FJ Labs 2022 Year in Review

Tech Entrepreneurship, Economics, Life Philosophy and much more!

Tech Entrepreneurship, Economics, Life Philosophy and much more!

Internet entrepreneurs and investors

By Connie Loizos reproduced from TechCrunch

Fabrice Grinda says he never intended to run a venture firm. He just really (really) enjoyed angel investing. In fact, by late 2013, when he was on the verge of selling the global classifieds marketplace OLX — his third business — he says he had already written checks to more than 150 startups with his longtime friend, serial entrepreneur Jose Marin. “We’d been working together forever. It was really a family office that was angel investing at a massive scale,” Grinda recalls.

Noting that flurry of checks, potential LPs, including strategic investors, family offices, and founders began to express an interest in investing with them. By 2016, a Norwegian telecom company Telenor offered to provide exclusive funding to the duo, giving them $50 million to invest toward that end.

Fast forward, and their outfit, FJ Labs, has evolved from a two-man outfit to a sprawling firm with 34 employees, including eight investors and four “full-blown partners.” It began to grow in earnest in 2018, when LPs committed to invest $175 million with the outfit. Now, Grinda is announcing that FJ Labs has garnered $260 million in capital commitments across a pre-seed fund and an opportunity-style “Series B and beyond” fund, with backing from family offices, institutional investors, and a wide array of founders, including of LinkedIn, PayPal, Supercell, Transferwise, MongoDB and Wayfair.

Indeed, over time, FJ Labs has come to look less like a “lab” and more like a traditional venture firm, though Grinda rejects the comparison.

“We are a venture fund,” he says, but one that does “angel investing at venture scale,” he insists. “We don’t lead. We don’t price. We don’t take board seats. We decide after two one-hour meetings over the course of a week whether we’ll invest or not because we have extraordinary pattern recognition that allows us to decide extremely quickly.”

It sounds high risk, yet FJ Labs has results to show for its approach. Among its many investments, for example, it has bet early on outfits that have ballooned over time, including Alibaba, Coupang, Flexport, and Delivery Hero.

Focusing on marketplaces and network effects businesses — which Grinda knows well — certainly helps. So does the portfolio that FJ Labs has built over time, which includes 900 active investments as part of what Grinda describes as the “world’s largest marketplace portfolio.” (Pitchbook data supports that FJ Labs was the most active venture outfit globally in the third quarter of last year.)

It all builds on itself like its own kind of flywheel, Grinda suggests, pointing to the firm’s deal flow to underscore the point. Through FJ Labs’s 900 companies, it has connections to roughly 2,000 founders, and they “come back for their next companies, and send us their friends and employees,” says Grinda.

Similarly, because FJ Labs is a “source of differentiated deal flow for the VCs, they invite us to their deals,” he says.

FJ Labs will get bigger still if everything goes as planned. Grinda says that the “idea is to create an institution that is going to be a legacy and “be around “for decades.”

It’s hard to imagine that Grinda, who is famously itinerant, could stick with venture capital so long. But he says to believe it. Right now there are three problems FJ Labs would like to help address, while also making money, and none of them are minor. The first is inequality of opportunity, the second is climate change, and the third is the “mental and physical well-being crisis.”

One related bet is on User Interviews, a seven-year-old Brooklyn startup that helps user experience researchers source study participants across different demographics and behavioral criteria. (TechCrunch covered its newest funding here.)

Other startups don’t easily fit into one of those three buckets, including Gravitics, a one-year-old Seattle startup that is developing living and work modules for space travel and that announced a $20 million round last year. (We covered that round, too.)

Apparently, if there is a web3 angle, that also works. Just yesterday, a year-old London-based blockchain infrastructure company said it has $8.5 million in seed funding to build private sharding capabilities for blockchain networks, with participation from FJ Labs.

A lot of the firm’s bets boil down to what FJ Labs’s perspective on what the future of humanity looks like, offers Grinda. “We have a perspective on the future of food, automobiles, real estate, work . . . we’re trying to solve the world’s problems; we’re also thesis driven.”

You can find out more about what FJ Labs is funding and why from a story we published last month about the outfit, before FJ Labs closed its newest funds.

By Ludvig Sunström reproduced from StartGainingMomentum

This is a summary of my conversation with Fabrice Grinda for 25 Minuter Podcast, in which we covered topics such as marketplace companies, angel investing, how to know a lot about many things, decision making, self-improvement and book recommendations.

(Be sure to check out the resources in the bottom.)

Becoming a Polymath:

Having many interests and reading broadly from an early age.

Reading 50-100 books per year.

How does he select new projects to work on?

Mostly by focusing on what is interesting and makes him curious. Years of entrepreneurship and investing have given him Expert Pattern Recognition.

Why are marketplace companies good?

Because they tend towards winner-takes-all, for the category, assuming there is a network effect.

Advice for angel investing:

It is important to specialize and find your niche; but your niche can be broader than commonly assumed. For example, while Fabrice specializes in companies with a marketplace business model, there are many types of marketplace companies (horizontal, verticals, “pick”, B2B) and there are many industries (musical instruments, staples, logistics, food delivery, chemicals, steel, crypto, beauty, etc…) and there are also many different countries. Therefore, he is left with a large range of potential companies to invest in.

What marketplace company would Fabrice start if he were 25-30 years?

Hard to say, because the largest categories have been taken. But as an investor, the most compelling opportunities are currently in the B2B verticals (within a large, fragmented, industry). Good case studies include:

But these marketplace companies are very hard for a young entrepreneur to start, because it takes a lot of industry expertise and reputation to build them; without that, it’s difficult to get the industry players to join the platform.

The founder of Reibus bought a billion dollars of steel before starting the company. The founder of Knowde came from the industry.

A more general piece of advice would be to look at what the big problems are and how they intersect with your skill set.

9 Macro Factors for 2023-2024:

People are pretty bearish right now, but I think the consensus is wrong in not being bearish enough.

Any one of these nine factors would be enough to create a global recession. What worries me is that most of them are playing out simultaneously suggesting that a replay of the Great Recession of 2007-2008 may be in store.

There is also a massive overhang in Crypto with Genesis, DCG, and possibly Binance.

(Ludvig: My personal belief is that point #1: is especially true.)

But this is good for angel investing

The best investments in the past 10+ years were made around 2008-2009. For the coming decade or so, the equivalent will likely be investments made during Covid 2020 and in 2023-24.

Fabrice’s current portfolio allocation:

20% cash, 70% early-stage tech startups, 10% real estate.

More on Macro: Can the deflationary force of digitization outweigh the inflationary force of higher energy prices?

Not in the short-term. The geopolitical risk is bad. But over the long-run, yes.

Which companies may have increased adoption since Covid?

Food delivery and eCommerce had the biggest boost.

There was a supply crunch, followed by excess demand. Now there is too much competition for a lot of the things that boomed during Covid.

Overall: Very bullish on food delivery (as a category) over the coming 10 years.

Thoughts on Ai right now?

It appears to be early-to-mid in the Hype Cycle:

I don’t invest in Ai, but the companies I invest in apply it…. I think it [Ai] will become commoditized.

Most likely, the value-added/producer surplus will go to Internet companies. But not necessarily to investors in Ai companies.

Big areas where digitization have yet to have a big impact, but will in another 10 or so years

Public services.

Healthcare.

The education system.

Why are they slow to change?

Due to regulation.

His decision making framework:

Be extremely deliberate about the most important decisions. These type of decisions may only happen once every couple of years. Before making them, consider doing the following:

(1) Write yourself an honest letter/email: What am I happy with? What am I unhappy with? What are all the options, and how can my life be different? (Job, relationship, country). List all available options without limiting yourself.

(2) Share the letter with close friends/advisors: Ask: (a) If it were them, what would they do? (b) Knowing you, if they were you, what would they do?

(3) Try: After getting feedback and ideas, give it a try.

(4) Assess & iterate: What worked? What did not work? Do more of what worked and less of what didn’t.

How to lead an Epic Life:

If you are a knowledge worker, sitting in front of the computer every day, try doing outdoor activities. And if possible, have vacations where you completely disconnect for a week or two, no cell phone, just alone with your thoughts, getting in tune with your intuition.

Vision: 100 years in the future:

Books recommended in the episode:

Fabrice’s website:

FJ Labs portfolio:

https://fabricegrinda.com/portfolio/

Some great articles of his:

Here are some articles if you want to understand his investing methodology for marketplace companies:

We do talk quite a bit about marketplace companies (running them and investing in them) but not as much as I had hoped for. Therefore I will share a brief summary below.

The (r)evolutions of marketplace companies:

The Big Bang Beginning: It started with Horizontal marketplaces (having multiple categories by virtue of being first: eBay, Amazon, Craigslist).

(1) Verticalization of marketplaces: After the first ones got all the volume, new companies had to specialize in one niche category. A profitable one. After conquering that category, they can expand TAM by creating additional services for the existing customer base.

(2) Managed marketplaces: “Marketplace pick model” – meaning the marketplace picks the supplier for you. For example, Uber picks a driver nearby you, for you. Provides value for both consumer and service-providers. Consumers don’t have to select the provider, and the service-provider can get more customers (effortless lead-generation, even if the take-rate is high, so most will agree). But this requires a superior matching algorithm. (This is what Fabrice referenced when he said “our companies apply Ai”.)

(3) B2B Marketplaces: Either in a large industry that has been slow to adopt online technology, or in supply chains within a large industry. Online B2B should have happened 10 years ago, it’s just that B2B tends to be family-owned by Boomers, without technological know-how, or there is a strong history and direct relationship between Producer › Reseller › Customer. They could do it more efficiently (cheaper) by skipping the middleman (Reseller) but due to having a many-year long relationship with the Reseller, they won’t do it easily. Overcoming this obstacle requires a better customer experience, and a founder with a strong track-record from the existing industry.

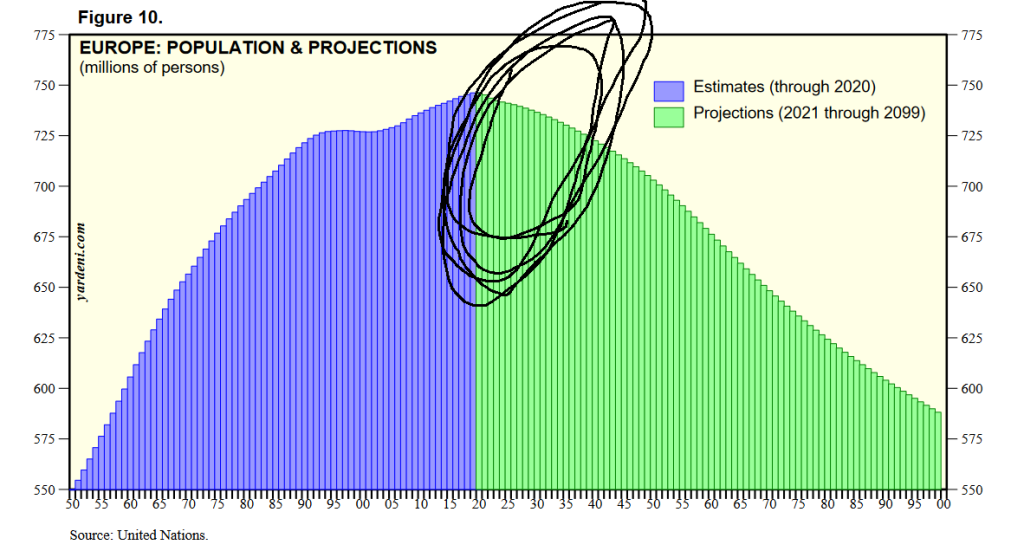

Europe’s population:

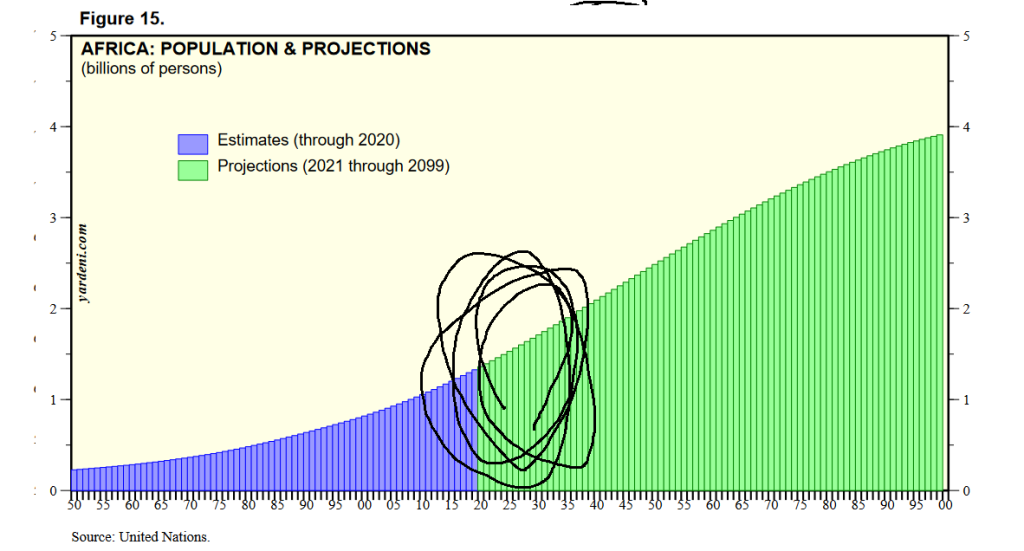

Africa’s population:

Europe’s population is going down.

Africa’s population is going up.

African countries have nowhere near European countries’ spending power, but on the positive side they have fewer established systems (so there is less resistance to behavioral change).

This should increase the total addressable market for all things online and marketplaces, including:

It’s 5-8 years early.

But it will become a tailwind for digitization.

In addition to the embedded podcast player, you can also listen to the podcast on: