Given that I was in Lake Placid looking at the foliage change without my multi-screen setup, I tried a “Ask Me Anything” session for the week. It was a resounding success with very varied questions.

We covered:

- The impact of antitrust laws on the venture ecosystem

- The differences between being an angel and running an early stage fund

- How we acquired the first customers at OLX

- Whether marketplaces should start by building supply or demand

- How to build your brand in VC

- How to prioritize your time as an entrepreneur

- How foreign startups can succeed in the US

- Whether we are in a tech bubble

- Whether startups should be hyperlocal, national, or global

- My thoughts on impact investing relative to philanthropy and traditional venture investing

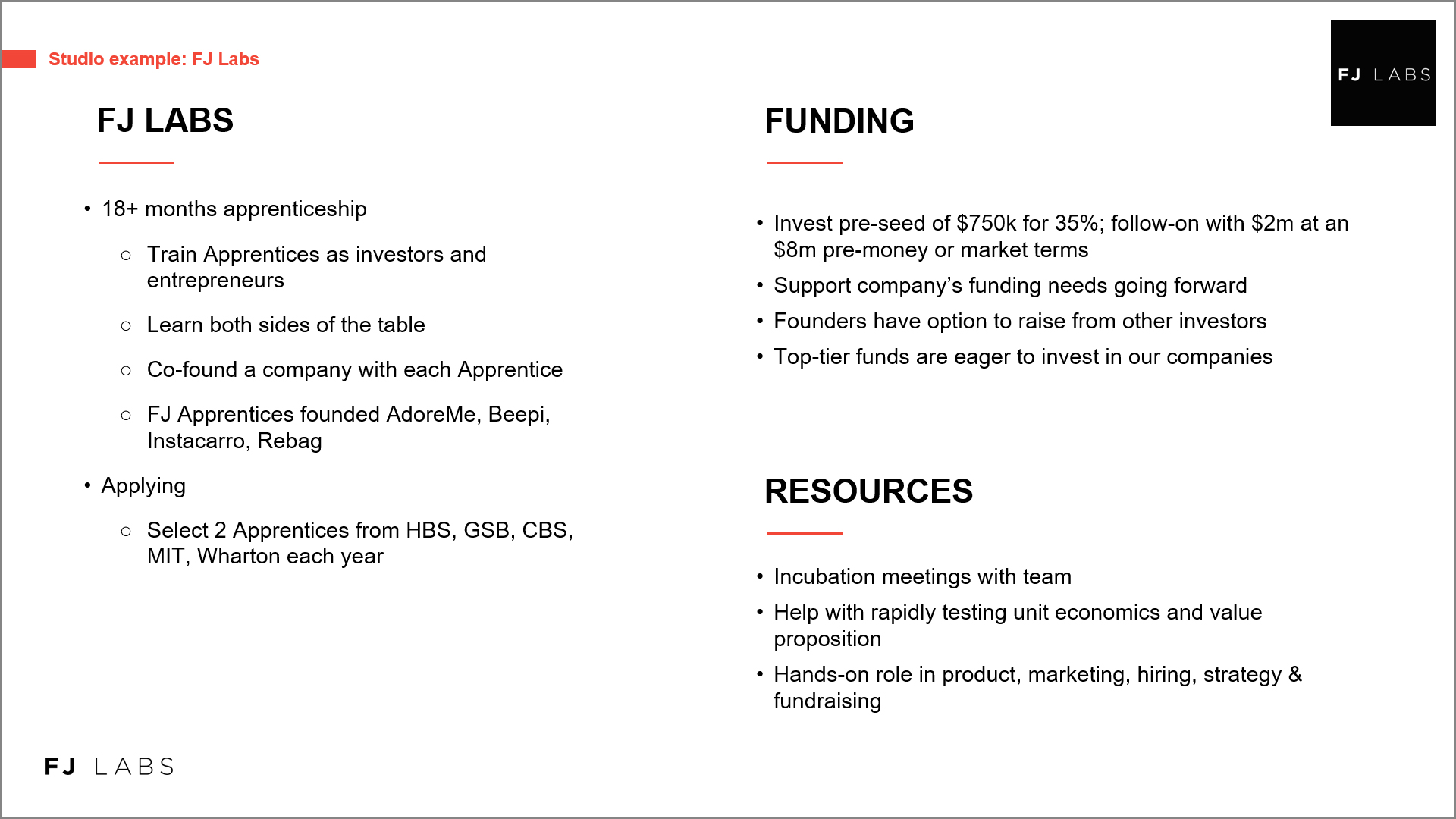

- Whether hunting unicorns is the only viable path for entrepreneurs

- The state of startups in Africa and whether once could build a unicorn via a rollup

- Whether business plans are worth the paper they are written on

- Whether it is essential to be in less competitive markets to succeed

- What company I would have loved to have founded

- Whether I will operate another startup in the future

- The role debt can play in financing startups

- Whether investors in the pre-seed / angel round should also invest in seed rounds

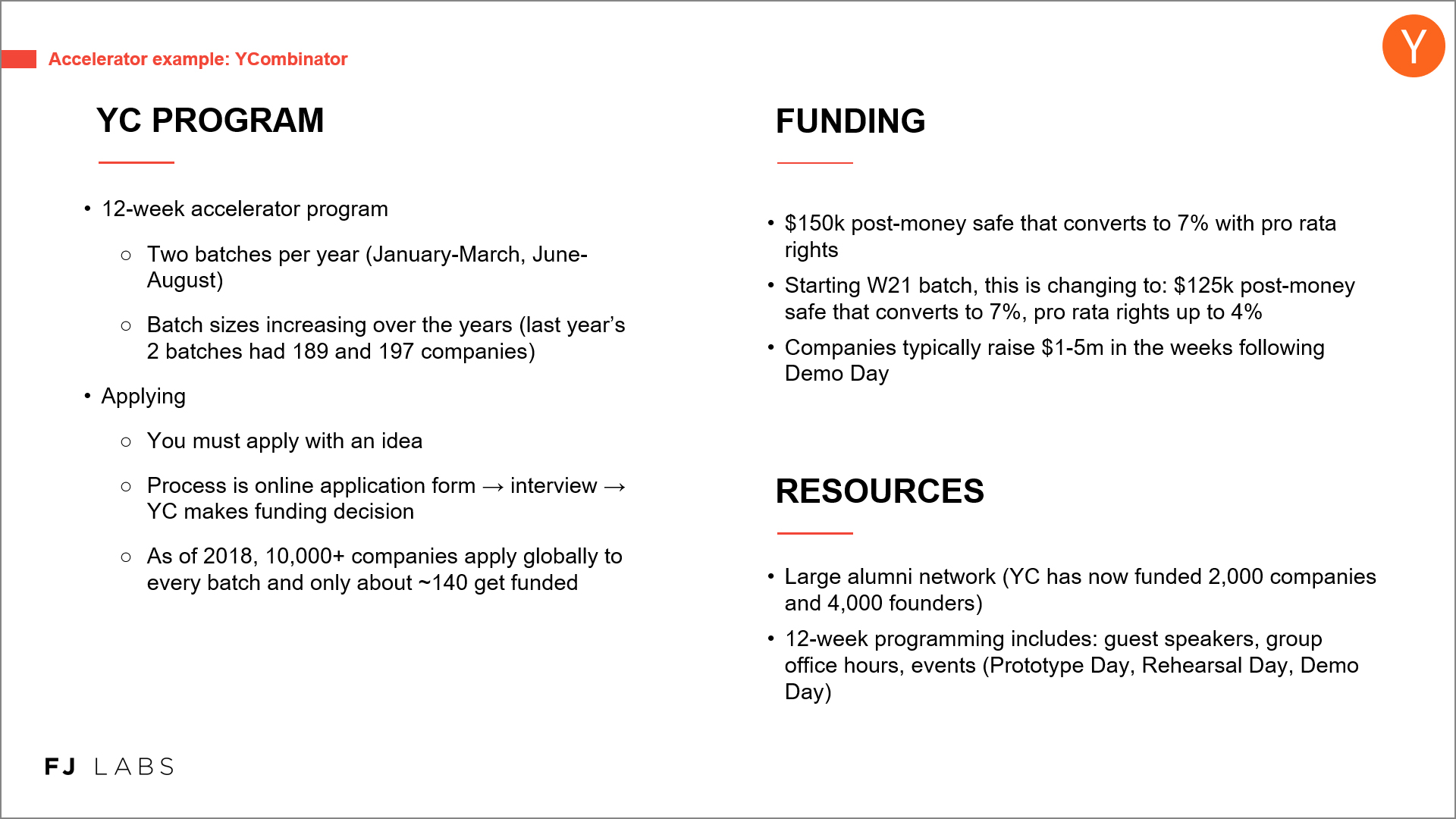

- Whether YC is correct to focus on user and revenue growth rather than other metrics

- What my guiding philosophies have been over the year

- Whether macroeconomic considerations should be relevant when building or investing in a startup

- Which investment gave me the best return

- My perspective on Bitcoin

- My thoughts (or lack thereof) on the stock market

- The pros and cons of learning to code as a founder

- The use of a single vs. multiple KPIs as objectives for teams in startups

- Why VCs invest where they are located

- How useful is a college education to an entrepreneur?

- What helps me stay open and creative

- My thoughts on The Social Dilemma

I stand by all my answers, but I should complement one of them. With regards as to whether tech is in a bubble, I explained why the low interest rate environment was leading to frothy valuations, but not (yet?) a bubble. However, I should have mentioned that the SPAC world is in a bubble. There are lots of SPACs chasing a few good companies leading to significant adverse selection. The best companies are IPOing outright. The mediocre companies are SPACing. Also, SPACs have historically underperformed the market. Of the 313 SPACs IPOs since the start of 2015, 93 have completed mergers and taken a company public. Of these, the common shares have delivered an average loss of -9.6% and a median return of -29.1%, compared to the average aftermarket return of 47.1% for traditional IPOs since 2015. Only 29 of the SPACS in this group (31.1%) had positive returns.

If you prefer, you can listen to the episode in the embedded podcast player.

In addition to the above Youtube video and embedded podcast player, you can also listen to the podcast on: