Given the pace at which Jose and I have been angel investing, it’s not surprising we have now invested in 100 startups! Pitzi, the Assurion of Brazil, takes the prize for being the 100th startup! In fact given my procrastinating in writing this blog post, we are now at 105 startup investments!

In two prior blog posts, A SuperAngel’s Investment Guide and Angel Investing Secrets, I presented our investment philosophy and many of our lessons learned. However, crossing this milestone is a great time to take stock on how things have played out and describe the adjustments we made in the past 18 months.

Note that all of the statistics presented in this blog post only cover my angel investing and do not include the performance of companies I created and ran (Aucland, Zingy and OLX) or the performance of the companies I incubated. Also note that I am only presenting my performance and not Jose’s. Jose Marin and I have been doing 100% of our investments together since 2009, but we don’t always invest the same amount. Moreover, while our portfolios overlap by more than 80%, they are not identical because of our investments prior to 2009. That said Jose’s performance is just as good if not better than mine.

Of the 105 investments I made, 85 are still active.

A bit less than half of my active investments are in the US. More of my investments were in Brazil, but I had 4 exits from Brazil recently. The fact that 13% of my investments are in France represents mostly legacy investments as we rarely invest there anymore. We just made our first two investments in Turkey and are actively looking in India and Indonesia.

Of my US investments, 50% are in New York, a disproportionally large number explained by my presence and public profile there, which allow us to meet many of the best companies. We are not nearly as well implanted in the Valley. The best companies there go to Y Combinator, Ron Conway, Jeff Clavier and the like. We thus selectively co-invest with them, typically in companies with global ambitions where our expertise is relevant.

We invested in 7 cities, a testament to the fact that Internet ecosystems are proliferating. It’s now possible to attract talent, follow-on capital and have exits outside of Silicon Valley. That said many startups still opt to move to the Valley or New York because it’s still easier to operate there. New York is the place to be for fashion, finance and 3D printing startups. The Valley, as usual, is the place to be for hard core tech and social startups.

The seed stage startup scene is frothy.

Despite their recent stock market travails, thousands of new millionaires have been minted by the IPOs of Facebook, Pandora, Zynga, Linkedin, Homeaway, Zipcar and countless others. Many of those have become angel investors, a path facilitated by the emergence of sites like Angel List.

Incubators are also proliferating and investing more than ever before: Techstars, 500 Startups and many others have appeared on the scene and Y Combinator classes are bigger than ever. Even the emergence of Kickstarter and other crowdfunding startups is tilting the tables in favor of entrepreneurs.

The number of startups and entrepreneurs is also proliferating. The clearest and scariest sign of this bubbliness is seeing investment bankers, management consultants and others, who never normally consider entrepreneurship, join or create startups. This is typically a clear sign that we may be nearing the peak of the investment cycle.

The amount of seed stage capital available has increased more than the amount of startups pushing up valuations, especially for those that somehow become hot (which at the seed stage is not always correlated with actual traction).

- 2006-2010: Priced rounds at $2-3 million pre-money for startups that are live, with clear unit economics and a modicum of traction (say $25k per month in revenues)

- 2011: Notes with a 20% discount on the series A and a $4-6 million cap for startups that just went live

- 2012: Notes with a 20% discount on the series A and a $4-12 million cap, though a number of startups are raising on notes without discounts to the series A or on uncapped notes often on Powerpoints or with no traction and no pre-defined business model

This seed stage bubbliness has also extended to Brazil where startups with no traction often expect to raise on notes capped at $4-6 million, despite a worsening economic outlook for the country both at a microeconomic (counterproductive labor laws were recently passed) and macroeconomic (worsening outlook for its exports) level.

As I mentioned in a prior post, startups should not have debt. Those notes create fragility as they often convert only in the case of a Series A financing, which happens only for a minority of seed funded startups. If no institutional funding takes place, then the notes eventually and inevitably come due. This leads to a difficult conversation between investors and entrepreneurs. Since the entrepreneurs rarely have cash to pay back the debt, they are technically in default and the investors can demand significant equity. The entrepreneurs, many of whom may just be fair weather entrepreneurs given that they came to it late in the game from nontraditional entrepreneurial profiles, may just walk away.

Also, as I had previously noted over 99% of startups sell for less than $30 million, a fact definitely borne out by my exits. Of my 21 exits, only 3 sold were for more than $30 million. Many sold for less than $10 million, yet I managed to make money on most of the exits because we were very price disciplined. Unfortunately, many entrepreneurs who raised capital at high valuations will find it difficult to sell at these prices for two reasons. First, their investors will have a preference so most of the proceeds of an exit below $30m will go to the investor, leaving the entrepreneur with little or no gain from selling. Second, because of structural fund incentives, investors will typically prefer to gamble on a big win than to accept an acquisition for less than, equal to, or even marginally more than their initial investment. The result is that the investors block low sales and prevent middling exits even if they would benefit the entrepreneur. In essence, by raising at too high a valuation, entrepreneurs are pricing themselves out of many exits.

The day of reckoning has not happened yet. Many of the startups that were funded with notes over 12 months ago but could not raise a Series A have been able to open new notes and further tap seed capital without raising a formal round or cobbled together angel led Series A rounds.

Barring a macroeconomic accident coming from an exogenous shock (a blowup in Europe, a war with Iran, the US not dealing with its fiscal cliff, etc.), the frothiness will probably continue for a while especially when the JOBS act comes into effect bringing even more money to the seed investing game.

However, make no mistake the great early stage startup debt overhang will lead to a day of reckoning where many entrepreneurs and angel investors will be burned, potentially never to return to the market again.

Despite the seed frothiness (or even bubble), we are not in an overall tech bubble.

The emergence of late stage mega funds like Adreesen Horowitz and the ever larger funds being raised by traditional VCs (with many VCs raising over $1 billion!) has also made the late stage pre-IPO financing very frothy for companies with traction displayed by the high valuations commanded by companies such as Dropbox, Airbnb, Twitter, Pinterest, Tumblr, Foursquare, Gilt, Fab, JustFab and many others.

With $1+ billion dollar funds, these investors have to write $25-50 million checks. However, very few companies cross the $100 million valuation threshold, let alone the $1 billion threshold. With so much capital chasing so few deals, late stage pre-IPO valuations have also increased significantly for hot companies.

However, a bubble requires high valuations relative to fundamental value. Past examples of bubbles include the technology bubble in the late 1990s, and the real estate bubble in the late 2000s.

However, recent technology IPO valuations are generally aligned with their underlying value. At the time of the Business Insider research cited above, Groupon was trading at 1.4x 2012 expected revenue, Zynga at 2x revenue, Pandora at 4x revenue, and Linkedin at 14x revenue. Over the last ten years, even Apple.com has seen forward P/E multiple converge down from 80x to 12.5x compared to an S&P 500 average multiple of 12.5x. Investors can nitpick about the underlying value, but the important point is that these prices are nowhere near bubble multiples.

In fact, this is creating an issue for many startups which raised capital at a high price as they are finding that their public market valuations would often be lower than their last round private valuation.

Also, except for extremely hot companies, the Series A market is more difficult than ever. The amount of capital invested as part of a $3-7 million Series A round has not increased markedly. Given the explosion in the number of startups created, VCs are now seeing more startups looking to raise Series A money than ever before, sometimes 10 or more virtually identical companies going after the same space, often with unrealistic price expectations because of their high seed price. As a result, many are standing by the sidelines and waiting for one of them to separate itself from the pack.

While it may be a case of stage envy from not knowing enough about the real conditions at the Series A level, if we had more capital to deploy, Jose and I would probably opt to invest at the Series A level – both in new startups and as follow-ons to our most successful seed startups. This is especially true in emerging markets where Series A capital is extremely hard to get.

The “trade” of copying successful ideas from the US to other markets is becoming a very crowded.

Clone factories like the Samwer brothers’s Rocket Internet are proliferating. The greater dissemination of information through sites like Techcrunch has also inspired entrepreneurs to copy ideas earlier than ever.

Jose and I typically invest in a copy only if the original model has reached $100 million in revenues and is profitable or on the path to profitability. Increasingly companies that have just raised seed money are being copied.

We are also surprised that many companies, such as Pinterest, that are seemingly global in nature given the ease of their potential internationalization are being copied. From our perspective, it makes more sense to invest in companies where the network effects are national (e.g.; OLX) or where local expertise is essential (e.g.; ecommerce where you need local suppliers, logistics, payments, merchandising, etc.).

We have stayed true to our investment principles, but made course corrections.

In light of the seed stage frothiness, the difficulties of raising Series A capital and the increasing competition in the international arbitrage model, we had to make a few adjustments, but for the most part have pursued our existing strategy.

As a reminder, our principles are as follows:

- We invest in consumer facing models, specifically in marketplaces, ecommerce, travel and user generated content. Both Jose and I have full time jobs respectively as Co-CEOs of OLX and IG Expansion. We have no intention of becoming full time investors. As a result, we focus on categories we know well and can evaluate rapidly.

- We only invest in countries with large domestic markets. It’s easier to attract capital and have exits in those markets. We have mostly focused on the US, Brazil, Russia, Germany and the UK and have recently started investing in Turkey.

- We don’t take simultaneous business model and market risk. We invest in new, innovative ideas in the US market and in copies of established ideas in other countries. For us established means that the original idea has over $100 million in revenues and is either profitable or on a clear path to profitability.

- We invest $50k-$100k as part of $500k-$1 million seed rounds. The company cannot be raising too little which would not give it the runway to prove itself out. The company cannot be raising too much, as it should keep investment discipline, not to mention Jose and I both expect to own a meaningful stake in the startup (at least 1% each). Investing a small ticket allows us to crowd source the due diligence, especially as we are often the last money in, which is essential given the part time nature of our angel investing.

- We expect the startup to meet our 10 business selection criteria. They are essentially my personal 9 business selection criteria plus the requirement that the startup be live and have some traction. We realize that we care more about market size, unit economics and for the company to be live than most other investors do, but our failures have mostly come when we deviated from those principles.

- We must be comfortable with the deal terms. Being price sensitive, mostly investing in priced rounds with pre-money valuations between $1 and $3 million, has allowed us to be successful on the majority of our exits – even when they were for less than $10 million.

- We must love the team!

- We must love the product!

- We don’t join boards. As I learned at my expense with my earlier investments, the quality of the time spent with a company matters more than the quantity of time spent. It’s very easy for board roles to impose administrative and reporting overhead on startups. Given the number of investments I made and my role of co-CEO of OLX, I just don’t have the time. I don’t expect any reporting or to hear from the startup unless they feel compelled to share or want some help. Interestingly, despite the lack of time commitment, many of the startups we invest in think Jose and I are the most useful angels they have. We rapidly reply to their requests for introductions to partners or VCs, or feedback on their deck, product, marketing strategies or term sheets they receive from VCs. Given that they seldom make those requests, it takes us very little time despite being very helpful to them. Another reason not to join boards is that I suspect that joining them is detrimental to investment performance. Human nature is such that we would spend too much time with the companies fairing badly (even though the worst that can happen is that the value of our investment goes from 1 to 0) and not enough with the ones doing well (even though their value can go from 1 to 10 or 100!).

- We have a portfolio strategy. Most studies suggest that angels with fewer than 10 investments lose money, while those with more than 10 investments make money. Moreover, the more investments angels make, the higher their IRR as it increases their probability of a huge hit. You don’t want to invest in everything, but informed “spray and pray” seems to work, especially given the huge amount of luck involved in the success of Internet startups. Time and time again startups in my portfolio that I thought were dead came back and did extraordinarily well, while former high flyers crashed and burned!

- We don’t do follow-ons. This is less of an absolute rule as we have sometimes followed-on. The reason we avoid them is not because we don’t think they are good investments. Rather, the typical check size required to participate pro-rata in a Series A follow-on investment would require us to concentrate too much of our capital. Sadly, we are not rich enough to contribute so much capital to many different companies, and thus we could not apply our portfolio strategy. Instead, we use the same capital to make 5-10 different seed investments. The reason we have occasionally followed-on is that the combination of insider knowledge about the company and entrepreneur and the reasonability of the deal terms have been too compelling for us to pass up on the opportunity.

- We decide rapidly. We noticed that the quality of our decision making does not increase by taking more time to make the decision. We often decide whether to invest or not in the course of a 1 hour Skype call or in person meeting. This probably stems from the fact that we invest in categories we understand very well. We typically don’t need to research the competition, unit economics or business model because we are familiar with them. That is not to say that the commitment is final. It depends on the entrepreneur getting the rest of the capital for the round and the details of the investment terms being in line with what we consider reasonable. In particular when it comes to convertible notes we are sensitive to what happens if the company is sold before a formal round happens or if a round does not happen before the note comes due. I know we alienated a few entrepreneurs who felt we were committed but who saw us back out once we found out the details of the terms. We will be more explicit about the contingencies of our commitment going forward.

As we found ourselves increasingly priced out of rounds or unwilling to invest in great teams because they were being funded before the product was live, we thought long and hard about whether we should relax our investment principles. In the end, we decided to stay true to them and as such invested in 50% fewer startups in 2012 than in 2011. Given our overall worries about the frothiness of the market, we also divided the amount invested in each startup by 2 leading us to invest 4x less in 2012 than we did in 2011.

Specifically:

- In 2011, I made 33 primary investments and 10 follow-on investments for a total of $2.3 million invested.

- In 2012, I made 16 primary investments and 7 follow-on investments for a total of $690k invested.

We are investing our own money and as such have no mandate to invest a certain amount in any given year. If we did not find amazing companies to invest in, we would not invest. I would not be distressed if we made 0 investments a certain year. So far, despite the frothy conditions, we are still finding extraordinary entrepreneurs and companies to back on reasonable terms.

Our performance to date has been exceptional, but we are considering tweaking the strategy.

In total, I invested $6.6 million in 105 companies. I had 21 exits, one of which was partial. I still have 85 companies in the portfolio. I made money with 14 of the exits and lost money with 7. The biggest returns came from 3 Brazilian exits: Dineromail and Brandsclub sold to Naspers and the partial exit in Viajanet.

I made $9 million out of the 21 exits for $1.8 million invested. The $4.8 million invested in the remaining 85 startups is valued at $10 million based on the last round’s valuation.

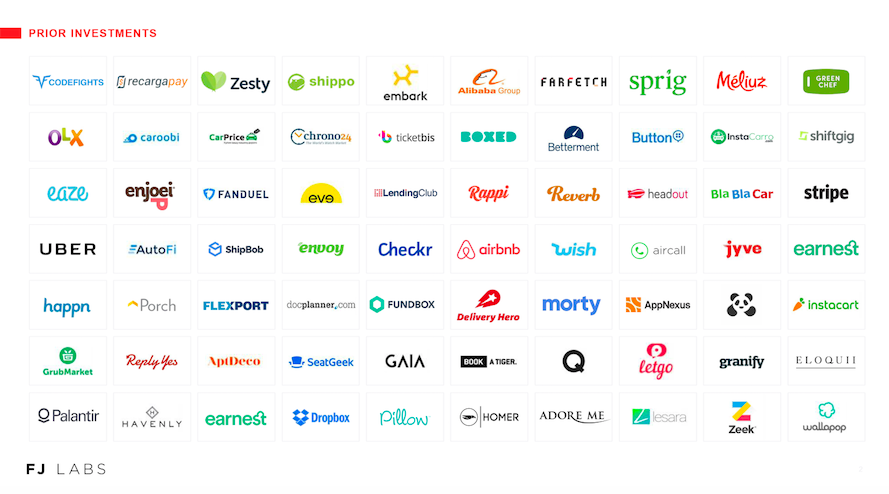

You can see some of Jose and my best exits below:

A few things seem clear:

- Our 66% success rate on exits is unprecedented and explained by having the discipline of sticking to our principles of not taking simultaneous business model and market risk, requiring the site to be live, clear unit economics and low valuations.

- The corollary is that by not being based in the Valley and by being so disciplined, we have not had any huge hits. Had we been given the opportunity to invest in Facebook, Google, Youtube, Linkedin and Pinterest at seed, we would have probably passed. None of the companies in the portfolio are worth more than $1 billion. Only a few have the potential to reach $1 billion and none seem to have the potential to be worth $10 billion.

This is not to say we don’t have great companies in the portfolio. As you can see from a selection of the startups in the portfolio below, there are many great companies:

In light of those observations and the fact that the international idea arbitrage play was becoming crowded, we decided two years ago to invest more in innovative ideas in the US. For those we slightly relaxed our investment and valuation criteria, accepting slightly less traction and pre-money valuations or caps up to $4 million. We also halved our typical investment size to invest in more companies to increase the probability of getting a massive hit. Our expectation is that more of those will fail, but that a few will have outsized returns. It’s too early to tell how those investments will play out given that most of them were made in the last 2 years.

Our US bet is both a bet on Valley startups and on NY startups. Exactly 50% of our investments in the US have been there given my presence there. I was lucky to be on the ground for the Internet explosion there that has been fuelled by three factors:

- The multibillion Doubleclick exit to Google minted a number of New York angels and showed local engineers that entrepreneurship was a valid alternative to finance.

- The financial crisis freed tons of engineers from financial companies and decreased their opportunity cost of working in startups.

- New York became the logical hub for startups in areas of its historical strengths like fashion (Gilt, Fab, Ideeli, Renttherunway, Birchbox, Bonobos, Adoreme and countless others), finance (Betterment), crafts and design (Etsy, Makerbot, etc.) and advertising.

So far none of the NY tech companies since DoubleClick have had a $1+ billion exit and it will be interesting to track the performance of NY startups in the coming years. We will definitely be tracking in our portfolio the relative performance of our NY investments vs. our Valley investments vs. our international investments.

We are also looking to start investing in mobile startups. The global trends clearly point that the future is increasingly mobile and often mobile first and mobile only, especially in emerging markets.

The issue is that to date, outside of gaming, there have been few examples of effective business models on mobile. Moreover, we hate businesses that depend on gate keepers, be they mobile operators, Apple or Google. However, given the inevitable trend towards mobility, we are thinking hard about how to best invest in the category.

As a side bar, while I am an avid gamer, the reason I have not invested in gaming startups, casual, social, mobile or otherwise is that while at first games are inexpensive to build and often profitable, the businesses rapidly become more expensive and hit driven as customers expect better graphics, storytelling and competition drives up customer acquisition costs. They become studio businesses better suited for large companies which can invest in 10 games rather than startups. My analysis has not changed since I wrote it in 2007 (Why I don’t work in the gaming industry) and Zynga’s recent travails are seemingly due to those factors playing themselves out in their business.

We are also thinking of investing in SAAS businesses targeting small and medium sized businesses and investing in the next tier of emerging countries, but we have not yet made any investments.

Here is the list of companies we have invested in since my last angel investing update in July 2011:

- July 2011: Guestmob, a Priceline 2.0 Disruptor.

- July 2011: Hubdub, a casual fantasy sports game.

- August 2011: Invino, private sales for Wine.

- August 2011: Mallstreet, Amazon for Russia.

- September 2011: Dreamzer Games, a European animal-oriented casual gaming company.

- October 2011: Aprovecha, a Groupon for Venezuela.

- October 2011: Tienda Nube, a Shopify for Latin America.

- November 2011: AdoreMe, an online, subscription Lingerie brand.

- November 2011: Docrun, a dynamic, next generation Legal Zoom.

- December 2011: Shoply, a social ecommerce marketplace.

- December 2011: Spotflux, a web browsing tool that enables anonymous browsing of any website from anywhere in the world.

- January 2012: Parking Panda, an AirBNB for parking spaces.

- February 2012: Mile High Organics, a west coast FreshDirect.

- February 2012: Sophie & Juliete, a Stella & Dot for Brazil

- March 2012: Lozo, a Kayak for grocery coupons.

- March 2012: WeHostels, and AirBNB for hostels.

- April 2012: Tigertrade, an Alibaba for Southeast Asia.

- April 2012: Turning Art, a Netflix for art.

- May 2012: Printi, a VistaPrint for Brazil.

- June 2012: Quincy Apparel, an online brand of women’s work clothes.

- June 2012: Anne Lutfen, a Diapers.com of Turkey.

- June 2012: Bespoke Post, subscription men’s products.

- July 2012: AnyContract, contract management SaaS.

- July 2012: CurioRoad, a Fab.com for creative women.

- August 2012: Pitzi, cell Phone repair insurance for Brazil.

- August 2012: Virool, a video promotion platform.

- August 2012: Thuzio, a network of athletes and celebrities.

- September 2012: Planet Prestige, a European ecommerce site focused on cosmetics.