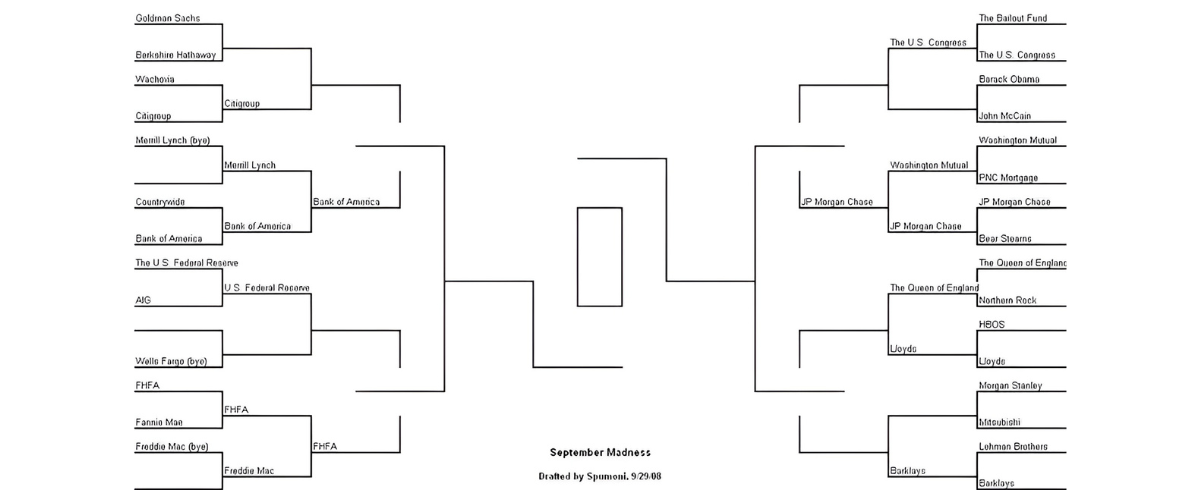

Last March I explained why startups should raise as much money as possible to prepare for the upcoming crisis (Why the startup market is like the real estate market). Now that the crisis has hit, we can examine what it means for entrepreneurs.

1. Aspiring Entrepreneurs:

There is no better time to start a company!!

The opportunity cost has decreased as many high paying jobs have disappeared and employment opportunities in general have lessened. If you have a job, companies will have less room to give generous bonuses and/or raises.

It’s going to be harder for entrepreneurs to raise money, but competitive pressures decrease dramatically in downturns giving you more chances to establish yourself as the leader in your field and more time to do so. When I created Aucland, a copy of eBay for southern Europe in 1998, we faced dozens of VC backed competitors in every major country. We wasted millions of dollars in advertising to establish ourselves as the leader.

When I launched Zingy in September 2001, we essentially had no competition. The online advertising market had completely dried up allowing us to buy billions of advertising impressions for $10,000! The lack of competition proved critical to our success given that it took two years for the company to start establishing itself in the marketplace.

If you have been thinking of creating a company, now is the time to make the plunge!

2. Poorly Capitalized Startups:

My definition of a poorly capitalized startup is a startup with less than 1 year’s worth of cash on hand. A company may have $100 million in the bank, but if it’s burning $20 million per month, it’s poorly capitalized. If this is the predicament you find yourself in, I will reiterate the recommendations that most VCs have been giving to their portfolio companies during the past week: cut your burn as much as possible as fast as possible:

- Stop marketing unless it has a proven positive return on investment

- Lay off anyone non essential

- Focus development on the most important features

- Consider salary cuts for the top management and anyone highly paid

- See what payments you can defer

Only profitability will put you in control of your destiny!

If you have not seen it, check out the Sequoia “RIP: Good Times” presentation.

3. Well Capitalized Startups:

If you have more 3 years worth of cash on hand, you are well capitalized. Given the current environment, you may very well need it and I would advise you to heed many of the recommendations I mention for poorly capitalized startup in terms of keeping lowering your burn and aiming for profitability. However, I would recommend being selectively aggressive.

It’s when everyone else is cowering and sitting by the sidelines that the best opportunities arise. For Internet startups, they usually come in the form of inexpensive acquisitions and marketing. That time has not yet come.

In terms of potential acquisitions, many entrepreneurs have not adjusted to the new reality and many startups have not run out of cash yet. This opportunity will come in 2009 and/or 2010. In terms of marketing, the time has not yet come either. Many media buys are committed to ahead of time and will probably run until December. In 2009, the opportunity may appear to buy a lot of traffic cheaply. You will notice it when if your average cost per click decreases significantly in your Google AdWords campaigns.

In the meantime, cut costs and be patient knowing that your time will come!

Conclusion:

The economic environment has been radically altered fundamentally changing conditions for startups. Valuations will decrease. M&A activity and IPOs will decrease. The average life cycle of a startup from inception to exit will be much longer – over 5 years. In this environment, only the truly committed should venture. Your mettle will be tested and you will need all your grit, tenacity and passion, but if you stand the test of time and take advantage of the opportunities the crisis offers you, you will be richly rewarded!