In the first episode I covered how and when to fundraise. In this episode, I describe how venture capitalists (VCs) evaluate you once you are in front of them to help you refine your approach and pitch.

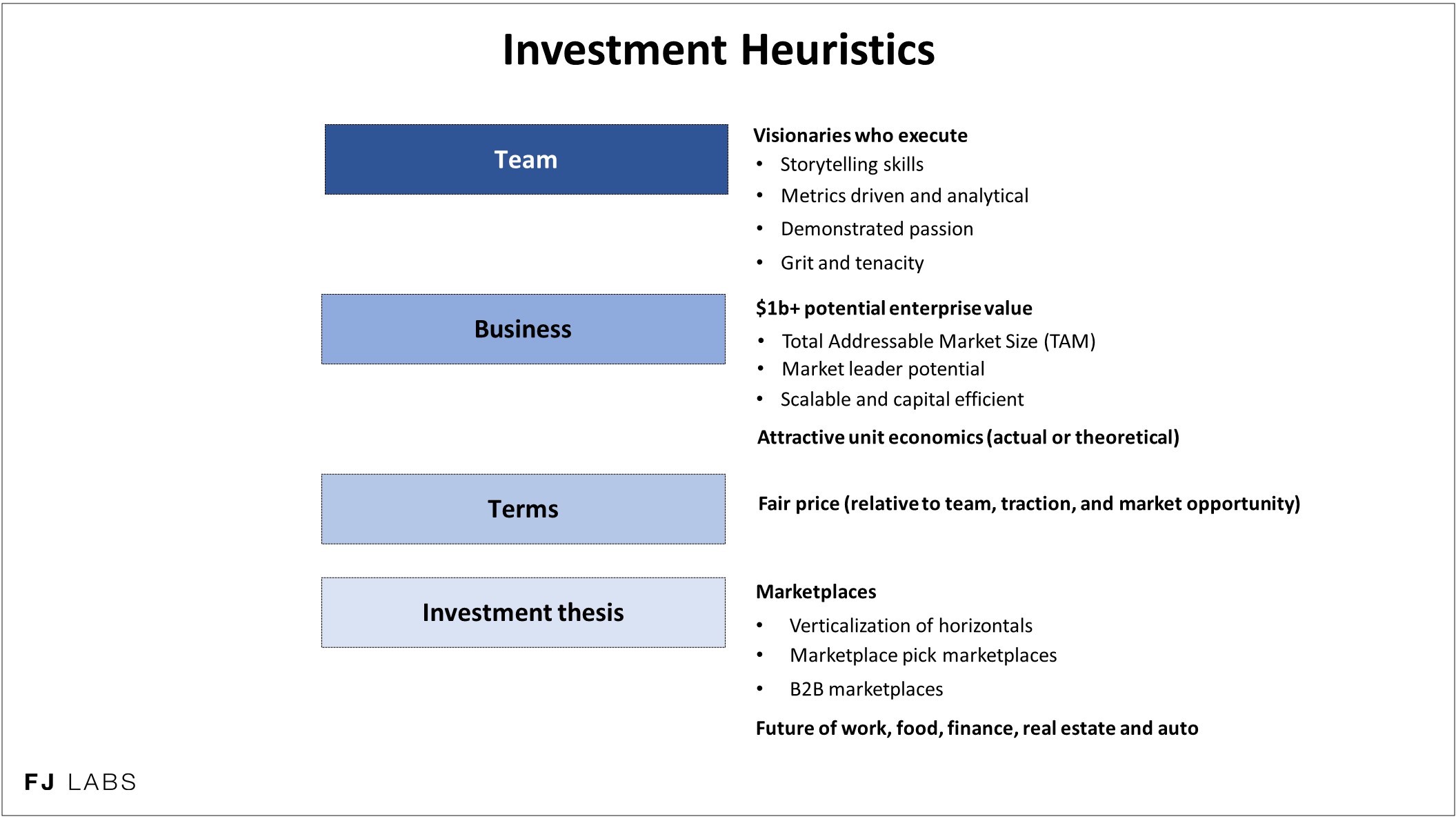

I explain how VCs use a combination of the team, business, deal terms and whether the idea fits with their thesis to decide whether to invest or not. I also detail:

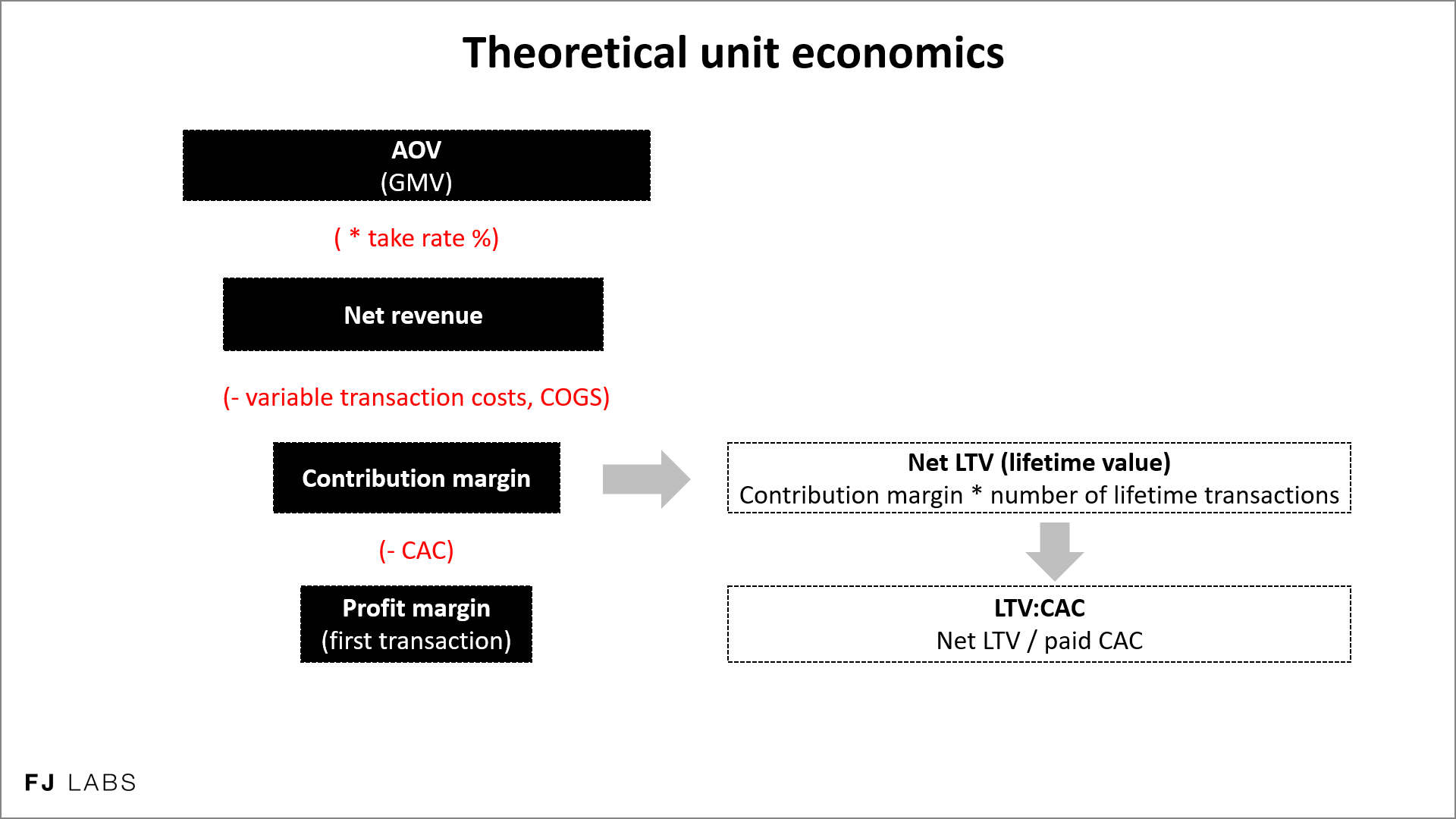

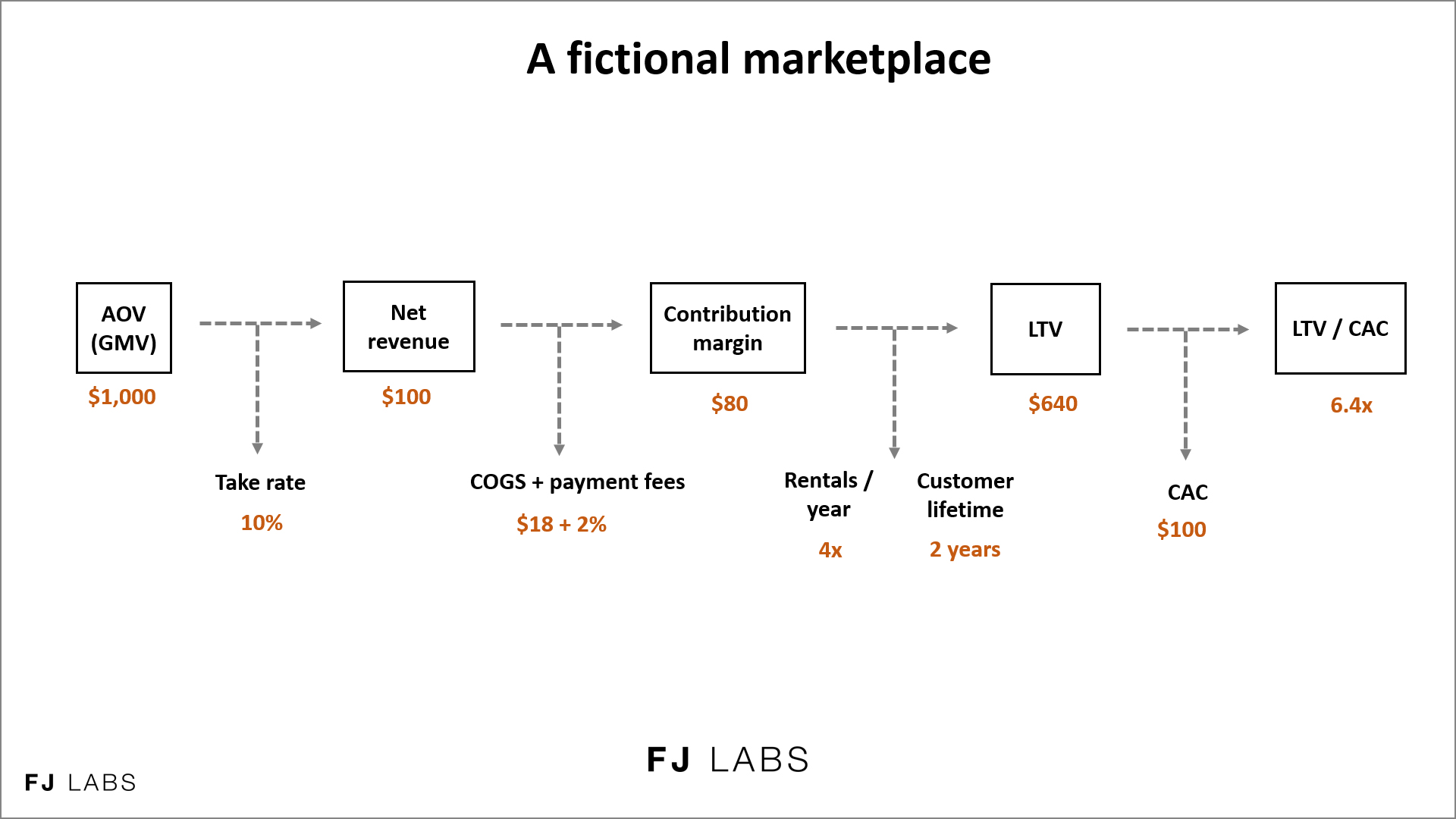

- What are unit economics

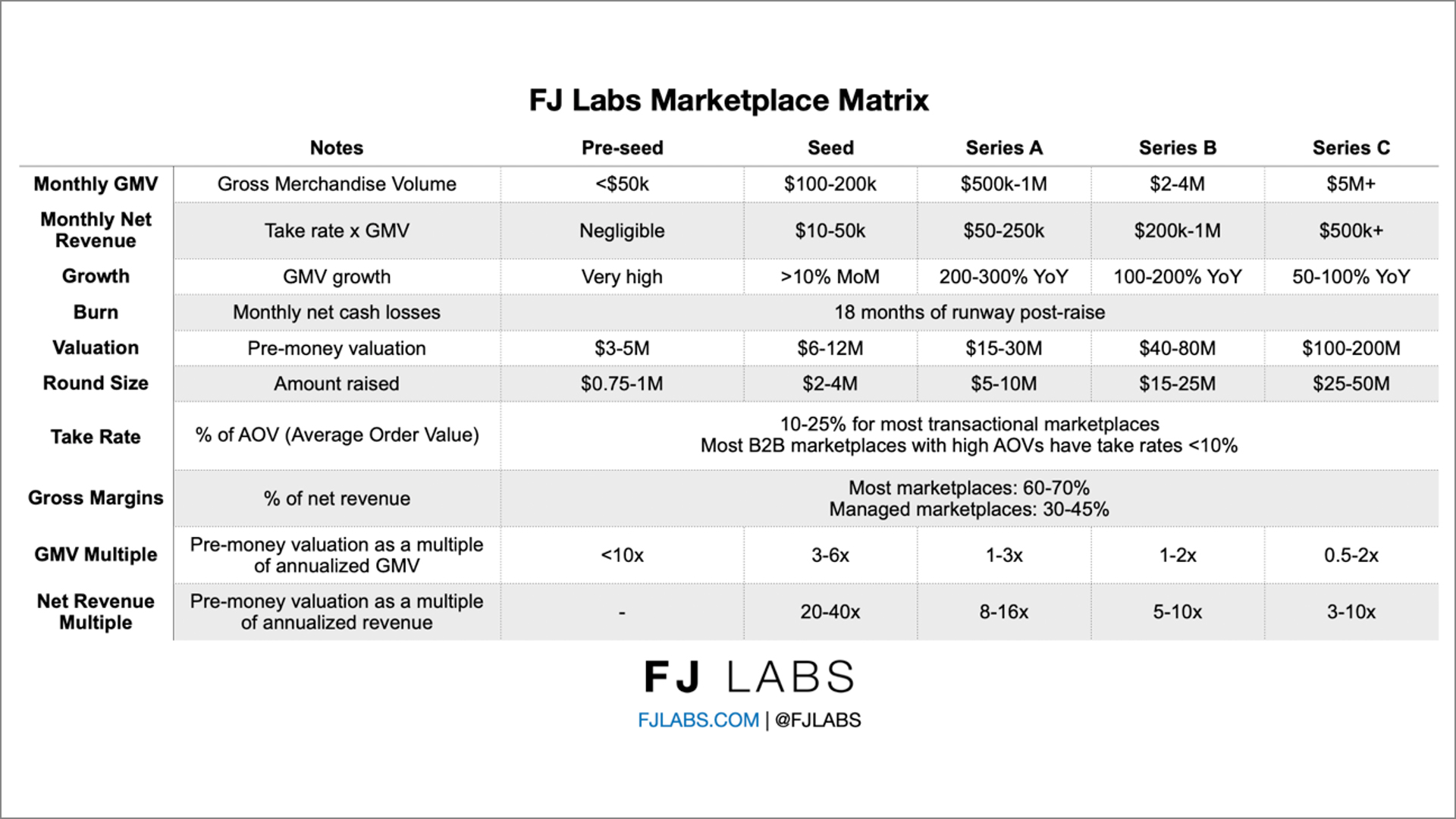

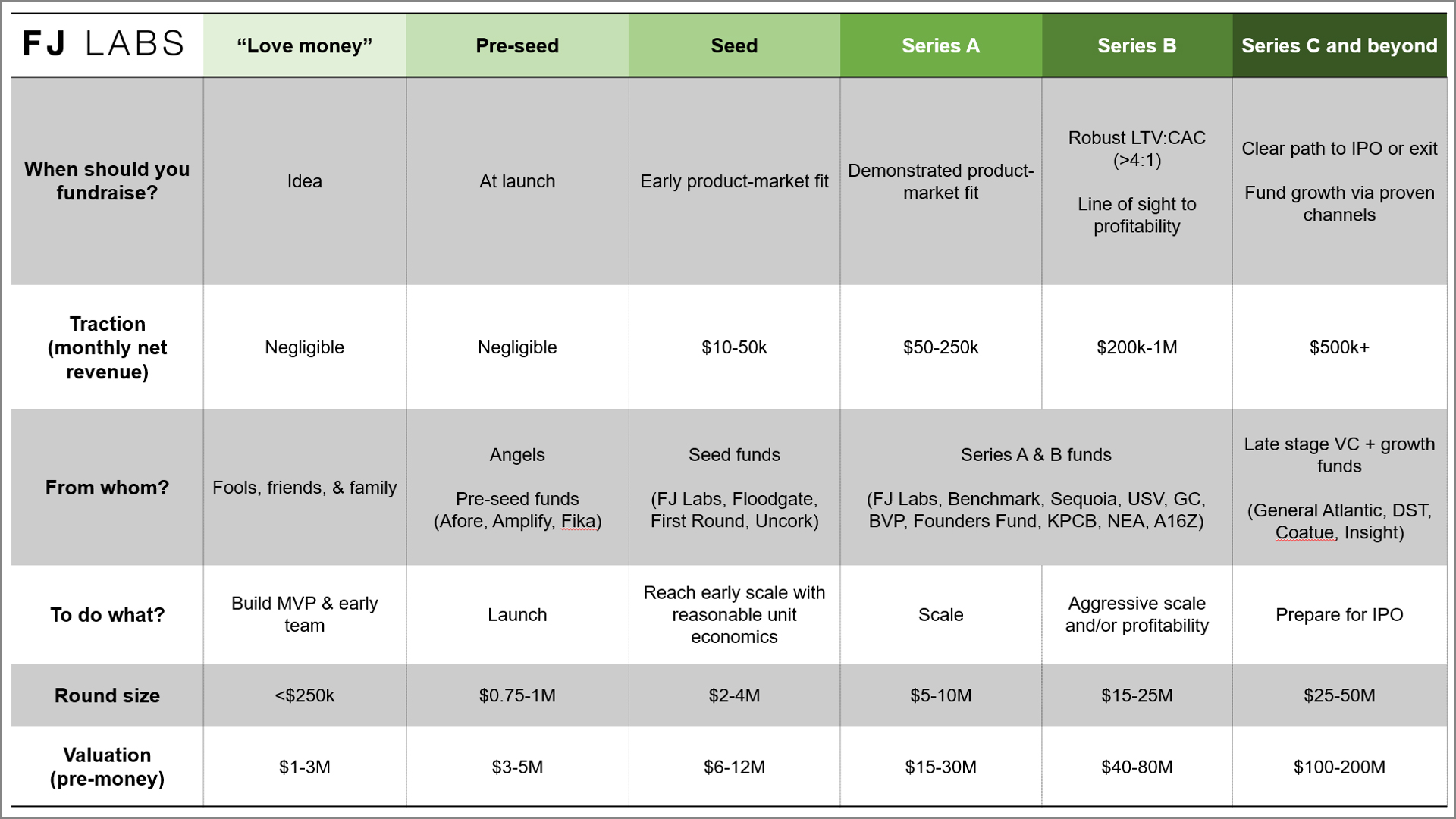

- Expected traction and valuation at various stages

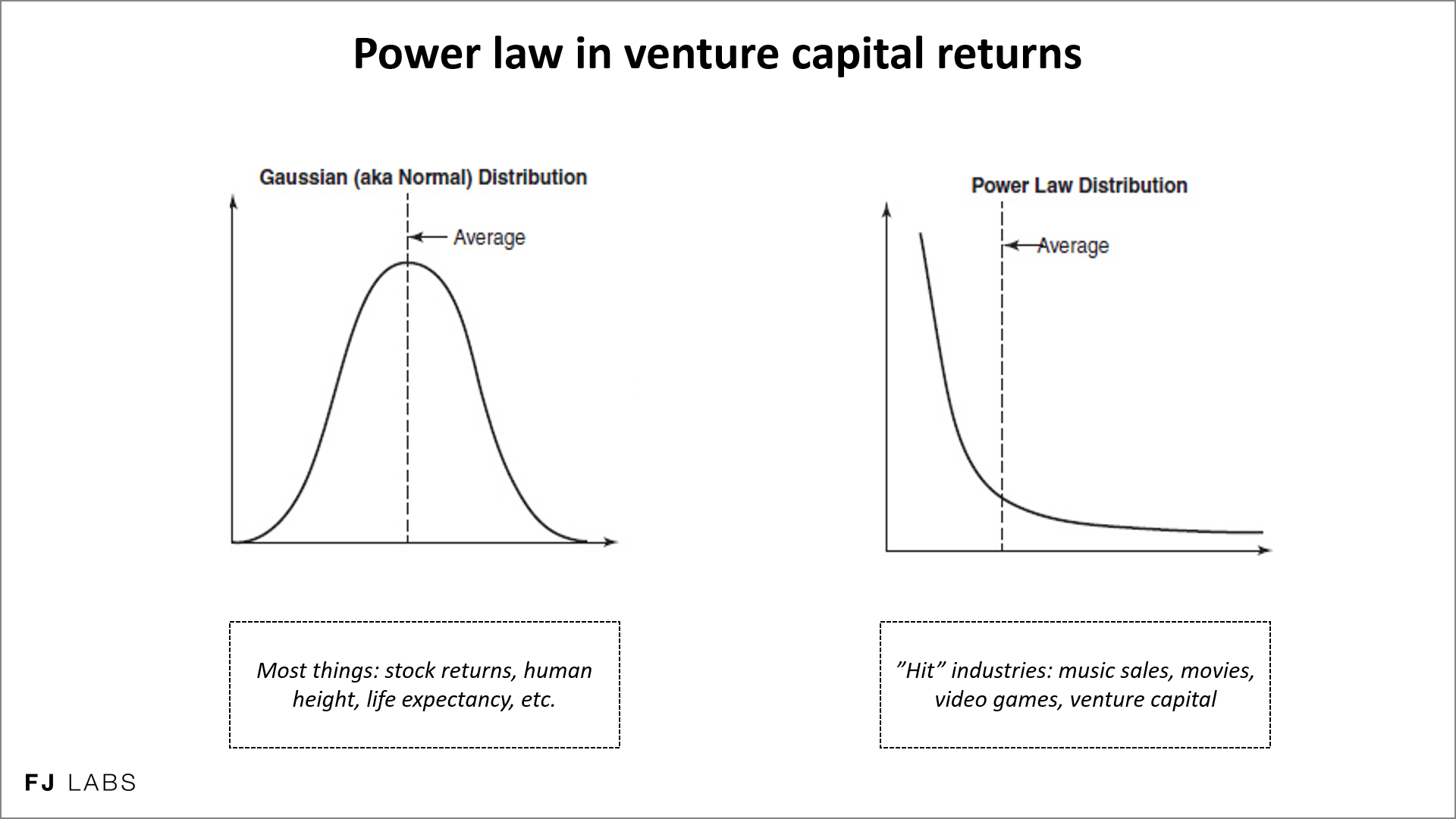

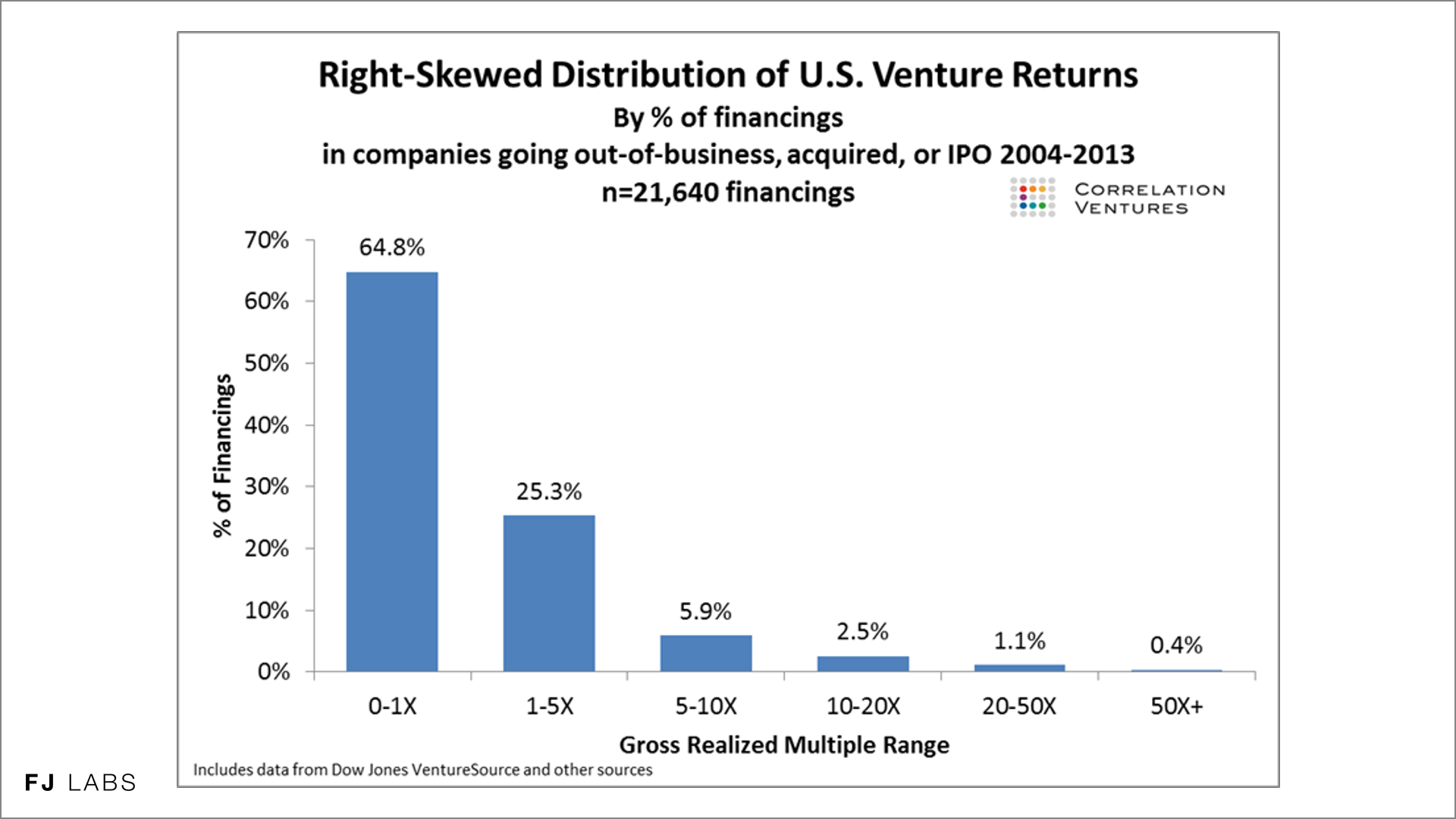

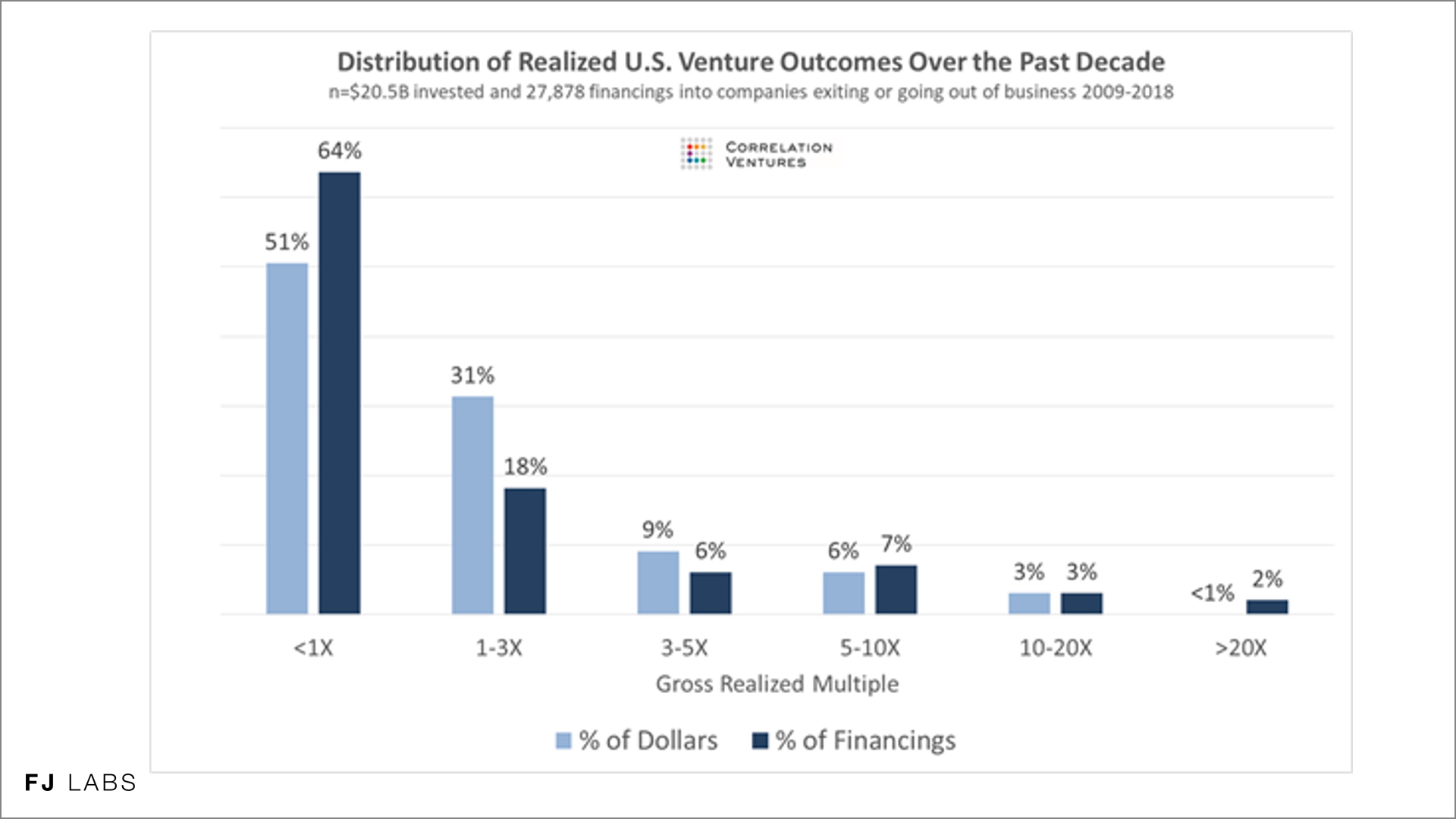

- That venture capital follows a power law

- How various VCs weigh the different investment criteria based on whether they are playing “Powerball” vs “Moneyball”

For your reference I am including the slides I used during the episode.

If you prefer, you can listen to the episode in the embedded podcast player.

In addition to the above Youtube video and embedded podcast player, you can also listen to the podcast on: