My conversation with Erik Torenberg was so rich that I decided to transcribe it for those who did not want to listen to a 75 minute long podcast. I will use this transcription as the starting point on a series of posts on marketplaces covering:

- How FJ Labs gets its deal flow

- How FJ Labs evaluates startups

- FJ Labs’ current investment thesis

In the meantime here is the transcription.

Erik Torenberg:

Hey everybody. It’s Erik Torenberg, co-founder of Village Global, a network-driven venture firm. And this is Venture Stories, a podcast covering topics relating to tech and business with world leading experts. I’m here today with a very special guest and friend of the firm, Fabrice Grinda. Fabrice, welcome to the podcast.

Fabrice Grinda:

Thank you for having me.

Erik Torenberg:

Okay, Fabrice, you’re here to talk about marketplaces. You’ve been building and investing in marketplaces for over two decades now. Why don’t we start with sort of a backdrop and introduction? And I’ll start by asking you to sort of chronicle the evolution of marketplaces as you’ve seen it over the last couple decades. I know it’s a big question. You wrote a post about this in 2014. And, of course, even since then a lot has changed. But how has building and investing in marketplaces changed since you started doing it two decades ago?

Fabrice Grinda:

The first marketplace I came across was eBay and that was in the mid to late ’90s. It was love at first sight. As an economist by formation (it’s what I studied at Princeton), I loved the idea that you could use marketplaces to bring transparency and liquidity to fragmented and opaque markets. If you go to the garage sale across the street, you’re not going to find what you’re looking for. If you’re trying to sell something, it’s not likely you’re going to find a buyer. But if you create a national or international marketplace, transactions are way more likely to be successful. The marketplace unlocks a massive amount of liquidity.

That was the original marketplace, alongside Craigslist, but things have evolved dramatically. Especially in the last decade, there have been three major evolutions. The first evolutions that happened, which I described in the 2014 post, is the verticalization of marketplaces. People started realizing that on Craigslist or eBay, you could find a little bit of everything, but if you create a vertical-specific site that does the job better for that category, you’re going to have a much better experience.

The original example of that was StubHub. You could buy and sell tickets on eBay and Craigslist, but on StubHub you had the seating chart for the venues, integration with the e-ticket providers and verification of the authenticity of the tickets. It was a significantly better experience. The same was true for Airbnb. Subletting existed on Craigslist before Airbnb existed, but they didn’t have a calendar. They didn’t have payments. They didn’t have reviews. As a result, the user experience was really broken. It was full of fraud. Airbnb really expanded the category. On Craigslist it was sub $1 billion a year and now it’s tens of billions a year.

That verticalization has continued and it’s happened not just for products, but also for services. As mentioned eBay is being verticalized. You have a company like Reverb, a musical instrument marketplace, doing almost $1 billion a year in GMV (gross merchandise volume). They were acquired by Etsy last year. In services you have Thumbtack, Angies List or Home Advisor. They are being verticalized by companies like Block Renovation which created a much better experience for renovating your bathroom. You have companies like Upwork in the remote work category that allow you to hire remote workers for almost everything and anything that are being verticalized by companies like TopTal for programmers.

The definition I use for a horizontal marketplace is a multi-category marketplace that covers many different things. In the job space for instance Indeed or Linkedin would be horizontal sites. In products it would be eBay or Craigslist. In food, Uber Eats would be a horizontal player, given that they offer multiple types of cuisine. But even that is being verticalized. You have companies like Slice, a pizza food ordering app or Chowbus, in the Chinese food space that are doing very well.

What’s interesting is, if you ask me what is it that I believe today in 2020 that most VCs don’t believe, is that verticalization is only beginning. It’s in its infancy and it’s going to continue and the players in it are going to do well. Most investors think that these verticals are very niche. They can’t be very large from a market perspective but they are wrong. Pizza is a $43 billion a year market in the US, that’s more than enough. Now, what else do VCs believe? Most of them are going to tell you, you have Uber Eats, Seamless, GrubHub, and DoorDash. It’s incredibly competitive. It doesn’t make sense to have a vertical. All of them are losing money, it’s a bloodbath; but that’s because they put themselves in the shoes of a consumer. If you put yourselves in the shoes of a Luigi, the pizzeria owner, you realize that his needs are not being met by the existing incumbents.

The way the pizza market is structured in the US, you have about a third that’s controlled by Domino’s, Pizza Hut, and Papa John’s. For them 85% of their orders come from online and they have big R&D budgets. But the 50 thousand independent pizzerias that are owned by the Luigis of the world, half of them don’t have a website. The vast majority don’t allow online ordering. So Slice creates their website, can pick up the phone, answer questions on Yelp and do all the support functions such that Luigi can focus on cooking pizzas. The future of work is one where people will do the job that are meant to be doing and everything else will be outsourced and done for them. Slice is a great illustration of both a vertical marketplace and the future of work. By doing so, they’ve created a business that now does hundreds of millions in sales.

In the same vein, we’re investors in a company called TCGplayer. It’s a Magic: The Gathering marketplace. When we invested many questioned how this could make sense. They felt the market was tiny. First of all, Magic: The Gathering is a lot bigger than you might think it is. What happened is that the founder owned a comic book store. And as an owner of a comic book store, he realized that the point of sales (POS) systems that were available didn’t manage all the different SKUs required for Magic as there are millions of SKUs.

He built his own and he uploaded all of his inventory. He considered building a SaaS business but charging $100 / month to all the comic book stores would have only been a small business. Instead he gave the software away for free and all the comic book stores started uploading their inventory. All of a sudden, he had all the inventory of all the comic book stores and he offered them to sell some of it on his marketplace in exchange for 10% if it sells. Low and behold, it’s nearing $100 million in sales.

These businesses may seem small. but If you provide an extraordinary user experience to at least one side of the marketplace – and ideally both – you can have much better economics and very low customer acquisition costs and end up dominating the category as you face little to no competition.

Slice doesn’t pay for the end-users who buy the pizza. They’re just existing customers who start ordering online. You could be a large and massively profitable business this way. You are probably not going to build a $100-billion company, but you’re going to build extraordinary products with loyal, dedicated fan bases and amazing economics and you can usually expand from this dominant position into conjoint verticals addressing a larger TAM (total addressable market). That’s one big trend. Marketplaces have been verticalizing. They’re becoming ever more sophisticated and the user experience is ever-improving, which leads to the second big trend.

Managed marketplaces are all the rage. The issue is that the term has come to mean everything and anything. The type of managed marketplace place we love to invest in is one where the the marketplace picks the supplier for you. We call them marketplace pick models.

Imagine an old-school marketplace. I need a plumber. I go to Thumbtack and 300 of them apply. You need to sort through the plumbers. Or if I want to hire a PHP developer, I go to UpWork. Hundreds of them apply. I need to sort, review and select. From a marketplace design perspective, that methodology is called double commit. Both the supply side and the demand side need to interact with each other, pick one another, and agree on a transaction. It’s easy to have listing, but there’s a lot of friction in getting a transaction to happen. On Craigslist, you list an item. A hundred people contact you and then you need to meet in person, etc.

The marketplaces I love best these days are “marketplace pick” models, meaning the marketplace picks the supplier. The marketplace knows who has availability in your neighborhood, who would be the best match for you. Think of Uber: when you say you want to go from point A to point B, you don’t pick your driver. Uber picks the driver for you. It’s not the drivers who pick themselves. Uber sends a notification to a driver indicating this ride is available for them if they want it. It’s the marketplace that picks.

What do I believe that most VCs don’t believe? Most VCs believe the “marketplace pick” model is great for commodity-type jobs, like an Uber driver, but that this cannot work for high-skilled labor, like programmers.

I posit that this is not true. If a company has a selection process they use to select people, we can replicate it. In fact because we have more data and are doing a lot more recruiting in this specific vertical, we can do a much better job at it. For instance if a medium sized company needs to hire a SEO expert. It’s the type of hire they will only do once. However a company like Advisable will place many of them and will be in a better position to pick the right person for your needs than you are.

We’ve invested in many of these “marketplace pick” models. We’re investors in a company called Meero. It’s a photographer marketplace. Airbnb says, « I need a photographer at Erik’s place next Tuesday at 2 p.m. because he wants to list his place. » Meero picks the photographer.

Again, thinking about the future of work: what does a photographer want to do? He wants to take photos. What does he not want to do? Create a website, do marketing, find clients, do invoicing, do post-processing, editing, retouching, and sending the images. Meero will do all that for the photographer. Even though they have a 50% take rate, the photographer is happy as he makes more money than he would otherwise doing only the part he loves doing, Airbnb is happy, and Meero is, of course, very happy.

The same is true of a company like Rev.com. Rev.com is a transcription marketplace. To transcribe our conversation today, you send the recording via their app and pay $1.25 per minute. You don’t pick the transcriber, Rev.com picks the transcriber, then sends you the text. They take a high take rate, but because they provide tools to the transcribers, everyone’s happy. It also allows the transcribers to do their job better.

In this “marketplace pick” model, the marketplace picks everything. They pick your general contractor, your plumber, your Uber driver. This is a massive trend that we’re following and investing in. We’re still at the very beginning of it.

What people objected to in marketplaces was the amount of work it took. If you go on Amazon and you’re buying a product, everything works very beautifully, seamlessly in one click. Though, in many cases, Amazon is also a marketplace. So, if you do enough of the work and you can hide it effectively, you can create experiences for end users where it looks as though the marketplace is the provider of the service, even though it actually is a marketplace model. This way, you can build a company a lot faster.

The key success factor of these marketplaces is rather different than the key success factor in normal marketplaces: you need to highly curate your supply because you are picking the supply on behalf of the demand. You need to pick the very best providers and match effectively. That’s key. If you do it well, you’re doing a good job.

The third big trend, which is only emerging over the last four to five years, is B2B marketplaces. The internet took the consumer world by storm and we ended up having these extraordinary experiences and extraordinary sites, like Instagram, Google, Airbnb or Uber. When you look at the way most companies still transact, especially the large-scale companies, it’s still a lot of Rolodex and Excel spreadsheets and relationships. There’s no online pricing or online ordering. Nothing’s been automated.

We’ve been investing in B2B marketplaces that are either in the industry itself, for instance Knowde – a petrochemicals marketplace – or we’re investing in the supply chain of an industry. For instance, we’re investors in RigUp – an oil labor and worker marketplace where oil services companies and oil companies can hire contract laborers, like welders. In a way RigUp is the trifecta: it’s a vertical job marketplace that is marketplace pick and B2B. It’s all three of our current theses.

We’re still at the very beginning of these three trends. Last year, we invested in 124 startups and the vast majority of them were marketplaces. Many people thought, “marketplaces are all done”. It’s completely wrong. We are at the very beginning of the internet revolution. Only 15% of the commerce is online, the largest components of GDP have not been digitized at all: healthcare, education, public services, construction. In all of these marketplaces have a primordial role to play.

I published on my blog an article in 2019 on the latest trends in marketplaces. You can watch the keynote or check out the slides there. Not only do I present these three theses, I also go through what’s going on in food, cars, real estate, labor, services and lending marketplaces.

Erik Torenberg:

Totally. It’s fantastic post. I will link that talk in the show notes.

There’s a lot to get into. To zoom out on and close the loop on the historical perspective, you had a post where you said the different phases were: horizontal, then we went to vertical, then vertical transactions, then end-to-end vertical transactional.

Andressen Horowitz has a post where it says it went from listing era, to the unbundled Craigslist era, to the Uber for X era, to the managed marketplace era, to whatever’s next. Do you have commentary on either of those or how that’s evolved?

Fabrice Grinda:

Yes, the horizontals went from listing-based, where you put a listing on Monster.com or Craigslist. Then transactional, where you can buy online – that would’ve been StubHub, eBay, Airbnb, to the verticals of those, then to the managed marketplaces, which meant they intermediated the transaction in some way, shape, or form.

But to me, they’re subcategories of the three theses that I’m investing in. It’s a correct historical analysis of how marketplaces evolved. Today, you have elements of all of these in the three theses that I’m following. When I’m describing marketplaces becoming marketplace pick, it means they’re mostly going listing-based to ones where the marketplace is picking the supply.

In fact, I could argue that there was an intermediate step between listing-based to demand pick. From the buyer picking his supplier to, now, the marketplace picking the supplier for you. I think all of these are correct but where are we today?

I think the verticalization is continuing and accelerating, including things that are considered niche, a la the Magic: The Gathering. The listing-based ones will have to evolve if they’re going to survive in a world of higher-quality experience marketplace pick verticals, but they are not going to disappear.

The reason they’re not going to disappear completely is they have a CAC (customer acquisition cost) of zero. Craigslist does not pay to acquire new customers, they come organically. For your marketplace to work, you need your unit economics to work. This means you need to recoup your fully-loaded CAC on a net contribution margin basis after 6 months and ideally triple your CAC after 18 months.

There are some categories where the average order value is so low and where the recurrence of transactions is so low that it probably does not make sense to have these beautiful, extraordinary, vertical marketplaces because you cannot make the economics work. It’s why Shyp didn’t do well.

For instance, a fire alarm system installation marketplace doesn’t make sense because the average order is low. It’s pretty expensive to acquire this supply and the demand, and you only need the installation once.

Horizontals are not going to disappear, but the highest-value categories where great experiences can be created will be verticalized. The market is evolving. If you look at Craigslist traffic, their traffic is down 30 – 40% over the last four to five years, though it’s partly because they’ve had to close down a number of their Personals categories.

Erik Torenberg:

You’re big on verticalization. Does that mean you’re dubious on building horizontal marketplaces today? Is it a matter of timing or are you just, in general, more excited about verticalization? Would you have passed on Thumbtack? Are you dubious on these types of horizontal businesses? Is it a timing thing or is it a structure thing?

Fabrice Grinda:

It’s more a timing thing. When Thumbtack was created, there was no horizontal to do this. It made sense. If you can win the horizontal, you create more value than if you win the vertical. So if you have to choose, you want to build the general horizontal marketplace. You get more users, you have ultimately a lower CAC. That’s a total natural monopoly, but once you have an incumbent that has liquidity and they have scale and network effects, it’s hard to break in. OfferUp and LetGo have been trying to break in the Craigslist business with that much success as might’ve been expected, partly because they’re competing against each other instead of being one company, but also because, despite its horrible user experience, Craigslist works. They have liquidity. At the end of the day, in these businesses, user experience is less important than liquidity. Because Craigslist has liquidity, people still use them despite the fact they don’t moderate content.

If the option is there, I want to build, own, or invest in a horizontal marketplace. That’s the biggest outcome. Also, if you’re a really smart player as a horizontal, you then verticalize.

OLX, which was the company I built, has five thousand employees and 350 million unique visitors a month in 30 countries. It’s really Craigslist 3.0 for the rest of the world. It’s what Craigslist would be if they were mobile, moderated all their content, didn’t have any personals, murderers, prostitution, spam, and scam, and actually cared about the outcomes for the users.

OLX has 350 million uniques a month and that’s extraordinary. The strategy there was: win the horizontal C2C (consumer to consumer) used goods transactions because people transact regularly and keep coming back to the site. Once we won that, we then launched C2C cars, which allowed us to launch B2C cars and win that category. Then we launched C2C real estate, then we launched B2C real estate. Often we also launched either services or jobs.

Now, we didn’t win everywhere in every country. In countries like Russia, we ended up winning every vertical in addition to the horizontal. You start by horizontal then you use it as a launching pad because your cost structure or customer acquisition cost is much lower than any else’s. Since you’re in a category where people are using you every month, you can launch the verticals if you do a really good job.

In the US specifically, we’ve had two players that have been largely incompetent. You’ve got Craigslist, which has not improved their UX UI, has not verticalized, has not created better experiences. And eBay, which has been ineffectively managed because they’ve been trying to be an Amazon competitor even though everyone in the world knows they’re not going to beat Amazon. And yet they’re investing all this money in selling you goods. 80% of goods on eBay these days are new. That makes no sense. Sure, they offer long-tail, Chinese goods, that are somewhat differentiated from Amazon. But they strayed away from their original core and never verticalized properly.

In other countries around the world, the horizontals have totally gone vertical. The verticals are easier to build, but the network effects are not as strong, especially in the marketplace pick model, you have logarithmic network effects.

Let’s say you are calling an Uber in a given city and your wait time is 10 minutes. If you increase the supply enough that your wait time is four minutes, that’s a massive increase in value. But increasing supply more to go from a four-minute wait time to a three-minute wait time is not that much more valuable. And because you don’t need that many suppliers to cover any given market, the barrier to entry is somewhat lower.

Whereas in classifieds or auctions, it’s a total natural monopoly. You have one player that wins and has all the liquidity. It’s also relatively true in the verticals that are not marketplace pick, but it’s less true in these marketplace pick models.

To summarize: if I could own the horizontal, I would own the horizontal and then I would verticalize. I would rather be HomeAdvisor than Block Renovation. I would rather be eBay than Reverb. But, then you should be doing a good job at verticalizing, which these incumbents have not done. That said, I don’t see any obvious horizontals that I would launch now.

I was involved with a company that ultimately became LetGo. We tried to attack Craigslist with a lot of money and a much better product at every level. It has done well, but it’s not disrupting Craigslist. It has not had the outcome that we had expected when we launched.

Erik Torenberg:

Yeah. Do you see LinkedIn similar to Craigslist? I guess it just has such a first mover advantage.

Fabrice Grinda:

Absolutely. LinkedIn is a marketplace for jobs, essentially, and it’s horizontal. It’s interesting because it got there indirectly. It built a social network for business, that then became a job site. And being the repository of people’s profiles actually allowed them to become that.

Clearly, there’s a trend for job sites to verticalize. We’re seeing a lot of sites going after hiring developers, like Hired and Vettery. We’re seeing a lot of sites, especially in the staffing categories, that are going after the verticals. We’re in Trusted Health, a nursing marketplace. Of course, we’re in RigUp, the oil worker marketplace.

Staffing is unique for a variety of reasons, but it’s only a small percentage of overall employment in the US, at around 6%. Outside of staffing, job sites have not been great businesses. And obviously, you’re going to tell me, « Wait a minute, I’ve looked at the Indeed.com or Zip Recruiter’s P&L, and they’re doing really well.” The thing is, they don’t seem to have network effects because a business that has network effects is one where, over time, the more users you have, the more it attracts other users and your customer acquisition costs go down. But the problem with job sites is that, if they do their job well, they find you a job. And so you lose you as a customer and you need to reacquire you next time you are looking for a job.

Often, job sites look like outsourced marketing companies, meaning the large employer like Walmart or a small employer like Luigi’s Pizzeria could put their own ads on Google, Facebook, etc to attract candidates. However, they are no very good at doing this. The job sites do this better for them, but end up merely being arbitrage business. They are simply buying ads more effectively than their clients would and are reselling them the candidates at slightly higher prices. These businesses are good, but they’re not great. They don’t have amazing networks effects.

So, most of them have not built a LinkedIn. LinkedIn is great because they have true network effects. The only job site that really has network effects and is disproving my assertion that most job sites are actually outsourced marketing companies is RigUp. RigUp has become the defacto standard in oil. If you are in that industry, this is where your profile lives. It’s not on LinkedIn. This is where people look at your reviews, your experience, etc. It is doable, but it requires real deep sector expertise and in a category that’s large enough where it makes sense. Rigup is a great exemple of how to successfully attack and verticalize Linkedin.

Erik Torenberg:

If the idea is that every horizontal company should also then verticalize once they dominate, is it similar that every vertical company, once they own the verticals, should try to horizontalize?

Fabrice Grinda:

No, but they should go to adjacent verticals. TCGplayer – the Magic: The Gathering marketplace – is now in Pokemon. Pokemon, is now 30% of their GMV. Reverb started with guitars and later became music instruments writ large. In fact, Etsy bought Reverb, to enter another vertical. So I would say, go into adjacent verticals to increase TAM, but don’t go horizontal. That’s a recipe for disaster and losing your identity.

Erik Torenberg:

Totally. And so if the “why now?” for going vertical is that there are already a bunch of big horizontal incumbents, what’s the “why now?” for the marketplace pick strategy or the B2b approach? Why wasn’t the “why now?” in 2014 or in 2024 or 2025?

Fabrice Grinda:

In order to do marketplace pick, you need to have a matching algorithm that’s really good. You need AI to be at a point where you can actually replicate the recruiting methods of different verticals.

B2B should have happened 10 years ago, it’s just that businesses are conservative and move extremely slowly. But the “why now?” is, it’s a massive comparative advantage if you‘ve digitized procurement. If you digitize your online sales, your supply chain and your competitors have not, you can extract efficiency. You can source lower costs, and you now have the examples of it having happened in the consumer world.

Of course, it’s harder because you need to create a behavior change. And so the people, the type of entrepreneurs that succeed in these B2B marketplaces are people that come from the industry, but want to change it. They can get buy-in if they are connected well.

It’s less likely to be the 25-year-old Stanford grad who decides he wants to build a dump truck driver marketplace. It’s more likely someone who actually came from that industry. And, we are, believe it or not, investors in a dump truck driver marketplace. Until I spoke to the founder, I didn’t even know this market existed. It’s a $37 billion a year market!

The next “why now” is that many are mom-and-pop, family-owned businesses. They used to be owned by boomers, who are not very tech literate. But as these companies are now being handed over to the next generation – the millennials – they are completely tech-savvy. The idea that they’re going to be running a construction firm without having online ordering of underlying items, without having online visibility into project management, etc, is nonsencical. They’re tech-savvy and digital natives and they want to bring that digitalization to their companies.

This is true, whether you’re a millennial inheriting or coming into the family business, or whether you’re the next generation of leaders in the corporate world coming in. The number of CEOs in their 60’s, 70’s, and 80’s, who are still not dealing with email and who have a secretary bring their email to them and are not super tech-savvy is mind-bogglingly large. But as the leaders who are in their 30’s, 40’s or 50s are coming into leadership positions of larger companies, I think they’re absolutely going to start digitizing their companies. It’s astound how little has happened to date.

Erik Torenberg:

Totally. You’re a thesis-driven investor. And so what types of marketplace businesses are you not interested in looking at or not interested in investing in, even within your thesis? Even within the ones that are B2B marketplace vertical and ones outside that. I presume you’re doing some consumer marketplaces still, correct?

Fabrice Grinda:

Absolutely, we didn’t do TCGplayer that long ago. Three years ago, I talked to them for the first time and they were vertical, but they had no real tech. I said “great, but I don’t see a moat.” And to his credit, that founder went in, spent all his money, built an amazing product, and basically locked up the supply. Then he convinced me to invest. We still do a fair amount of consumer because I still think we can create amazing consumer experiences. For instance, in the vertical food space, we’re in Chowbus, a Chinese food ordering app and they’re doing really well.

Erik Torenberg:

What makes something that you would not invest in?

Fabrice Grinda:

To evaluate companies, we have four criteria.

These four criteria are:

- Do we like the team?

- Do we like the business?

- Do we like the deal terms?

- Does it meet our investment thesis?

The first three need to be collectively true. If any of them is not true, we’re not going to do it. If you have an amazing business and amazing team, but the valuation is too high, we’re not going to do it. And if the team is amazing, the valuation is reasonable, but we don’t like the business, we’re not going to do it.

We are a bit less strict with the fourth criteria of meeting our thesis. 70% of what we do is thesis-driven, 30% is other things that we think are cool. That obviously evolves, over time. For instance there was a period where we were doing D2C brands. Also, if you are a founder who has been successful for us in the past, we will back you no matter what you do. Given that we invested in almost 600 companies and had 200 exits, many of these founders are at it again. We back them no matter what, and that leads to a number of investments outside of our thesis.

Now, the three evaluation criteria.

So one, do we like the team? Now, every VC in the world will tell you, « I invest in extraordinary talent and amazing teams. » The thing is, what does that mean? What’s an amazing founder? For us, it’s really someone who exhibits three traits. One, someone who’s an amazing storyteller. Storytelling skills are absolutely key because if you can actually weave a super compelling story, you’re going to attract more capital at a higher valuation. You’re going to get more PR and more business partnerships and you’re going to attract better talent to your company. But, that’s not enough because if that’s all you have, you may raise a lot of capital, but you many not build a very profitable, successful business.

Number two, we want people that are numbers-driven and who are quantitative. You’d be surprised that the Venn diagram of people that are numbers-driven and also great storytellers is actually rather small. There are amazing, numbers-driven people who understand their unit economics extremely well, but can’t tell a story, so they can’t raise money. And we really want both of those to be true.

And then three, we want to back people who have demonstrated grit and tenacity in their background. In the course of my one-hour conversation with a founder, I’m pushing really hard to see that they can actually hold their own and are willing to say that they don’t know as opposed to crumble. If you crumble, you’re not ready for the difficulties you’re going to face as a founder. Me questioning your assumptions is nothing relative to the difficulties you’re going to face.

So that’s one. Number two, do we like the business? Now, do we like the business has a number of variables. What is your total addressable market size? What is the business model? But there is one thing we care above all else: what are your unit economics?

For us, good unit economics are a business where you (a) recoup your fully-loaded CAC on a net contribution margin basis in the first six months of the business and (b) 3x your CAC after 18 months. Ideally, you don’t know what your LTV:CAC ratio is because you have negative churn. So maybe after 18 months, you’ve lost 50% of the customers, but the remaining 50% are buying more, and more, such that maybe your LTV:CAC is 10:1 or 20:1 .

We’re seed and pre-seed investors for the most part. We do every stage, but we’re 65% seed/pre-seed, 25% A/B, and 10% late stage. As a result, most of our companies have not been live for that long and some are pre-launch. So if you’re pre-launch, I want you to be able to articulate what your theoretical unit economics are going to be, but not just based on putting your finger in the air and guessing. Instead, you’ve done unit testing on a limited marketing budget and the CPC was $1 and 10% of the people who came to the site signed up saying they were interested. That’s a $10 CAC and we think 10% of those will buy. It’ll be $100 customer acquisition cost.

On the flip side, we know that the industry average order value is $300 and, we’re taking 20% and on that 20% we have a 66% margin. So 20% of $300, is $60, and you have a 66% margin, so you’re making $40. And we know from the industry average that people are buying this four times a year. So you’re recouping the CAC after nine months. And again, you better be telling me industry averages. If you’re trying to pitch me that you’re going to be way above the average for whatever reason, I’m less likely to believe you.

Now, there’s another case where I’m willing to back you, even if the unit economics are not there, if you have a compelling reason as to why, with scale, you’re going to get there. So maybe you’re telling me, « Hey, I’m currently doing one delivery per hour and my delivery guy is costing me $15 bucks an hour. That said, with scale, I’m going to be able to deliver three times an hour and that’s very reasonable because of XYZ which shows that this is something I’m going to reach very easily with a little bit more scale. Then my delivery cost is $5 bucks per hour, at which point my unit economics work. »

So either unit economics are there already, unit economics are going to get there with scale, or they’re theoretical, but they theoretically make sense and you could argue them very well.

I’m very unit-economic driven. If you launch and you don’t have a business model, you don’t know how you’re going to monetize, I’m not going to fund you. If you launch and you may have massive GMV, massive traction, etc, but if you don’t know your unit economics and you don’t know when you’re going to monetize, I’m going to pass. I passed on many companies that ended up doing really, really well. It’s just that, when they came to see me, they didn’t have that figured out.

If you invest in things that don’t have business models, most of them will fail and it’s not the way I operate. To date, we made money in around half of our investments because we’ve been very disciplined both on that and on valuation, which brings me to point number three: we want the valuation to be reasonable.

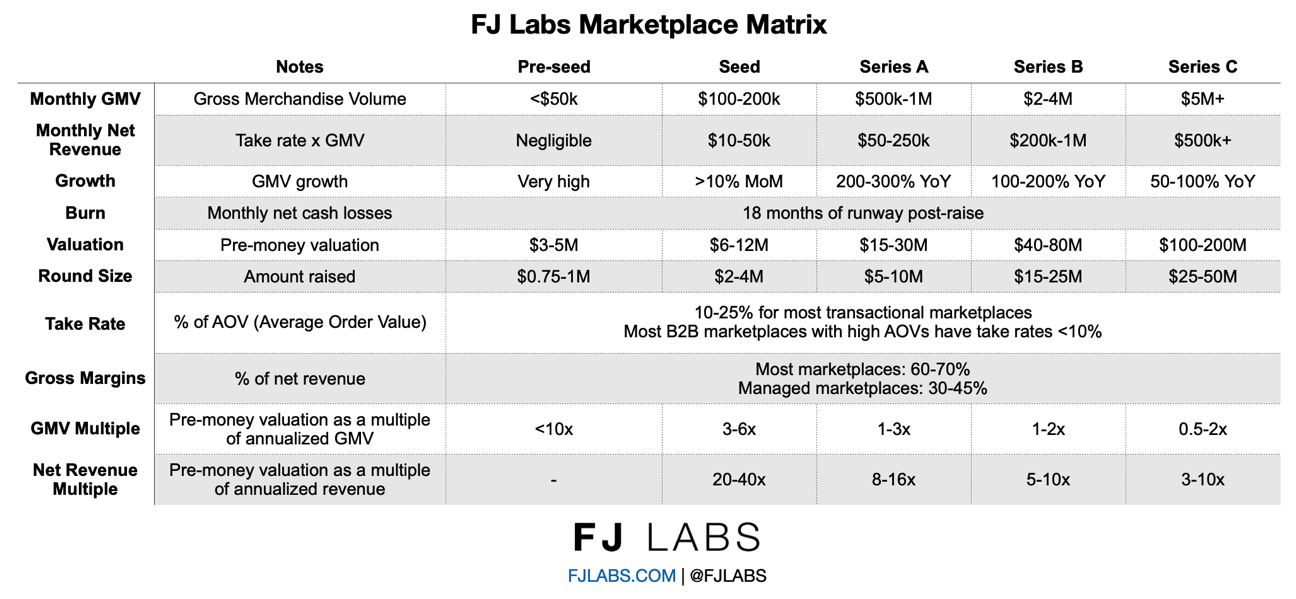

Obviously, “reasonable” means I have a model in the back of my head of what is an appropriate level of valuation from an appropriate level of traction. Now, there’s massive variation in the numbers I’m about to give you because if you’re a second-time founder and you’ve done really well the first time, you’re going to command a higher valuation. If you are growing faster than average, you’re going to command a higher valuation.

These days, for the most part, we’re seeing if you’re pre-launch and you’re raising a $1 million pre-seed round, the average pre-launch valuation is going to be $4-5 million for a first-time founder.

If you’re post-launch and you’re raising your seed round, you are typically doing $150K a month in GMV, for a business with a 15% take rate, and you raise $3M at a $8M pre money valuation. And with that, I expect you to get to $650k GMV in the next 18 months.

Then you’re going to raise your Series A and you’re going to raise $7M at $25M post. And with that, you get to $2.5M a month in GMV and you can raise your Series B at $20M on $50m, pre or $70M post.

This is the median. The standard deviation is really wide because for the best companies that grow faster than that, their A looks like a B. In that case, at your A you may raise at $30M.

There’s so much capital available in the later stages that if you are growing really quickly and have a compelling story, you might bypass some of these stages. However, this is the median for most deals, especially in the vertical marketplaces because many of the VCs don’t believe they can necessarily be big enough to warrant putting much capital into them. But all of these three things need to be true. You need to have a reasonable valuation, good unit economics, and an amazing team. And if that’s the case and you meet our thesis, we will invest.

We decide in, maximum, two one-hour meetings over the course of a week. If I am on the call, very often, after a one-hour meeting I will tell you on that very call whether we are investing and why.

Erik Torenberg:

And on the deal terms, is there any science behind those numbers? Or is it, “hey, that’s what market is and that’s what we think is fair?”

Fabrice Grinda:

We don’t lead deals. We just join other people’s term sheets. As a result we invest relatively small amounts to make sure other VCs don’t see us as competition. We want to be friendly with all VCs and share our deal flow with them at every stage. We make sure not to compete with them for allocation. As a result we have no minimum ownership requirements. We try to invest $250K at pre-seed, $500K at Seed, $800K at the Series A, $1M at the Series B, and $1.5 million at Series C. The deal terms I gave you are not our justification of why they should be that. It’s where the market is today in the categories that I’m investing in.

Erik Torenberg:

Yeah. And you mentioned the unit economics and you think a lot about that. How did you come to those sort of specific numbers in terms of your framework? And what mistakes do marketplace founders typically make, as it relates to unit economics?

Fabrice Grinda:

The mistake is easy. The mistake people make is they overvalue GMV growth, but they undervalue net revenue and unit economic growth. There are periods of time where there’s a lot of capital available and people value GMV growth. Uber would not have been funded had that not been true when they were fundraising and their unit economics were underwater for a long time.

But the problem is, if you’re growing negative unit economics, frankly, it’s easy. If I create a business where every time you give me a dollar, I give you two dollars, I can create a very big business very rapidly. But that’s never going to be profitable. So you need to really make sure that you have customer acquisition channels that are effective, scalable and profitable. Then you can, ultimately, at scale, turn this into a very profitable business.

Many of the companies we pass on, it’s a unit economic problem. The unit economics are too marginal and I don’t see how they get there, even at scale. Scale just makes the problem bigger. So the mistakes people make, they try to grow with bad unit economics too quickly. I’m a very big believer in nail it before you scale it. Launch a city, nail the city. Once the unit economics work for the city, you’ve created a playbook for owning a city, launch the second city. Make sure that your playbook works there, too, and keep going. Often, people think that it’s a land grab so they launch very quickly in many different places, but if you’re growing really quickly without a playbook, with negative unit economics, the only thing you’re doing is increasing burn. It doesn’t make sense.

Now, once you have a playbook that works, actually go for it. Put the pedal to the metal and go crush it, but I wouldn’t recommend doing that before you are ready otherwise you increase the risk of blowing up mid-air. If you have underwater unit economics, at some point, if market sentiment turns, you’re not going to be able to raise, especially if you raised too much money at too high a price. You’ve basically dug a grave for yourself. So that’s the big mistake that most people make that I would recommend avoiding.

Erik Torenberg:

And some people say it’s okay to have low margins, but what really is important is to focus on the payback period because you could make it up in different ways. Is that accurate?

Fabrice Grinda:

Well, your effective take rate and your effective margin are not that necessarily important. I do want you to be able to 3x your CAC in the future. But, yes. Payback matters a lot because I’m way more likely to believe that you’re going to have an LTV:CAC of 4:1 or 5:1 if you’re paying back in six months and then you’re doing 2x on your CAC in 12 months than if you tell me, « Well, I’m going to recoup my CAC in three years, but don’t worry. After that, it’s going to be a straight line to the moon and it’s going to be 100:1. » My belief of that is very low, but if you actually can recoup your CAC quickly and the channel you’re using is scalable, I definitely want to fund that. Then, I think there’s something there and we can grow.

As a VC, I like to fund growth. If you have a channel that works, with good economics, you nailed what you need to do operationally, and all you need is more gasoline to pour on the fire, that’s exactly what I want to invest in, regardless of stage. If you’re at seed, all you need to do is get to the numbers that get you to an A. So I want to fund you to go from that $150k to $650k / month in GMV. If you’re at A, I want to get you to your B. You need to get from $650k to $2.5M a month. And if you’re at B, then it’s different because you can create optionality. You can go for profitability or you can do a C to keep growing quickly depending on how big the market is and what makes the most sense for you.

Erik Torenberg:

Why is the six-month number important?

Fabrice Grinda:

The what number?

Erik Torenberg:

You said 3x CAC within six months. Is that what you said?

Fabrice Grinda:

No, no, no, no. That would be amazing, but that’s almost never the case. No, no. Recouping CAC in six months.

Erik Torenberg:

Oh, my mistake. My mistake.

Fabrice Grinda:

You recoup the CAC in six months, then you 3x the CAC in 18 months. In the B2B businesses, by the way, it’s a little bit different because sometimes they have a pretty long sales cycle and your salespeople cost a fair amount of money, but they churn very little. There, it’s okay if your time to recoup your CAC is longer, as long as your churn is low. If you can prove to me these people are almost never going to churn and, in fact, you have negative churn because you not only you lose almost no logos, your existing customers buy more and more, then I’m happy to have somewhat different numbers. So in the B2B businesses, I use slightly different metrics.

Erik Torenberg:

What did you believe that you no longer believe about D2C brands, in terms of when you were investing in it versus not anymore?

Fabrice Grinda:

Well, even in D2C brand investing, I was always numbers-driven. I always liked the subscription businesses better than the unique product sales. So I prefer a, say, contact lens subscription to buying a mattress. Mattresses have a high AOV (average order value) but you’re buying it once and it’s harder to make the economics work with a one-time purchase. That said, there are some things that are better suited for subscription than others. So if you’re telling me birth control, sure. Erectile dysfunction, not so sure. I mean, do you really need to take Viagra every day? I’m not so sure. Hair loss, absolutely as you need to use the product daily.

The problem is that the costs and complexity of launching D2C brands has gone down so much. In the grand scheme of things, that’s an amazing thing for consumers as you have more products available at a higher quality and lower price than ever before.

As an investor, though, often it becomes a race to the bottom on price and a race to the top of increasing CPCs on Google and Facebook and Instagram. Also there’s an amount of serendipity and luck in which brands hit. So it’s hard to make the economics work. And as a numbers-driven investor, there’s very few D2C brands that I think are compelling enough that they make sense to invest in because it’s just too easy to launch a competitor and too many of them get funded and the economics are not great.

Erik Torenberg:

Is it fair to say you only want to invest in businesses that have a high frequency or a high AOV?

Fabrice Grinda:

Absolutely. You need one of those two things otherwise the economics don’t work. If you have low frequency and low AOV, you’re just not going to be able to recoup your CAC and very few businesses can actually grow without paid acquisition.

Erik Torenberg:

Is this why a model like Homejoy didn’t work?

Fabrice Grinda:

Absolutely. Homejoy didn’t have enough recurrence and had a low AOV. There’s also another problem with Homejoy. So the ideal marketplace design is one where the demand side has a non-monogamous relationship with a supplier, meaning you have different suppliers every time you use them. For instance you have a different Uber driver every time you ride. Maybe the Uber driver would like to drive you everywhere, but the problem is that’s not what you want because he’s not going to be available when you want, at all times. However, if you have someone cleaning your house, it’s actually different because you need to trust them. If they do a good job, and it’s the same person coming over and over again, you’re more likely to disintermediate the marketplace and have a direct relationship, especially if the marketplace is taking 15% or 20%.

In the case of monogamous supplier relationships, the marketplaces need to have very specific and explicit value to avoid this disintermediation. In the end Homejoy didn’t provide enough value to either sides of their marketplace and had low AOV and too low recurrence.

Erik Torenberg:

How about when you look at Beepi and Sprig? Are there other companies who do those same things that will be successful, at some point? Or are those markets just too hard?

Fabrice Grinda:

Those are two different problems. Beepi was a prototypical example of founders thinking it was a land grab when it wasn’t. So they were like, « Oh, my god. There’s Carvana, Shift and Vroom. We need to go to all these different markets as soon as possible. »

Beepi was actually a really good business in the first three cities they were in; in LA and SF and Tucson or Houston. They were doing really well. They had good economics, but then they exploded their burn and grew too quickly out of control.

People loved the experience. There are a number of ways that the marketplace was designed that could have been better and more capital efficient, but it was a great product. The problem was a misreading of the tea leaves. I think they should have burnt a lot less money, grown slower, but kept nailing it and scaling it.

Also, they raised too much money at too high a price. They were priced for perfection. If you are an entrepreneur, especially a first-time entrepreneur, there’s a temptation to just raise the most money at the highest price possible. Let’s say a VC tells you, « Okay, I’ll give you $10M at $40M pre, $50M post, » and the other one will tell you, « I’ll give you $20M at $80M pre, $100M post. » And in both cases, it’s the same dilution. It’s 20% dilution. So you’re going to be like, « Wait a minute. I should always take the $20M at $80M pre, $100M post. » The thing is, if your intrensic value is a lot lower than that, you need to grow into the valuation. If for whatever reason, you do well, but you don’t actually grow into it, then you screw yourself. There are anti-dillution provisions in down rounds and most people prefer to avoid them so instead of a down round the company does not get funded and dies.

So Beepi was a combination of expanding too quickly with bad unit economics in many different cities, burning too much capital, and raising too much money at too high a price.

Sprig had a different problem. They created their own kitchens to deliver to you in 15 minutes, low-cost meals, which turns out to be an extremely expensive value prop. It’s capital intensive to build, you need quality control, you need your delivery infrastructure. At the same time Uber Eats started coming up and offering all these discounts in order to take share away from Seamless GrubHub and became a viable alternative even though the food was not delivered as quickly or as good.

Sprig, with that approach, was way too capital inefficient. And it’s not just Sprig that died. Maple died. But are there Sprig-like products that are going to exist in the future? Absolutely, with different startups taking care of different parts of the value chain. For instance, Travis’ CloudKitchens is creating dark kitchens on behalf of other companies. They aspire to become the Amazon Web Services (AWS) of the food space. Other companies are building brands on top of that infrastructure. We’re investors in a company called Mealco, which builds brands on top of dark kitchens. Because they use infrastructure built by third parties, they don’t need to spend hundreds of thousands of dollars per location to be able to launch, nor do you need to build their delivery network. They use Uber Eats, Doordash, Seamless Grubhub and the like.

In other words there will be brands created on dark kitchens in the future. It will be way more capital efficient and with better economics than existed or were possible in the Sprig days. Those brands will differentiate and compete on food quality, menu composition, etc. It’s going to accelerate the trend towards online food ordering.

The same thing is happening in the catering space. We’re investors in a Canadian company called Platterz, which is absolutely crushing it. They’re an asset-light caterer. In food, we’ve probably made over 50 investments.

What I like about Platterz is that they select caterers in every major city and then provide a curated experience to their large corporates clients, like Netflix. They are asset light. Their job is doing the matching, making the menus, figuring out which caterer they are going to use on which day, negotiating volume discounts, making sure that the quality is great. They re really a marketplace. They are really an intermediary.

The early players were doing way too much of the work and were way too capital-intensive. It’s much better if you don’t actually need to be building any infrastructure and actually do the work yourself. Otherwise, you’re not really a marketplace. Sprig was not really a marketplace.

Erik Torenberg:

Totally. And do you prefer asset-light businesses as opposed to ones that are trying to own the entire value chain?

Fabrice Grinda:

You can own the entire value chain and yet be asset light, meaning you can provide an experience where it appears that you are the provider of the service to the end user, even though you’re a marketplace. And yes, I much prefer asset-light businesses.

Being asset heavy and intensive can be a massive barrier to entry. If you can raise hundreds of millions and other cannot, in a category that’s capital-intensive, that’s absolutely amazing. However, the problem is it’s a big if. You need the right entrepreneur, you need to be at the right point in time in the macroeconomic cycle, which may change for reasons out of your control. So on average, yes, I much prefer asset-light businesses, with the caveat that not everything can be built in an asset-light way.

Erik Torenberg:

Totally. And so let’s talk about building marketplace businesses. There’s the business model. There’s the chicken and the egg problem. There’s go to market. What are some core principles of building a marketplace business in 2020 that maybe have stayed the same or maybe are different from 2015 or 2010?

Fabrice Grinda:

99% of marketplaces are demand constrained. So you start with the supply. The reason is the suppliers are financially motivated to be on the platform. They want to sell and they want to make money. And so you can go to them and say, « Hey, I’m launching this new marketplace. Today, I don’t really have any volume, but I’m not going to charge you anything. You will only pay me if I successfully send you a lead or a client that pays you. » Most people will say yes to that. So make sure that you highly curate your suppliers. You pick the very best suppliers and get going with that.

Once you have that, find them a limited number of high-quality demand. Now, if you’re in a services or labor marketplace, you ideally want to represent, on an annual basis, 25% or more of the income of your marketplace. Do not go overboard if your supply. Because it’s easy to get supply, many marketplace founders have a tendency to say, « Okay, let’s get every single … » Let’s say you’re building a plumber marketplace. « Let’s get every single plumber in New York on the marketplace. » That’s a recipe for disaster because you’re not going to send them enough leads so they’re not going to be engaged and they’re going to churn out of your platform and they’re not going to respond to client inquiries.

Instead, in one neighborhood, in one zip code, get the very best plumber. Make sure he’s engaged. Make sure he has the app. Make sure that every time he has a request, he replies quickly. If you can send him a meaningful percentage of his business, he will be using you and be active. And once you’ve made that work, then you get another one, and another one, and another one. So you always want to match your supply and your demand very carefully. It’s very easy to overload your marketplace with too much supply that churns because they’re not engaged and they’re not active. And if they’re not active, your demand side when they come is not going to have a great experience.

You want the first transactions to be amazing and to set the tone and standard for transactions going forward. Nail it before you scale it. Launch hyper-local in a zip code or neighborhood and take it from there.

Some marketplaces are innately national or global, in which case that’s fine especially since it’s cheaper to buy traffic and ads at a national level than a local level, but many businesses are local, in which case, really go hyper-local, like a neighborhood. Nail it there and then you go to the next neighborhood and then you go to the city. And then once you’ve gone to the city, you go to the next city.

Likewise it often makes sense to start in a very specific well defined sub-category of your vertical before expanding to adjacent categories. For instance for your plumber marketplace you might want to focus on one specific type of plumbing jobs that you can easily price and measure quality for.

Erik Torenberg:

Totally. In a business model, do you have any favorite approaches?

Fabrice Grinda:

Yes. My favorite approach these days is to charge a commission. On average, people take 15% from the supply side, but there is a lot of nuance. The reality is you should be taking the commission on the more inelastic part of the curve. You should test the elasticity of demand and elasticity of supply and then take your rake on the more inelastic curve and so you really need to check for price sensitivity. But on average, it’s going to be 15% from the supply side, maybe start at 10% and increase to 15% over time.

Another favorite trick of ours, especially these days, is to offer a B2B SaaS tool for free to lock in the supply or demand side. You offer for free a tool that others are charging for and build a marketplace on the back of it.

For example, we are investors in Fresha. Fresha is a MindBody competitor. MindBody is an OpenTable for hair salons, barbers, spas, etc. They charge the store a booking fee for each customer reservation, similar to the way OpenTable does it if you are getting a table at a restaurant. However, most small business owners hate being charged when their existing customers are making a booking.

So what Fresha decided to do is, « You know what? We’re going to give you the same product as MindBody, in fact, better and cloud-based, for free. We will not charge you for the customers that you send our way. » And instead, they said, « We will charge you when we send you new customers and we’re going to provide you a POS system that’s amazing and with lower billing fees than anyone else because we’ve aggregated the volume of tons of stores.” They’re now in the hundreds of millions of GMV per month using a non-traditional business model.

Giving away a free SaaS tool in order to lock in the supply is amazing. It’s what I described about TCGplayer for their Magic: The Gathering business. They created a POS system for Magic: The Gathering, which they gave away for free to all the comic book stores, which led them to have all the inventory. Slice has been doing the same in the pizza space. Most pizza owners want to cook pizza and not do all the administrative work around running their business. Slice does all the work for them. They pick up the phone, create their website, help with packaging. They become their phone, web and mobile pizza-ordering provider. As a result they have a CAC of zero on the demand side as they are converting existing clients rather than acquiring new ones. So, yes giving away a SaaS tool that is an amazing trick to grow a marketplace.

Erik Torenberg:

Totally. I want to run through a few different spaces and get your take. These are new marketplaces. So one is home school, two is childcare, three is therapists, and maybe even a non-trained therapists like a listener or a coach. And we’re talking about monogamous, non-monogamous. All of these have potential for people to find a person and go off platform, but how do you think about these spaces?

Fabrice Grinda:

We actually looked at a lot of these. We thought for a long time about creating a childcare marketplace. Ultimately, we couldn’t quite make the economics work. I think, if I recall correctly, you needed a premise where someone could take care of multiple kids for the economics to work.

We never got there. On the high end, there were people that would just hire the care directly or had it provided at work by their high end employers. On the low end, you’re competing with traditional daycare and there was no super effective way to create asset-light daycare or childcare. We’re like, « Okay, maybe we do it in people’s home, but for that we need to get them certified. How do we get them certified? Once they’re certified, do they need us? » And so we couldn’t quite crack the, how do we create a lock-in system and provide enough value after we certify them and find them clients.

So we couldn’t quite make that work. We looked at elderly care as well. We were investors in a few of them. They all died once the California legislation came into place. They worked from a business model perspective as 1099s, but they didn’t work as W2s and they all went under.

We also looked at different therapy marketplaces. For instance in physical therapy, there’s Kulagy out of LA which is doing reasonably well. For psychologists you have TalkSpace, which is absolutely crushing it, as far as I can tell, given that you can get a therapist remotely for cheaper and with more convenience than if you’re doing it in person. For therapy, the key success factor, if I recall correctly, is actually getting reimbursed by insurance or paid for by the employer. It’s too expensive at $100 or $200 per hour for many people to afford it out of pocket. You have to demonstrate the value of the therapy either to employers in terms of productivity or absenteeism or to insurance companies in terms of lower medical costs to get it paid for by one of them.

Note that we have not invested in any of the players in the category yet. We got close to a few, but we haven’t pulled the trigger. That said, I could see marketplaces working in the category if they find a way to get paid.

For homeschooling, it feels like a monogamous relationship on a go-forward basis to the extent you have one tutor for a child, especially at the early ages. If it’s multiple tutors, it’s less of an issue. I also don’t know how big the market is.

I suspect continuing education is the first place that’s going to be disrupted. It ridiculous that you finish college right after 22 or 23, and that’s it. You never get more education, even though the world is changing so quickly.

Having online courses in order to complement your learning makes a lot of sense. Imagine you were doing marketing at a startup in 2000, you were probably doing display ads. Later, you had to do search engine marketing (SEM) on Google. Then you had to do Facebook. Then you had to do Instagram. Then you had to do video ads on YouTube, etc. That world completely changed and is continuing to change and you need to keep updating your skillset. What Teachable, Udemy and Lynda are creating make tons of sense. It’s easier to disrupt than existing schooling.

Homeschooling is kind of a way of saying, « Okay, I’m not satisfied with the way the current K through 12 education system works. I’m going to create an alternative. » That said it has serious downsides. It’s harder for your kids to socialize. It’s also very expensive so I wonder how big that market ends up being. In order for the marketplace to work in that category, you probably want to provide a lot of value to the parent to make sure that the experiences that they’re getting from their tutor is on track with traditional schools. Despite the fact that it’s a monogamous relationship, if you can prove to the parent that the tutor is actually teaching in line with what colleges are going to be expecting in the future, then there is ongoing value, especially if you add other forms of tutoring on top. That said the monogamous relationship probably means your take rate has to be limited to something like 10%. You probably have to do payroll processing on behalf of the parent as well in order to increase your value. All things considered, I think it could work there, but I think I would have an issue with TAM. The real long-term solution, as a country, is to fix our K through 12 education.

Erik Torenberg:

Totally. And I’m curious what other spaces, you mentioned childcare earlier, that you’ve maybe considered incubating or got close to, but just couldn’t quite get there. I’m curious if you’ve looked at whether some of them might be in education or healthcare or public services, construction. What are some spaces you got excited about, but couldn’t quite pull the trigger on?

Fabrice Grinda:

As investors, we ended up investing a lot in the construction space because the user experience is really broken, both B2B and B2C. For instance we invested in a marketplace for architects to find contractors. We invested in Toolbx for contractors to order products to be delivered the same day. If you are at a construction site and run out of two by fours, Toolbx will go and get it for you. We’re in a dump truck driver marketplace. If you need to remove all the debris for your construction site Tread will take care of that for you. We are investors in Toolbox which connects skilled construction workers to construction projects.

Even though the experience has been broken for a long time, the “why now” is that many of the companies in the industry are family owned and are being taken over by millennials who expect to be able to transact online and are digitizing their businesses as a result.

Logistics has a similar profile and we have been very active in the category. We were early in Flexport, and we invested in Freightwalla, which is an Indian digital freight forwarder. We also invested in Leaf Logistics and many others.

We have been less active in education, healthcare, and public services. It’s harder to attack regulated markets because the regulator is very slow and they are not necessarily trying to optimize for either extraordinary outcomes or efficiency.

I liked disrupting education at the edges rather than the core because you don’t need to get approvals from the teachers’ unions or get public school to allocate budget to you.

The same applies to healthcare. We invested in Parsley Health. I like One Medical and Forward. More people are wearing Apple Watches and Fitbits, creating tons of data. However, it’s not currently being used by the medical profession. People are using the information themselves. This is especially true in our world of entrepreneurs and VC where everyone is bio-hacking. We’re all tracking our sleep, calories eaten, trying different diets and trying to improve our health outcomes.

I like this approach of doing it bottoms up, disrupting the category at the edges until the point that it has no choice but to affect the core. It doesn’t make sense that there’s so much pen and paper still in processes in medical offices. We consideredcreating a medical records encoding company to do it on behalf of doctors’ offices. Every time you go to the doctor’s it’s incredibly inefficient. You fill out all the same papers. They have multiple people at the front desk only to deal with all these papers, file insurance claims, send them to Medicaid. It’s ridiculous how inefficient the process is. Ultimately, we couldn’t quite get there for a variety of reasons, but I can’t wait for someone to digitize that.

Erik Torenberg:

Totally. Do you think it’s not too late to build a big company in the dating space? How have you reviewed that marketplace opportunity?

Fabrice Grinda:

I mentioned earlier I didn’t like job sites because their objective is to lose their clients by finding them great jobs, it’s the same reason I don’t love the dating sites because, if they do a good job, they find you a girlfriend or a boyfriend and then they lose you. And if you end up breaking up, they often have to reacquire you. I think the average lifespan of a user on a dating site is six months because they do a pretty good job. Around half of marriages come from people who met on online dating sites. As a result churn is very high. You can build a high revenue business and in the early days, you had interesting viral loops, but I don’t like the churn component of these business. I suspect the LTV:CAC is not great. You can build a billion-dollar business in the category, but I don’ think you can build a $20 billion business, let alone $100 billion business.

I like businesses where the better job the business does, the more their customers use it. For Uber, year one, you use it four times a month. Year two, you use it eight times a month. Year five, you use it 16 times a month, plus you started ordering on Uber Eats. So the revenue per user per month keeps going up, and up, and up. Who knows what the ultimate unit economics are? The problem with dating sites is, « Oh, I met someone I really liked and I got off the dating site. » Maybe you get back on it in the future, but the ultimate value they extract from you is pretty limited. It is a marketplace, but I don’t love it for kind of the same reason I don’t love the job sites.

BTW that’s why I like staffing businesses more than job sites. You keep finding people good jobs and then earning a percentage of their income on a go-forward basis as opposed to losing them forever or for multiple years, at least if you find them a full time job on a traditional job site.

Erik Torenberg:

In closing, what’s your request for job startups? Besides RigUp, are there verticals that you are excited about, despite your skepticism? Or what other spaces in B2B, or perhaps more broadly, that you want to invest in or see more entrepreneurs build it?

Fabrice Grinda:

For jobs, we’ve done a lot of the vertical staffing marketplaces. We’re in Trusted Health for nurses. In a way, Meero is a photographer marketplace. Frankly if you are building a marketplace, you should reach out to us. We are the premier global marketplace investors and it really doesn’t matter the industry, the category, or even the geography, though we do prefer typically larger markets.

Especially if you meet one of our theses, whether it’s a vertical or a marketplace pick model or a B2B marketplace, you should reach out. There is no specific industry or category we are looking at. We are business-model specific. If you are building a marketplace, we want to talk to you.

Erik Torenberg:

Awesome, that’s a great place to close. Fabrice, thank you so much for coming on the podcast. This has been a great episode. And for people who do want to talk to you, where should they reach out or where can they learn more about FJ Labs?

Fabrice Grinda:

We are very open and easy to find. You can find a lot of my thinking on my blog at FabriceGrinda.com. You can see our portfolio at FJLabs.com. It’s probably easiest to reach out to me on Linkedin. Even if you send us a cold email, we will review it if you are building a marketplace.

Erik Torenberg:

Awesome. Fabrice, thank you so much for coming on the podcast. It’s been a great podcast.

Fabrice Grinda:

Thank you for having me.