Tech Entrepreneurship, Economics, Life Philosophy and much more!

Tech Entrepreneurship, Economics, Life Philosophy and much more!

Internet entrepreneurs and investors

In 2019 I moved to Turks & Caicos and decided to sell my apartment in New York. I love my hybrid life where I split my time between New York and the Caribbean. It allows me to spend a month in New York where I am intellectually, socially, professionally and artistically stimulated beyond my wildest dreams. I meet countless extraordinary people, host intellectual dialoging salons and enjoy all of New York’s entertainment options. But after a month, I admit I am exhausted, and the constant doing takes time away from thinking. That’s why I then love spending a month in the Caribbean where I can work during the day, kite, and play tennis and really take the time to read, be reflective and recharge my batteries.

I decided to leave the Dominican Republic in 2018, and had to ponder where I should go. My real estate travails from 2012 to 2018 meant that for 7 years I did not have a real home or the playground with all the activities I adore. It’s not as though those are life essentials and I was deprived. Quite the contrary, I had amazing life experiences in asset light living (see The Very Big Downgrade & Update on the Very Big Downgrade). I traveled extensively and went on many adventures, but I must admit I do miss the convenience of being able to play tennis and padel every day or just to have my friends come over for a LAN party.

In hindsight, I should have just bought an already built house that I could just move in, in a stable country where I could buy inexpensive nearby land to build my playground and call it a day. It would not fulfill my grandiose vision of building a “Necker Island 2.0” to invite a community of entrepreneurs, artists, spiritual leaders and intellectuals to hang out, nor would it have my specific aesthetic preferences, but it would have the convenience of being immediately useful and to play the role of gathering point for friends, family and colleagues.

This led me to buy Triton in Turks & Caicos. Turks is very built out and does not have the raw authenticity of Cabarete. There are fewer days of wind for kiting, and it’s insanely expensive. However, it has the most beautiful water in the world. The weather is fantastic all year long. The flights are only three hours from New York. It’s English speaking and uses the dollar as its currency. The safety, flat water and gorgeous beaches, not to mention the absence of Zika, Chikungunya and dengue make it appealing for all my friends and their families, and not just my adventurous friends who liked the rougher conditions of my Cabarete dwelling with its massive spiders, rats and cockroaches.

Having gleaned some lessons from my prior experiences, I decided to buy a house on Providenciales on Long Bay Beach where I can kite directly from the house and play tennis at the house. I opted not to buy on the other islands despite significantly lower prices and the availability of more land, because the lack of infrastructure makes things way more complicated and expensive. It’s also inconvenient to go for a few days if upon landing you need to be driven to a boat to get to your destination. I will now buy a little bit of inexpensive non-beachfront property to build the missing elements of my playground starting with the all-important padel court.

At the same time the never-ending travails with my New York apartment made me decide that the time had come to move on. In 5 years, I have not been able to enjoy the apartment properly and the water damage has been such that I have been living in hotels and Airbnbs for the last 18 months. As the building is badly built, the management intractable and the building broke, I suspect that even if I ended up rebuilding it as my dream apartment, problems would keep popping up. In hindsight, I undervalued the benefit of being in a well-managed building with the financial means to address issues, nor did I realize the downside of having by far the best apartment in an otherwise relatively small and poor building. Having moved dozens of times in the last 18 months, I intend to rent an apartment March 2020 onwards.

These travails have also cured me of home ownership. I would much rather rent and have the owner deal with whatever issues arise rather than having to deal with them myself. It means I won’t have the apartment of my dreams, but as life keeps highlighting: the best is the enemy of the good. I look forward to having a place in New York I can call home for the next few years bringing a modicum of stability to my life.

I keep being surprised by the amount of work and costs involved with real estate ownership and how illiquid an asset class it really is. The maintenance required highlights that it is a depreciating asset that requires constant work. When you take into consideration property taxes, insurance, maintenance and the constant renovations, the net yield is negligible. Despite historically low interest rates it makes much more sense to rent. This is especially true in New York right now as the glut of high-end apartments makes it a renter’s market. I can’t wait to be rid of all the real estate I own, though the pace of divestiture has been glacial.

In an ideal world I would not have bought the house in Turks, but it was unfortunately not available for long term rental. The limited housing stock on the island, almost none of which is available for long term renting, forced my hand. I do not consider it to be an investment. It’s consumption, pure and simple: a place to call home.

Having found my new home in Turks, allowed me to have an amazing year on both the personal and professional fronts. I brought my friends and family to visit countless times. I started learning to kite foil and had countless adventures.

Highlights were:

I also spent time visiting my family in Nice. It felt amazing to be back in my hometown enjoying the amazing food, playing tons of padel and spending time with my nephew.

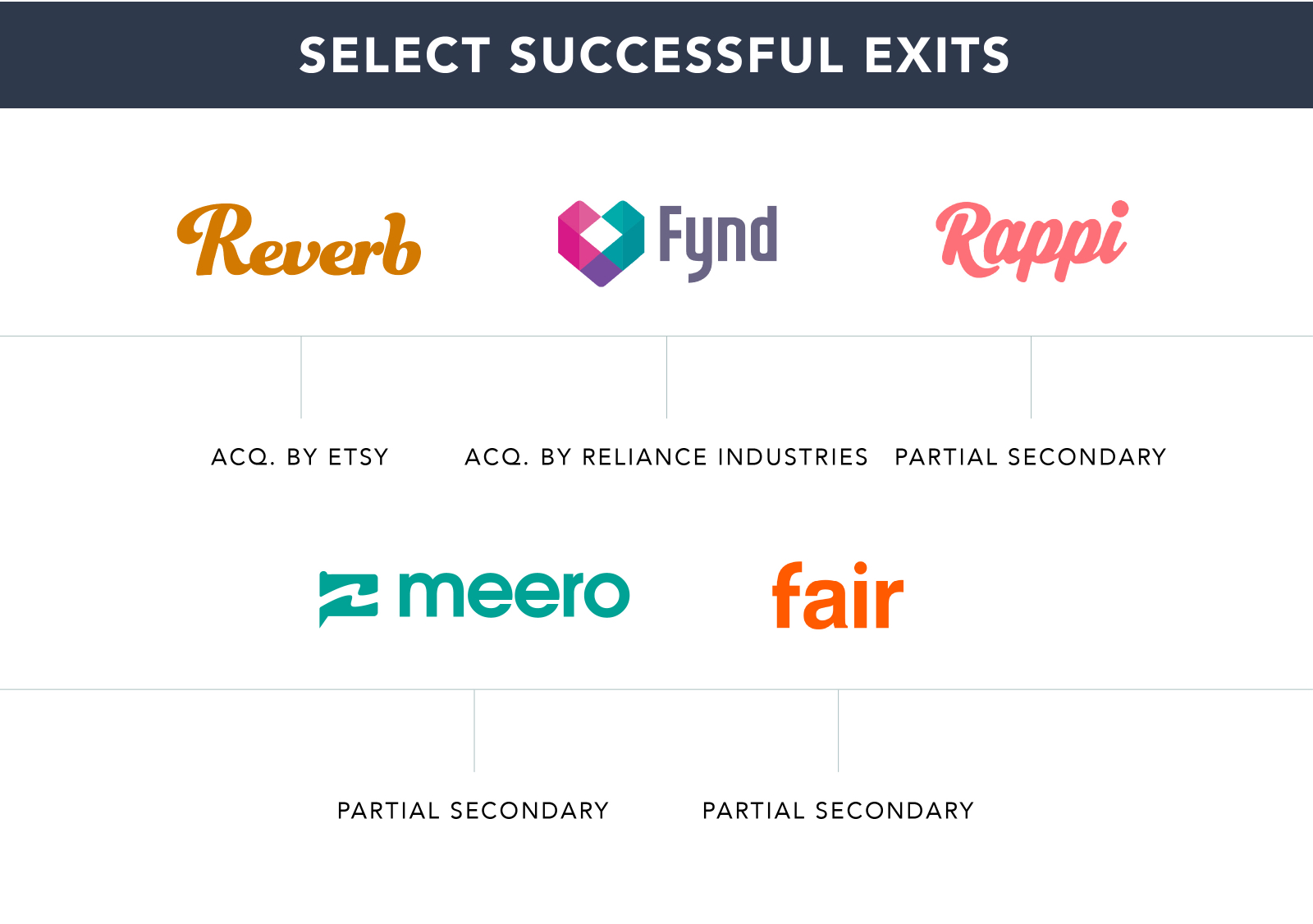

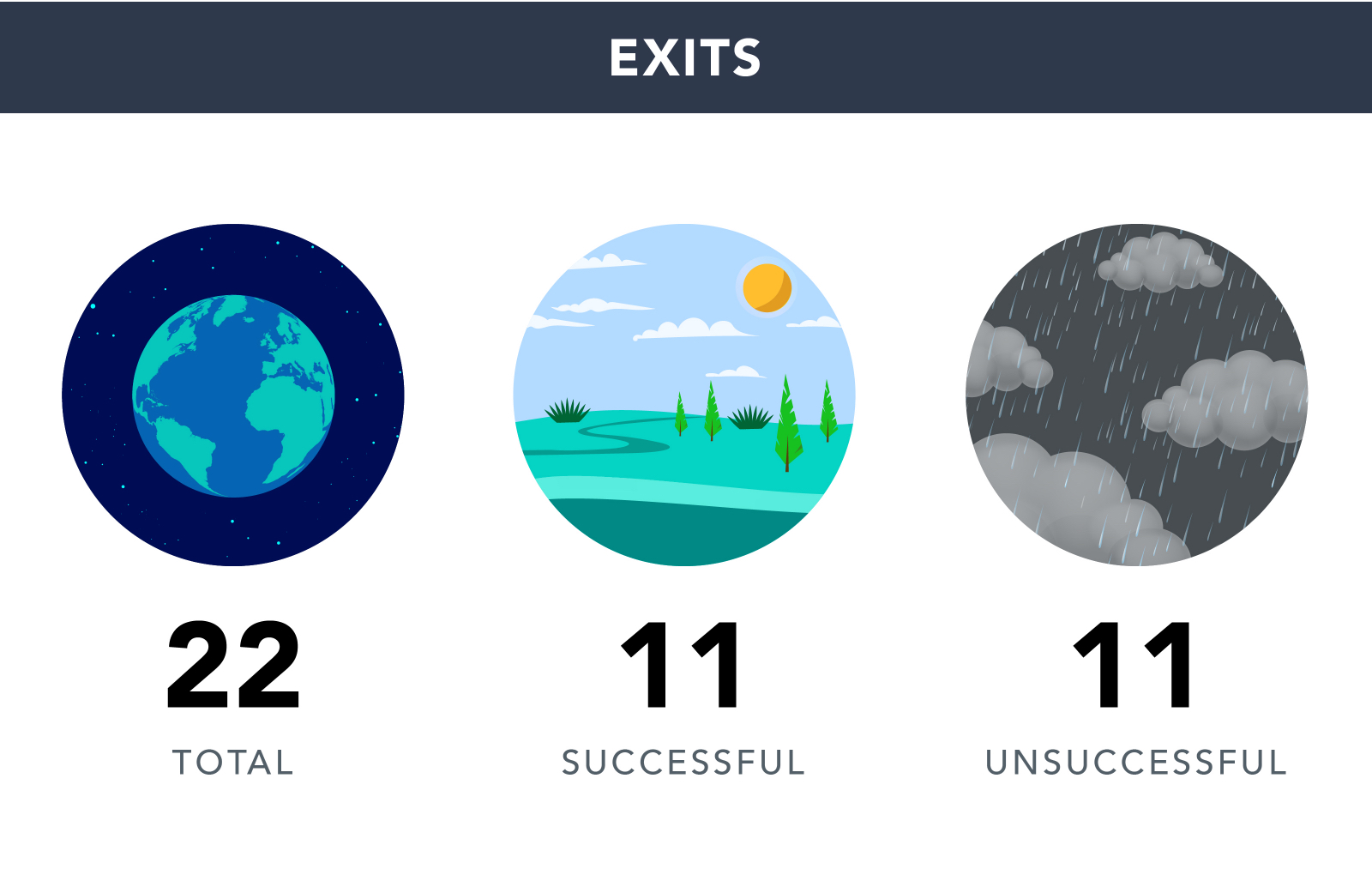

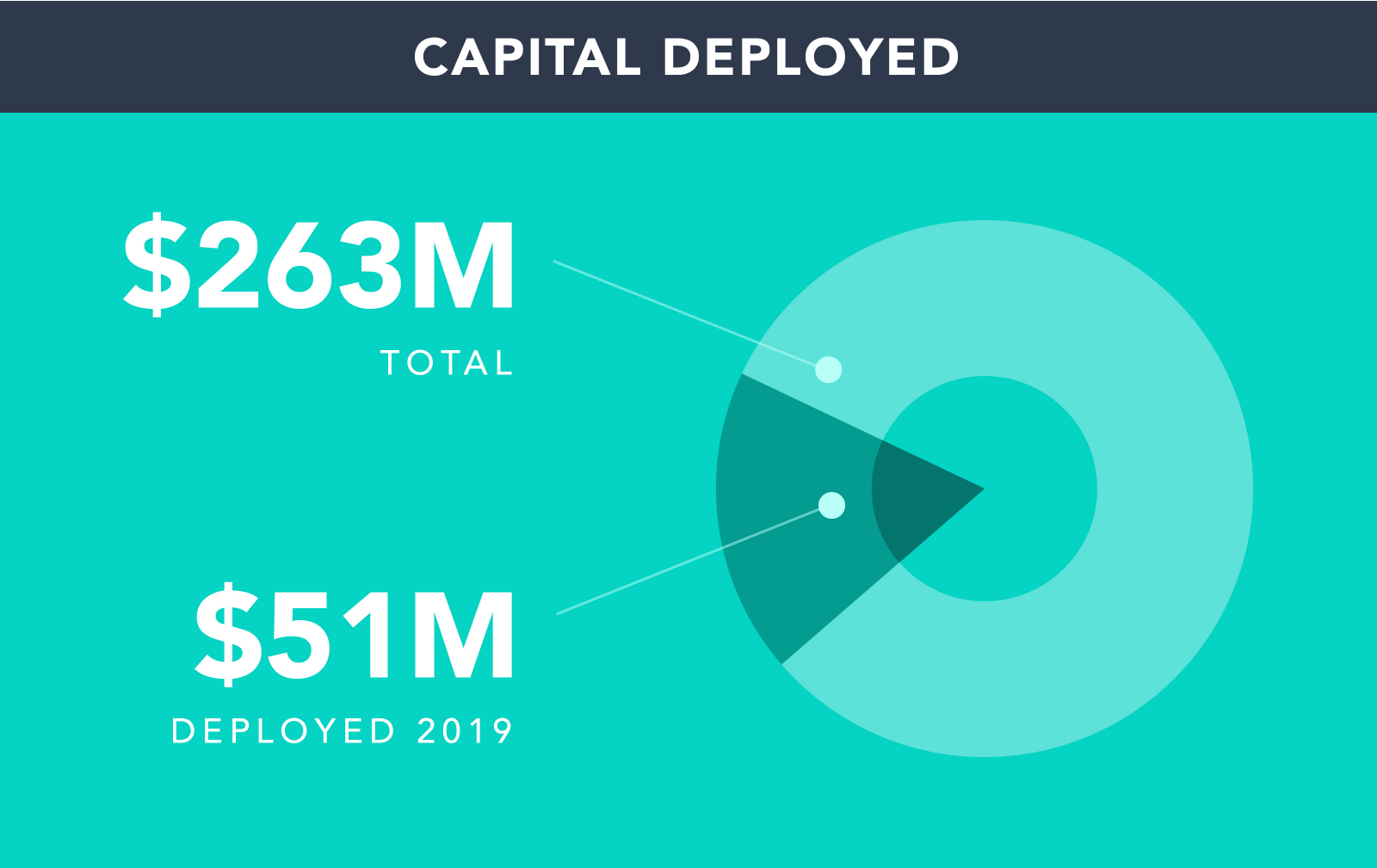

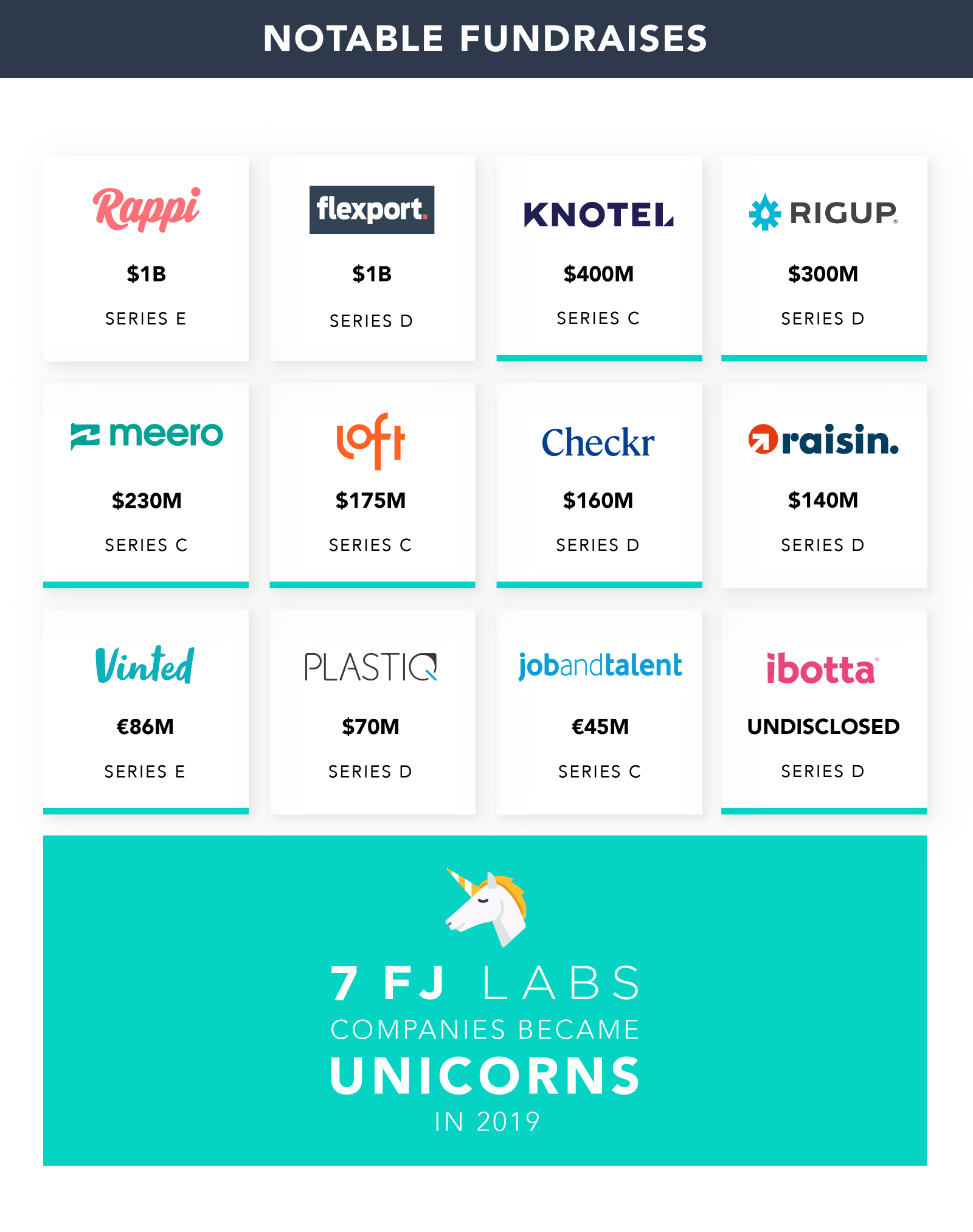

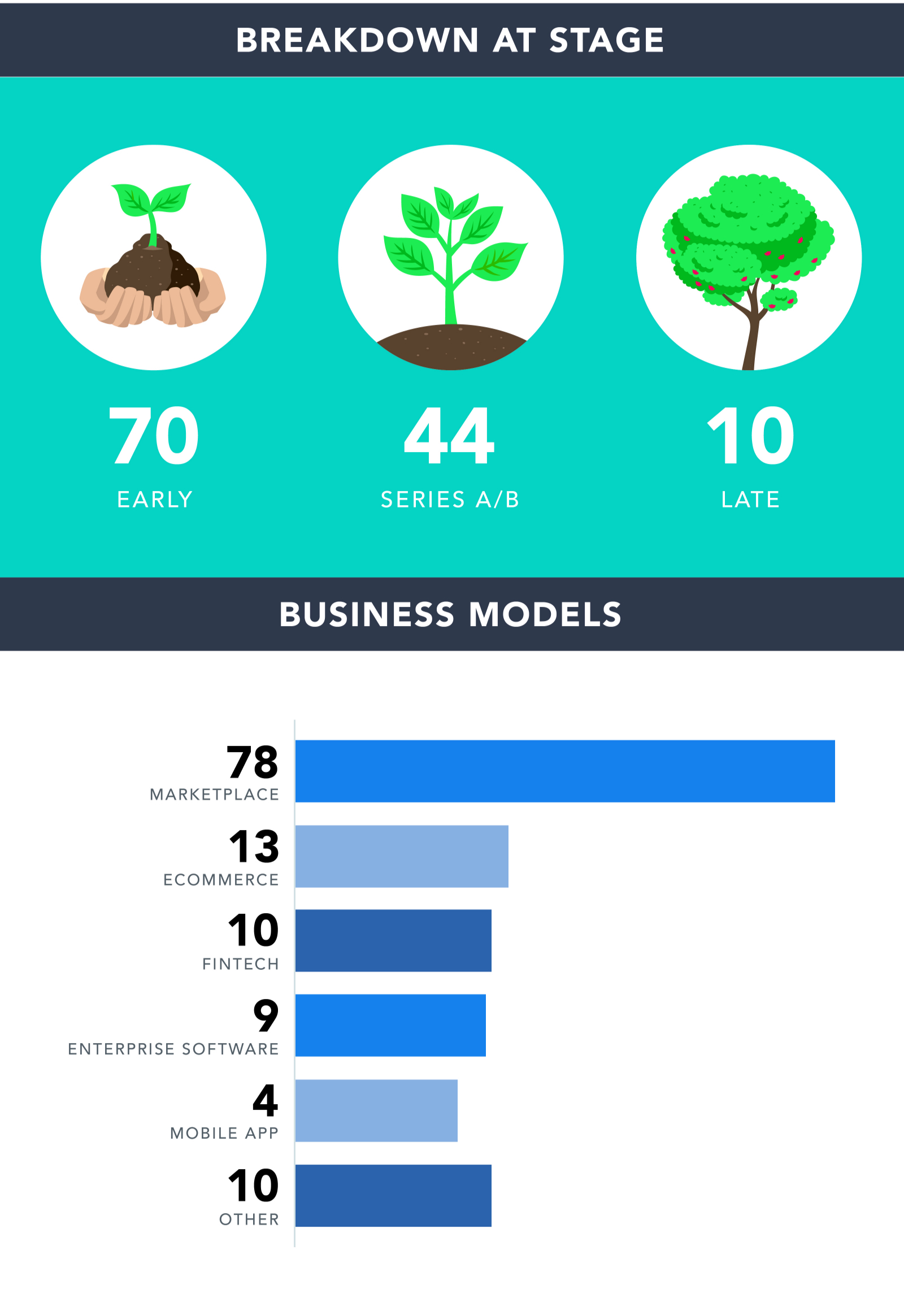

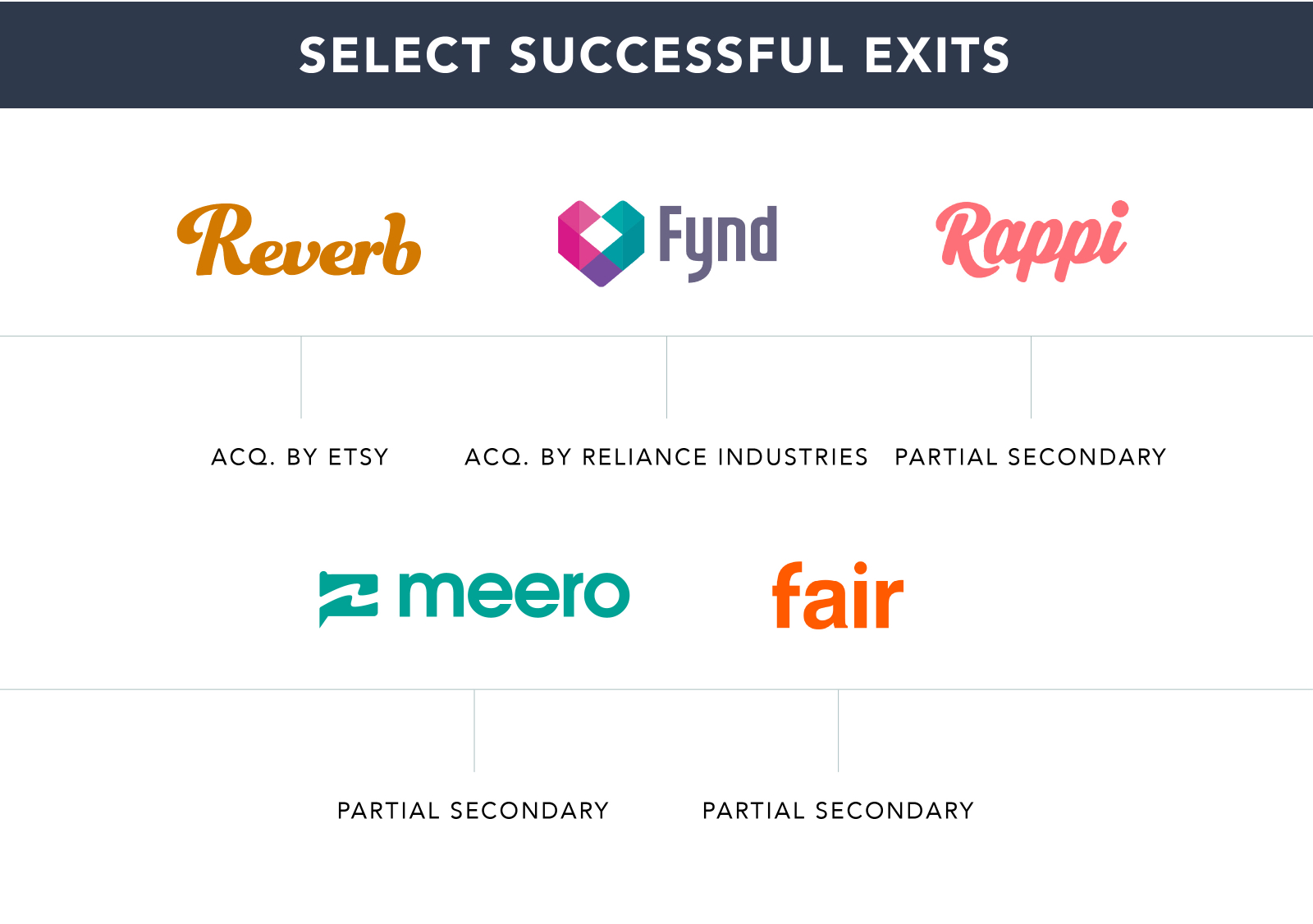

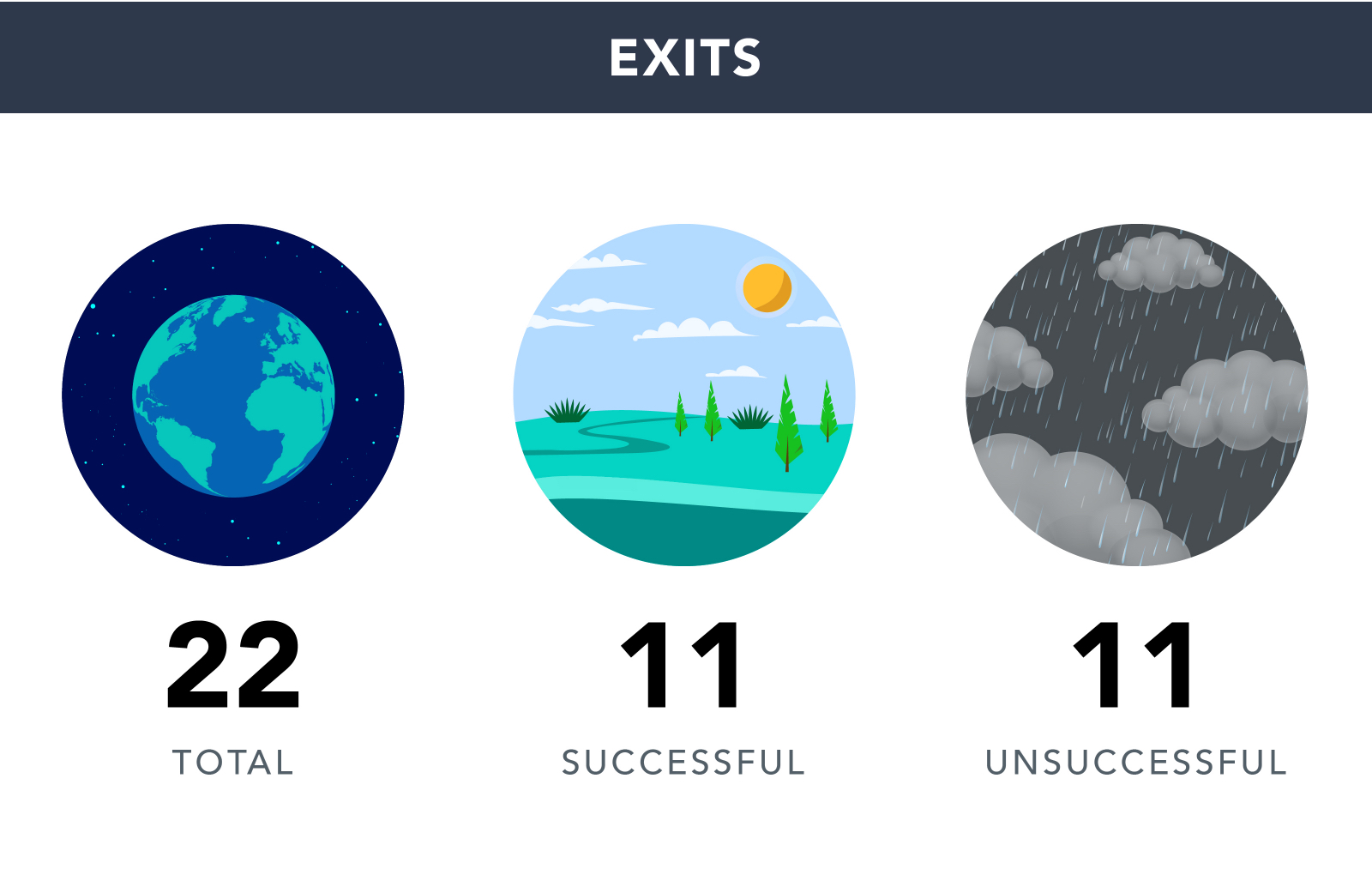

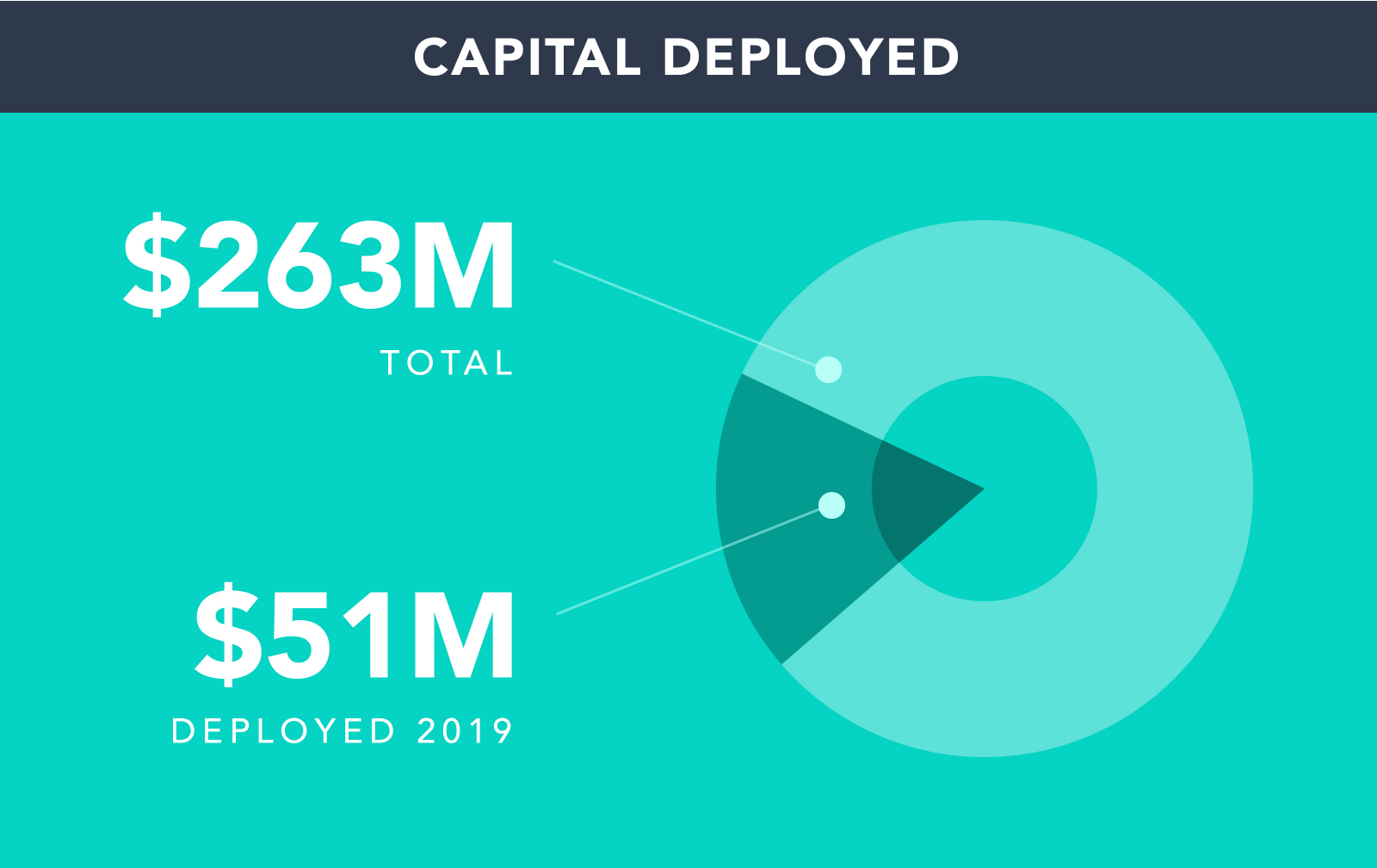

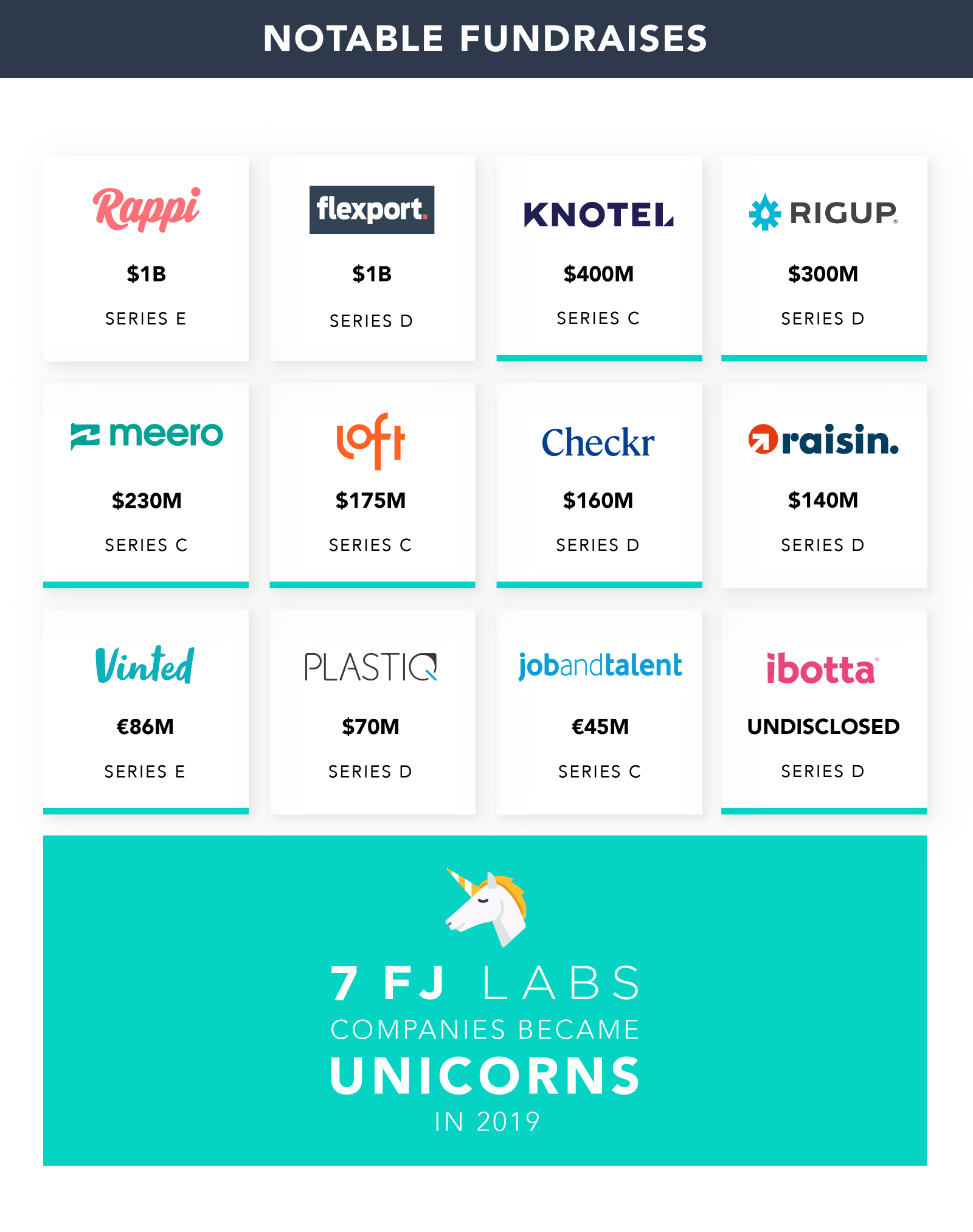

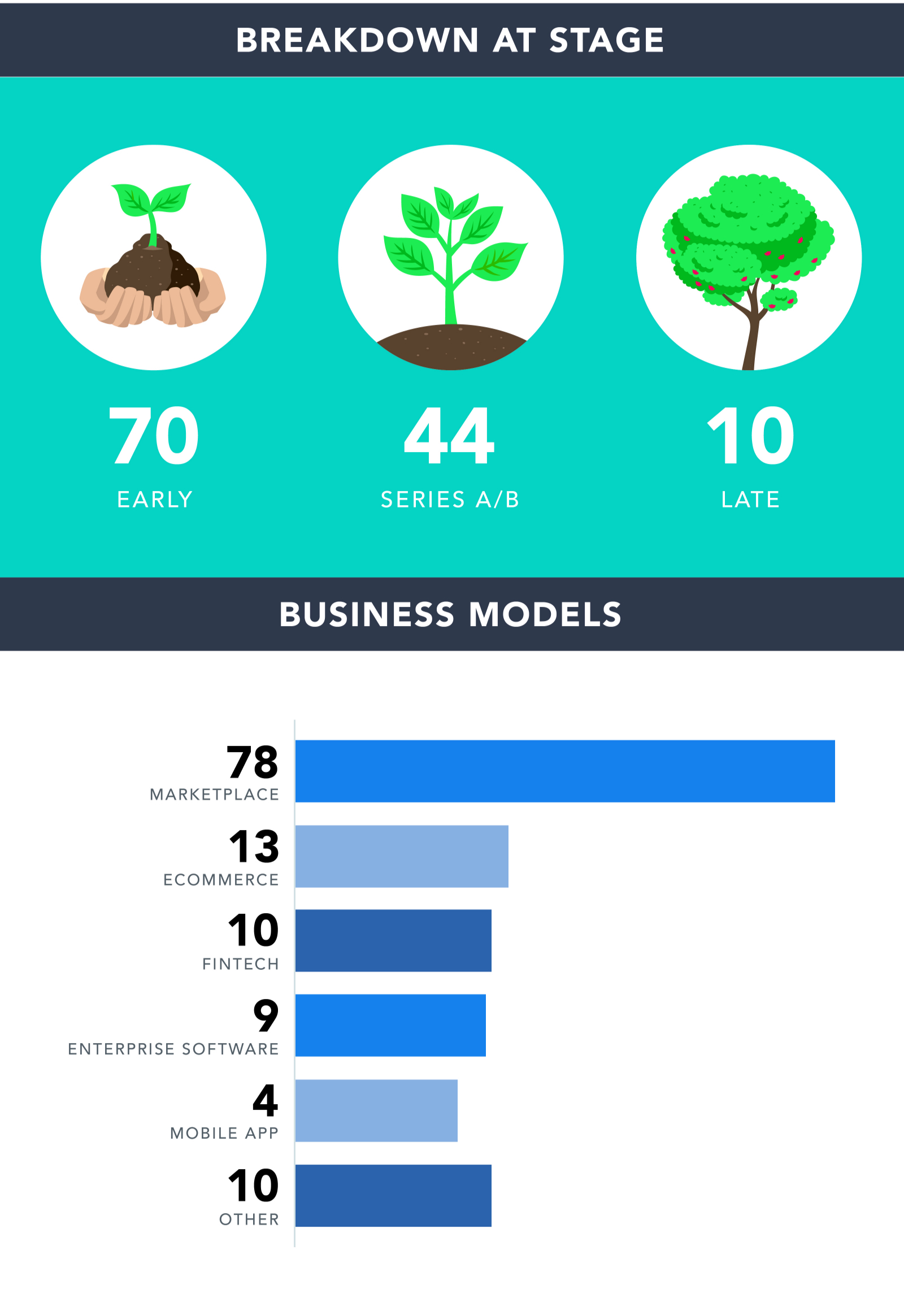

FJ Labs continued to rock. In 2019, the team grew to 26 people. We deployed $51M. We made 124 investments, 83 first time investments and 41 follow-on investments. We had 22 exits, of which 11 were successful including the acquisition of Reverb by Etsy and the acquisition of Fynd by Reliance Industries.

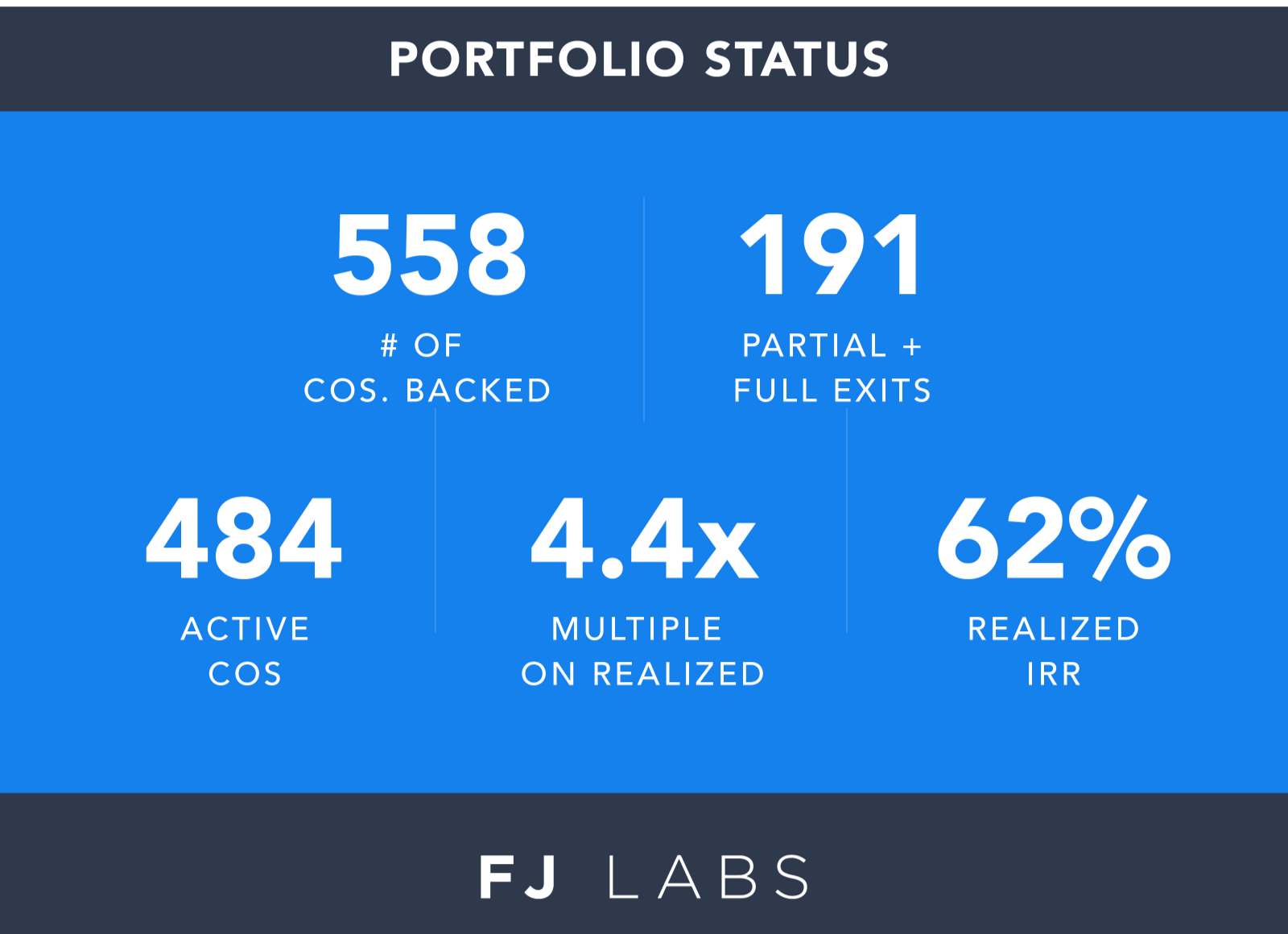

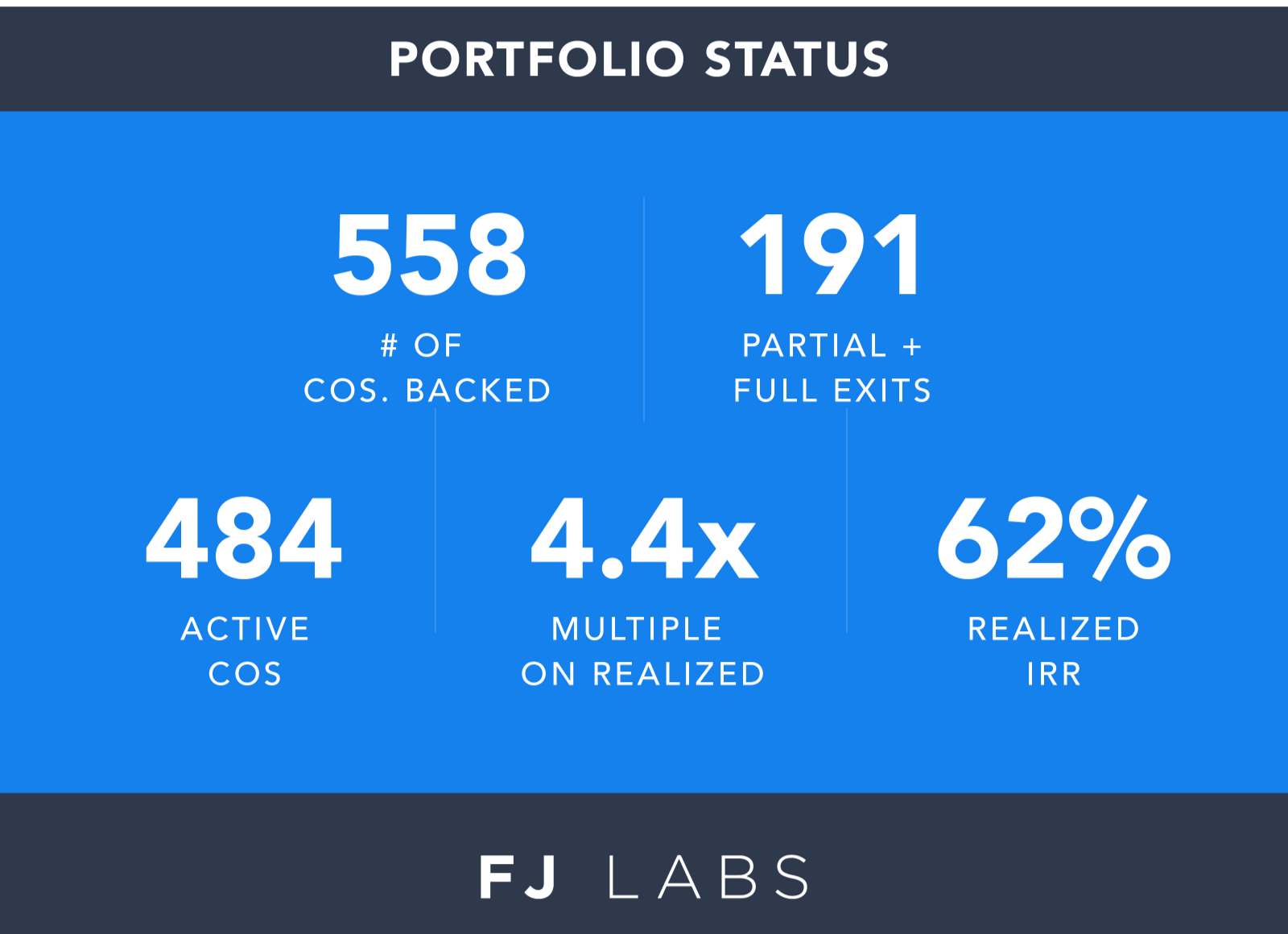

Since our inception, we invested in 558 unique companies, had 191 exits (including partial exits where we more than recouped our cost basis), and currently have 484 active investments. We’ve had realized returns of 62% IRR and a 4.4x average multiple.

I spent some time thinking about the latest trends in marketplaces.

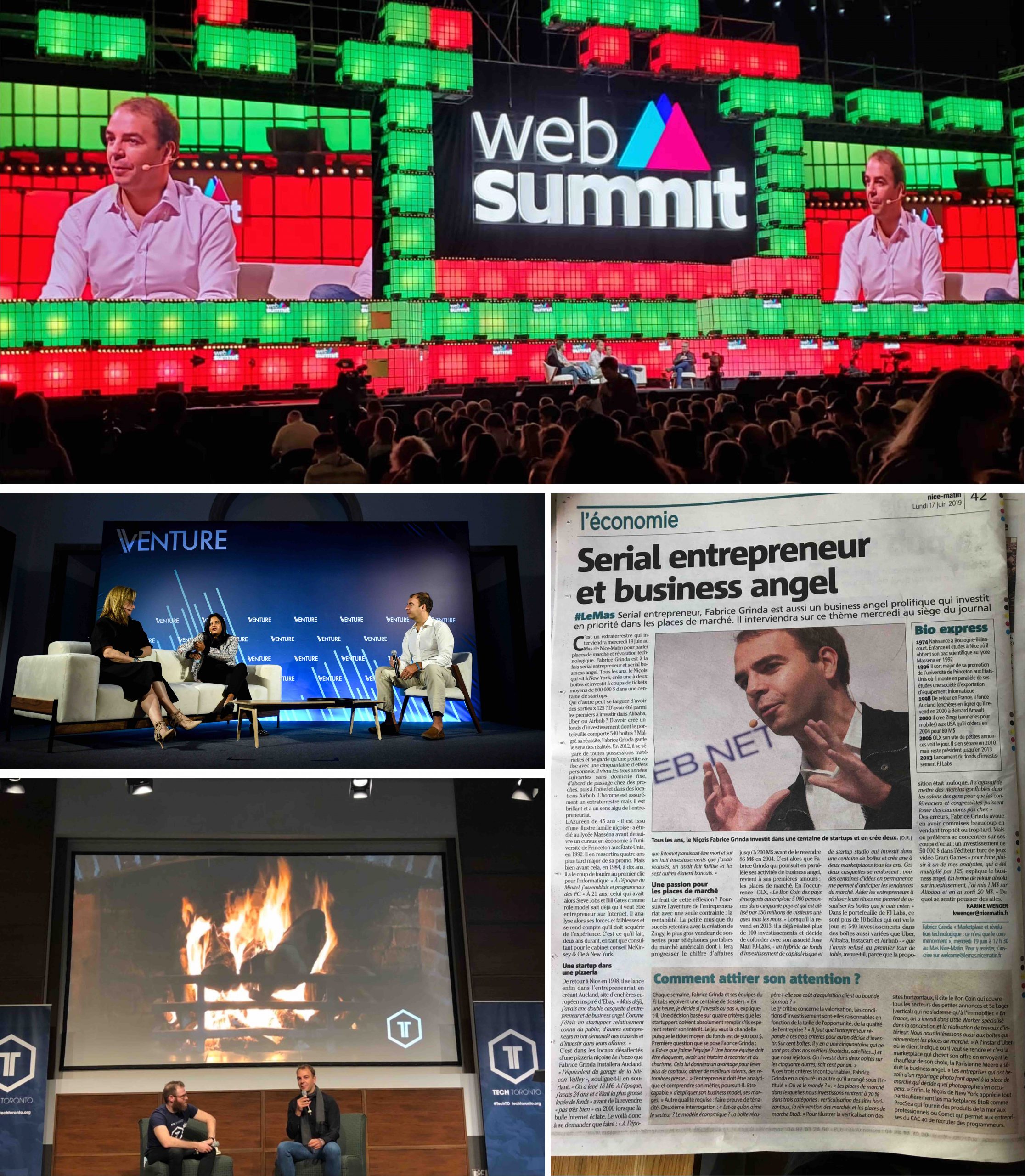

I also shared a lot of my entrepreneurial lessons learned in a series of keynotes, fireside chats, podcasts and video interviews:

It was fun to get a full page in the local newspaper just as I came to visit my family in Nice and to be covered in Les Echos around the French Tech conference.

In terms of writing, I finished my framework for making important decisions in life:

I also reviewed Why We Sleep given that I made significant life changes post reading the book and wrote a packing list for Burning Man to help virgins and grizzled veterans alike.

My economic predictions for 2019 were correct: the US economy did well. We are now in the longest expansion on record, and tech remained the sector to be in. While we are late in the economic cycle, the US may very well continue to do well until the end of 2020. We are at full employment and presidential election years typically have loose fiscal and monetary policies.

The main recession risk seems geopolitical given the current slew of world “leaders.” I suspect that the largest risk to the world economy is a budget crisis in Italy. It would put the Euro project at risk and lead to a massive flight to safety, creating the next global recession.

The current political climate keeps reinforcing my decision to avoid following and reading news be it in newspapers, online or on TV. It’s sensationalist negative entertainment that misses the real technology-led improvements that happen slowly, but inexorably transform our lives for the better.

Despite the implosion of WeWork and the travails at Softbank, I remain very bullish on early stage venture capital. We are still at the very beginning of the technology revolution. Only 15% of commerce is online. Online penetration remains negligible in the sectors that account for most of GDP: education, health care, and public services. The way we build homes is still artisanal. Synthetic biology is in its infancy. The emerging trend of no-code, which allows non-programmers to build complex fully functional websites, is unleashing a massive wave of innovation. It democratizes startup creation and innovation allowing people from all walks of life and every educational background to partake in the Internet revolution.

We are meeting more extraordinary entrepreneurs than ever before. There are still billions of capital on the sidelines in later stage funds like Sequoia and Insight that need to be put to work in the next few years. I suspect that even if some of these funds disappoint, most will still be able to raise their next fund. The current low rate environment, with no end in sight, will continue to lead to yield chasing. All that to say Seed and Series A funded startups will have access to plenty of capital. The technology sector remains the engine of productivity and economic growth and will continue to do well in 2020.

Happy new year!

Mijn vrienden leken allemaal te hebben besloten om naar New York af te zakken voor de feestdagen. Omdat ze de prototypische New Yorkse attracties al hadden gezien (Met, Museum of Natural History, MOMA, Liberty Tower, The Lion King), vroegen ze om meer unieke aanbevelingen.

Deze raunchy variétéshow bevat een beetje van alles: acrobatiek, burlesque en algemene waanzin. Het is verbazingwekkend en op de een of andere manier draagt het amateurisme van sommige acts alleen maar bij aan de charme. Je maakt ook kennis met het jonge, leuke en hete Burning Man-volk van Bushwick.

Het is meestal om de paar woensdagen vanaf 20.00 uur. De volgende is op 29 januari

De verslinding

Als Bushwick en de naaktheid van House of Yes te agressief voor je zijn, dan is The Devouring echt iets voor jou. Het is het resultaat van een samenwerking tussen Ian Schrager van Studio 54, House of Yes en de met een Michelin-ster bekroonde chef-kok John Fraser. Het is wat Dirty Circus zou zijn als het geld had en professionele artiesten in de context van een voortreffelijke maaltijd. Het is een ode aan de menselijke ervaring en een duizelingwekkende neo-burlesque extravaganza. Het is een hedendaags cabaret, een feest en een viering van het leven.

Derren Brown: Geheim

Deze show loopt af op4 januari, dus haast je om hem te gaan zien! Derren Brown is de beste mentalist ter wereld. Zijn show is een mix van gedachten lezen, overtuigen en psychologische illusie gericht op de verhalen en overtuigingen die ons leven sturen.

Als je er niet bij kunt zijn, kijk dan zeker naar zijn shows op Youtube en Netflix.

De goochelaar in de Nomade

Dit is de beste goochelshow die ik ooit heb gezien. Het bevat een beetje van alles: levitatie, kaarttrucs, mentalisme in een kleine, donkere en intieme setting. Als je een fan bent van magie, is dit de show die je moet zien!

Elke avond nemen de performers suggesties aan van het publiek en draaien ze om in onmiddellijke riffs en avondvullende muzieknummers. Elke show is een freestyle, hiphop, improvisatie, nooit eerder vertoonde komedie met regelmatige onverwachte gastoptredens van Lin-Manuel Miranda van Hamilton die een van de medescheppers van de show is.

Ik ben een grote fan van het Woom Center en vooral van de geluidservaring van David & Elian. Deze meditatie bevat groepszang, Holotropische ademhaling (die op natuurlijke wijze het effect van LSD op je hersenen nabootst) en prachtige boventoongeluiden die je meenemen op een reis naar een verhoogde staat van bewustzijn.

Ik raad het iedereen aan en vooral meditatie neofieten zullen zich getransformeerd voelen. Het is elke vrijdag om 19:30 uur. Laat je niet afschrikken door de drie uur, want het voelt alsof het elke keer in 20 minuten voorbij is!

VR Wereld

VR heeft nog niet het stadium bereikt waarin ik mensen zou aanraden om een apparaat te bezitten. De graphics verbleken in vergelijking met die op PS4, Xbox en PC en de latentie leidt nog steeds tot bewegingsziekte. Het is echter ontzettend leuk om een paar uur door te brengen met tientallen topklasse VR-apparaten met precies de juiste instellingen voor elke game of ervaring. Zorg ervoor dat je met een paar vrienden gaat, want het is ontzettend leuk om samen of tegen elkaar te spelen.

Nul ruimte

Zero Space is een meeslepende, interactieve, digitale kunstspeeltuin. Het voelt psychedelisch aan en is echt geestverruimend. De show is een beetje simplistisch, maar zeker de moeite waard als voorbode van wat komen gaat, ook al zijn we nog tientallen jaren verwijderd van een echt holodeck op Star Trek-niveau.

Sleep No More was een pionier op het gebied van immersief theater, maar als er één punt van kritiek was, dan was het wel dat je ervaring sterk kon variëren afhankelijk van wat je uiteindelijk deed en wie je uiteindelijk volgde in het theater. Then She Fell pakt dat probleem aan door een meeslepende theaterervaring te creëren met slechts 15 toeschouwers per show. Hierdoor maak je altijd deel uit van de actie.

De show speelt zich af in een drie verdiepingen tellend gebouw in Williamsburg dat zorgvuldig is verbouwd om op een psychiatrisch ziekenhuis te lijken. Het werk en het leven van Lewis Carroll komen aan bod en vooral zijn relatie met Alice Liddell, het jonge meisje dat zijn muze was voor Alice in Wonderland en Through the Looking Glass. Het is intiem, meeslepend en verreweg de leukste, boeiendste en interessantste meeslepende theaterervaring die ik heb bijgewoond.

Comedy Cellar is een instituut en de beste comedyclub ter wereld. Er is altijd een fantastische line-up met een mix van zeer bekende en opkomende comics. Sommige supersterren uit het vak komen soms onaangekondigd langs. Ik ben er geweest met Robin Williams, Chris Rock en talloze anderen!

Als je ooit dacht dat musea saai waren, dan is dit de manier om ze te ervaren. Deze zijn snel en hilarisch ondanks dat ze buitengewoon informatief zijn. Het is zeker de manier om zowel The Met als The Museum of Natural History te ervaren.

Magie op maandagavond

Monday Night Magic is een leuke, goedkope, kindvriendelijke goochelshow. Er zijn diverse optredens van de beste goochelaars die toevallig die week in New York zijn, waardoor er steeds nieuwe ervaringen worden gecreëerd.

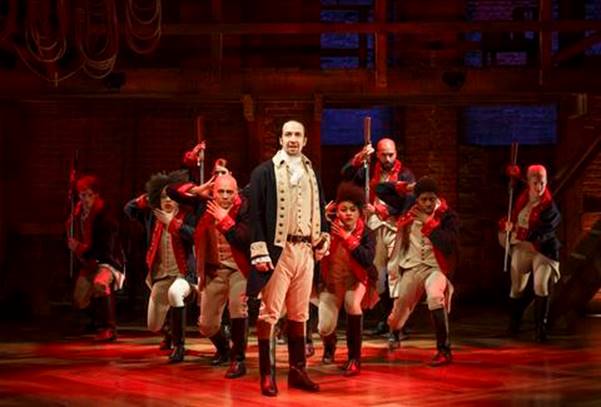

Dit is waarschijnlijk de beste musical ooit. Ik ben erg bevooroordeeld omdat Alexander Hamilton een van mijn rolmodellen is en ik een grote fan was van zijn biografie door Ron Chernow, waar de musical op gebaseerd is. Deze waanzinnige hiphopmusical is echter een tour de force en de enige musical die me de tranen in de ogen deed lopen. Je moet het zien!