Tech Entrepreneurship, Economics, Life Philosophy and much more!

Tech Entrepreneurship, Economics, Life Philosophy and much more!

Internet entrepreneurs and investors

In 2019 I moved to Turks & Caicos and decided to sell my apartment in New York. I love my hybrid life where I split my time between New York and the Caribbean. It allows me to spend a month in New York where I am intellectually, socially, professionally and artistically stimulated beyond my wildest dreams. I meet countless extraordinary people, host intellectual dialoging salons and enjoy all of New York’s entertainment options. But after a month, I admit I am exhausted, and the constant doing takes time away from thinking. That’s why I then love spending a month in the Caribbean where I can work during the day, kite, and play tennis and really take the time to read, be reflective and recharge my batteries.

I decided to leave the Dominican Republic in 2018, and had to ponder where I should go. My real estate travails from 2012 to 2018 meant that for 7 years I did not have a real home or the playground with all the activities I adore. It’s not as though those are life essentials and I was deprived. Quite the contrary, I had amazing life experiences in asset light living (see The Very Big Downgrade & Update on the Very Big Downgrade). I traveled extensively and went on many adventures, but I must admit I do miss the convenience of being able to play tennis and padel every day or just to have my friends come over for a LAN party.

In hindsight, I should have just bought an already built house that I could just move in, in a stable country where I could buy inexpensive nearby land to build my playground and call it a day. It would not fulfill my grandiose vision of building a “Necker Island 2.0” to invite a community of entrepreneurs, artists, spiritual leaders and intellectuals to hang out, nor would it have my specific aesthetic preferences, but it would have the convenience of being immediately useful and to play the role of gathering point for friends, family and colleagues.

This led me to buy Triton in Turks & Caicos. Turks is very built out and does not have the raw authenticity of Cabarete. There are fewer days of wind for kiting, and it’s insanely expensive. However, it has the most beautiful water in the world. The weather is fantastic all year long. The flights are only three hours from New York. It’s English speaking and uses the dollar as its currency. The safety, flat water and gorgeous beaches, not to mention the absence of Zika, Chikungunya and dengue make it appealing for all my friends and their families, and not just my adventurous friends who liked the rougher conditions of my Cabarete dwelling with its massive spiders, rats and cockroaches.

Having gleaned some lessons from my prior experiences, I decided to buy a house on Providenciales on Long Bay Beach where I can kite directly from the house and play tennis at the house. I opted not to buy on the other islands despite significantly lower prices and the availability of more land, because the lack of infrastructure makes things way more complicated and expensive. It’s also inconvenient to go for a few days if upon landing you need to be driven to a boat to get to your destination. I will now buy a little bit of inexpensive non-beachfront property to build the missing elements of my playground starting with the all-important padel court.

At the same time the never-ending travails with my New York apartment made me decide that the time had come to move on. In 5 years, I have not been able to enjoy the apartment properly and the water damage has been such that I have been living in hotels and Airbnbs for the last 18 months. As the building is badly built, the management intractable and the building broke, I suspect that even if I ended up rebuilding it as my dream apartment, problems would keep popping up. In hindsight, I undervalued the benefit of being in a well-managed building with the financial means to address issues, nor did I realize the downside of having by far the best apartment in an otherwise relatively small and poor building. Having moved dozens of times in the last 18 months, I intend to rent an apartment March 2020 onwards.

These travails have also cured me of home ownership. I would much rather rent and have the owner deal with whatever issues arise rather than having to deal with them myself. It means I won’t have the apartment of my dreams, but as life keeps highlighting: the best is the enemy of the good. I look forward to having a place in New York I can call home for the next few years bringing a modicum of stability to my life.

I keep being surprised by the amount of work and costs involved with real estate ownership and how illiquid an asset class it really is. The maintenance required highlights that it is a depreciating asset that requires constant work. When you take into consideration property taxes, insurance, maintenance and the constant renovations, the net yield is negligible. Despite historically low interest rates it makes much more sense to rent. This is especially true in New York right now as the glut of high-end apartments makes it a renter’s market. I can’t wait to be rid of all the real estate I own, though the pace of divestiture has been glacial.

In an ideal world I would not have bought the house in Turks, but it was unfortunately not available for long term rental. The limited housing stock on the island, almost none of which is available for long term renting, forced my hand. I do not consider it to be an investment. It’s consumption, pure and simple: a place to call home.

Having found my new home in Turks, allowed me to have an amazing year on both the personal and professional fronts. I brought my friends and family to visit countless times. I started learning to kite foil and had countless adventures.

Highlights were:

I also spent time visiting my family in Nice. It felt amazing to be back in my hometown enjoying the amazing food, playing tons of padel and spending time with my nephew.

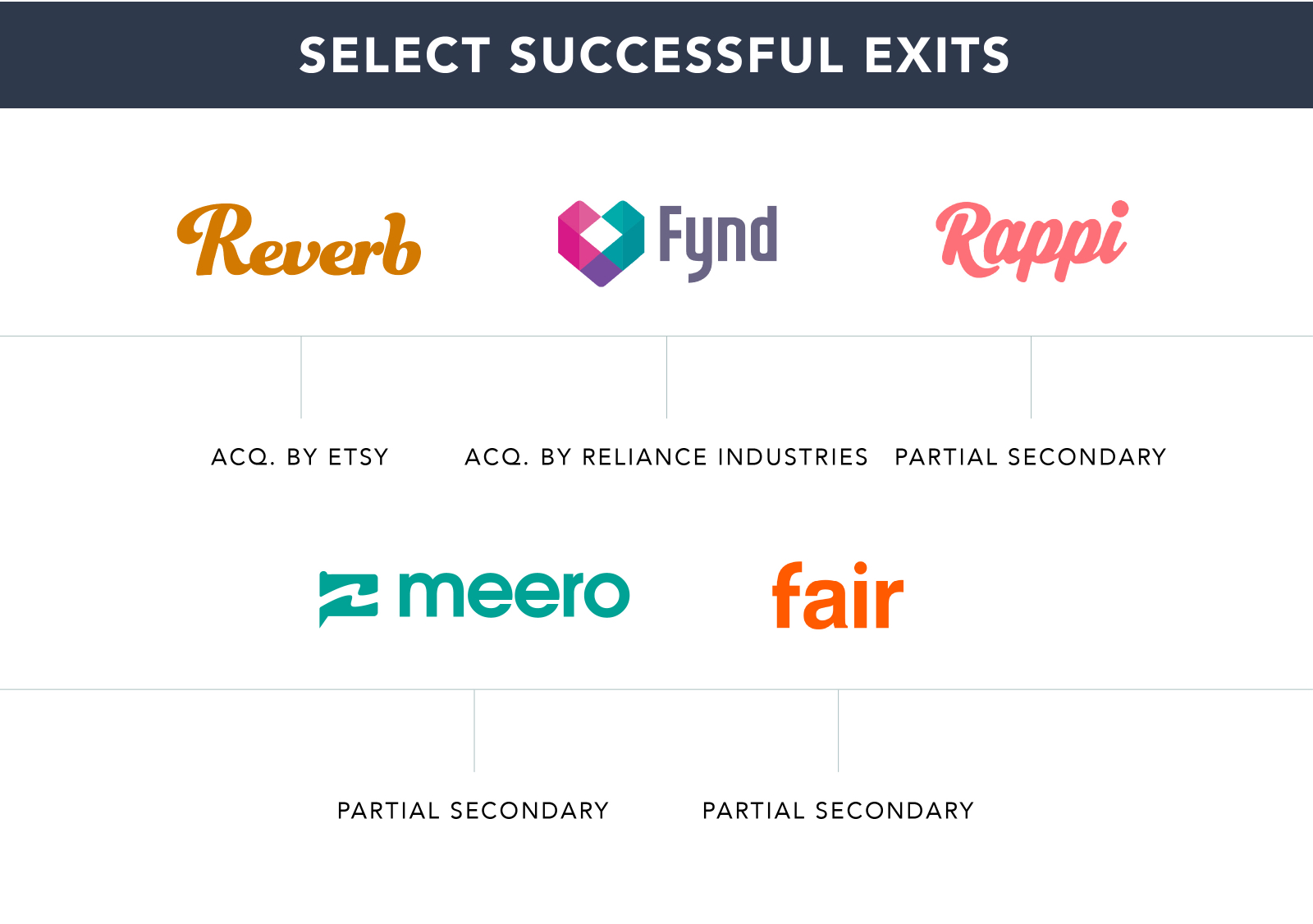

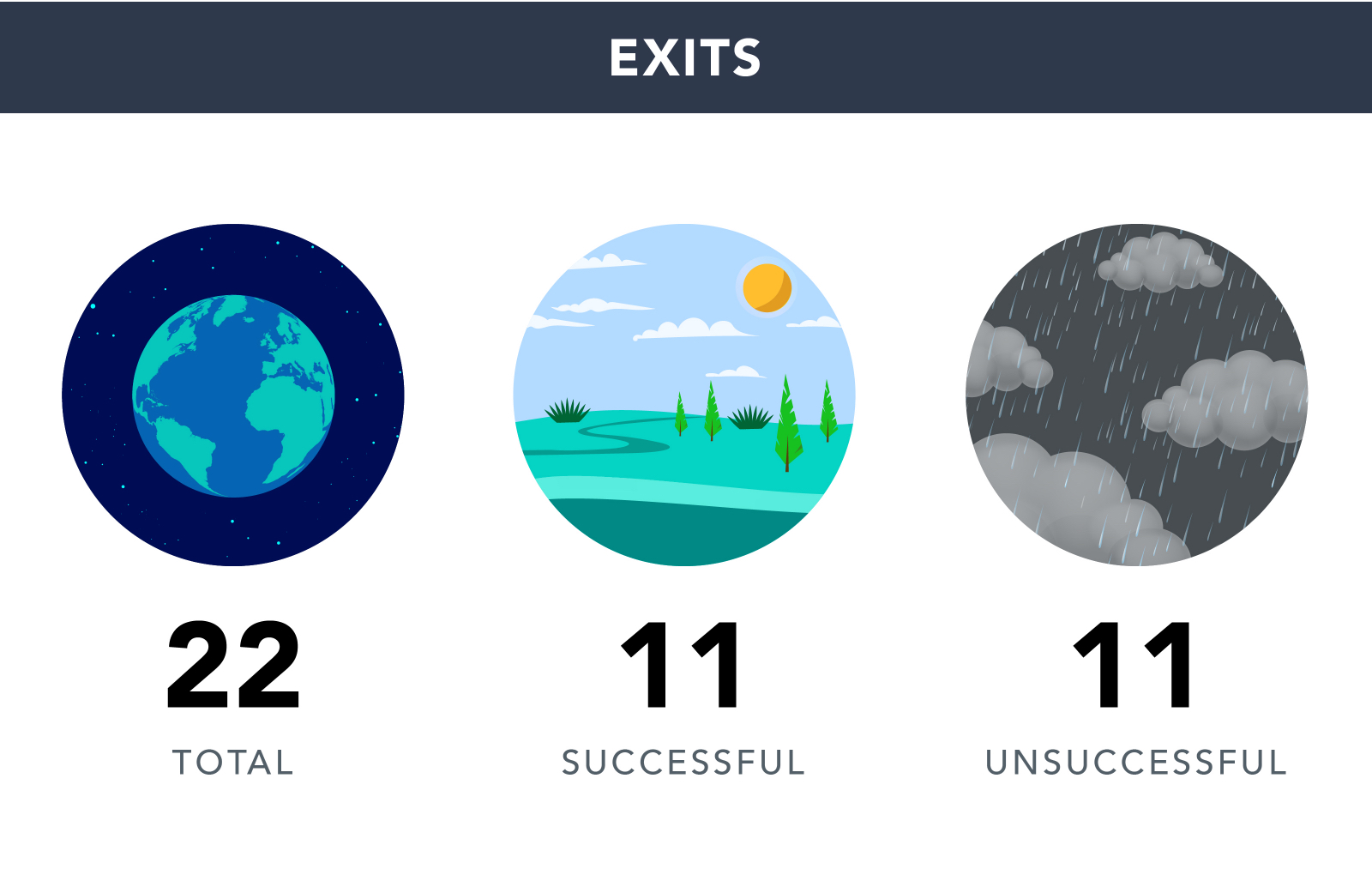

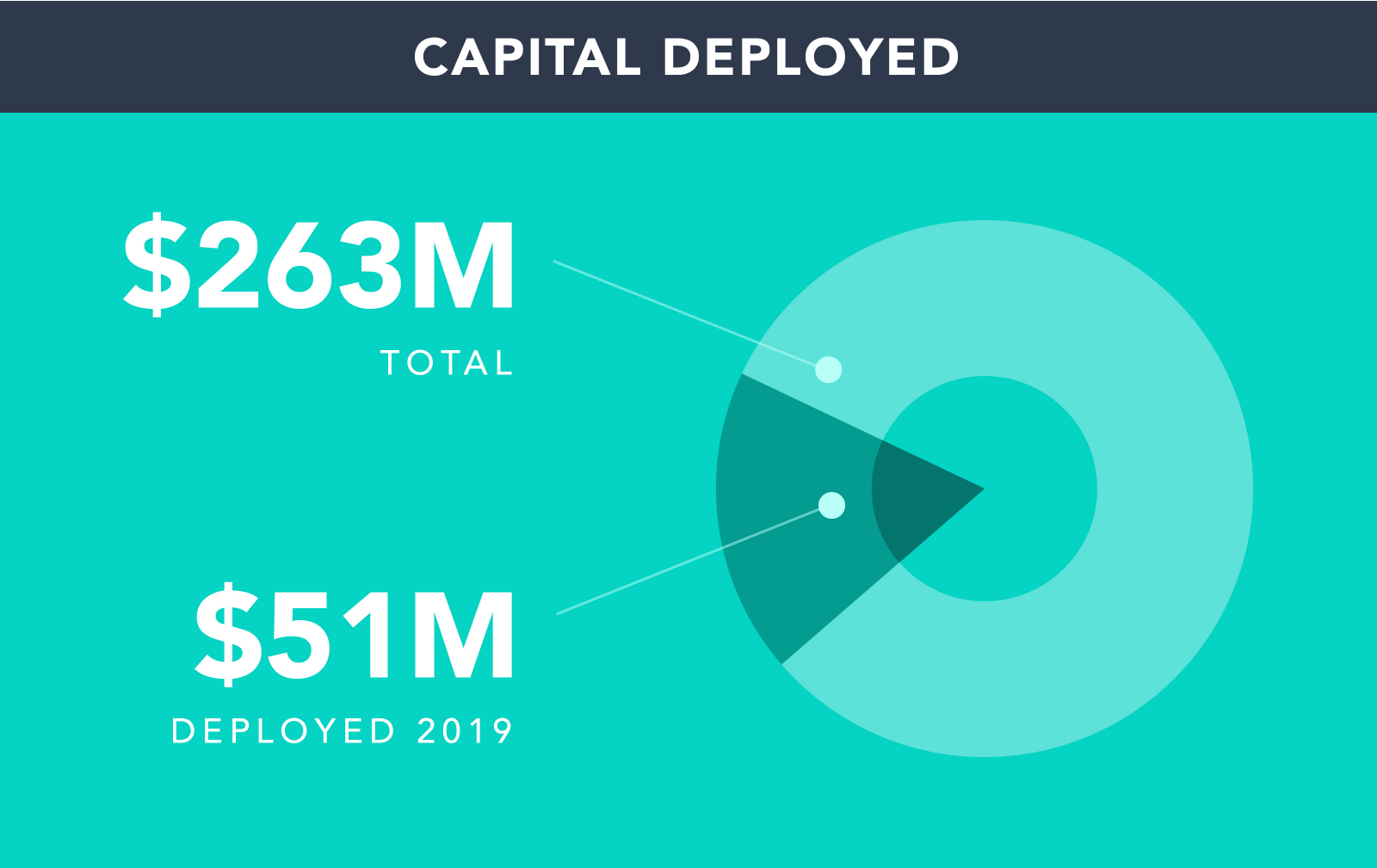

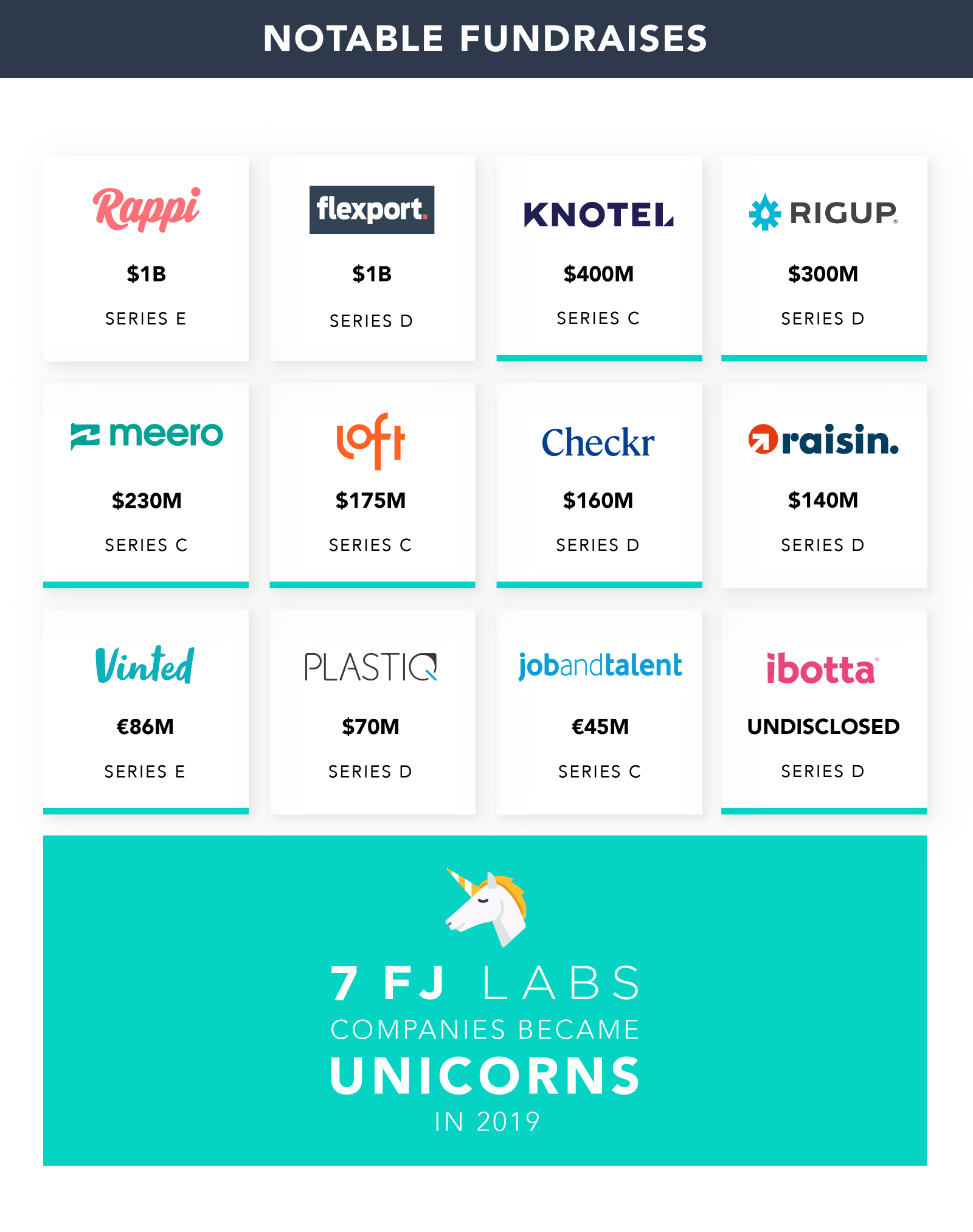

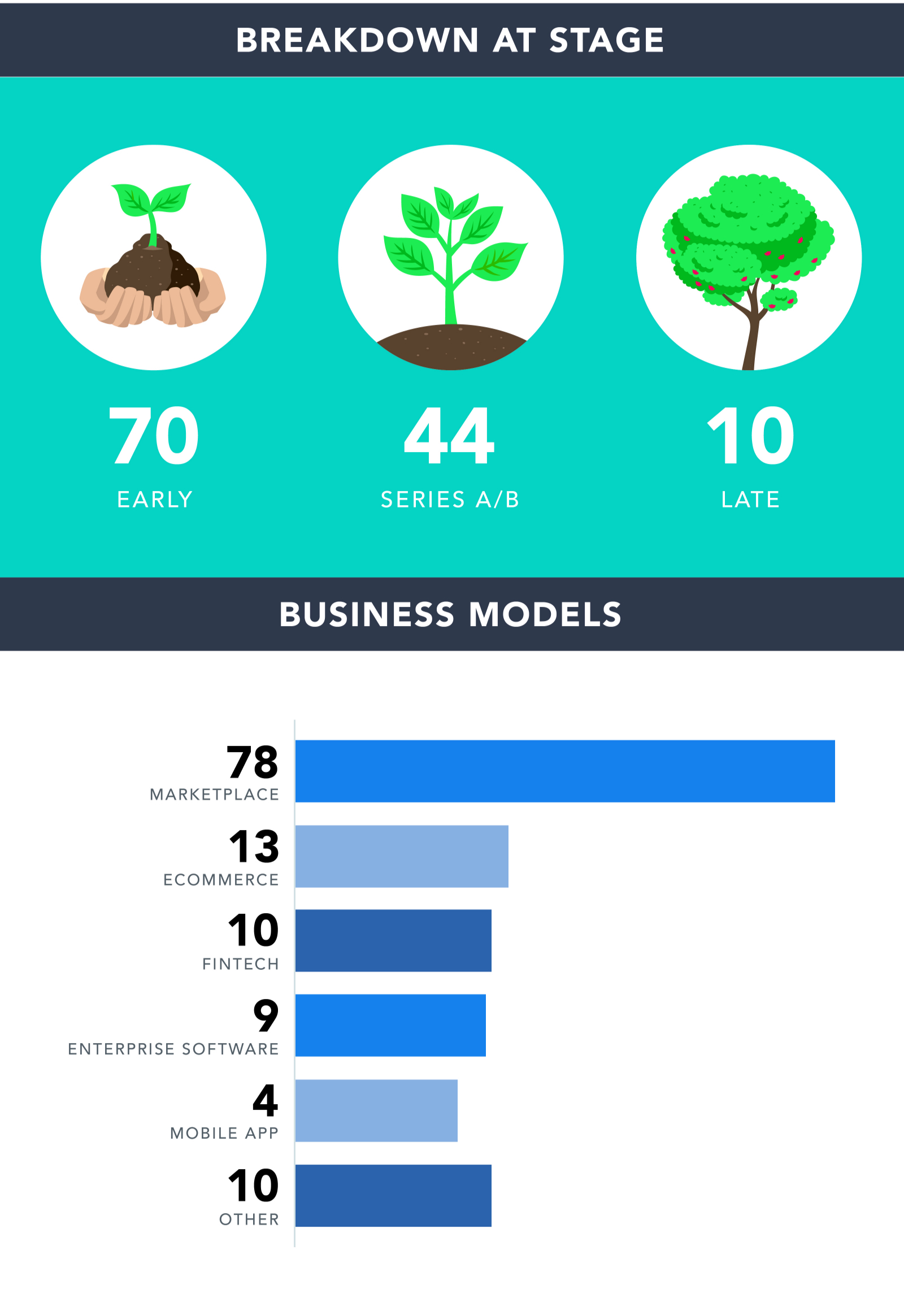

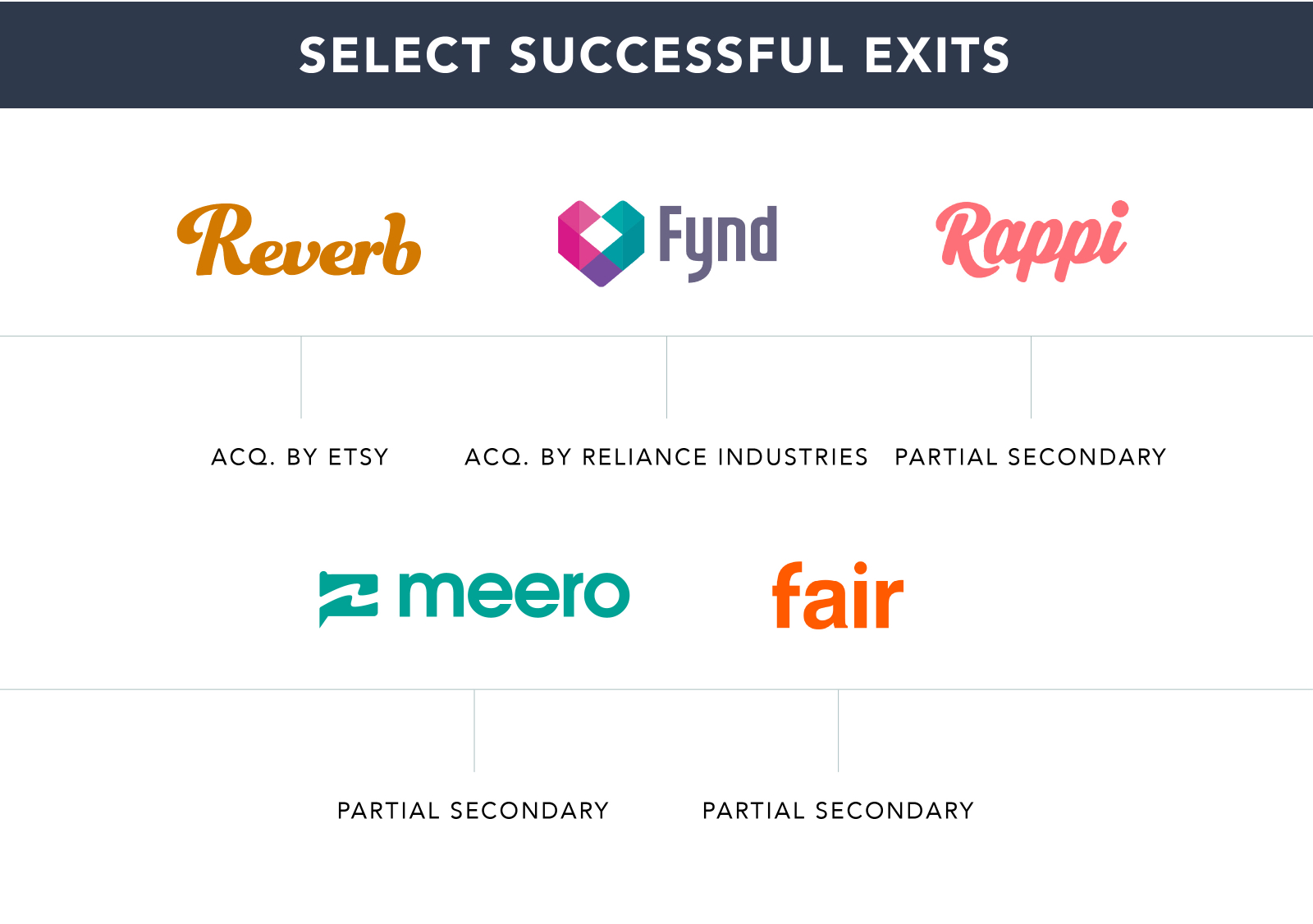

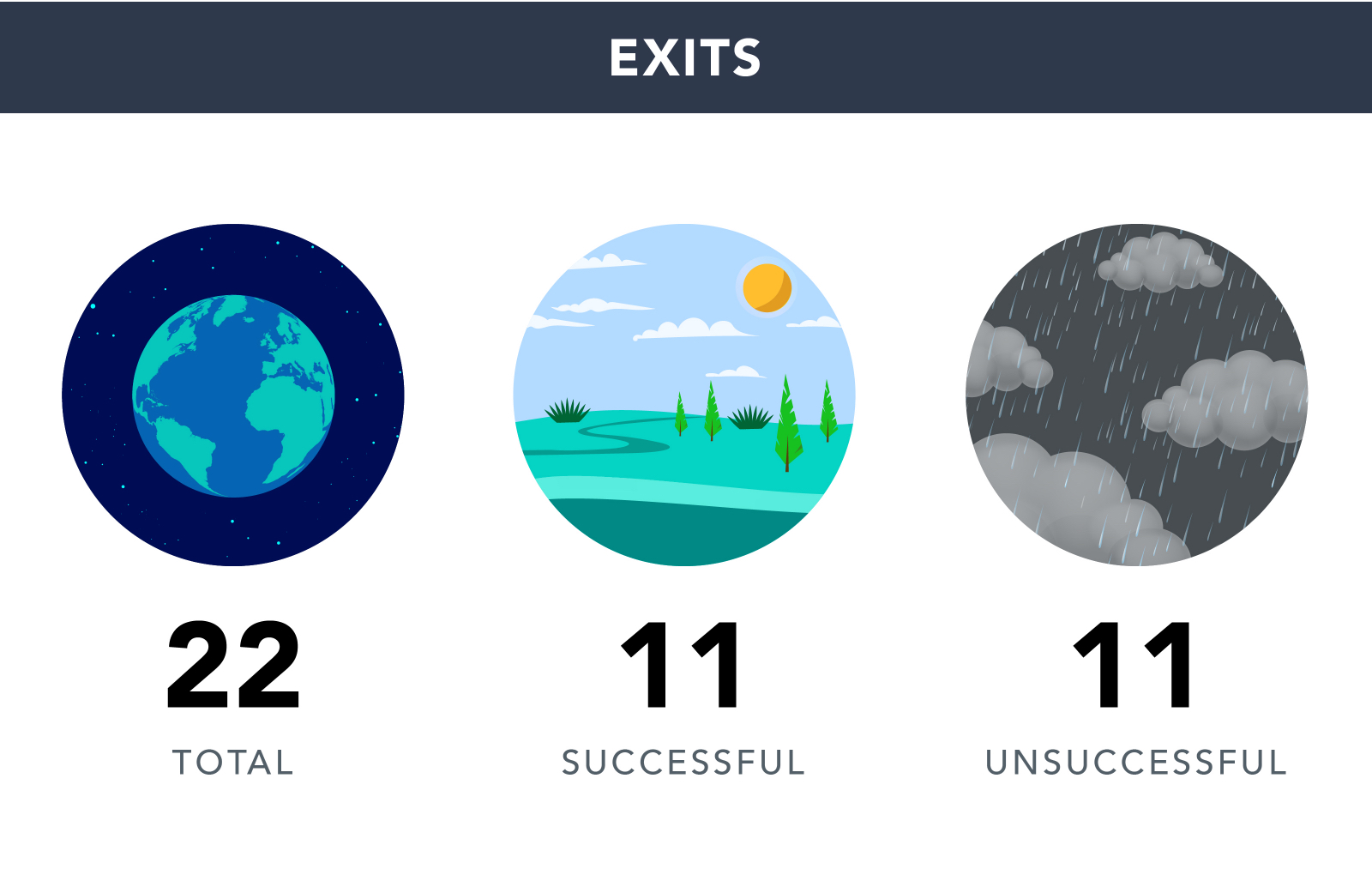

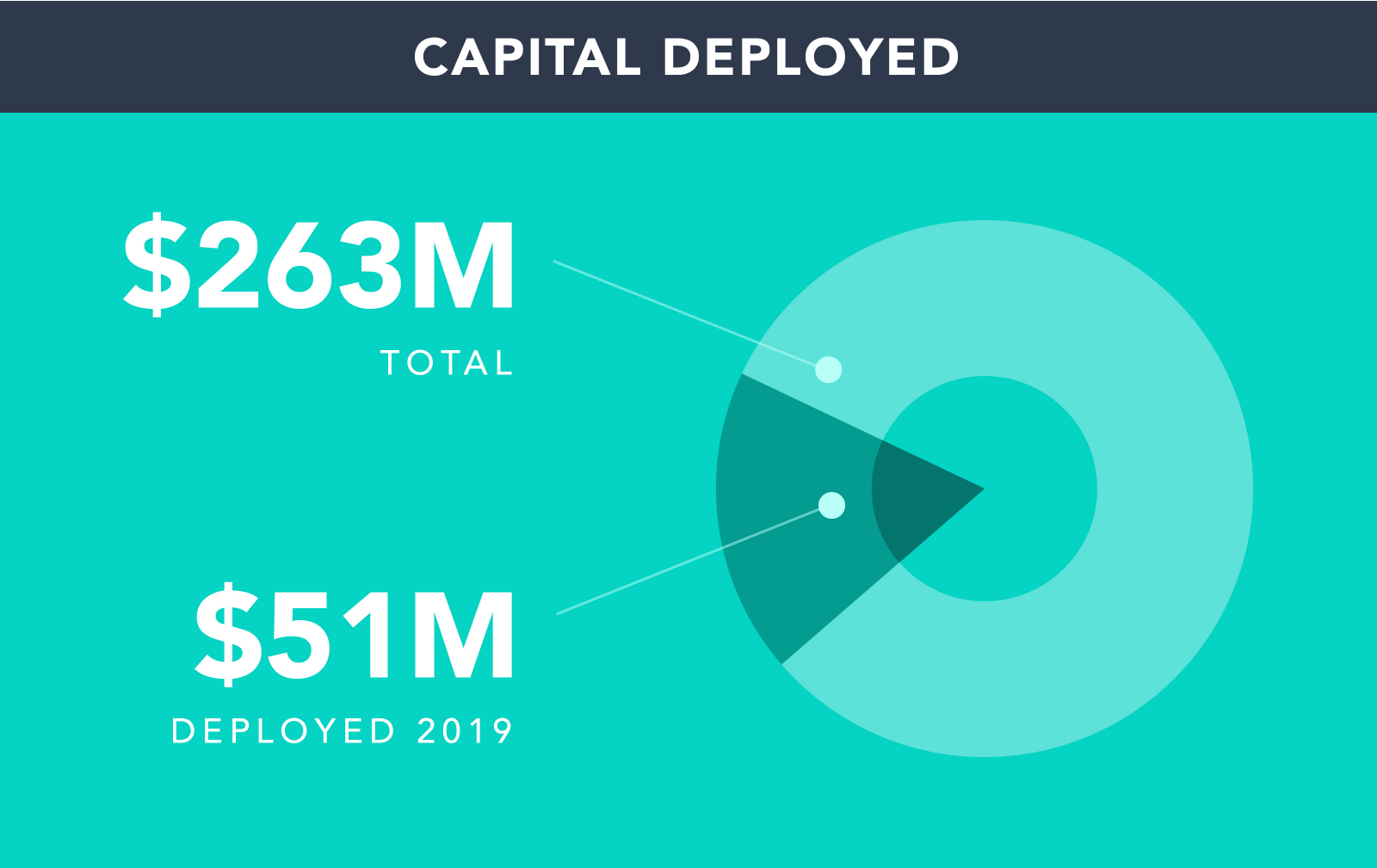

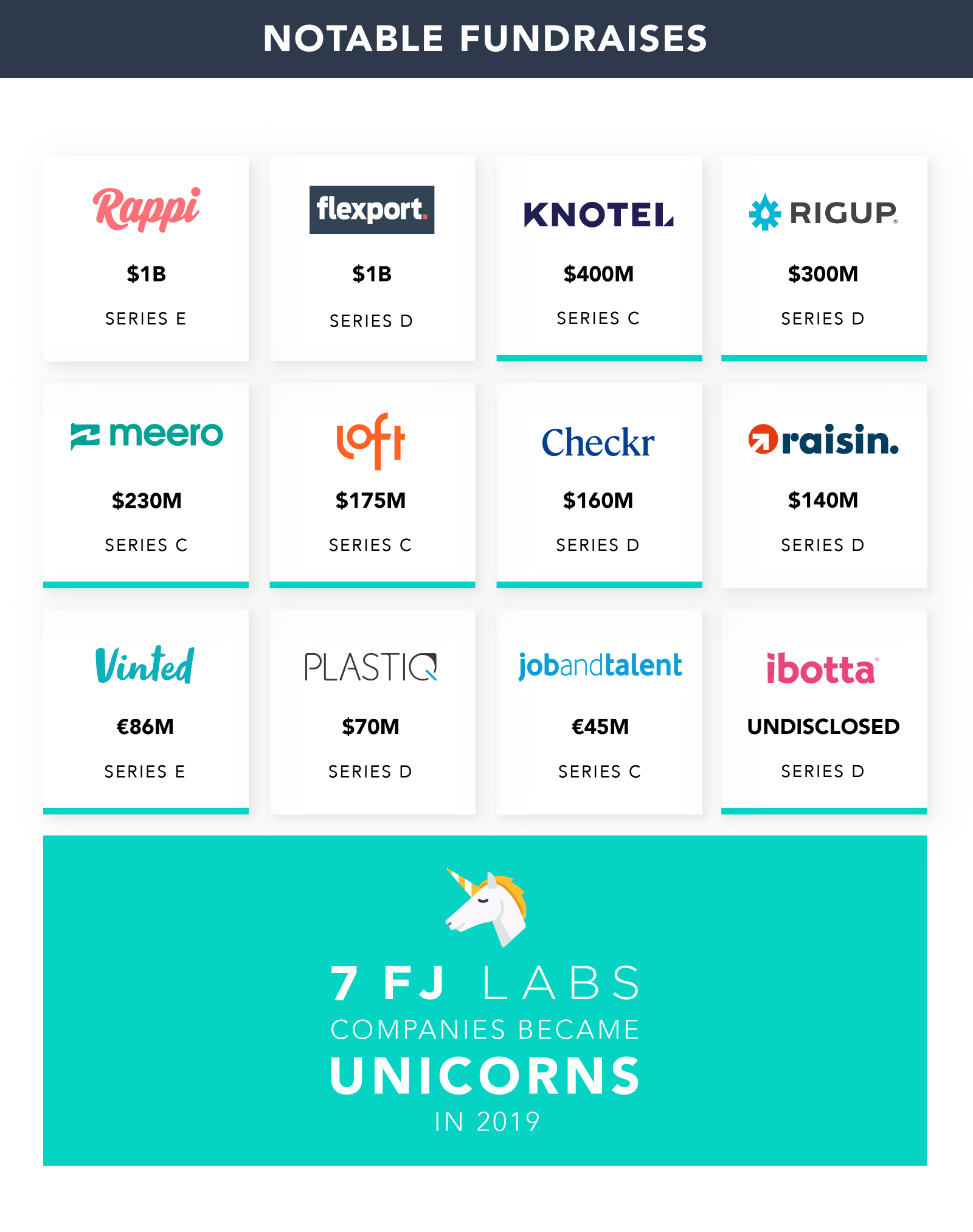

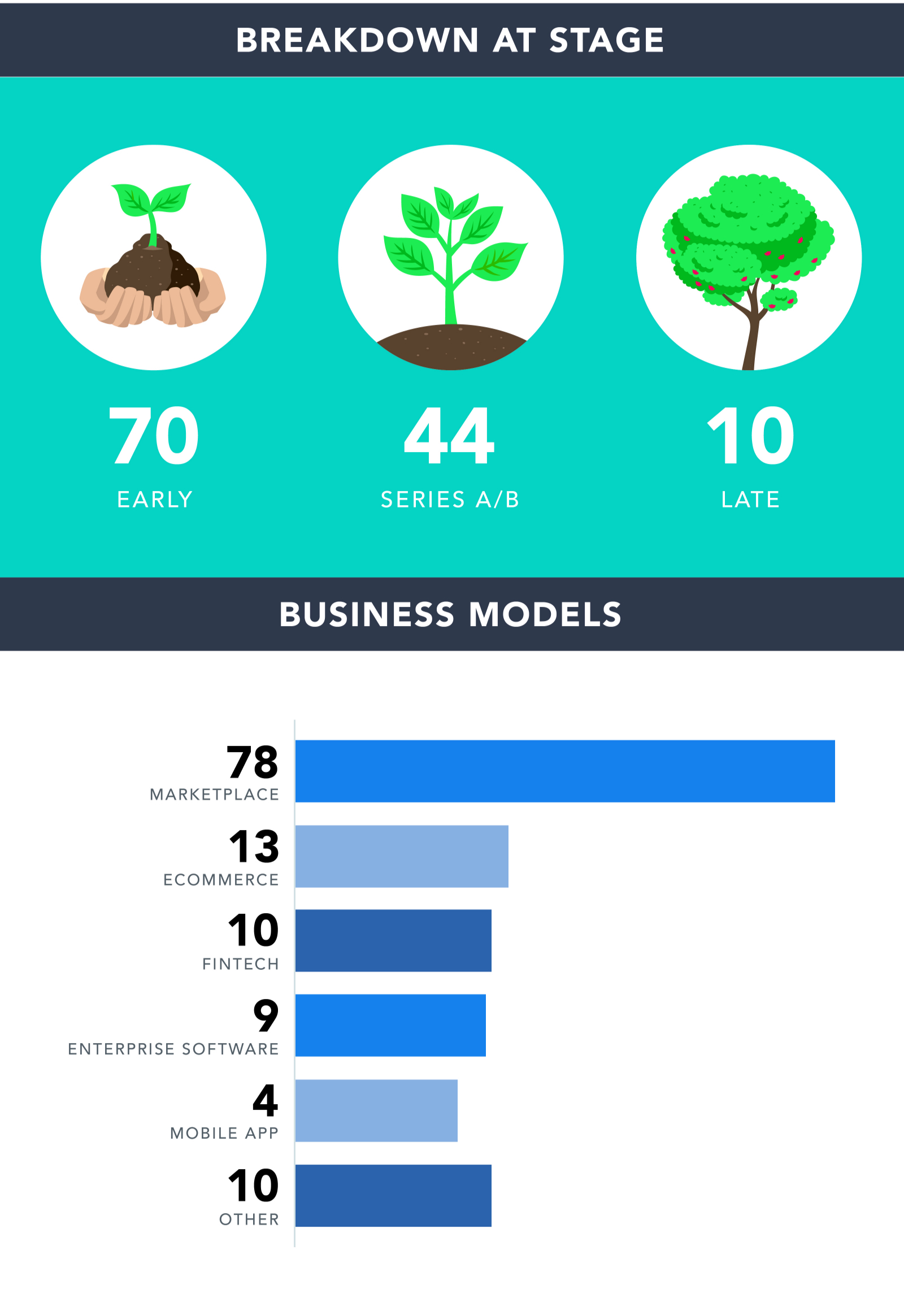

FJ Labs continued to rock. In 2019, the team grew to 26 people. We deployed $51M. We made 124 investments, 83 first time investments and 41 follow-on investments. We had 22 exits, of which 11 were successful including the acquisition of Reverb by Etsy and the acquisition of Fynd by Reliance Industries.

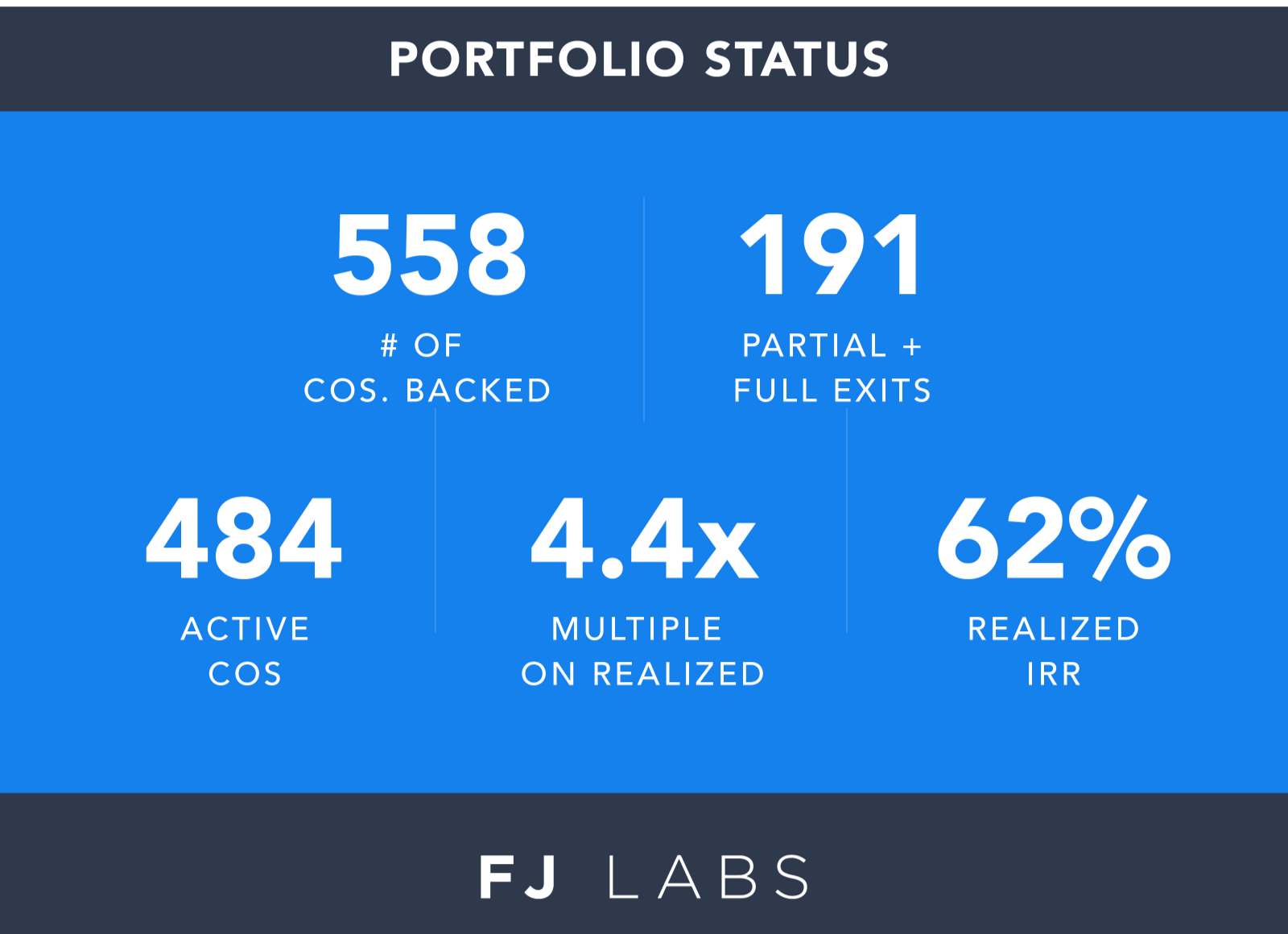

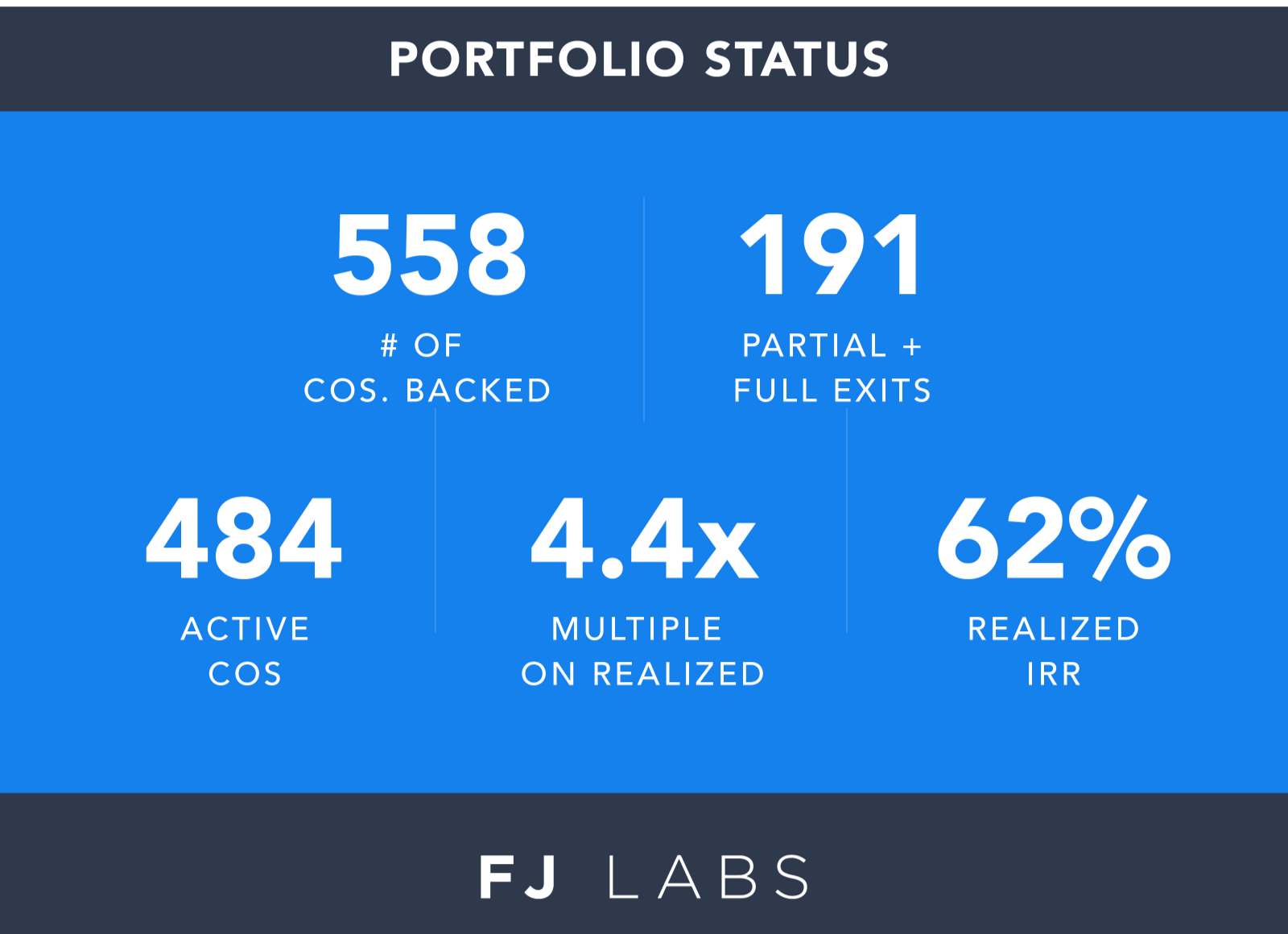

Since our inception, we invested in 558 unique companies, had 191 exits (including partial exits where we more than recouped our cost basis), and currently have 484 active investments. We’ve had realized returns of 62% IRR and a 4.4x average multiple.

I spent some time thinking about the latest trends in marketplaces.

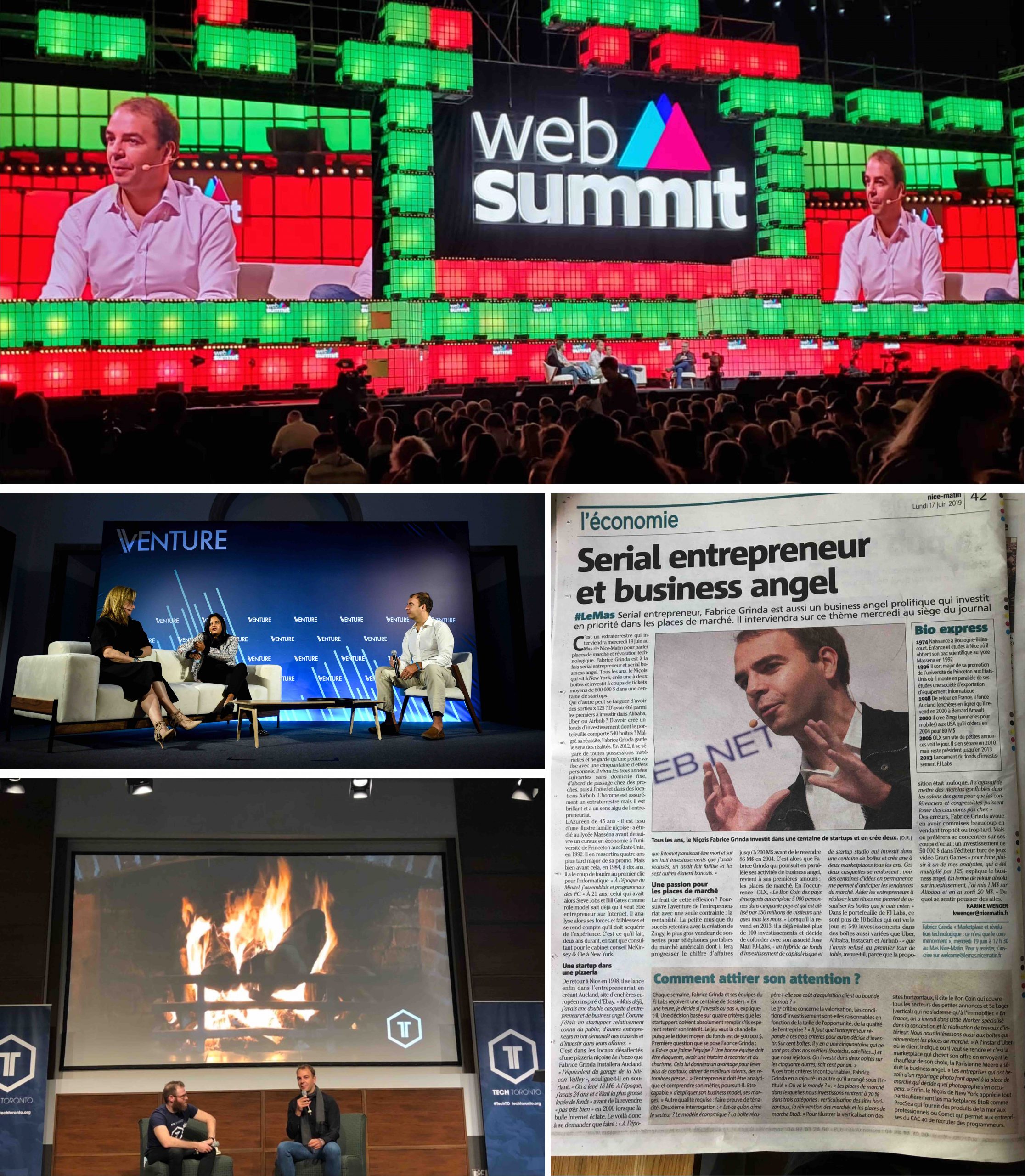

I also shared a lot of my entrepreneurial lessons learned in a series of keynotes, fireside chats, podcasts and video interviews:

It was fun to get a full page in the local newspaper just as I came to visit my family in Nice and to be covered in Les Echos around the French Tech conference.

In terms of writing, I finished my framework for making important decisions in life:

I also reviewed Why We Sleep given that I made significant life changes post reading the book and wrote a packing list for Burning Man to help virgins and grizzled veterans alike.

My economic predictions for 2019 were correct: the US economy did well. We are now in the longest expansion on record, and tech remained the sector to be in. While we are late in the economic cycle, the US may very well continue to do well until the end of 2020. We are at full employment and presidential election years typically have loose fiscal and monetary policies.

The main recession risk seems geopolitical given the current slew of world “leaders.” I suspect that the largest risk to the world economy is a budget crisis in Italy. It would put the Euro project at risk and lead to a massive flight to safety, creating the next global recession.

The current political climate keeps reinforcing my decision to avoid following and reading news be it in newspapers, online or on TV. It’s sensationalist negative entertainment that misses the real technology-led improvements that happen slowly, but inexorably transform our lives for the better.

Despite the implosion of WeWork and the travails at Softbank, I remain very bullish on early stage venture capital. We are still at the very beginning of the technology revolution. Only 15% of commerce is online. Online penetration remains negligible in the sectors that account for most of GDP: education, health care, and public services. The way we build homes is still artisanal. Synthetic biology is in its infancy. The emerging trend of no-code, which allows non-programmers to build complex fully functional websites, is unleashing a massive wave of innovation. It democratizes startup creation and innovation allowing people from all walks of life and every educational background to partake in the Internet revolution.

We are meeting more extraordinary entrepreneurs than ever before. There are still billions of capital on the sidelines in later stage funds like Sequoia and Insight that need to be put to work in the next few years. I suspect that even if some of these funds disappoint, most will still be able to raise their next fund. The current low rate environment, with no end in sight, will continue to lead to yield chasing. All that to say Seed and Series A funded startups will have access to plenty of capital. The technology sector remains the engine of productivity and economic growth and will continue to do well in 2020.

Happy new year!

Meine Freunde haben scheinbar alle beschlossen, über die Feiertage nach New York zu kommen. Da sie bereits die prototypischen New Yorker Attraktionen gesehen haben (Met, Museum of Natural History, MOMA, Liberty Tower, The Lion King), fragten sie nach weiteren einzigartigen Empfehlungen.

Diese schrille Varieté-Show bietet von allem ein bisschen: Akrobatik, Burlesque und allgemeinen Wahnsinn. Es ist erstaunlich und die Amateurhaftigkeit einiger der Darsteller macht den Charme noch größer. Außerdem lernen Sie die junge, lustige und heiße Burning Man-Crowd von Bushwick kennen.

Sie findet in der Regel alle paar Mittwoche ab 20 Uhr statt. Der nächste Termin ist am 29. Januar

Das Verschlingen

Wenn Bushwick und die Nacktheit von House of Yes zu aggressiv für Sie sind, dann ist The Devouring genau das Richtige für Sie. Es ist das Ergebnis einer Zusammenarbeit zwischen Ian Schrager vom Studio 54, House of Yes und dem mit einem Michelin-Stern ausgezeichneten Küchenchef John Fraser. Es ist das, was Dirty Circus wäre, wenn er Geld und professionelle Darsteller im Rahmen eines exquisiten Essens hätte. Es ist eine Ode an die menschliche Erfahrung und eine schillernde Neo-Burlesque-Extravaganz. Es ist ein modernes Kabarett, ein Fest und eine Feier des Lebens.

Derren Brown: Geheimnis

Die Vorstellung endet am4. Januar, also beeilen Sie sich, um sie zu sehen! Derren Brown ist der beste Mentalist der Welt. Seine Show ist eine Mischung aus Gedankenlesen, Überredung und psychologischer Illusion, die sich auf die Geschichten und Überzeugungen konzentriert, die unser Leben bestimmen.

Wenn Sie nicht dabei sein können, sollten Sie sich seine Shows auf Youtube und Netflix ansehen.

Der Magier im Nomad

Das ist die beste Zaubershow, die ich je gesehen habe. Es gibt von allem etwas: Levitation, Kartentricks, Mentalismus in einem kleinen, dunklen und intimen Rahmen. Wenn Sie ein Fan der Magie sind, sollten Sie sich diese Show ansehen!

Jeden Abend nehmen die Künstler Vorschläge aus dem Publikum auf und verwandeln sie in blitzschnelle Riffs und abendfüllende Musiknummern. Jede Show ist eine Freestyle-, Hip-Hop- und Improvisationskomödie mit häufigen, unerwarteten Gastauftritten von Lin-Manuel Miranda (bekannt durch Hamilton), einem der Mitgestalter der Show.

Ich bin ein großer Fan des Woom Centers und insbesondere von David & Elians Klangerlebnis. Diese Meditation beinhaltet Gruppenvokalisationen, holotropes Atmen (das auf natürliche Weise die Wirkung von LSD auf Ihr Gehirn nachahmt) und wunderschöne Obertonklänge, die Sie auf eine Reise in erhöhte Bewusstseinszustände mitnehmen.

Ich empfehle es jedem und besonders Meditationsneulinge werden sich wie verwandelt fühlen. Sie findet jeden Freitag um 19:30 Uhr statt. Lassen Sie sich von der dreistündigen Dauer nicht abschrecken, denn es fühlt sich an, als ob es jedes Mal in 20 Minuten vorbei ist!

VR Welt

VR hat noch nicht das Stadium erreicht, in dem ich den Besitz eines Geräts empfehlen würde. Die Grafik verblasst im Vergleich zu der auf PS4, Xbox und PC und die Latenz führt immer noch zu Motion Sickness. Es macht jedoch jede Menge Spaß, ein paar Stunden mit Dutzenden von erstklassigen VR-Geräten zu verbringen, die genau die richtige Einstellung für jedes Spiel oder Erlebnis haben. Gehen Sie auf jeden Fall mit ein paar Freunden hin, denn es macht einen Riesenspaß, zusammen oder gegeneinander zu spielen.

Nullraum

Zero Space ist ein immersiver, interaktiver, digitaler Kunstspielplatz. Es fühlt sich psychedelisch an und ist wirklich atemberaubend. Die Serie ist zwar etwas simpel, aber als Vorbote dessen, was noch kommen wird, auf jeden Fall sehenswert, auch wenn wir noch Jahrzehnte von einem richtigen Holodeck auf Star Trek-Niveau entfernt sind.

Sleep No More war ein Pionier des immersiven Theaters, aber wenn es einen Kritikpunkt gibt, dann den, dass Ihr Erlebnis sehr unterschiedlich sein kann, je nachdem, was Sie tun und wem Sie im Theater folgen. Then She Fell geht auf dieses Problem ein, indem es ein immersives Theatererlebnis mit nur 15 Zuschauern pro Vorstellung schafft. So sind Sie immer Teil des Geschehens.

Die Show findet in einem dreistöckigen Gebäude in Williamsburg statt, das akribisch zu einer Nervenheilanstalt umgestaltet wurde und in dem Lewis Carrolls Arbeit und Leben und insbesondere seine Beziehung zu Alice Liddell, dem jungen Mädchen, das seine Muse für Alice im Wunderland und Through the Looking Glass war, gezeigt wird. Es ist intim, fesselnd und bei weitem das unterhaltsamste, fesselndste und interessanteste immersive Theatererlebnis, das ich besucht habe.

Der Comedy Cellar ist eine Institution und der beste Comedy Club der Welt. Es gibt immer ein fantastisches Programm mit einer Mischung aus sehr bekannten und aufstrebenden Comics. Einige der Superstars der Branche kommen manchmal unangemeldet vorbei. Ich war schon mit Robin Williams, Chris Rock und unzähligen anderen dort!

Wenn Sie jemals dachten, dass Museen langweilig sind, dann ist dies die richtige Art, sie zu erleben. Sie sind rasant und witzig und trotzdem außerordentlich informativ. Das ist definitiv die beste Art, das Met und das Museum für Naturgeschichte zu erleben.

Montagabend-Zauber

Monday Night Magic ist eine lustige, preiswerte und kinderfreundliche Zaubershow. Es bietet verschiedene Darbietungen der besten Magier, die in dieser Woche in New York sind und immer wieder neue Erlebnisse schaffen.

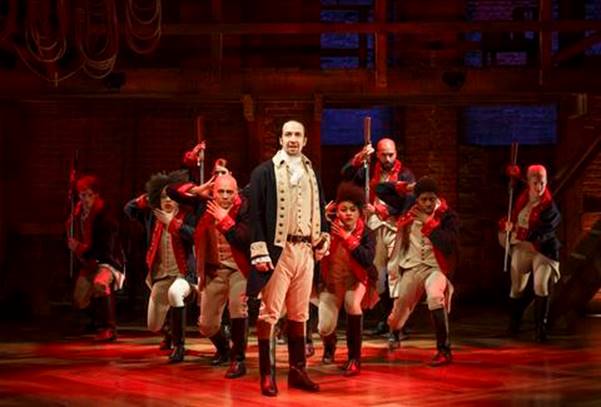

Dies ist wahrscheinlich das beste Musical aller Zeiten. Ich bin sehr voreingenommen, denn Alexander Hamilton ist eines meiner Vorbilder und ich war ein großer Fan seiner Biographie von Ron Chernow, auf der das Musical basiert. Aber dieses verrückte Hip-Hop-Musical ist eine Meisterleistung und das einzige Musical, bei dem ich mir die Augen aus dem Kopf geheult habe. Das müssen Sie sehen!