As I highlighted in FJ Labs’ Investment Strategy, FJ Labs is stage agnostic, geography agnostic, and industry agnostic. In other words, we invest in any geography, in any industry, at any stage. That’s not to say there is no area of focus. We specialize in marketplace and network effect business models which represent over 70% of the investments we make. Moreover, most of our investments in terms of number of deals are at the Seed and Series A stage and in the US. In a way that is not surprising as there are more Seed deals than A deals, more A deals than B deals and so on and so forth. Also, we are a New York based fund and there are more startups created in the US than anywhere else.

That said that flexibility has been extremely beneficial. When we identify trends, we typically invest in them in all geographies. We have also been able to adjust our strategy based on our reading of market conditions. For instance, we largely stopped investing in Russia after Putin’s annexation of Crimea in 2014. We also stopped investing in Turkey after Erdogan became president.

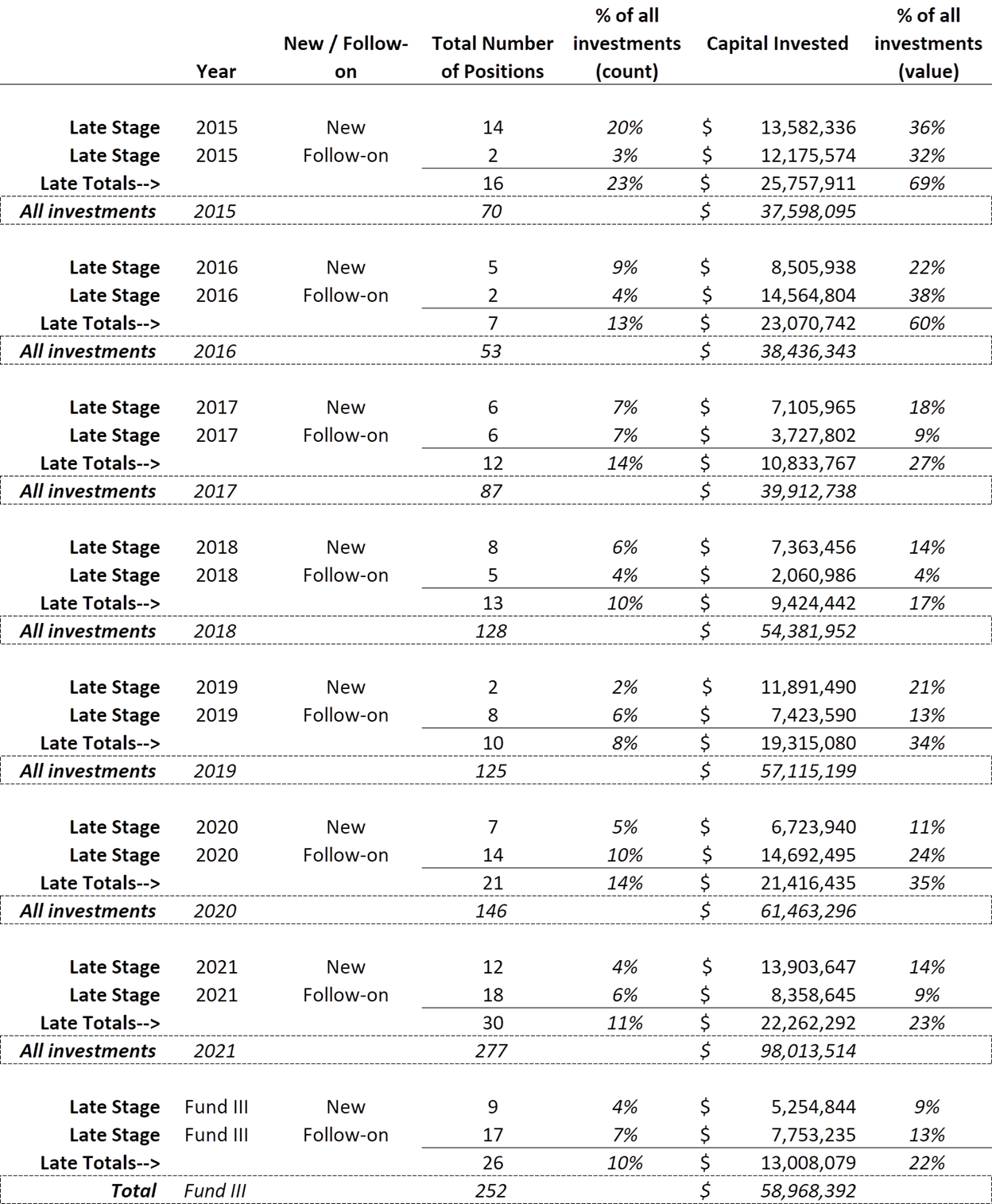

The place our reading of market conditions has expressed itself the most and in the percentage of capital we deployed late stage, Series C onwards. While we always invest in more early-stage deals, we often wrote large conviction checks in late-stage startups. As a result, most of the capital we deployed was sometimes in the late stage. In 2015 and 2016 over 60% of the capital we deployed was in the late stage. In 2019 and 2020 it was still 35%. In general, we feel that if the company is playing in a huge category, has a high probability of a 3x from our entry price and a reasonable probability of a 10x, it’s ok for us to enter at a multi-hundred million or even multi-billion valuation.

To give you a few examples of late-stage investments, we invested large amounts in Alibaba at $4 / share or a $15 billion valuation. We started investing in Airbnb at a multi-billion valuation and continued all the way to $17 billion or so. We first invested in Farfetch at a multi-hundred million valuation.

Sometimes we invest late-stage because we did not see the deal early, but more often than not it’s because we chose to wait until the company hit real product market fit with attractive unit economics at a reasonable valuation. For instance, we saw Coupang early but passed because they were following the Groupon model. Later they pivoted to becoming one of the companies vying to be Amazon of Korea. It’s only after they established themselves as the clear leader and hit a multibillion valuation that we pulled the trigger and started investing.

Reading the macro tea leaves

In February 2021, I published my macro piece Welcome to the Everything Bubble!. In it I argued that “The warning signs of market mania are everywhere. P/E ratios are high and climbing. Bitcoin rose 300% in a year. There is a deluge of SPAC IPOs. Real estate prices are rapidly rising. … It is unclear when the bubble will burst, but there are a few ways to be ready for when it bursts. … Right now, I am building my cash reserves while still investing. I particularly like the arbitrage of selling overvalued public tech stocks (or pre-IPO companies) and investing in somewhat less overvalued early-stage tech startups. I suspect having large cash reserves will come in handy at some point in the next few years.”

At FJ Labs we took that warning to heart. We significantly decreased our investments in late-stage companies to 11% of startups and 23% of the capital deployed in 2021. Likewise in our new fund, FJ Labs III which we started deploying in July 2021 and spans 2021 and 2022, late-stage investments represent only 10% of the startups and 22% of the capital. Even then, we mostly invested in reasonably priced late-stage companies with strong balance sheets and good unit economics which were usually follow-ons in our best startups.

We also sold secondaries in many of our late-stage companies. We loved the founders and the companies but felt it wise to de-risk our position and build up our cash reserves for the crisis to come. It is worth noting that we were usually begged by the founders and other investors to sell secondaries such that the new investors could reach their target ownership without diluting the founders too much.

This is not to say we played this perfectly. We did not sell as much in secondaries as we wanted to. We also misplayed our public equity positions. Most of them fell 50% between IPO and the expiration of the lockup 6 months later. As we felt the valuation had corrected and we loved the management team and companies, we decided to hold on to most of the positions only for them to fall another 50% since then.

However, we played our hand well and are entering this crisis in a position of strength. We deployed less than 25% of the $250M we have closed across our new funds for FJ Labs III. We plan on raising $400M+, at which point our 2021/Q1 2022 investments will only make up 15% of the investable capital in the fund giving us plenty of dry powder.

The most iconic companies of the last decade were created during the Great Recession of 2008-2009: Uber, Airbnb, Whatsapp, Instagram and countless others. We expect that many of the most important companies of the coming decade will be created in the years to come. Considering the environment, the founders will build more sound companies raising the right amount of capital at reasonable valuations, taking care of their burn, and focusing on their unit economics. Because they will face less competition, they will benefit from lower customer acquisition costs and will be more likely to dominate their category.

We beyond excited to invest in this coming generation of founders and startups whom we expect will rise to challenge of addressing the fundamental issues of our time: climate change, inequality of opportunity and social injustice, and the mental and physical wellbeing crisis.

Good quick thoughts. New times. New Opportunities. Integrated Logic.