Of late recessionary talk has cooled off. Jerome Powell and the Fed are no longer expecting a recession. The consensus is for the US to have a soft-landing allowing core inflation to go back down to 2% by 2025 while avoiding a downturn. While I hope for this outcome to happen, I find it unlikely as this feat was technically only achieved once in the last 60 years in 1993-1994.

Many areas give me cause for concern.

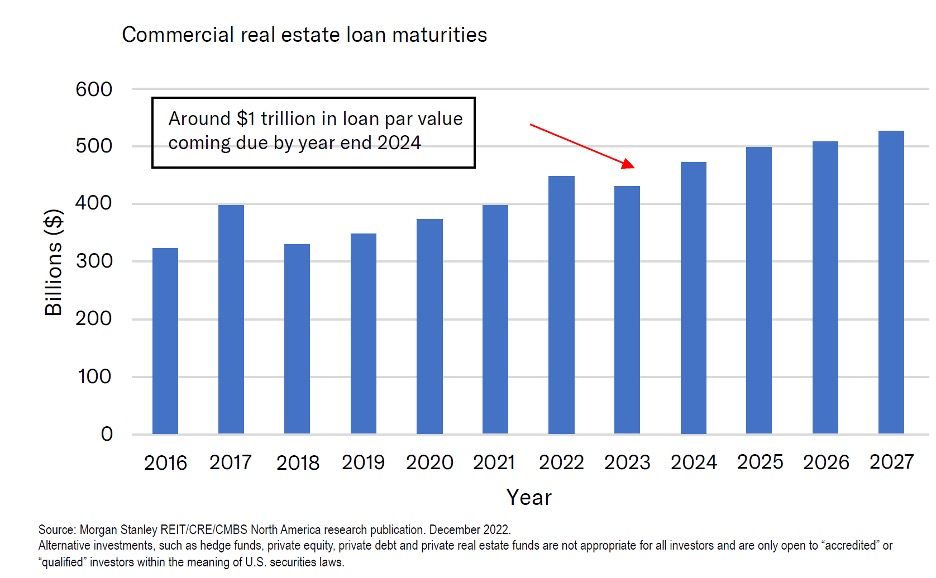

1. Commercial real estate is headed for a major crisis.

Commercial real estate is typically financed in tranches. There is a 30-year amortization but financed in 10-year increments. When you buy the building, you finance it in such a way that you pay down 1/3 in the first decade with a balloon payment for the remaining 2/3s due at the end of the decade. You then refinance this 2/3s, paying down another 1/3 over another 10 years. You do it again a decade later.

When the big balloon payments come due, if occupation is low while interest rates are high (today’s conditions), the economics may no longer work. Why refinance at high rates for a low yielding asset. Investors risk walking away, handing the assets over to the bank.

With $1 trillion of commercial real estate loans coming due by the end of 2024, there is a major crisis headed our way. While anecdotal, FJ Labs’ building default and take over by the bank seems an augur of things to come.

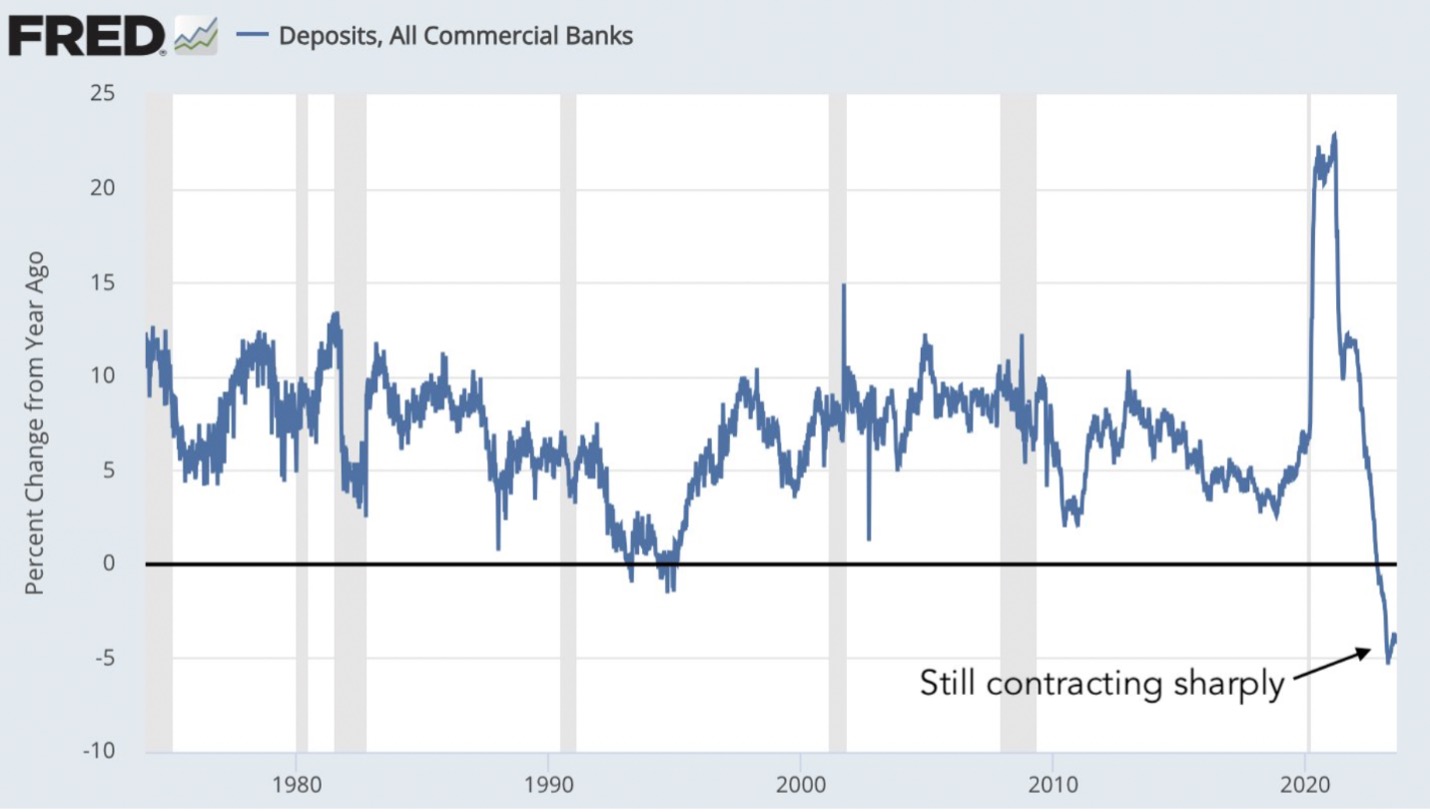

2. The commercial real estate crisis will exacerbate the banking crisis.

The commercial real estate crisis is going to saddle banks with low yielding assets. This is happening while bank deposits are continuing to contract at an unprecedented rate as depositors seek higher yields in safer assets such as treasury bills which will continue to depress commercial lending.

3. The U.S. Consumer is in dire straits.

All debt balances are at a record high:

- Household Debt: $17.1 trillion

- Mortgage Debt: $12.0 trillion

- Auto Loans: $1.6 trillion

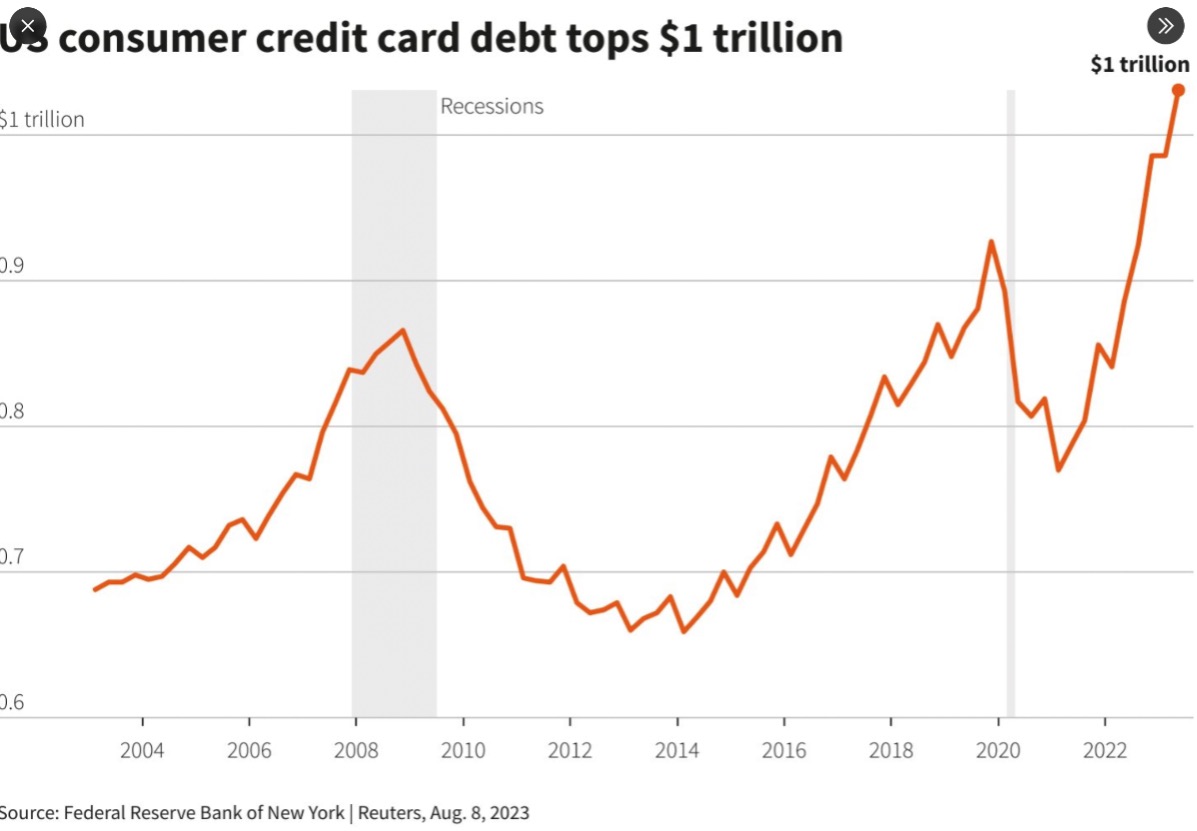

- Credit Card Debt: $1.0 trillion

- Student Loan Debt: $1.6 trillion

Interest rates are higher than they’ve been in 15 years:

- Credit Card Debt: 25%

- New Car Loans: 14%

- Used Car Loans: 9%

- 30Y Mortgage: 7.5%

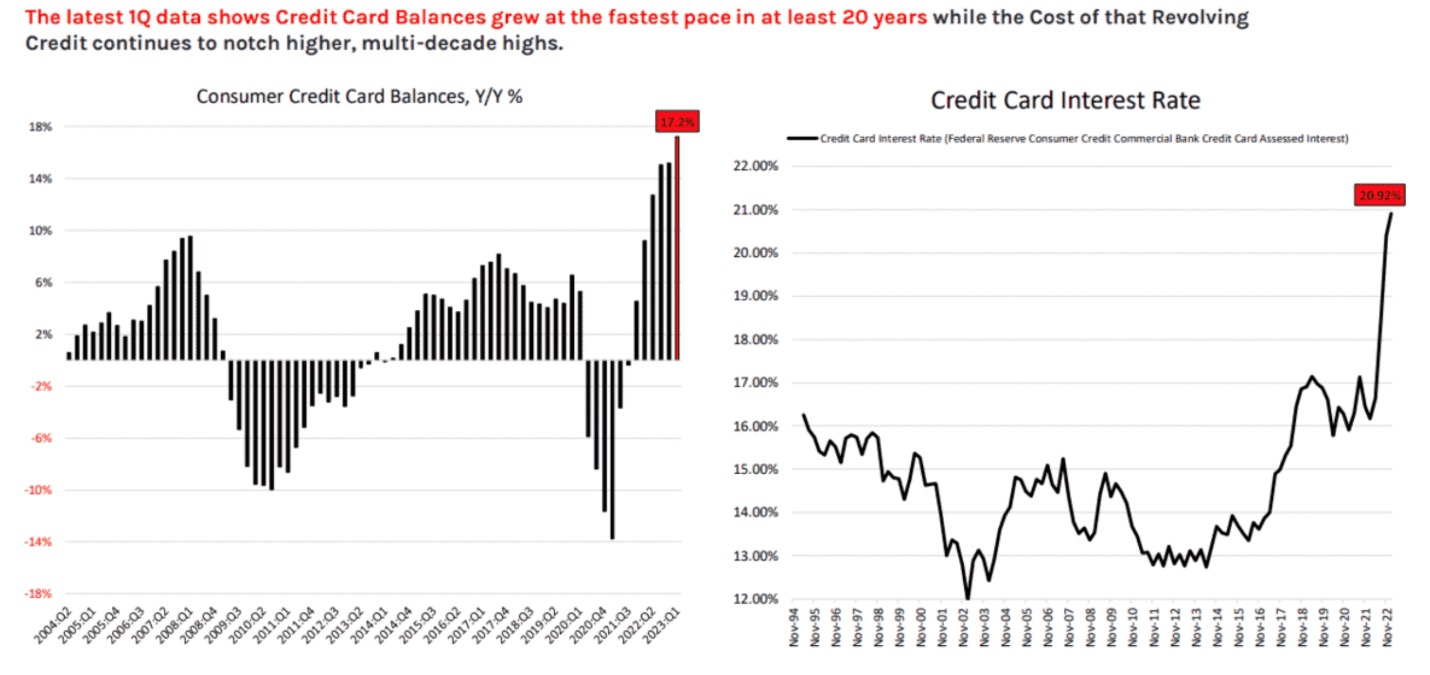

a. Credit Card balances are at 20-year highs while credit card interest rates are skyrocketing.

While the overall debt level is reported in nominal numbers which paints a slight worse picture than reality, the situation seems dire:

- The number of Americans rolling credit card debt from month-to-month is now higher than the number of people paying their bills in full for the first time ever.

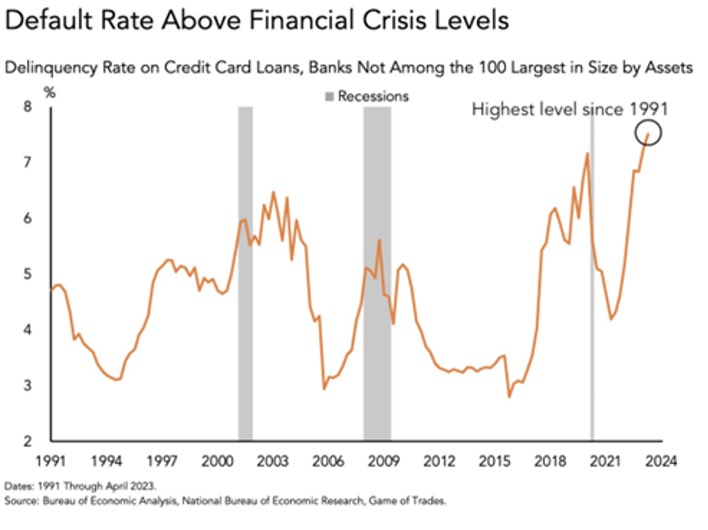

- The default rate on credit card loans from small lenders is now higher than during the dot com bubble, financial crisis, and Covid-19.

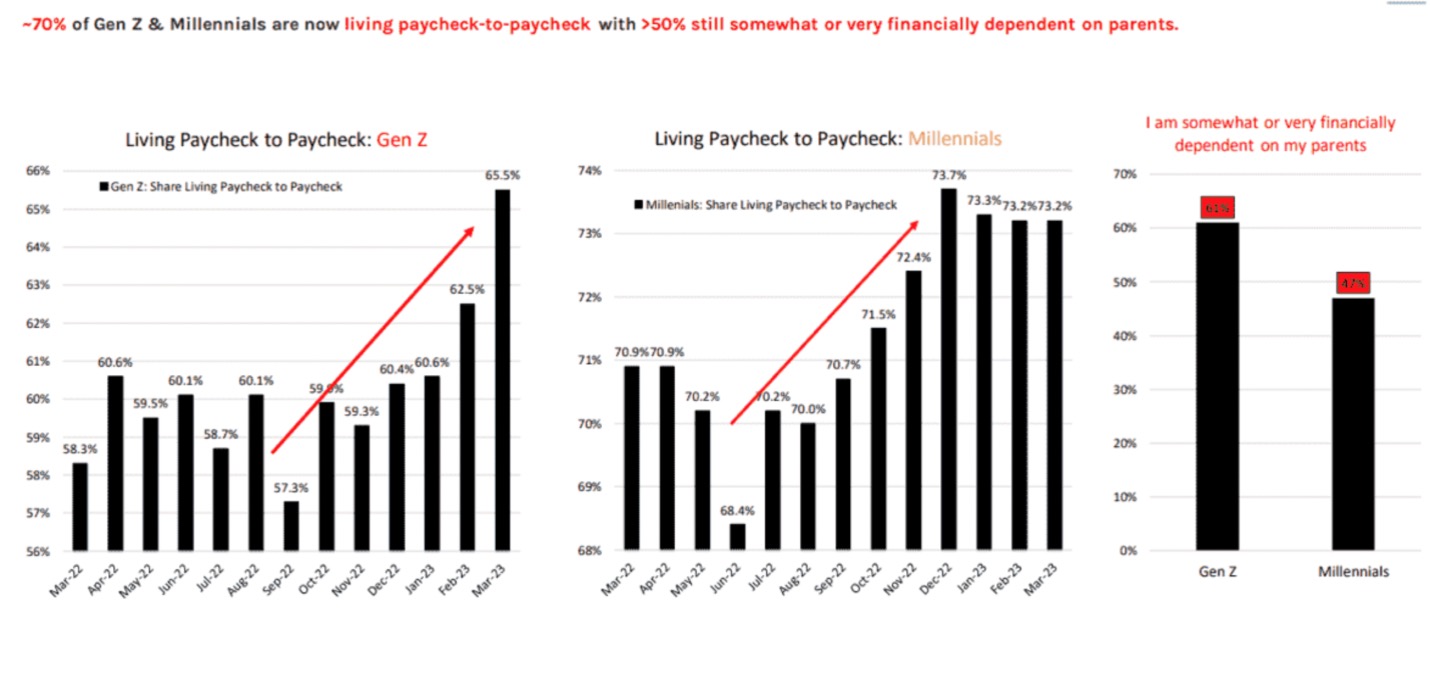

b. 70% of Gen Z & Millennials are now living paycheck-to-paycheck and over 50% are still somewhat or very financially dependent on their parents.

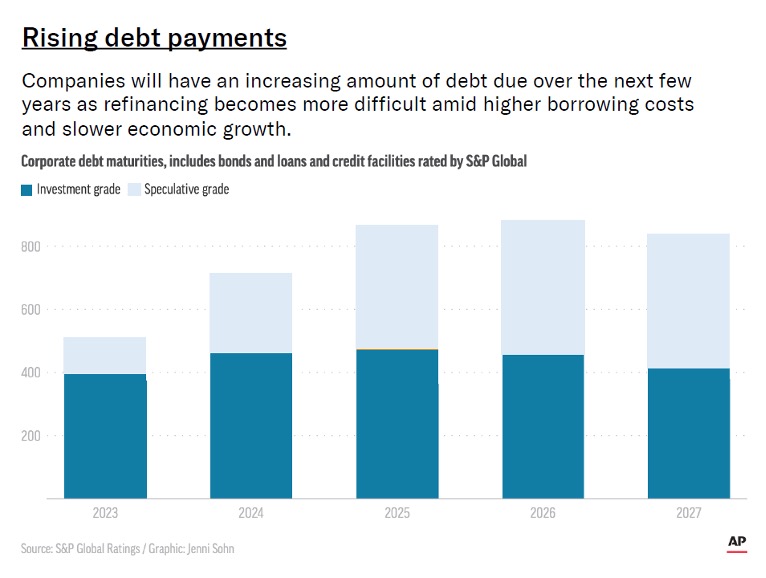

4. Corporate debt refinancings will be expensive and difficult.

Between $500 and $850 billion of corporate debt needs to be refinanced every year by Fortune 500 companies during the next 5 years at significantly higher rates than in the past 15 years.

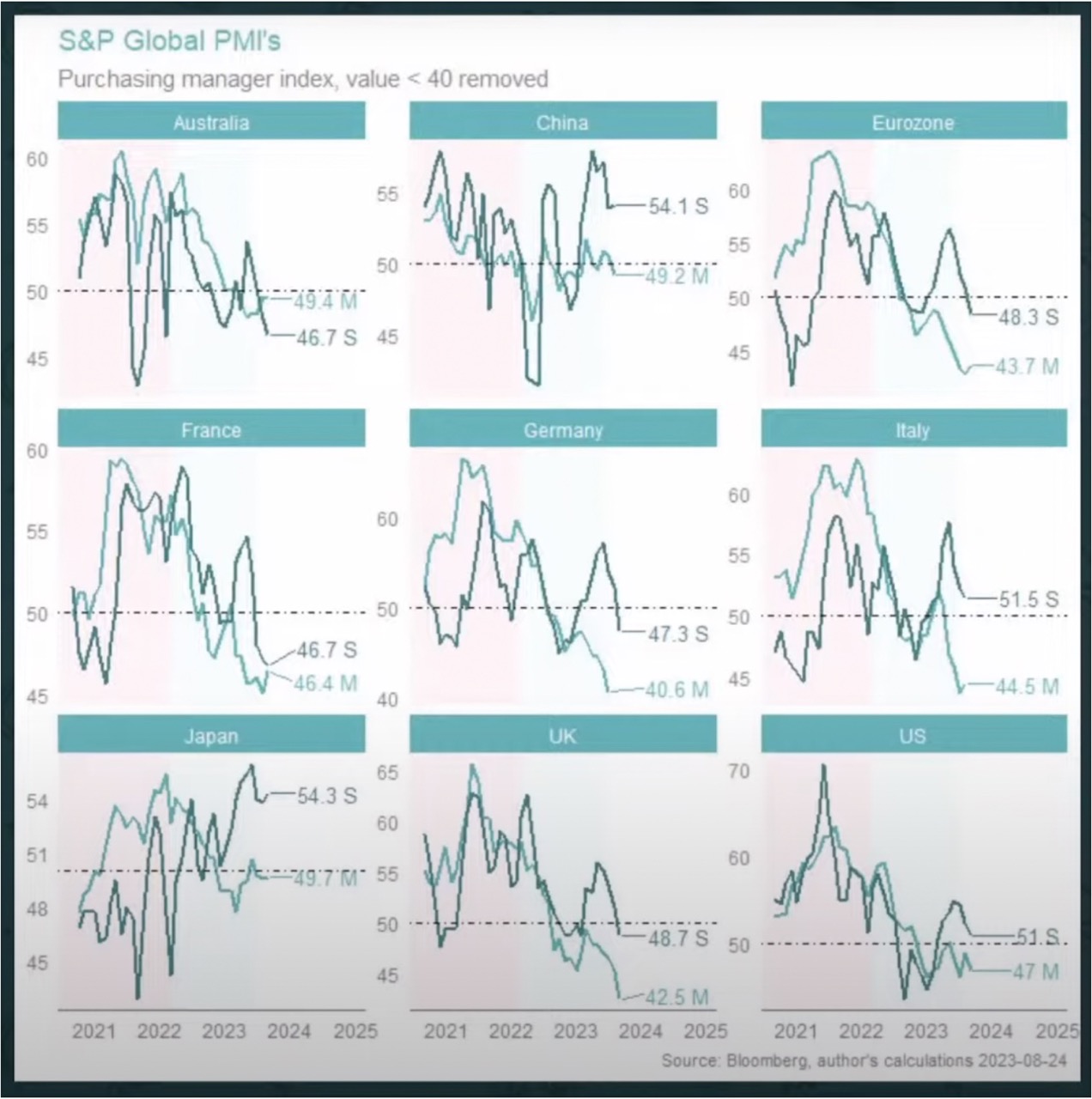

5. The Purchasing Managers Index (PMI) is contracting globally and nearing pre-recessionary levels where PMI drops below 50.

The direction of economic trends in the manufacturing and services sector is negative. This is happening simultaneously in all major economies.

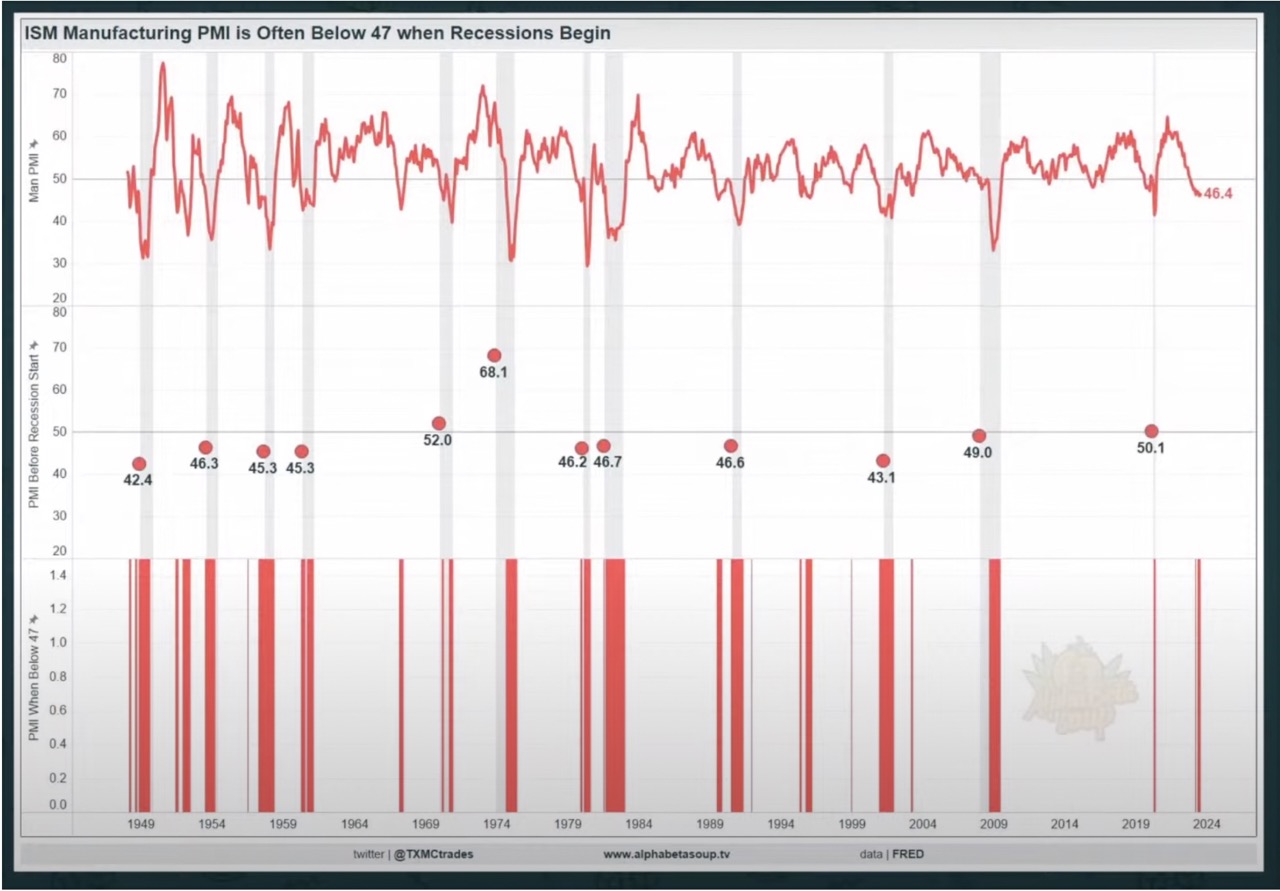

In the US we are at 46.4. 79% of the times the PMI went below 47, we ended up in a recession.

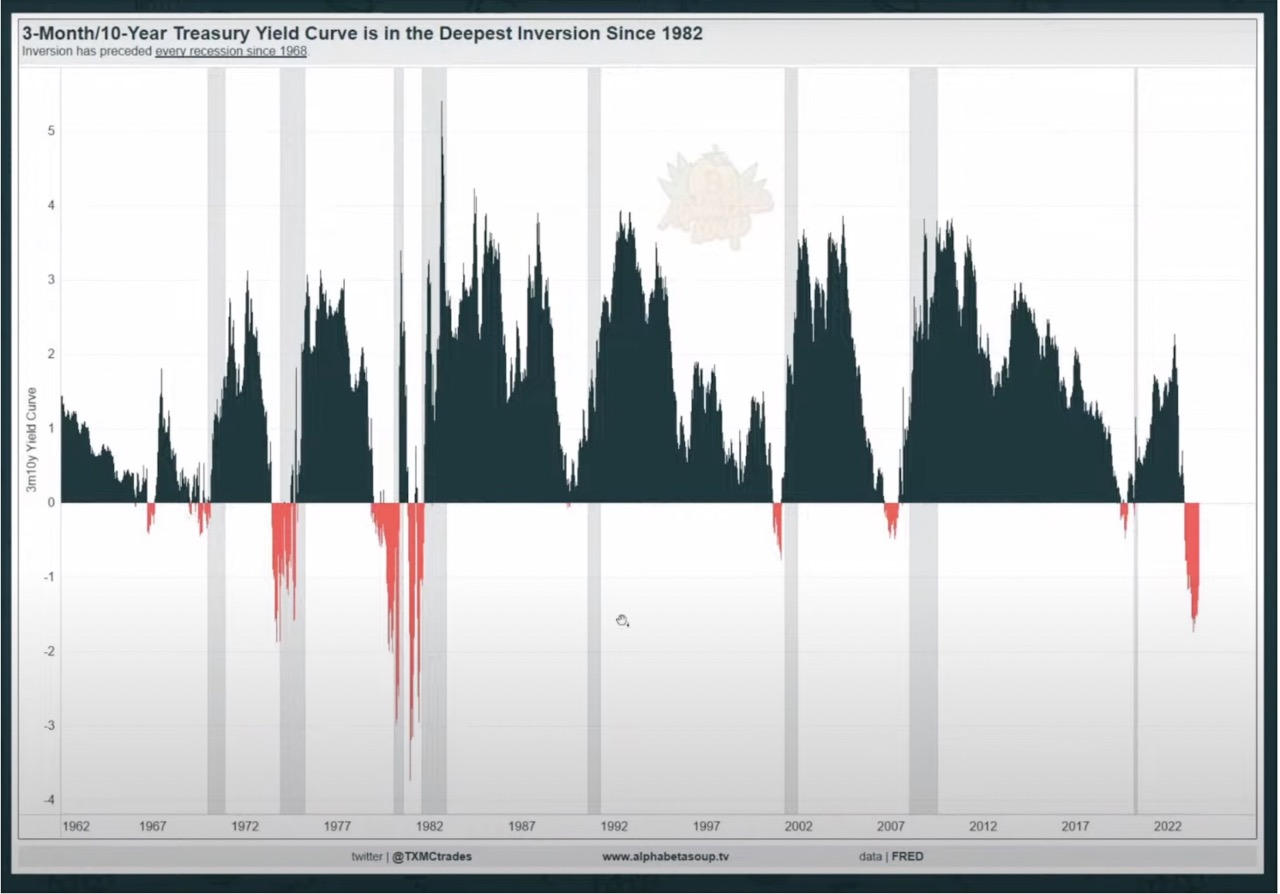

6. The yield curve is deeply inverted.

It’s rare for ten-year treasury rates to be lower than the 3-month treasury rates. The yield curve inverted before every recession that started in the last 70 years except in 1966. It’s currently more deeply inverted than it’s been since 1982.

7. People are finally coming to terms with the fact that rates will be higher for longer.

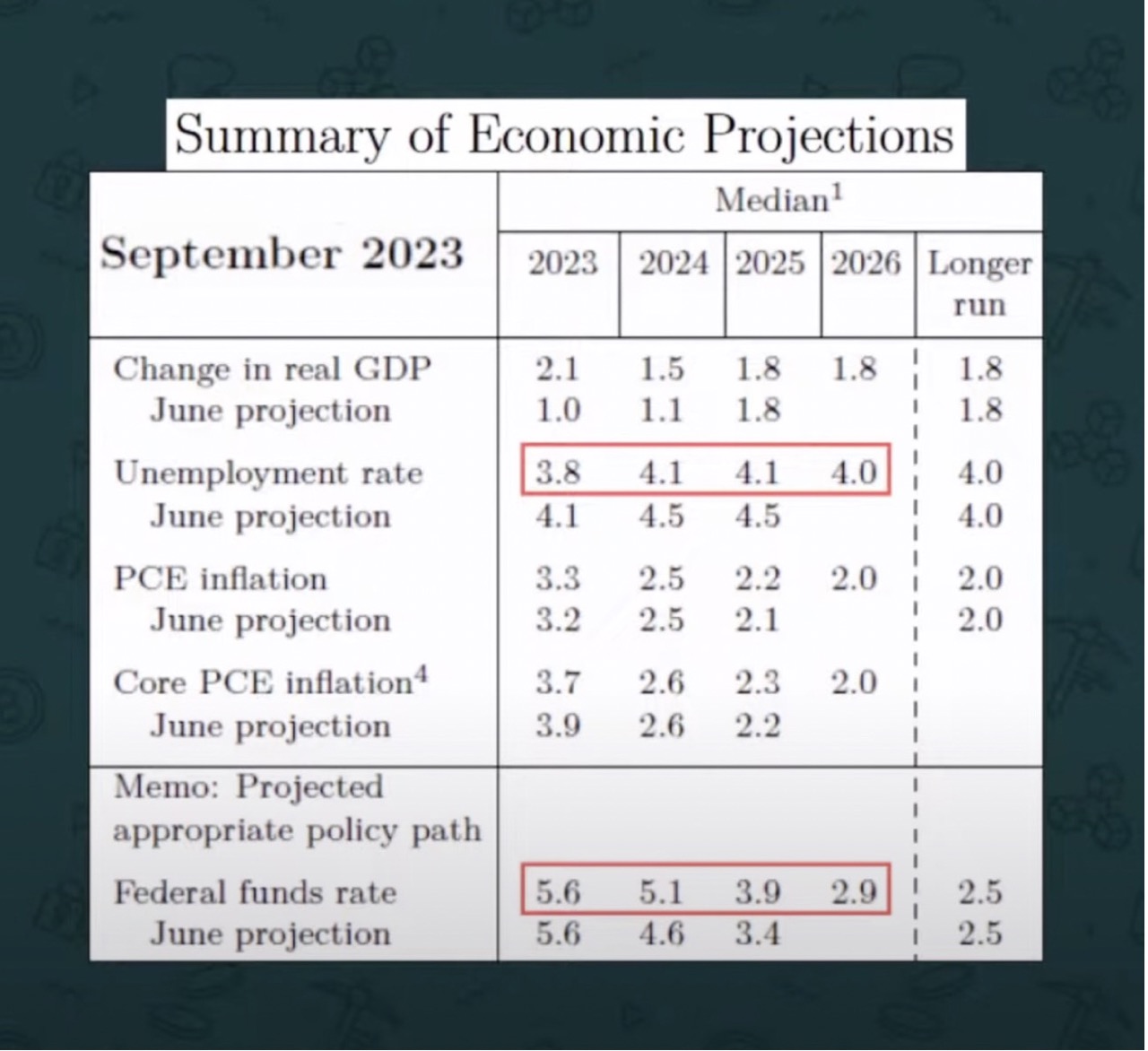

In early 2022 when people were still underwriting terminal rates of 3.6%, I argued that rates were likely going to top 5% and stay higher for much longer than people suspected in order to tame inflation. Between the last two FOMC meetings I’ve seen a drastic shift in market expectations. Markets were expecting a full 1% rate cut by next year and are now expecting half that. The new median feds fund rate projection is for 5.1% in 2024 and 3.9% in 2025. Given the higher discount rate, many fewer projects are being greenlit.

8. Political and geopolitical turmoil is not abating.

The political environment is exacerbating economic uncertainty. A US government shut down looks likely in November with continued turmoil over the 2024 elections. Russia and Ukraine are in a war of attrition with the quagmire likely lasting years keeping energy and food prices high for years to come.

Conclusion

I realize that pessimists sound smarter than optimists, but with so many indicators flashing red I find it extremely unlikely that we will have a soft landing. A recession seems like the far more likely scenario and as such we should brace ourselves for a difficult 12 months.

While in the short term the macro trumps the micro with markets not differentiating good companies from the bad ones, in the long run the wheat will be separated from the chaff. It also bears to remember that the average recession since 1950 only lasted 10 months with the longest lasting 18 months. As such, 2025 onwards should be rosier especially as we should be starting to see the beginnings of the productivity revolution and deflation brought about by the AI revolution and digitization of B2B supply chains. It won’t quite be the exuberance of the last decades given that interest rates won’t be nearly as low as they were and that we have not yet addressed our excessive sovereign debt and unsustainable government spending, but it will feel brighter than our gloomy present.

Until then it will pay to remain prudent in our personal and professional endeavors to ready ourselves to start being aggressive and taking risks at the very moment when everyone else thinks that all hope is lost.