourly earnings, seasonally adjusted, rose by 5.1% in February year-over-year. While this is still lower than inflation, if workers start to get an automatic 7% bump in pay every year to combat inflation, this will entrench inflation at 7%.

States are generally risk averse and slow to act. They may loosen restrictions slower than justified. This would keep the demand for goods artificially inflated longer, keeping supply chains clogged, and prices high. This in turn would increase the probability of entrenching higher inflation expectations.

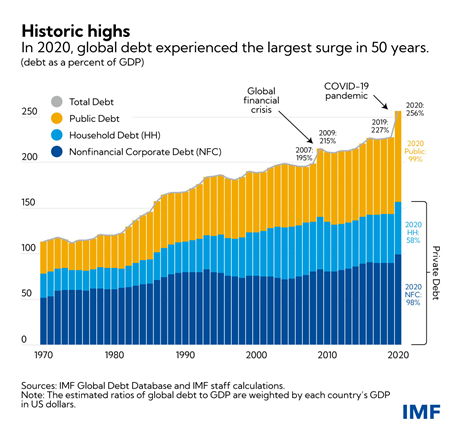

There is also a growing sense that many would be comfortable with higher inflation. Global debt is at an all-time high at over 250% of GDP, making governments, corporations and households particularly vulnerable to higher rates.

Permanently higher inflation would have many costs: lower purchasing power, lower investments, misallocation of capital, destruction of the value of savings. However, in the short term negative real rates would also erode the value of the debt.

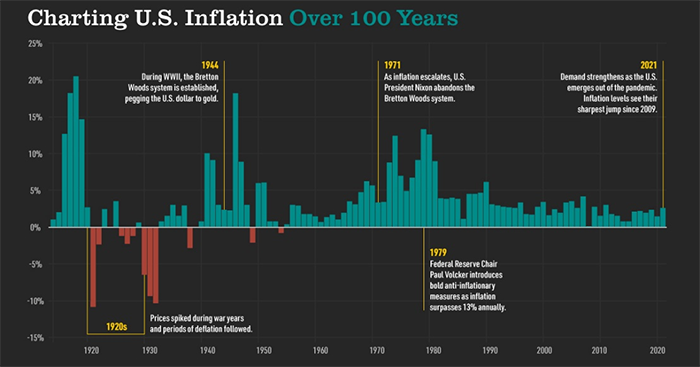

In times of war, states have tolerated higher inflation rates for reasonably long periods of time as you can see in the chart below for WWI, WWII and the Vietnam War.

While we are early in the Russian invasion of Ukraine, the current quagmire the Russian forces find themselves in may lead to a protracted conflict creating a cloud of uncertainty that impacts sentiment.

It’s easy to see how the stagnation scenario plays out. Interest rates rise, but not enough to counter increased inflation expectations. Politicians and the Fed choose to accept above trend inflation. When combined with geopolitical uncertainty, we would set ourselves up for low real growth. In this regard, we might start looking like many Latin American countries looked for decades. Instead of tracking nominal growth and values, we should track real values. While markets may not fall significantly in nominal terms, it is very likely that real valuations would decline over time.

This scenario may very well be the most likely one at this point.

C. The Pessimistic Case

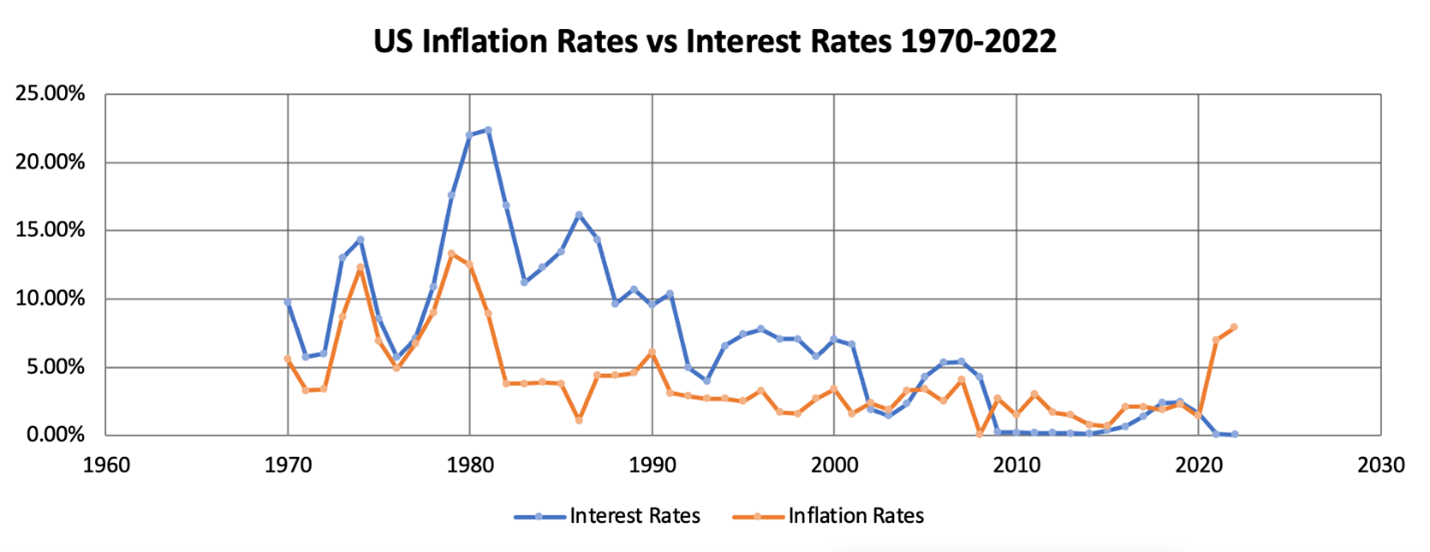

There is a real possibility that the worst is yet to come, with the number of scenarios that could lead to a catastrophic outcome growing by the day. While there is some tightening going on, the Fed and government are still running loose monetary and fiscal policies by historical standards. A 1.5% increase in interest rates may not be enough to contain inflation. In 1981, Volcker brought US rates to over 20%.

- Source for interest rates: Macro Trends

- Source for inflation rates: The Balance

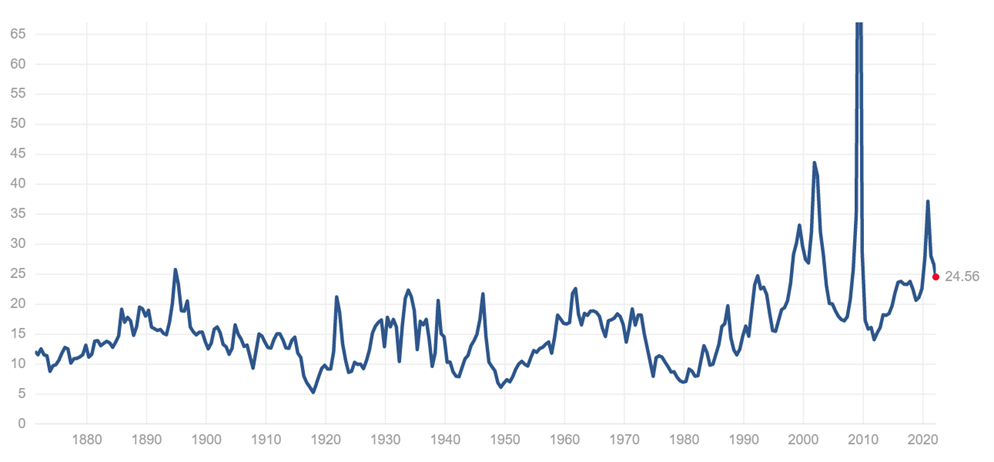

You do not need a Volcker 2.0 scenario to still have a significant impact on markets and the economy. Even a 5% rate, a level last seen in 2007, would tremendously slow down the economy and lower valuations, especially of risk assets. Even though public markets have corrected, valuations remain far above historical averages.

S&P PE ratio over time

It would not be unimaginable for valuations to be cut in half from where they are now, especially as earnings are likely to take a hit given higher energy costs and the fallouts of exiting Russia.

Worse there are many other scenarios that could lead to a global financial crisis and a general “risk off” mindset. Politicians, the public and the press seem to be like The Eye of Sauron. They are only able to focus on one issue at a time. For a long time that was Trump, then COVID, and now the Russian invasion of Ukraine. I often wondered if post-COVID that attention would not be brought to focus on the unstainable increase in the level of governments debts in many countries during COVID.

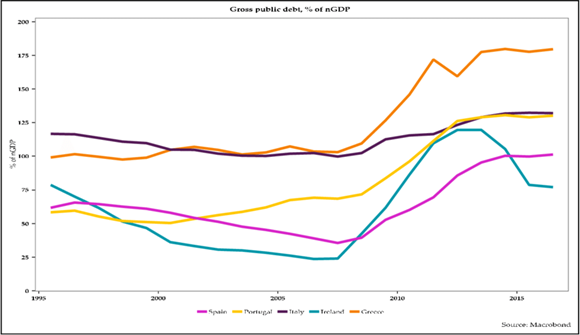

Italy, Greece, Spain, and Portugal all saw significant increases in their public debt over the last few years.

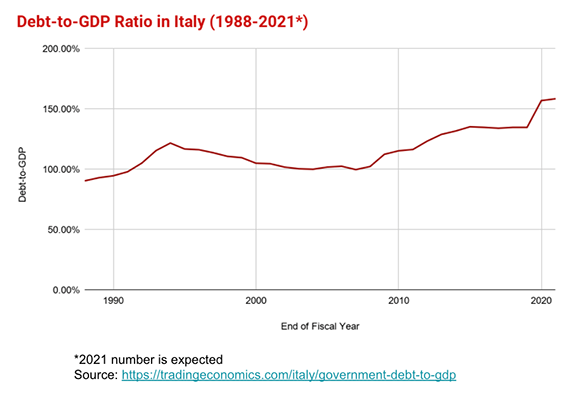

Italy’s debt to GDP ratio increased from 100% to over 150% in the last 15 years.

A crisis of confidence on Italian debt could threaten the entire Euro project with collapse. The Greek debt crisis triggered a massive global financial crisis. The Italian economy is ten times larger, and the crisis would be that much greater. In such a scenario the entire financial system might seize up. Many banks would be exposed to the debt of the defaulting sovereign. Banks would be wary of trading with each other with its implied counter party risk, as happened during The Great Recession of 2007-2009.

Such a crisis could also be created by an emerging country default, or just a large bank default for a variety of reasons including possibly over exposure to Russia. Credit Suisse and UBS in particular feel vulnerable. They have found themselves at the epicenter of every recent international debacle involving bad lending, e.g., Archegos , Greensil , Luckin Coffee, etc. Foreign currency denominated loans by themselves amount to ~400% of Swiss GDP. Officially, Swiss banking system assets are ~ 4.7x GDP but this excludes off balance sheet assets. Including these suggests a ratio of ~9.5x 10x is more accurate.

Switzerland has long been regarded as a safe haven with a prosperous and stable economy and a homogeneous population. I suspect that in the next crisis Swiss banks may prove too big to bail instead of too big to fail and could bring the entire Swiss economy down with them.

This is not unprecedented. For many years preceding the Global Financial Crisis, Iceland was widely perceived as an economic success story, winning plaudits from the IMF and elite commentators. Few people had noticed that in the seven years leading up to 2008, Iceland’s three largest banks Kaupthing , Glitner, and Landsbanki had embarked on a spectacular lending spree, which resulted in their total assets growing to >11x Iceland’s GDP (from <1x before). Beyond the sheer size of their loan books, the Icelandic banks compounded their risk by poor underwriting to highly dubious borrowers, often denominated outside the native Krona (e.g., ~€50b in Euro loans versus only ~ €2b in Euro deposits). When liquidity dried up in early 2008 and people began to question the solvency of the 3 large Icelandic banks, their huge size relative to Iceland’s total GDP meant that the Central Bank of Iceland was unable to act effectively as a lender of last resort. The result was a total banking system failure, a soft sovereign default and an economic depression, as Iceland itself had to take a massive bailout from the IMF. The Krona collapsed by ~35% versus the Euro, and the capitalization of the Icelandic stock market fell by over 90%.

We cannot ignore other risk factors. In the postwar era in the U.S., every instance in which oil has spiked above $100 per barrel in real terms has been followed by a recession. This pattern has played out in 1973, 1979, 1990, and 2007.

Geopolitical tensions could also escalate. It’s no longer inconceivable that Russia would use a tactical nuke in Ukraine. The conflict could easily engulf other countries. It’s not clear where our red line is and what would happen if Russia launched cyber-attacks on the infrastructure of our NATO allies for instance. It’s also possible that Xi Jinping makes a play for Taiwan while we are distracted in Ukraine further threatening global stability.

In the not-too-distant past, I ascribed low probabilities to all these scenarios, but they are now increasingly likely and becoming likelier by the day.

Macro Conclusions

There is now more downside risk than upside risk as I currently weigh the optimistic case at 33% (and declining). When it comes to your fear versus greed toggle, it is time to be more fearful. However, fortunes are made in bear markets. As Buffett has said, we should be fearful when others are greedy, and greedy when others are fearful.

To position ourselves to play offense in a bear market (either as investors or as founders), we must be proactive before the bear market materializes. For both investors and founders, the takeaway is simple: raise a war chest now. For founders, this means raising enough cash to survive and indeed to press competitors during tough times. For investors, this means raising liquidity in anticipation of chances to buy attractive assets at dimes or pennies on the dollar.

Individuals should try to lock in long term fixed mortgages at today’s low rates while they still can. I would also recommend maxing out the amount of non-recourse loans you can borrow against your home at a low 30-year fixed rate. Inflation will ebb away at your debt load. I recently renegotiated my mortgage on my New York apartment for instance.

Despite high inflation, I would keep a fair amount of cash on hand. While its value is being deflated it gives you optionality to buy assets cheaply should there be a large correction. It’s the reason we pursued an aggressive secondary strategy over the last 12 months. Note that I keep my cash in decentralized finance and insure it as a means of generating low risk above inflation returns. I am working on a way to share the solution I use myself with a much broader group.

Founders should raise now while keeping an eye on their unit economics and burn. Private market multiples have not yet compressed to the level of public markets. Given a potential multiples compression, you might get the same valuation today as you will in 1 year despite having 1 year of growth.

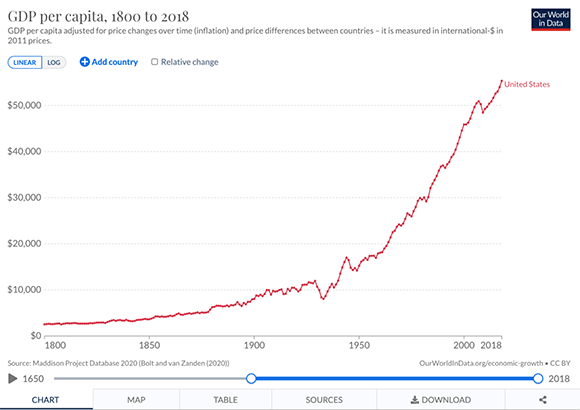

History Trumps Macro

I do want to leave you on an optimistic note. The tide of history trumps the macroeconomic cycle. They just operate on a different time scale. The last two hundred years have been a story of economic growth driven by human ingenuity. Over a long time, recessions and wars barely register. Even The Great Depression, while unpleasant to live through, is merely a blip in the history of progress.

Over the last 40 years we saw countless crisis and crashes: the 1981-1982 recession, Black Monday in October 1987, the 1990-1991 recession, the bursting of the dot com bubble & 9/11 and the corresponding 2001 recession, the Great Recession of 2007-2009 and the COVID-19 Recession of early 2020. Throughout all this, if you invested in technology writ large you did well.

My current asset allocation is as follows: 60% early-stage illiquid startups, 10% public tech startups (the companies from the portfolio that IPOed that I have not yet sold to reinvest), 10% crypto, 10% real estate, and 10% cash.

We are still at the beginning of the technology revolution and software continues to eat the world. I am optimistic that we are going to see a re-acceleration of technology driven growth. We will use technology to address the challenges of our time: climate change, inequality of opportunity, social injustice and the physical and mental health crisis.

As such, with FJ Labs, I will continue to invest aggressively in early-stage tech startups that are tackling the world’s problems. The macro for the next few years may suck, but ultimately is largely irrelevant. I care more about the amazing companies we are going to build to bring about a better world of tomorrow, a socially conscious world of equality of opportunity and of plenty.

Good read Fabrice. Very well written and made a lot of sense to me.

Good point on the compression of startup valuations. Time to raise indeed! As for public stocks: are there stocks benefitting from the situation (defense and maybe energy or mining?), some (tech) stocks unfairly punished? You didn’t mention gold and silver but those are also popular choices in uncertain times 😉

excelente!

Shared with our team at BlueOcean; powerful read and a line item on our LT offsite to discuss how we manage/rethink our budgets with the uncertainty in front of us. – Liza

Very interesting perspective thank you @fabricegrinda. What have been your portfolio returns in last 5 years following this strategy?

thanks for the post Fabrice… amazing as always.

Thank you Fabrice Grinda- Macro Conclusions are insightful and History Trumps Marco is key reminder that in the end all will happen as it must and probably be better than whatever it was. Different…. But… Better…

Thank you-