I loved my conversation with Jack Farley. Here is how he summarized it.

After correctly calling the “everything bubble” in 2021, here’s how Fabrice Grinda quiet legend of Venture Capital (VC), is viewing things:

- the VC bear market of 2022-? isn’t over but has created excellent opportunities.

- valuations for AI companies are “ludicrous” while valuations for non-AI companies are reasonable”.

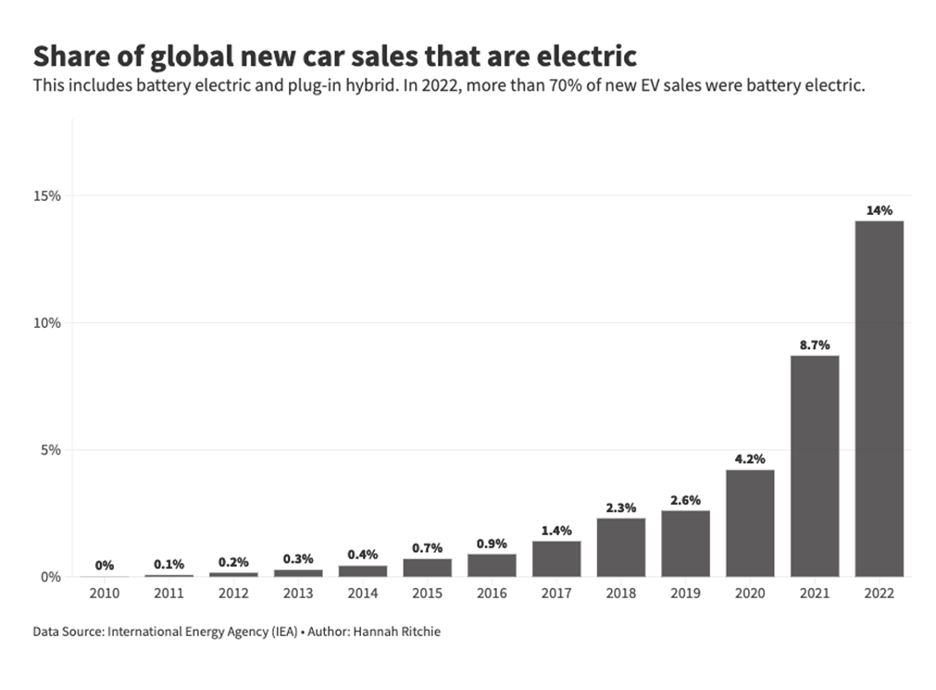

- Fabrice sees compelling opportunities in defense-tech as well as autonomous driving (very unloved right now).

- Most AI companies he’s seen have created “interesting products” but have “unclear business models” and “won’t live up to the hype” and “most of them are going to zero”.

- ^a note: he is SOLELY referring to private VC companies here, NOT publicly traded stocks. he usually exits once names go public (as he did in the case of Alibaba and Palantir $BABA $PLTR).

- he thinks the Gartner hype cycle applies to AI… in the short-term the transformation will be less than currently expected, but in the long run the scale of the move will go beyond the expectations of all but the most rabid AI soothsayers (my words not his).

- he has been and remains a crypto bull. in addition to owning lots of tokens, he is very involved with a European yield-bearing stablecoin called Midas (it’s not accessible from U.S. but is from most other countries), which in the interview he says is regulatory compliant, bankruptcy remote, and something that can actually be used on-chain DeFi stuff.

You can find the full transcript of our conversation here.

Jack: Forward Guidance is brought to you by VanEck, a global leader in asset management since 1955. You’ll be hearing more about a VanEck ETF later on, but for now, let’s get into today’s interview. I’m very pleased to welcome to Forward Guidance Fabrice Grinda, an entrepreneur and investor.

Fabrice was the founder of Auckland, which was later sold to Bernard Arnault, a founder of OLX, which was subsequently sold to Naspers, and is a serial angel investors in companies such as Airbnb, Alibaba, and FanDuel. Fabrice, wonderful to meet you. Thank you for coming on.

Thank you for having me. You have your entrepreneurial journey, which is great. And I wanted to ask you later on about Midas, a company you’re a co-founder and investor in, which is doing a lot of great things in the stablecoin world.

But I understand that you also are very interested in macroeconomics and what impacts asset prices and with central banks. So on your website, you’ve got articles such as Welcome to the Everything Bubble, which you wrote in February of 2021, as well as in February 2020, you wrote COVID-19, maybe the black swan that pushes the global economy into recession. So my first question for you is, how does macroeconomics affect your world of investing in venture companies as well as being an entrepreneur?

If your job is trading interest all day, it obviously makes sense to pay attention to macro and what central banks are saying. But for a broader person who’s investing in venture capital or starting a business, how does the macroeconomy impact them?

Fabrice: The macro cycle matters because of the price points at which you enter and which you exit. And that said, as an investor in the venture capital world, you don’t control the exit. Then know at what point you’re going to be in the cycle.

What you do know is when you are investing. And so, I try to be very cognizant of especially price levels to make sure that I’m not overpaying. And so, in 2021, while everyone else was basically going crazy, I took a step back and I’m like, OK, we are in an everything bubble because there’s overly loose fiscal monetary policy.

And it’s leading to asset price inflation in every asset class, correlating to one on the way up and everything from real estate to bonds, stocks, privates, publics, NFTs, crypto, SPACs, you name it. And therefore, let’s sell, actually. So, I basically ensued a policy that if it was an anchor to the ground, we should be selling it in every asset class possible.

Of course, in the private world, that’s not liquid. We only sold a fraction of what we would have liked to do. But while everyone else was investing, we were divesting.

And the reverse is true. Last year, while everyone in the venture world was basically saying tighten down the ashes, we’re not investing in anything. I was like, no, this is the very best time to be investing because valuations are reasonable.

I mean, nothing’s cheap in tech, but more reasonable than they have been. There’s way less competition. So while there used to be 20 companies funded to do the exact same thing, there’s one or two.

So you’re more likely to win the category. And the founders now are focused on unit economics, burn rates, making sure they have two years of cash and run away and they’re going to get to the next stage. And these things matter profoundly.

If you look at the last decade, so venture as an asset class is very different than most. It follows something called the power law versus all other asset classes follow normal Gaussian distribution curves. And in this power law, it means that the top few companies in the category end up making all the returns.

And if you look at the 2010s, the very best investments were made in 08, 09, 010, 011. So, in the aftermath of the great recession or the financial crisis. And so, I suspect the same thing will happen here.

The worst time to have invested will probably been 21 and maybe 2020. And the best time to be invested in the 2020s will have been late 22, 23, 24 until the turnaround. So macro matters.

Now that said, I’d be disingenuous to say that I do it because I think it helps me become a better investor. I actually have heuristics that I follow. And so, in 21, it wasn’t a top down directive.

Valuations are high. So, it’s like, I believe that we will, that our heuristics, the way we value companies is sound and we will find most companies to be expensive and therefore we will not invest, and we will choose to exit when the opportunities arise. So, it’s as much an intellectual exercise for me than it is anything else.

So, I’ve been, I’m an economist by formation. I spent a lot of time thinking about it, writing about it, reading about it. And it just so happens that it has consequences that could be applicable in the venture space.

But for most people, they, I guess they’re probably okay ignoring it if they are really strict on their heuristics, especially valuation.

Jack: I think that’s a really important point. You love macro. I love macro and it definitely has helped you.

But I think, we study it because we love it, not necessarily because it’s going to give us to see around the corner or create some great investing opportunities. So Febreze, just to set the stage, I read online, you sold your company, your first company to Bernard Arnault of LVMH in 2000. So, I think that is when the venture capital bubble burst.

So, when you were, your first job out of college or when you’re in college, that was when that, the first VC bubble, you were not in that world. So when you, your first world was as if that bubble was bursting. And then I imagine from 2010 to really now, VC, venture capital has really inflated as an asset class, a lot more money flowing into the space, valuations going up, people investing in Uber as you have it working out, then they have more money to invest in other companies.

So, a lot of people who are, let’s say, throwing money around, I’m sure I didn’t get every detail right, but is that a rough encapsulation of your timeline and the timeline of VC?

Fabrice: So even in the late nineties, so I graduated college in 96. I worked for McKinsey and company 96, 98, knowing there was a bubble going on, but I figured I needed more skills where I’m going to build my company. And I wanted to build a tech company.

I knew that. And I thought I would miss the bubble actually going to McKinsey, but lo and behold, I didn’t. So, I actually did see the euphoria night when I built my first company, 98, 99, 2000.

And I saw the reverse side of the bubble. I build my next company in 2001. And in 2001, when I was, I would call every VC telling them, “Hey, I have this amazing idea.”

It’s worked extraordinarily well in Europe and in Asia. There’s a valid business model. I know how to execute and I’ve been a proven entrepreneur with a proven track record.

I don’t think I finished the sentence that they’d hung up because, you know, everyone else was going under pets.com, e-toys, webvan, MCI, WorldCom, and there was no, no way to build a company. And so, I know that these things come in cycles and these cycles last multiple years. So I saw the boom and bust in the late nineties, early 2000.

I saw it again, like 2004 to 2007 euphoria to 2007, 2010, like bus. And again, 2021 boom. And then the 22, 23 busts in the venture world, which by the way, is to large extent continuing, right?

Like people in the public markets are like, Oh, everything’s amazing. We have the magnificent seven or whatever that are worth blah. But if you actually look at the public market caps of tech companies with stocks below 20 billion, most of them are down 80%.

They used to be down 95%. Now they’re down 80%. So they’ve forex since then, but they’re still down, you know, divided the soccer is still divided by four or five from the peaks.

And if you look at the venture market as a whole, the amount of LP money going into the venture space has declined dramatically. And the venture investments themselves are still down 75% peak to trough. So we’re still in the middle of a, of a bust.

And so this is the third big boom bust cycle I’ve seen in the venture space.

Jack: And in the boom of 2020 and 2021, what sort of valuations were you seeing at the various companies that, that you looked at, you know, please don’t reveal any specifics that you don’t feel comfortable revealing and how do they compare to the previous decade? And also, is there any particular story that might have, you know, sign of a bubble or, you know, there’s always that one store that’s a sign of a top.

Fabrice: So the median valuations basically completely exploded. So the median pre-seed 2013, 2019 was one at five pre the median seed was like three at nine pre the median a was seven at 23 pre 30 posts. The median B was probably like 15 at 50 with commensurate traction.

So no traction, 150 came on the GMV 600 K and GMV 2.5 million. I mean, in SAS revenues, maybe 20% of that.

Jack: So this is market cap to revenue in the stock world competency known as price to sales.

Fabrice: Yeah. I mean, it’s a combination of revenue, gross sales. If you’re a marketplace or your SAS revenues pre-seed would be, let’s say zero seed, like 30 K a would be a hundred, 150 K and B would be 500 K at these types of valuations.

And what started happening in the bubble days is we saw companies raising at a hundred X forward looking revenues. But the signs of the bubble were not, was not that the sign of the bubble. I mean, the valuations were insane.

We went from like 10, 15, 20 X forward looking revenues to a hundred X in some cases. But it’s more the speed at which the deals were being done, which suggested there was no due diligence, right? Like, Oh, I I’d like to take a call to evaluate the company.

And maybe we have a follow-on call. Well, maybe a first, an associate or principal takes the first call and I want to take a call next week for the second call. And we decide, and we’re extraordinarily quick decision-makers.

Two week, two one-hour calls in a week, we decide if we invest or not. And basically between the first, second call, they’re like, Oh, we’re over subscribed. You know, we have a lead.

We’re raising whatever a hundred million at a billion from Tiger or SoftBank, who are the two biggest, I guess, bull market investors who basically did zero due diligence and wrote massive checks on them on the basis of one call. And, and so deals were being done, which at a speed that suggested that no work was being done. And you’d have to believe that all the stars were aligned and the prices they were paying, especially since people were so bullish that they would immediately fund or other VCs would go and fund the competitors.

And so you’d end up having like 10, 15, very well-funded competitors going after the same space at insane prices. And so it was pretty obvious that they were mostly not all going to make it because the prices were so high. If it was priced to perfection and in venture, it’s very rare that you see down rounds because often when you do an investment round, there’s an anti-dilution clause, meaning that if you do a next round at a lower price, the prior round reprices and actually dilutes the founders because the founders don’t want that.

If you raise too much money at too high a price, it kills the company. So in the venture world, what kills companies, the three main reasons of death are number one, not finding product market fit, obvious. Number two, fighting with your co-founders, though having co-founders increase your probability of success.

So it’s a two-edged sword. And number three is actually raising too much money at too high a price. The issue is no first-time founder will say, no, it was like someone’s offering 50 at 150 pre, 25% dilution, 50 million, or someone’s offering, you know, I don’t know, 10 at 50.

They always take the 50 at 150, but, or 10 at 40 or 50 post. The issue is if you don’t grow into it, you might’ve just killed your company. And so you increase the probability of failure dramatically.

But there’s also bad dynamics. If everyone else is raising, you feel compelled to be raised. You feel compelled to spend it.

I mean, so yeah, I think speed of execution was really the, and the valuations at a hundred X forward looking was really what it was suggesting was extraordinarily frothy.

Jack: Why is raising too much money at too high evaluation? That sounds like a pretty good problem to have. Why is that so toxic to some companies?

Fabrice: Well, most startups, right, are not profitable and the expectation is not for them to become profitable with the amount they just raised. And so they raised too much money at too high a price and then they need to go raise the next round. If they cannot raise the next round at at least the same price, you need to do what’s called a down run.

And the down run, as I said, triggers these anti-dilution provisions where the prior run, so let’s say you just raised 200 million at 800 pre, 1 billion posts, 20% dilution of 200 million, but your company is only worth 200 million. The next round, you have to, they offer to raise 50 at 150 or whatever pre. Several things might happen.

One is the guys before the 200 might reprice at 200, in which case you just saw 50% dilution in your company. And so the founders lose a lot of their common stock, or maybe there’s no support from the insiders in backing the company, which means that the new investors aren’t going to do it. They create pay to play.

I mean, it really destroys companies because the cap tables end up being messed up. There’s too much liquidation preference. And so you need to do massive cleanups where, and you may wipe out the investors.

And so, which is okay, but it may wipe out the companies as well. So we’re seeing a lot of like fake unicorn death that’s been happening in the last few years as these companies were not worth as much as they’d raised or seeing massive, either they go under or they’re taking over pennies in the dollar and actually hired or, or completely recapped it. And so we’re seeing, I guess, three scenarios.

One scenario we’re seeing is complete wipe out where we’re raising the money now at like five pre diluting the former converting all the stack to common and the new investors are getting whatever 20, 30, 40, 50%. We’re recreating an option pool for the management team. So it’s a restart of a company as though the prior rent didn’t exit, didn’t exist.

And that’s been happening to wipe out the investors who don’t want to write checks anymore. So it’s mostly happened to the crossover investors who completely left. So whatever, D1, Co2, and to some extent SoftBank and Tiger.

Two, what we’re seeing more commonly is the company does not want to do down rounds. So they do a round at a flat price, but they put structure, they put in liquidation preference. So they, they say, okay, now this new round is happening, but any new money I’m putting in, I’m getting three X.

But the downside of that is essentially you’re capping your outcome. Meaning now the company is going to go try to sell itself and the last round investors are going to make it two or three X and people before probably going to be wiped out. We as venture investors, that’s not what I’m underwriting.

I want to underwrite a 10 X. And so doing these private equity-ish type deals with structure is not really my jam. And then number three, of course, people that have raised enough money that they actually made it and they won, but they’re far and few between.

Jack: There is an effect when venture capital companies raise money, they are somewhat, in effect, short a put of if the market cap goes in and they raise a down round, it hurts the founders because the actual investors, LPs or GPs who put money in venture capital firms have protected themselves. So if you raise money at too high valuation, and then you have to do a down round, that can be really toxic. And I imagine is it also, if you raise 200 million, your company gets used to a lifestyle of 200 million and you start to hire all these assistants and you start going on trips and that kind of stuff.

Fabrice: People have a tendency to spend it if they have it. And not necessarily that lifestyle, but more, okay, let’s hire, let’s grow faster, et cetera. And then all of a sudden going from a growth mode to a, let’s focus in unit economics.

I mean, the number of companies that are Series B and onwards, so reasonably late stage that I have to ref 65% or more of their staff is pretty mind blowing. And by the way, if you have to do it, you’d rather do it once. And they’re ready to do it in multiple times because it destroys morale.

And you do a massive ref, like you’ve just let 70% of the people go and you’re like, look, the people already left. That’s it. We’re the team and you use it as a morale boosting experience, even though it’s a traumatic experience versus doing it 5% and 5% and 5%.

That’s actually the worst because then people were wondering when or where they’re coming next.

Jack: And how do you square the brutal riff reduction in force people being laid off with the overall macro picture of the unemployment rate is still low at 3.9%. The US economy appears to continue to be adding jobs and the labor market is expanding. Do you see a disconnect between what you’re seeing in Silicon Valley and venture capital back world and the broader macro economy?

Fabrice: Absolutely. I mean, this goes to show that Silicon Valley, even though it is an engine of economic growth and productivity growth, it’s actually not been an engine of employment growth. So the number, the percentage of the US population employed by the tech companies is still in the low single digits.

And so you can have a massive recession in tech, which we have had. And then again, not in all sectors of tech, obviously the AI companies are mostly hiring and it doesn’t in impact employment as a whole. And the economy as a whole has been actually way more resilient than people expected.

If you take a step back in 22, most people predicted the US would have a recession by now with good reason. We’ve seen the fastest increase in rates since the early 1980s, nominal rates. And we were reasonably overloaded at the same time in every category from commercial real estate to consumer debt, credit card debt, student debt, and mortgage debt.

Plus a number of slowdowns were happening in various sectors. So the expectation was a recession, but employment actually has held off way better than people expected. People’s income has held off way better despite the overhang.

And historically, when you had inverted yield curves and the fastest rise in rates, you would have expected a recession. We’ve only had a soft landing once in the last 70 years, and that was in 1994. And so the smart money was recession.

And yet, normally did that narrative change from recession to maybe soft landing to maybe no landing, like where now we’re, yes, because the CPI remains higher than people would like. Maybe we don’t see, and in fact, that’s one place where the pundits, where the consensus has been wrong, that rates would stay higher longer has been what I’ve been saying forever, seems to be now becoming more consensus. People were originally underwriting four, five, six rate cuts this year, and maybe now we’re at two, but there’s way more resilience, and maybe there’s no landing on the horizon.

I think right now, the bigger risk is actually not macroeconomic anymore. It’s actually geopolitical. If I see gray swans or black swans on the horizon, it’s more, are we in the first innings?

I mean, we’re definitely in Cold War II, right? Like on the one end, you have Russia, China, Iran, and North Korea. The other hand, you have the West at large, and hopefully, we can move India in our camp, but there are confrontations already.

There are hot wars in Ukraine and in the Middle East, and the question is, does that escalate? I don’t think that China has the amphibious capacity to invade Taiwan, but what they recently did is basically they beta tested a blockade of Taiwan, and if they blockade Taiwan, what happens then? How does that escalate?

My macro concerns today in the short term are more driven by geopolitics and geopolitical and the risk of accidents, which are obviously higher than they are fundamentally, even though, yes, do we have unsustainable deficits in the US? Yes, but actually, the reality is you can fix it reasonably easily. Now, the political will to fix it is not there, but if you gave me the magic wand and I could change a few things, I changed my COLA calculation for benefits, you moved all the public pensions to the fine contribution, and you increased the retirement age to whatever, 70, or at least 67, 68, and you indexed it with life expectancy, you probably solved all of your various budget deficit problems, and frankly, across the board in the West. The dollar relative to other currencies, let’s say the Euro, looks right now way safer. If you look at the public debt situation in Italy, let alone Greece and others, it looks way worse.

The macro concerns, it’s interesting, not disappeared, but are now secondary to the geopolitical concerns.

Jack: You think a more pressing concern for you would be geopolitical than macroeconomic. I know you haven’t, or still are, I don’t know, you told me, an investor in Palantir, which is obviously very involved with defense technology and US national security and geopolitical threats. Is there anything you’ve seen being an investor in Palantir or any other companies that someone watching this, who reads the paper and is following stuff, but doesn’t have the experience that you have, might not know?

Fabrice: Look, I was an investor in Palantir when it was private. Then I preferred access to the founders. The thing is, when companies go public, I lose my privilege access, because of course, now you only get access to whatever the public market information is.

My more interesting, I think, investment these days, so I sold all, I typically sell my public stocks once the lockup expires, so the companies go public, I’m locked up for six months, then I sell. The most interesting investment in my portfolio on the defense tech side right now is a company called Anduril, A-N-D-U-R-I-L. I don’t know if you’ve heard of it.

I think I have. They are basically reinventing the prime contractor, the defense contractor for the government business, away from the Lockheed Martin, Raytheons, et cetera, in the world, because these guys have insane cost structures, or not efficient. They’re building a modern, acid light, capital efficient, fast move, technology forward contractor.

It’s winning contracts right and left. They’re creating extraordinary autonomous vehicles, underwater, in the air, doing defense, et cetera, that are amazing. They’re winning contracts right and left.

There’s definitely been an increase in defense tech writ large. Now, my geopolitical analysis or expertise, so I joined a bunch of groups, and it’s more an intellectual curiosity than anything else, but there’s a group called Ergo, E-R-G-O, that is former US intelligence operatives and CIA, et cetera, that have created essentially an advisory business for mostly probably hedge funds that are trading in the global macro business, but for people like me who are intellectually curious about the space, you get proprietary access to intelligence analysts, defense analysts, and people that are in the middle of what’s going on, who opine and put actually probability way outcomes on what’s going to happen and everything from different elections to geopolitical events.

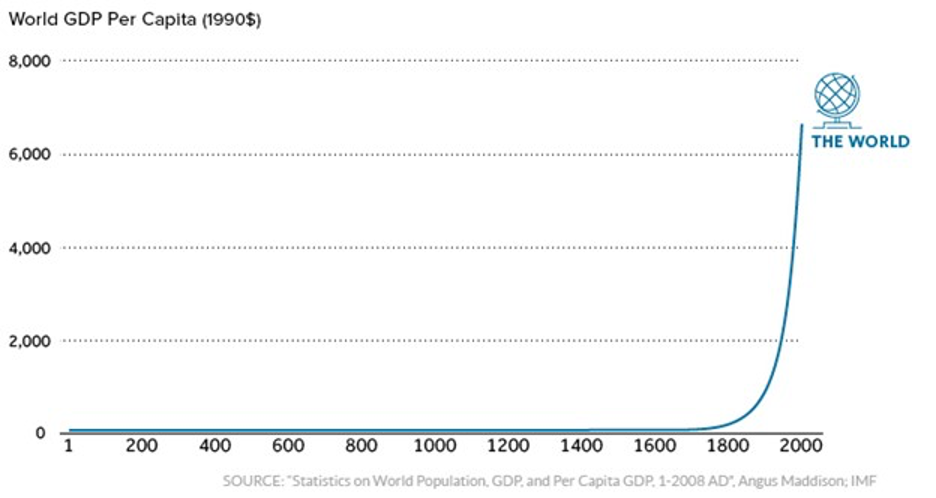

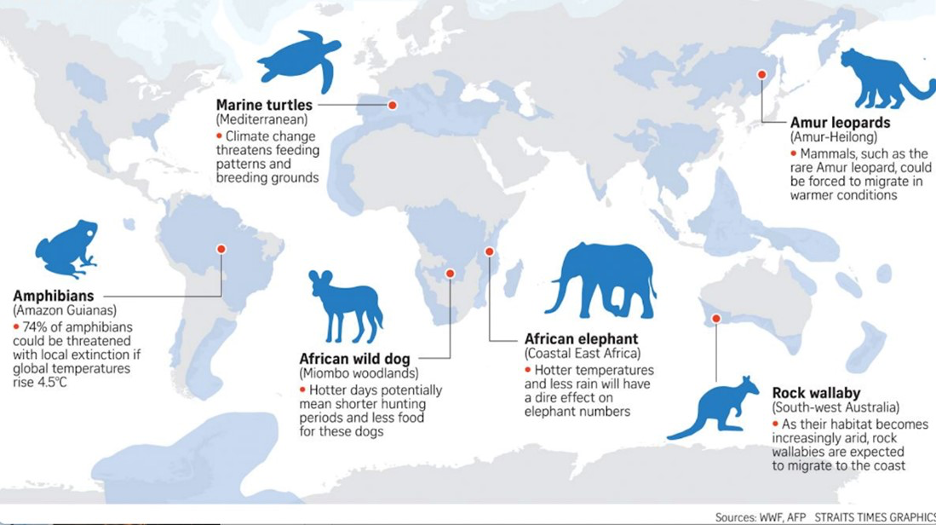

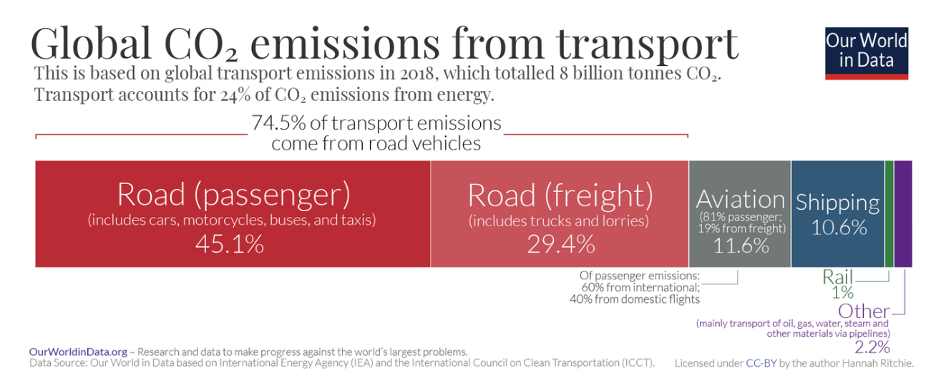

Look, I do it out of intellectual curiosity. It doesn’t change what I do in my investing side. On the investing side, at the end of the day, I’m a believer that technology, which is inherently deflationary, is going to solve most of the world’s problems.

The reason I’m in tech, both as an investor and as a founder, is I see problems in terms of inequality of opportunity, climate change, and physical mental well-being crisis. I think that policymakers are structurally incapable of addressing them, especially since many of these are global and have negative externalities like climate change. Therefore, instead, I fund for-profit solutions that are scalable to address each of these problems.

That’s why I’m an investor in 11 companies to try to solve that. Regardless of the geopolitical environment and the political environment, I take it as an exhaustion as to my models. I’m going to continue to do what I do because I do it, A, it’s extraordinarily lucrative, but B, more importantly and most importantly, I think it’s the right thing to do.

I retired 20 years ago, but I am mission-driven. I want to solve the world’s problems. I think technology is the way to do that because it is deflationary.

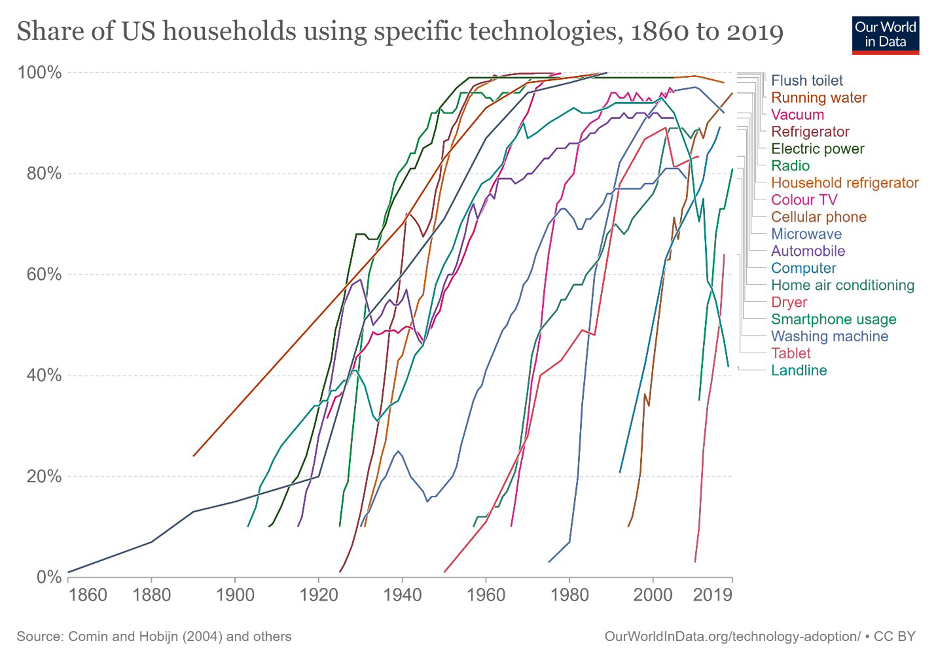

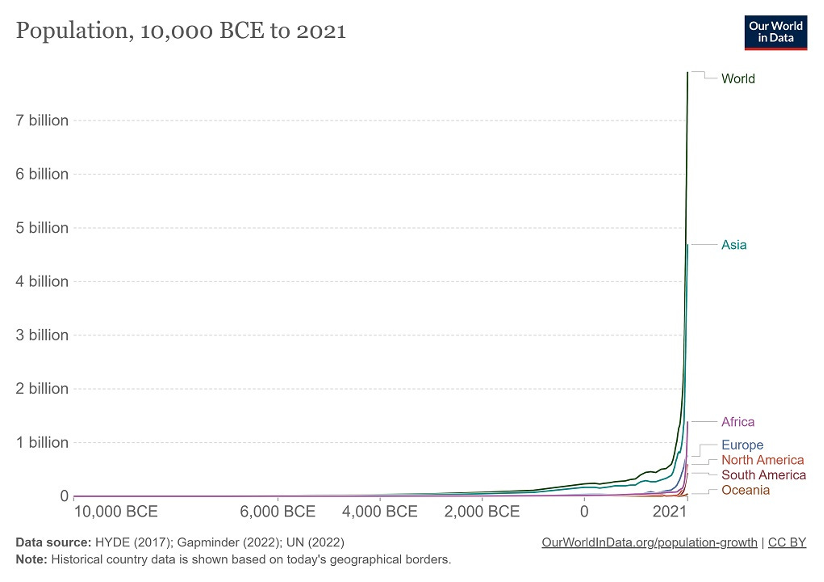

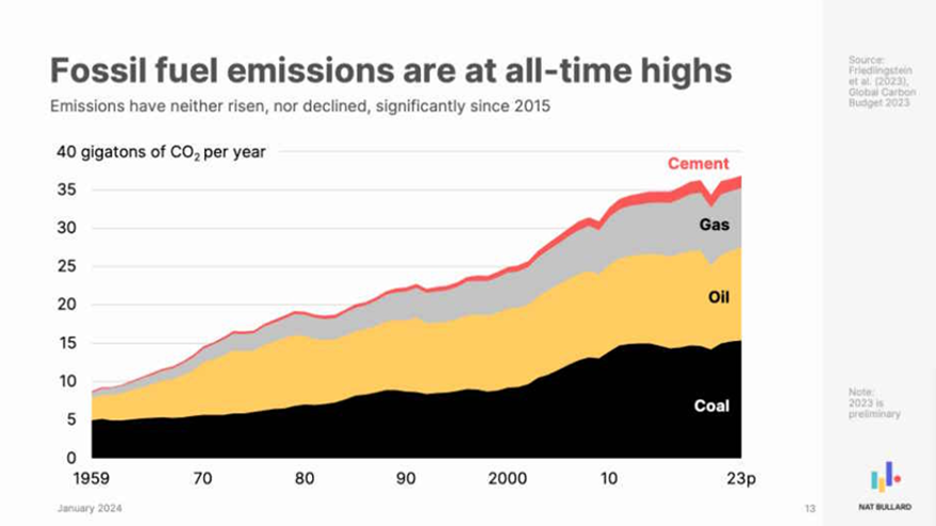

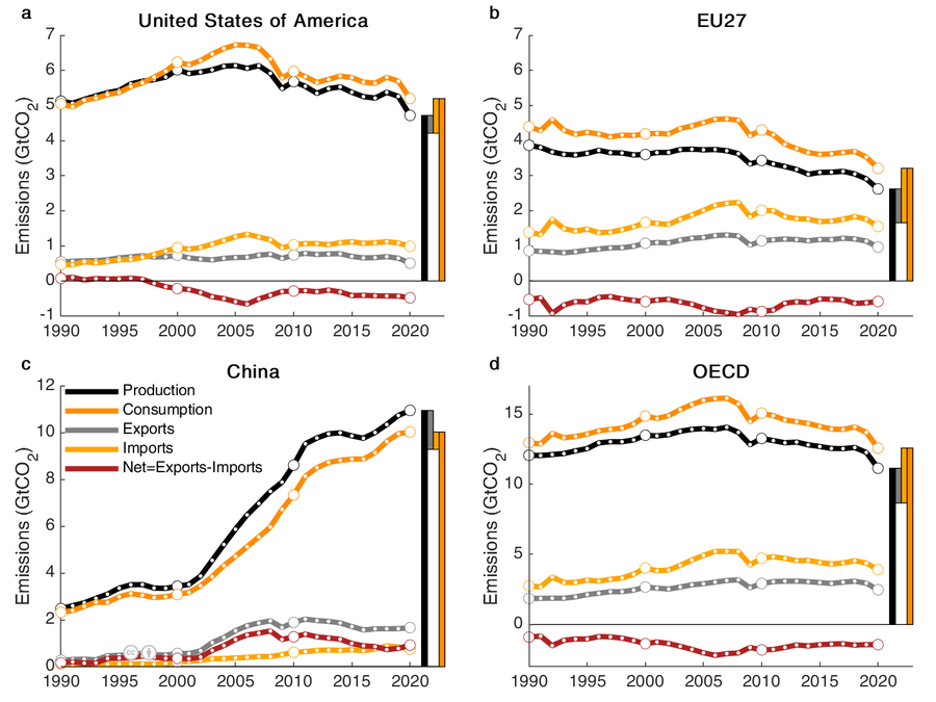

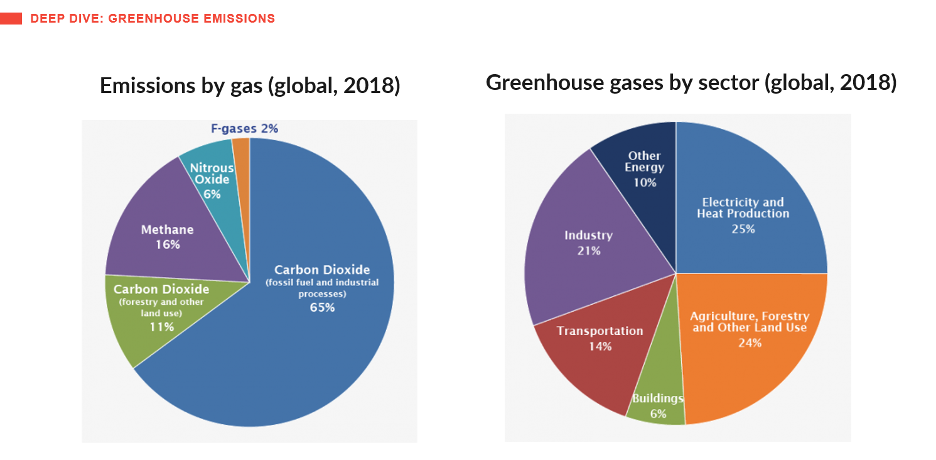

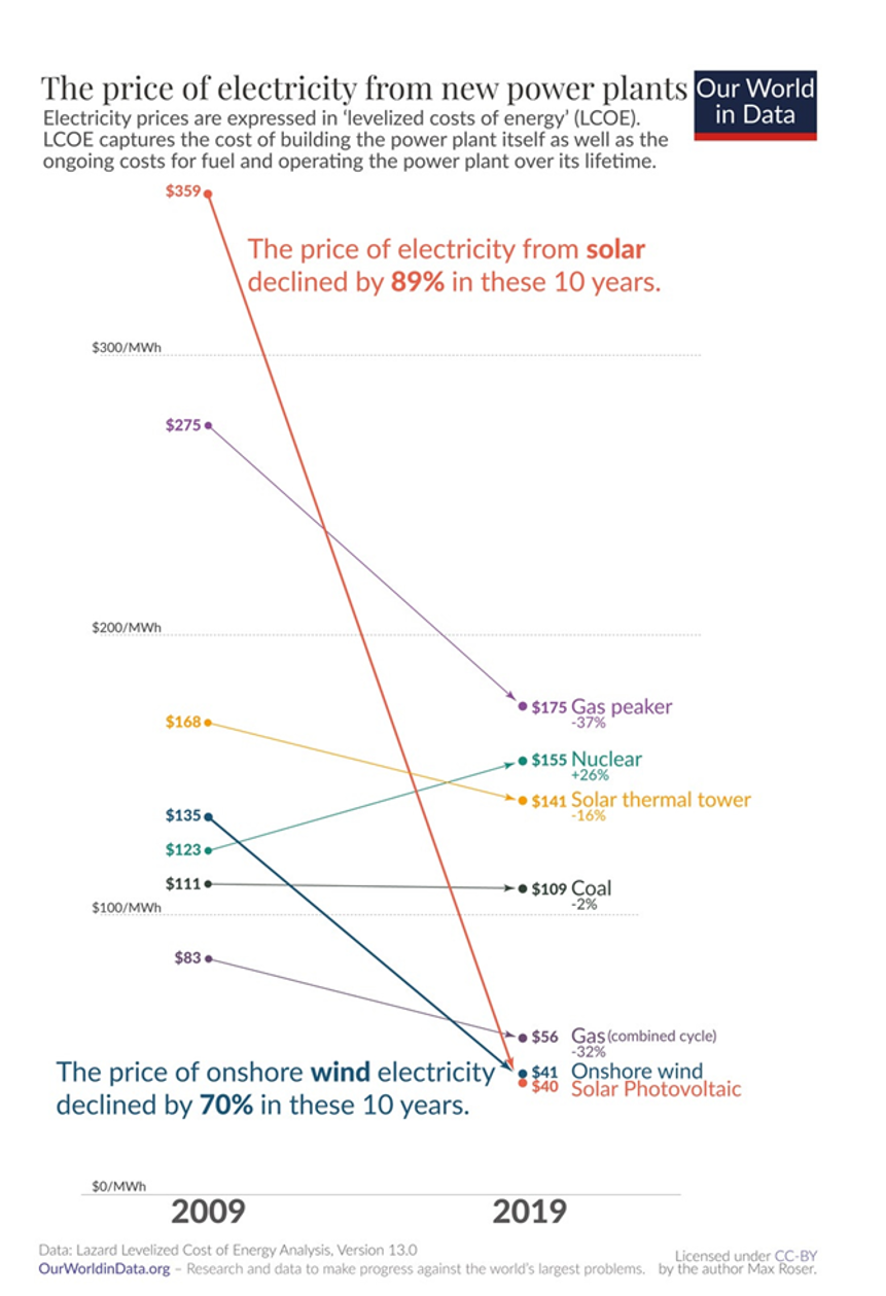

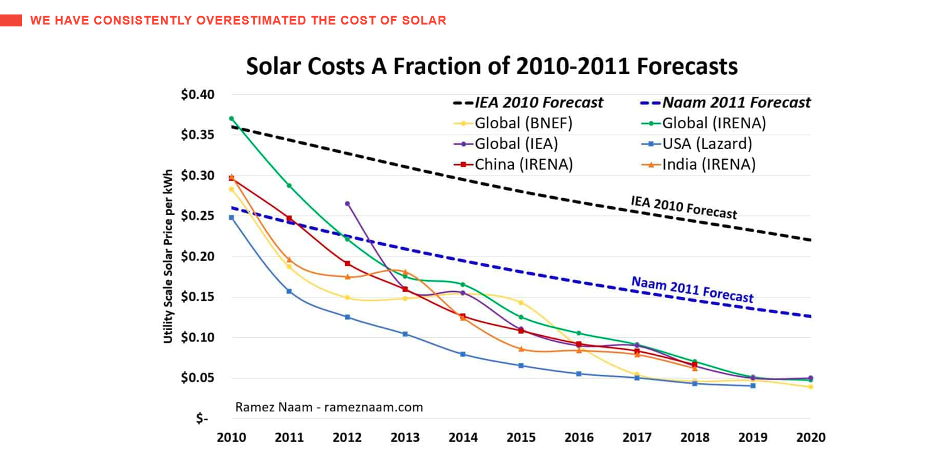

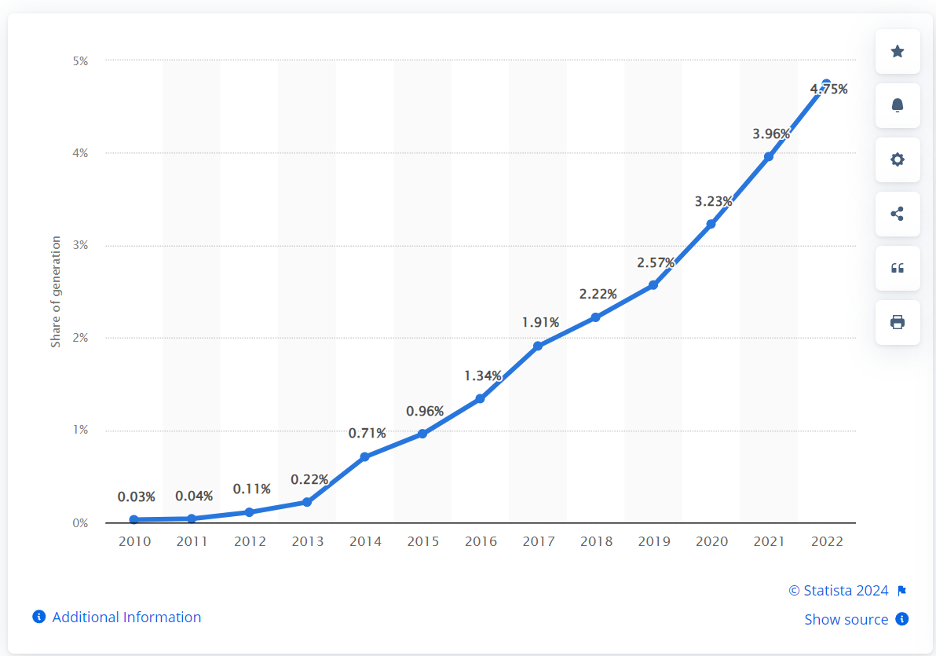

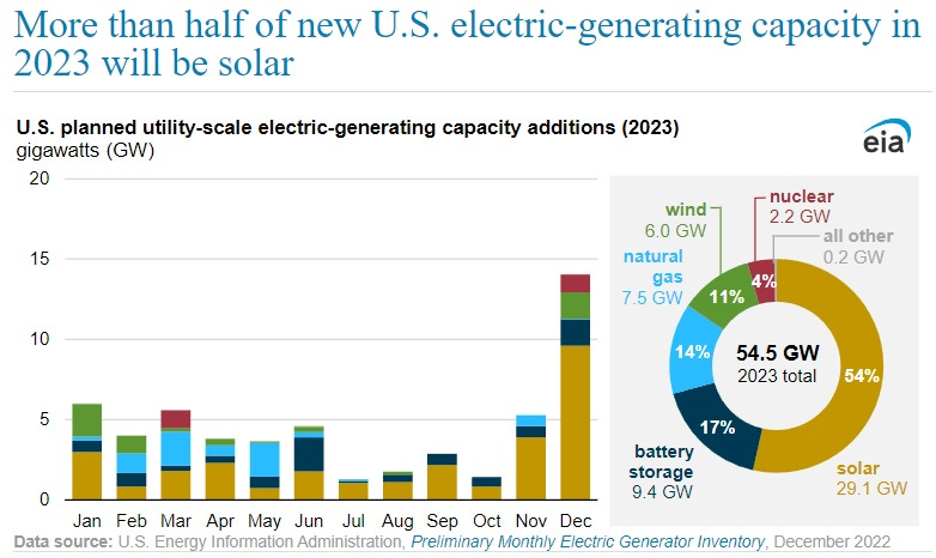

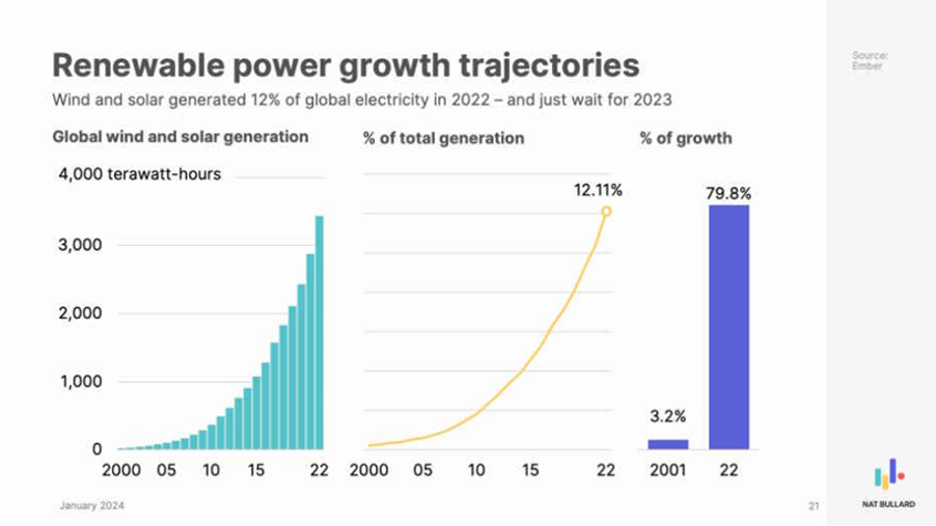

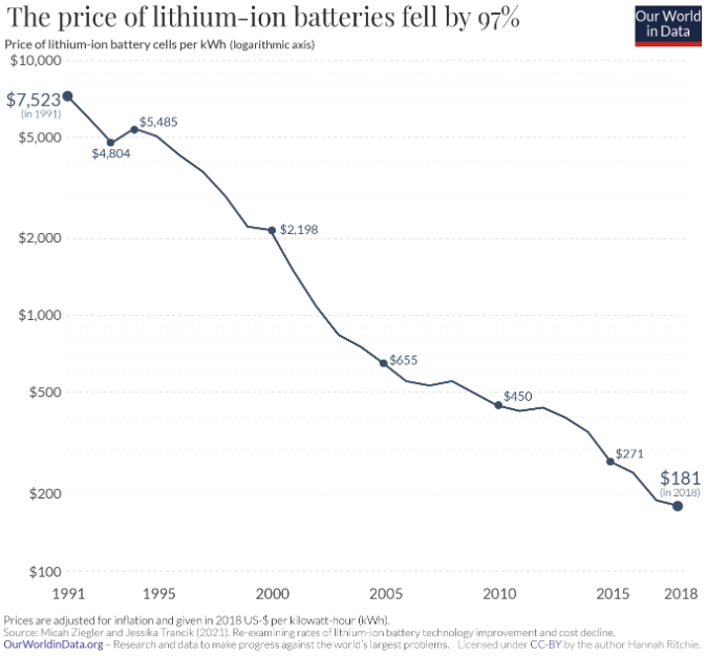

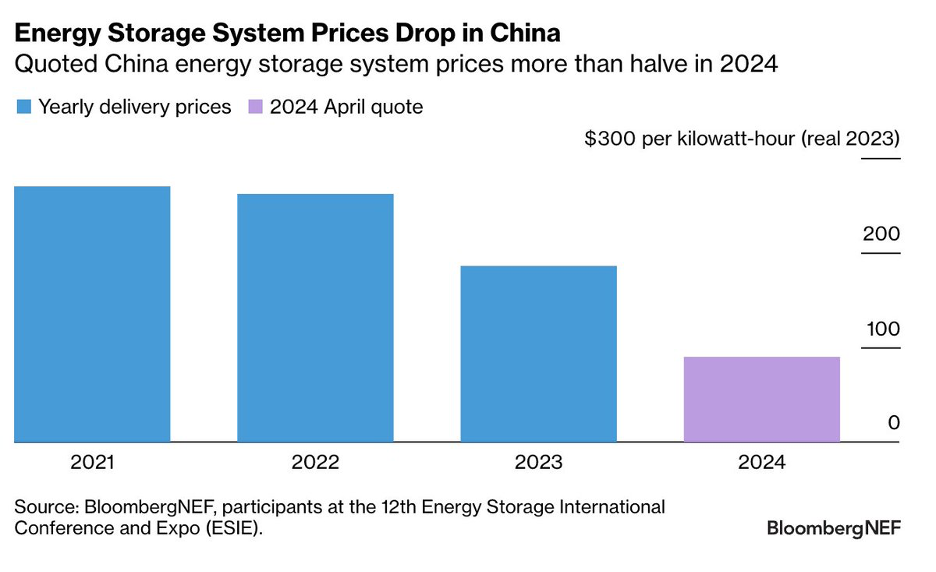

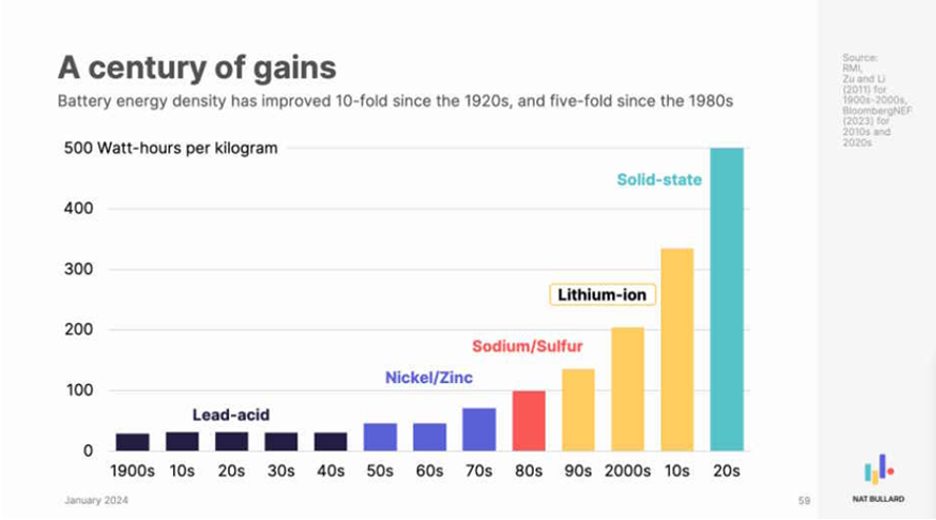

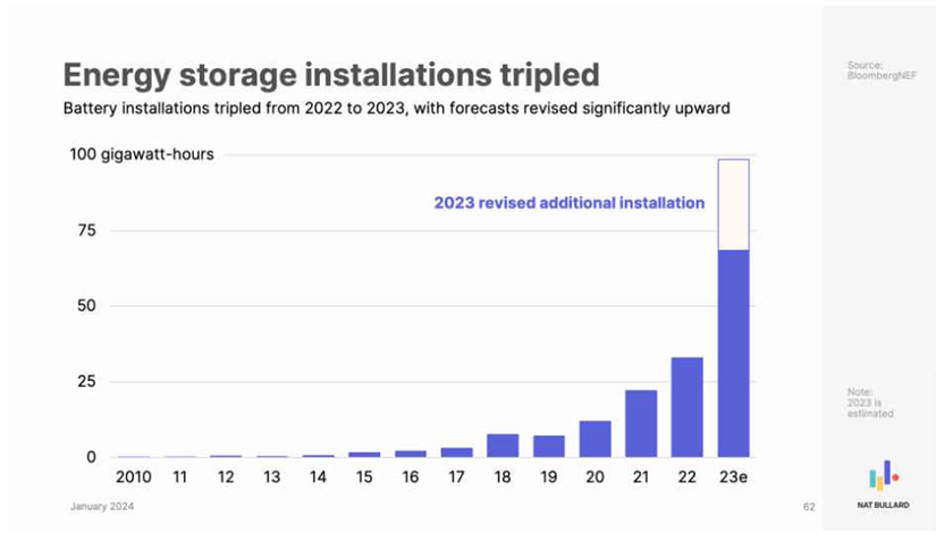

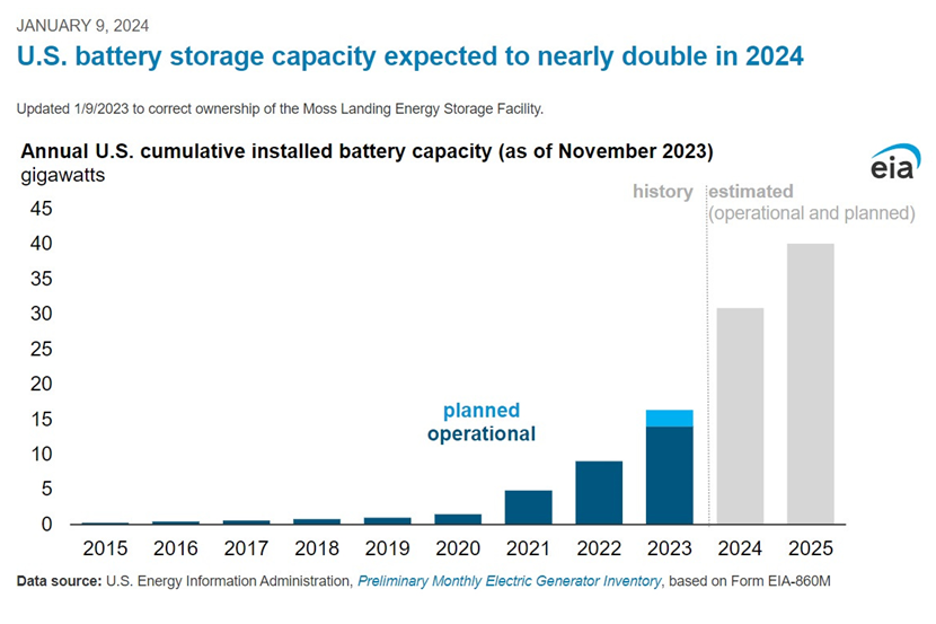

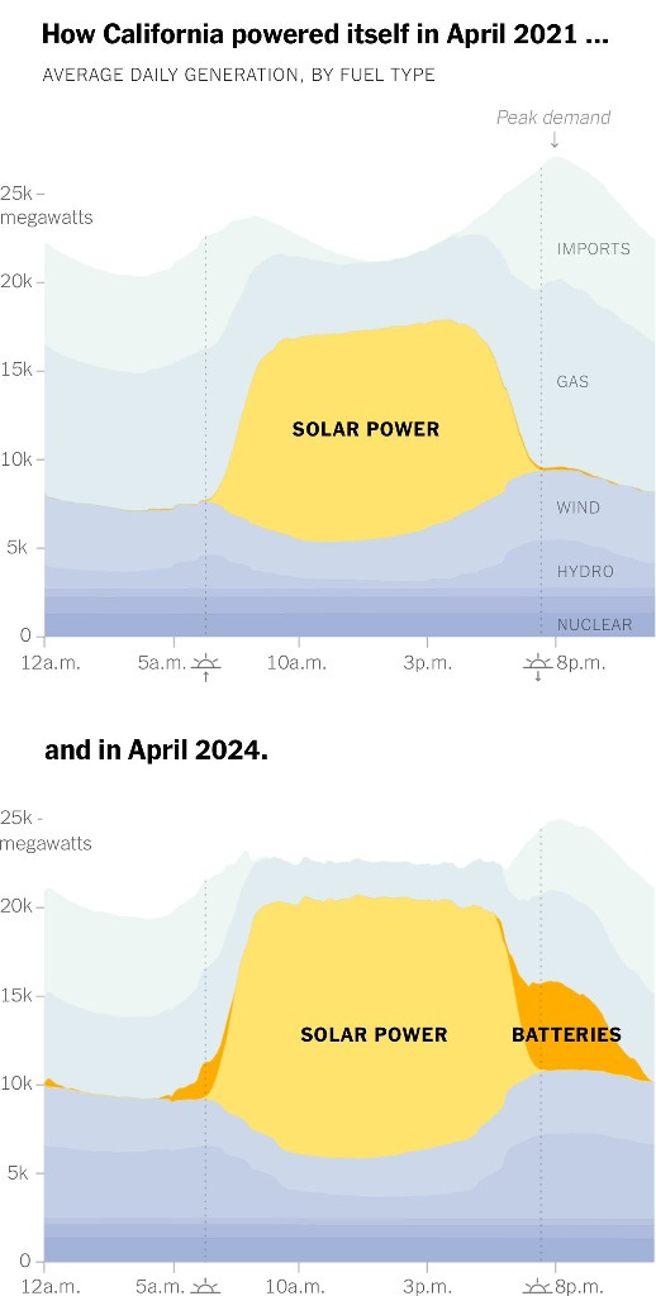

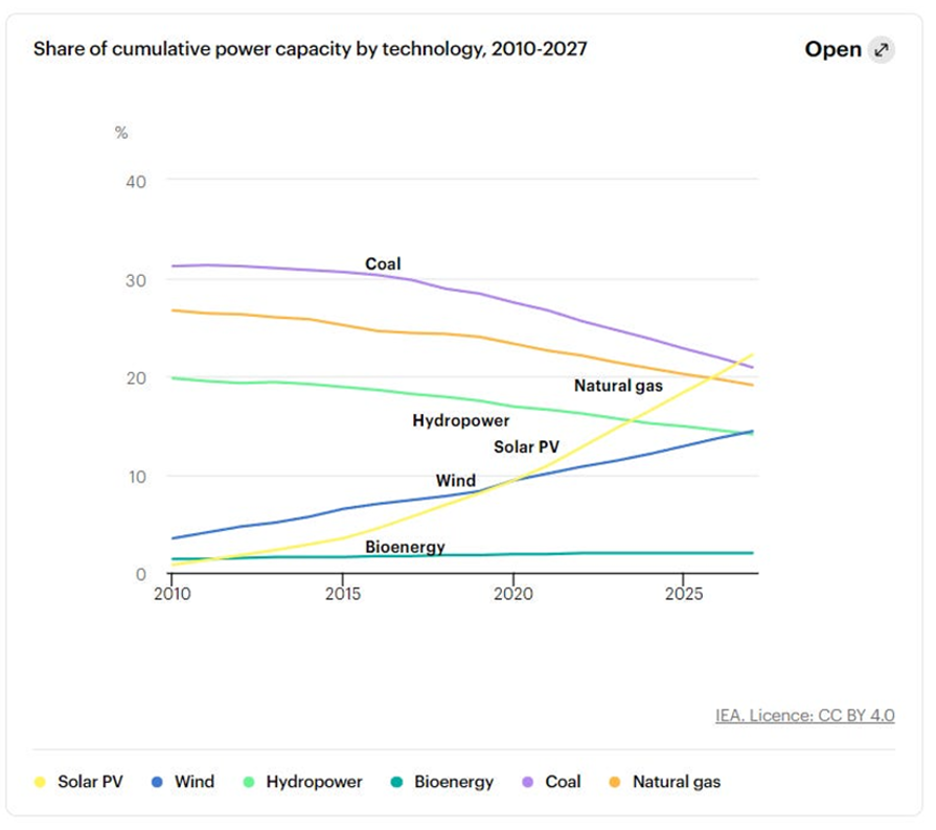

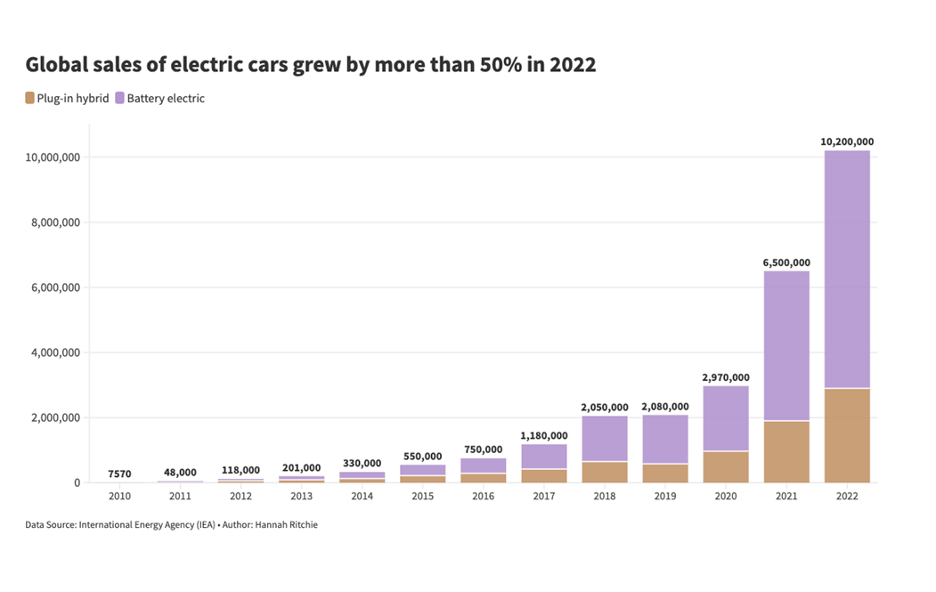

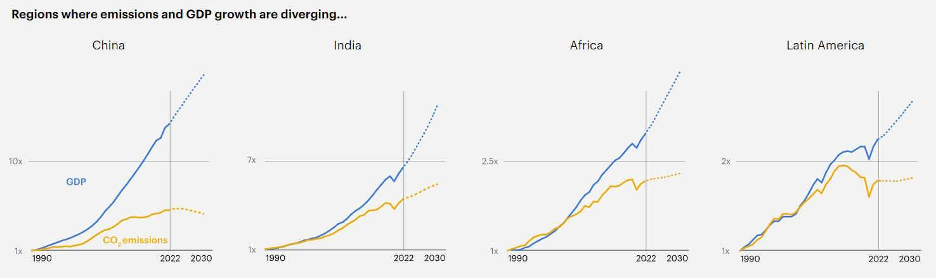

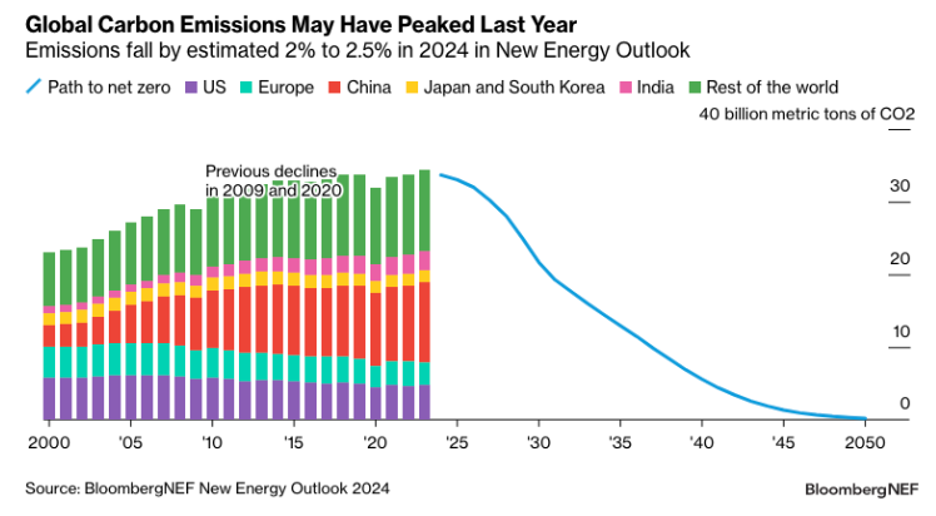

In fact, it’s also the way to solve the inflationary problem we’ve been seeing in the US. If you look at most categories, if tech has touched it, it’s been deflationary. Think of the quality and the power of your computers, of your cell phones over the last 40 years, but also true of solar panels, batteries.

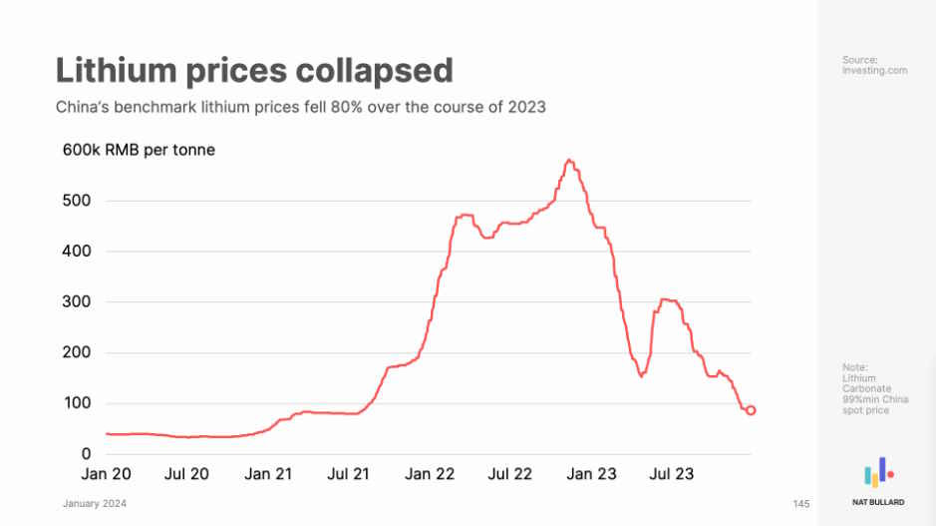

Solar panels have been dividing by 10 in price for the last decade, for each decade of the last four decades. That’s price decreases divided by 10,000. Battery prices divided by 42 since 1991.

They actually fell 50% in a year, mostly due to overproduction. In China, it still continued to decrease very rapidly, which is suggesting we are going to have green solutions, technological solutions to climate change. Even though I follow the geopolitical things with things like Ergo and things like Green Mantle, which is the Neil Ferguson gathering or dialogue, it doesn’t impact my ultimate decision-making.

I want to go and use technology to solve the world’s problems.

Jack: You’re always going to invest in technology, regardless of the geopolitical situation, but perhaps it may impact where you do those investments. According to your Wikipedia, which I don’t know if it is accurate, you can correct me, roughly 70% of your investments have been in the US and 30% in the rest of the world, including Brazil, France, Germany, UK, Russia, China, and Turkey. Is the geopolitical situation, your perception of a threat, is it such that you had an investment in Alibaba, obviously in China?

If you saw an opportunity now that was as promising to you as Alibaba was, you didn’t know it was going to be as successful as Alibaba, but it was as attractive, as compelling to you when you see it as Alibaba was when you saw that back in the day. Would you still make that investment, or is the geopolitical situation sufficiently dire that you might think twice about writing that check? Also, I might ask you a question about Russia, where I assume your answer is definitely.

Fabrice: You’re actually correct. It does inform where we invest, and the vast majority of where we invest is the US and Western Europe, but we used to invest aggressively in Turkey, Russia, and China. For geopolitical reasons, for completely different reasons, I’ve moved away from all three.

We stopped Russia after Putin decided to invade Crimea, so I think it’s like 2014. We were investors in extraordinary companies there. We had a B2B market like the Alibaba of China.

It was backed by Tiger Investor. Of course, they got scared, and correctly so. All of a sudden, the company that was worth whatever, a billion, there was no funder available for it anymore, and some oligarch took it over for peanuts.

We definitely do not invest in Russia anymore. China, same thing. After Jokhma disappeared for a bunch of months, I’m going to study Mandarin at Beijing Normal University.

I love China. I love the story of taking a billion people out of poverty. Deng Xiaoping is one of my heroes in terms of what he did to modernize China.

The problem with autocracies and dictatorships is you’re only as good as your dictator. You definitely saw it in the Roman Empire where you had Augustus or Marcus Aurelius and Trajan, but you also had Commodus and Nero. As much as I love Deng Xiaoping, I think Xi Jinping is normally incompetent, but dangerous, dangerous to the world.

He has the wrong view of where nations’ powers come from, which I think is also true of Putin, by the way, and doesn’t believe in the legacy of what Deng Xiaoping and others have done. I actually truly believe that if someone like Deng was in power today in China, we would not have this Cold War II and this conflict brewing between the US and China, and actually be way better coexistence. Xi has his world view, which is in direct conflict with mine, and so no, I do not invest in China anymore.

Turkey, Erdogan, to me is violating the legacy of Ataturk. Ataturk is one of the great statesmen of the 20th century. I loved what he did with Turkey and how he reformed it and modernized it.

Erdogan is both from a political perspective, but frankly, even a macro perspective. He believes that printing more money decreases inflation. We’ve seen where the impact on the currency is.

We had extraordinary investments in Turkey and companies like Trendule, which is like the Amazon of Turkey. The problem is when you have that much inflation, the lira devalues that even if you’re growing your revenues in dollar terms, ultimately, you’re still shrinking. Even if you’re doubling your year on year in dollar terms, the currency depreciation more than it impacts it.

I do use a geopolitical lens to decide where to invest, and you’re right. I currently shy away from not just these three countries, but definitely China, Russia, and Turkey.

Jack: Got it. Thanks. Earlier, you referenced certain investors who entered the venture capital world.

You said Tiger Global, CO2. I think of these as hedge funds, which traditionally managed a hedge fund going long short, taking macroeconomic bets, not venture capital, but then they later entered venture capital, and you alluded to it. My perception is they wrote checks without doing as much due diligence, and they were the tourists, my words, not yours.

Tell us, how did you observe their entry into the venture capital space over the last 10 years? Give us a little bit more color about their involvement at the peak of bubble issues valuations of 2020 and 2021, and where are they now? Are they still writing their checks?

Have they written them down? Have they learned their lesson, or what’s going on?

Fabrice: First of all, a lot of these were investors before in tech. They had a history. It’s just that they ramped up a lot during the bubble days, or the 21 bubble.

The guys that were the most fair weather investors were really the crossover guys. The idea for them was we’re coming in private late at a high valuation, because of course, the public market, and we’re going to be investors in you when you go public, and we’re public market investors. The thing is, I don’t think they understood how private markets worked, and that many of these companies were not ready.

Once the markets turned, and the public markets also turned, most of them left. Now, I don’t follow very closely, because this is way later than where I play typically, though they were buyers in my companies. Very often, when I’m like, this valuation is too high, there’s a new ramp happening, can we do a secondary?

They would like to own more, because they were competing with each other, like SoftBank and Tiger instead of our allocation, we weren’t in a position to sell our positions to them. I don’t know if they’re out, but they’ve definitely scaled back their operations, and maybe they’re dipping their toes in again, but to be honest, I haven’t followed. I think SoftBank is still a bit active, though maybe they had different funds for Geos that have been consolidated, but I definitely don’t see them nearly as much.

Right now, venture is still in a retrenchment period. As I said, we’re still down 70% peak to trough in the venture side, with many LPs still feeling over allocated to venture and private, and so it’s hard to raise funds, and as a result, the GPs don’t have that much capital to deploy.

Jack: What were you perceiving the bottom to be of venture capital 2022? High-flying technology stocks in the publicly traded world were down, as you said, 80%, 90%. But what was the price discovery like in the venture world, and what was 2023 like, and where are we now?

Fabrice: I’d say late 22 to Q1, 24 was terrible. It was terrible, except a tale of two cities. If you’re an AI, it was extraordinarily frothy and reminiscent of the bubble of 21.

In almost all categories, it was terrible. It was hard to raise, down round, you needed more traction in order to raise anything. People wanted you to raise two or three years worth of cash, etc., except AI. If you were an AI-related company, it was like you’re at the top of the hype cycle. It’s interesting, while most of tech was in a deep, deep recession, AI was in a crazy bubble. Now, both are correcting a little bit.

I think we’re post-peak in the AI bubble in tech, in terms of where people are raising at for new AI companies. I don’t mean the Game of Kings. I don’t mean the open AI type investors.

I mean applications of AI and the companies that were raising around it. We’re seeing some recovery in price discovery valuations and ease of getting rounds done in the venture side, but we’re still far, far, far from normality. It’s still harder than I would have expected it to be.

Some categories are completely unloved, like food delivery, for instance, and food tech in general, which basically, because everyone went and ordered food online in the bubble days, the companies grew a lot more and penetration increased more, and people expect that to become normal. When they shrank again, it multiplied by five and then divided by two. The problem is the divided by two is so painful that the category became very unloved.

Anything related to food, for instance, food delivery, food tech is completely unloved by investors, and that’s going to take a while to recover.

Jack: Is it fair to say that in the venture world, because it’s all about growth, if a company stops growing, that is just the worst thing a company can do from the investor’s point of view? Is that fair to say or no?

Fabrice: Depends on the stage. If you’re early stage, for sure. If you’re late stage and you take a year where you’re growing 10%, 20%, but you fix your unit economics, so you go from burning 100 million to being break-even, that actually is probably okay.

If you’re a seed stage company or a stage company, you’re not growing, then yes, that’s a death sentence, because we’re not PE investors. We need to underwrite a 10x or more. If you’re not growing, you’re not going to make it.

In the early stage, for sure, it’s true.

Jack: What about crypto and crypto venture capital? How involved with that have you been? Tell us how you first learned about crypto.

Fabrice: I’m a gamer. I had very powerful GPUs. As an intellectual exercise, I was mining Bitcoin on my GPUs in, I don’t know, 2010, 2011, very, very, very early.

As a venture investor, my specialty is network effect businesses and marketplaces. Crypto has extraordinarily profound network effects. If you think of the analogies of maybe operating systems like Microsoft Windows, there’s extraordinary network effects because once you have developers on the platform and developer tools, people build applications because they have applications, more people get it, and so on and so forth.

The same thing happens in layer one, so Solana or Ethereum, and then people build these applications themselves or marketplaces. If you think of something like Uniswap, it’s a marketplace where liquidity matters. You need to match supply and demand.

It follows the exact same dynamics as Alibaba or eBay or Airbnb and all of these types of businesses. We started investing in the private side of crypto pretty early in 2016 or 2017. We now have, I think, 70 crypto investments on the private side, which is about 10% of our fund.

We were at the very beginning of Figment and early investors in Animoca and some of both the fundamental infrastructure layer companies and application companies in the space. We were early investors. We continue to be investors in the space.

Now, on top of that, because many of the applications of crypto, the value accrues to the tokens and not to the equity, we decided to start investing in tokens as venture investors, meaning we value the team, we value the tokenomics, we value the company, and we buy the tokens, and we hold. We’re not a hedge fund. We’re not trading.

We’re not doing, but we’re just buying and holding. We bought 30 tokens, which were, well, we deployed 10% of our latest fund, which was a $290 million fund, so $29 million, but today it’s worth, I don’t know, $50 million. It got so big.

We realized that as a US venture fund, the limitations on having liquid crypto were pretty high. We’re not RIA, and so we could only have 20% of our book that is public and secondaries, and we do buy a lot of secondaries as well. It’s hard for us to recycle.

It’s hard, and in the US, it’s illegal to buy any of the tokens. In the US, it’s illegal to stake many of the tokens, so you’re leaving a lot of yield on the table. What we just did literally a few weeks ago is we spun off our liquid crypto assets into its own fund.

It’s called Trident Liquid. We took the entire liquid crypto team of FDA and put it in its own fund. We seeded it with the $50 million or whatever, I don’t know if it’s $45 or $50 that we put in, and now that’s living its own life.

In fact, I’m actually currently hosting a Trident Liquid crypto conference with a whole bunch of liquid crypto managers down here in Turks and Caicos. That’s the next thing we’ve done on the crypto side. Then the third thing is we have a studio program where we build companies, and I built a crypto company in the last few years that is now coming to the fore, basically.

That is Midas? That is Midas. Tell us about that.

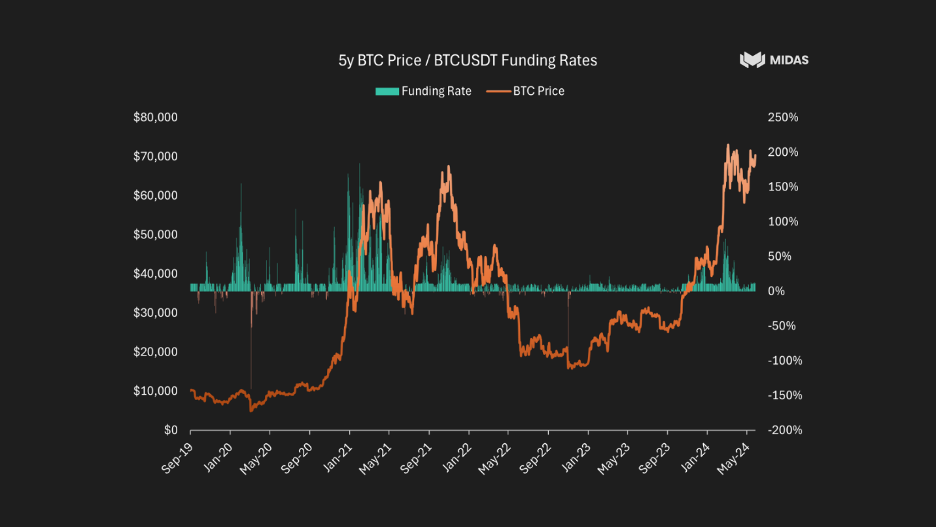

Post my macro analysis of 21, it was clear to me that as rates went up, we’re going to have a bear, a crypto winter, if you want, as we’ve seen before. What I was describing earlier in the venture space, where we’re in a complete bear market in 22, 23, and Q1, 24, that is starting to turn around, was even more so in the liquid crypto space, because crypto, whatever the bull thesis around it is, ultimately is a risk asset, and it’s possibly the ultimate risk asset. It is completely negatively correlated one for one with US interest rates.

I can tell you that the peak of crypto was the day before the US interest rates started rising. March 2022? No, I think the first or at least the announcement of the first rates was November 21.

Basically, as soon as rates started rising, crypto started falling. It went down massively. Most things were down 90%, 95%.

Many projects died. Of course, many projects were meme, coin-ish and not really viable. It led me and my partner, and I’ll tell you about him in a second, to think through, okay, what is a use case of crypto?

What is the use case of crypto? Ignoring digital gold, Bitcoin, which is okay, but it’s okay if you need a savings product and you’re in Argentina and you’re facing inflation, but in the US, not super useful. Ultimately, the one use case, the one mass market use case actually is stable coins.

Stable coins, USDC and USDT, are a combination of a means of exchange and means of payment and a store of value and extraordinarily useful. Again, not super useful in the US or Western Europe, where you have reasonably stable currencies, but in Argentina, in Africa, in most countries, extraordinarily useful. Even at the bottom of the bear market, there’s about 130 billion in stable coins.

My analysis was like, we’re no longer in a zero rate environment. The long-term FED’s funds rate is not going to be 0%. Maybe it’s not five and a quarter, maybe it’s 300 basis points, 200 basis points, but it’s not zero, in which case a non-yield bearing stable coin, which USDC and USDT are, doesn’t make sense.

Right now, you have Tether and then USDC, where you give them 100 USD, they go and buy T-bills, they make five and a quarter, you earn zero. I’m like, that makes no sense. There should be a yield bearing stable coin.

By the way, the idea that we’re paying in the traditional financial world with our checking account and that savings account, checking account distinction, it’s really a ledger entry in a bank in order to maximize bank profits. It’s not the way it should be. Actually, there’s a reason you couldn’t be settling in T-bills or settling in your savings account.

It’s just a means for the banks to maximize profits. I’m like, okay, obviously, crypto is a highly regulated space. The question I asked my partner, and I’ll tell you about it in a second, is like, is there a legal way to have a yield bearing stable coin where we can give most of the yield to the end user?

He comes from Goldman Sachs, his name is Dennis. We’d worked together on listing vehicle, we’d bought 200 million in treasuries, we’d gone through SEC registration. We realized that actually, in Germany, they have a bearer bond legal framework where basically, they do KYC and AML on issuance of redemption, but all signer transactions were not.

To the extent we could issue a security token that’s yield bearing, where we KYC and AML people on issuance of redemption, but all the signer transactions were not, KYC and AML, which means you can integrate in DeFi, and you can do long trades, etc. It made a lot of sense. We took a while because you have to become Mifit compliant, you need to be approved by the European regulators, we have to be my compliant, but we ended up building a company called Midas, where the first product is called MT Bill.

It’s a fully regulatory compliant bankruptcy remote tokenized T-bill, which you can use to do many things, including we’re integrated in lending vaults like Morpho, where you can borrow against it or lend against it. Because of course, if you’re going to be lending, you might as well have a yield bearing collateral. And in moments where DeFi rates are lower than the T-bill rate, you can do levered long trades, and you can make 15-20% on your T-bills.

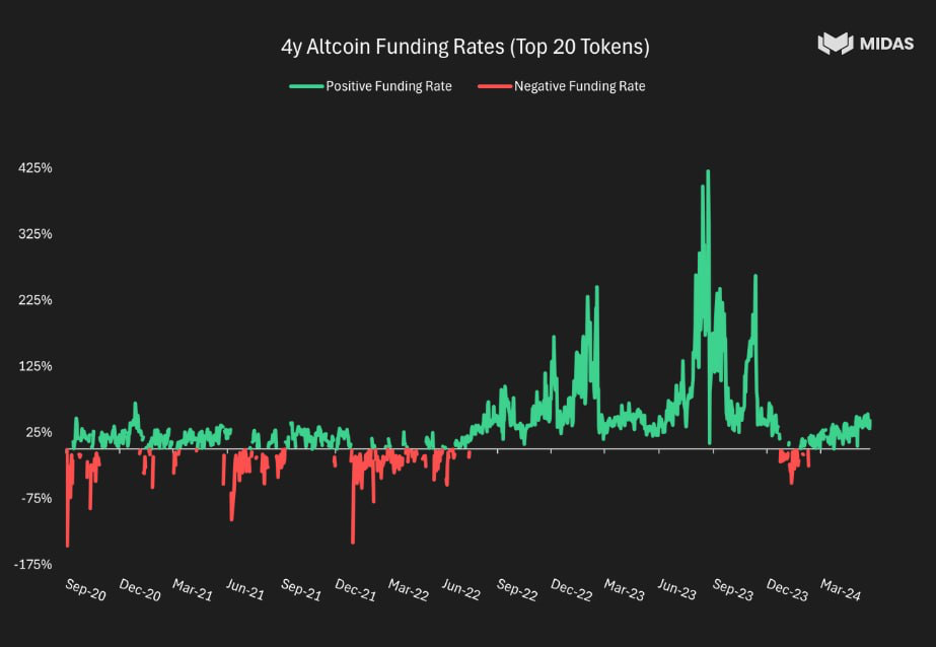

And we’re in the process actually of launching using the same legal framework, a delta neutral basis trade. So in a product called N-basis. So what’s been happening, the most successful probably company of the last year in the crypto space is a company called Athena, which is the fastest one to gather 3 billion of assets.

And what happens in bull markets? So what I want Midas to be is a crypto company that is safe for consumers and to offer institutional grade investment products that work in both bear markets and bull markets. So the bear market, you have a T-bill product, which gives you the T-bill rate, and then the bull market that you can do interesting things in DeFi with.

And then the bull market, you have a basis trade product. So the way it works is, because people believe in bull markets that Bitcoin, Ethereum, and others are going to be worth more in the future than they’re worth in the present, what you do is you create a basis trade where you’re long the spot, you own the spot, and you short the future rate. And because of that, and you create a future product, because of that, people are so bullish, they think BTC will be worth 100k, 120k, a million, whatever it is in the future, you can earn that spread.

And that spread in bull markets could be worth as much as 50% a year. Because if you think it’s doubling, you’re willing to pay 50%. Now, it obviously moves up and down based on people’s future expectation of where prices are.

But that’s a product that we’re launching in the next few weeks. So Midas is really an institutional grade tokenized security product that is completely regulatory compliant, bankruptcy remote, with two main products, tokenized T-bills and a tokenized basis trade product, delta neutral basis trade product.

Jack: So on this program, we talk a lot about traditional finance. So the basis trade we’ve talked about has been shorting treasury futures and being long cast treasuries. What you’re referring to is a crypto equivalent of that, of being short a Bitcoin future and owning the actual Bitcoin.

Exactly. And the reason that that would be a profitable trade is because everyone is so bullish on Bitcoin that they’re just buying Bitcoin futures. Exactly.

Fabrice: And therefore, and the trade in the very bull, right now, it only yields, I mean, only 15% or so. But like a few months ago, when people were really bullish, it was yielding like 50%. And the perpetual futures product is really a crypto invention where it reprices every eight hours or so.

But people like leverage in this business or in the crypto world, and there’s a lot of degens. And so it’s an extraordinarily profitable trade. Now, it only works in bull markets, right?

Like it would definitely not work in the bear market, but in the bear market, then you switch over to the tokenized T-bill product that is just your saving, safe savings product until you are feeling more bullish. And that trade work, both of these products are fundamental tools that people that want to be in the DeFi and the crypto ecosystem should be using.

Jack: o MT-bill is live, M-basis is on the way.

Fabrice: Correct. MT-bill is live, M-basis will be live within a month or so. We are currently, yeah, basically negotiating which of the three asset managers we’re going to be working with to do all the trades.

Jack: Got it. So in the traditional financial world, March 2020, the Fed took interest rates to zero and interest rates across the curve went to zero, did a lot of quantitative easing, which indirectly flooded the banking system with reserves. And it ended up being a lot of deposits were created.

So banks had lots of assets and there was a tremendous amount of non-interest bearing NIB deposits in the banking system. And, you know, you could get six basis points, but you didn’t really care because zero, six basis points, who cares? And in 2022, as interest rates rose, there was a massive transformation, an exodus of money outside of non-interest bearing deposits into money market funds to get a yield as well as interest bearing deposits.

So your thesis is basically the crypto world is going to undergo that transformation and money is going to come out of the non-interest bearing stable coins like tether or circle USDT or USDC and go into yield bearing instruments.

Fabrice: Correct. Be they depending on your risk appetite, just T-bills or a basis trade type product. Absolutely.

And it makes sense, right? Right now, Tether is the single most profitable company in the world on a per employee basis. That does not make sense.

Jack: Yes. So Tether, and I want to share my experience of it, of hearing, you know, some skeptical things about Tether and also saying, look, if they have all the money, 60 billion or now it’s over a hundred billion dollars, why don’t they just get regulated? Why don’t they just get audited and show that they have it?

They release these attestations. Interesting enough, funny to just reveal how it never ends up the way you think. I remember listening to a very popular podcast where Sam Baikman Freed was being asked by very good journalists, what’s up with Tether?

Is Tether a fraud? Is Tether going to implode? Of course, Tether is still here and Sam Baikman Freed’s empire has utterly collapsed and he is in jail.

Fabrice: If there was ever a hole in the Tether bank account balance sheet because of the money they’ve been printing of late, I bet they’ve plugged up.

Jack: Yes. Because they just have such low costs and they don’t pay anything on deposits and they get interest rates, which are now at 5.3%. Exactly. Got it.

And then Circle, USDC, tell me about that because that, you know, I think of it as, okay, we’re going to legitimize stable coins, we’re going to be audited, we’re going to be onshore. And so they had the US Treasuries, but I think they also maybe had something in money for against funds. I know for a fact they had deposits at Silicon Valley Bank.

So there was a de-pegging in March of 2023 because there was concerns about, is this going to be back, is this deposit good? Obviously they had over the limit of a quarter million dollars. Ultimately, all deposits were backstopped.

Fabrice: Do you think Circle made improvements, but you’re just looking to- Yeah, Circle is definitely way more sound, but they cannot give you yield because if they gave you yield, it’d be a security token and they don’t want to be a register of security in the US. It would actually defeat the purpose of everything they’ve built. Now we are not available in the US because for that exact reason, we’re a solution that is regulated in an institutional grade, but it’s non-US.

And given what Circle would like to do, I don’t think that’s a path they can go under or into unless their US regulatory regime changes dramatically. In which case, yes, or the incumbents are better positioned to do this than we are. In theory, the answer is yes, but regulatorily, I don’t think they can change the structure to which either of those are, and they cannot be yield bearing.

And the SEC has been going at anyone who’s been trying to give yield bearing counts pretty aggressively from Coinbase to BlockFi, you name it.

Jack: What regulatory regime are you in and where can people get involved with MT bills?

Fabrice: So they can’t do it in the US, but in all of Europe- Any country other than US and sanctioned countries. So we’re European regulated, which means you can buy us anywhere from Latin America to Africa. I mean, anywhere unless you’re sanctioned or US.

Got it. So what about China? I think China is a no-go as well, but I’m not that regulatory expert.

I probably should know the answer to that question. In fact, I suspect the answer is probably no.

Jack: Got it. Okay. So is it safe to say that the US has a crackdown against crypto and is more hardcore, less lenient than most other countries in the rest of the world?

Fabrice: Oh, for sure. I mean, the fact that what we’ve done in Europe, a completely regulatory compliant, et cetera, is actually an illustration of that. There’s no- What we’re offering, I mean, think of it, we’re buying US T-bills.

This is great for the US government. We’re financing its debt. You would think this is the one product they would love and yet illegal in the US.

I mean, it’s ridiculous. So the US has been extraordinarily conservative and backwards, and I would like them, and I hope that at some point they become more forward thinking. Now, admittedly, has there been a lot of fraud in crypto over the years?

Absolutely. ICOs, meme coins, things that have zero underlying value, but that doesn’t mean regulate the entire category out of existence. It means be a smart regulator.

The problem is, sadly, the regulators have not been particularly competent and or smart. So I would like smarter regulation in the US where you can actually prevent fraudulent use cases and yet allow for innovation. And I hope that that comes at some point.

Historically, the US has been the happy center of innovation. And a lot of the crypto innovation actually is in New York in a state where it’s actually, most of the activity is actually illegal. So it’s pretty weird.

We have consensus there. We have so many other crypto companies and yet you’re not allowed to operate. So it’s very odd.

Jack: And so you said regulatory compliant and bankruptcy remote. Tell us what that means, because as you referenced earlier in the crypto world, especially in 2020, 2021, crypto world was replete with protocols that were yielding 10%, 20%, 30% that appeared to have low risk or was implied to have low risk. So you were saying actually that this is you own US Treasury securities, which are the least risky securities in the world, Treasury bills.

Fabrice: Yes. So bankruptcy remote, what that means is if we go under, your assets are yours. And because we own the underlying assets or T-bills, you have your own assets.

So even if the company went under, you still have access to, you still own the underlying assets and you can recoup them. So the only risk you’re taking is US government default. So the actual T-bill risk.

So we’re not co-mingling, the funds are not in our own name. They’re actually in your own wallet. It’s not like SBF, if you want, and when they were doing FTX, where they basically were, they were playing with the client’s money.

And if they went under, they lost the money of their clients. So bankruptcy remote is something that’s reasonably rare still in the crypto world, but should be, I think, the norm where even if you go under, the clients own their underlying assets and they can recoup them.

Jack: Yeah. And in bankruptcy remote, in the TradFi brokerage world, I think my understanding is if you have a cash account, meaning you only buy securities with money that you actually have, that it’s most common to be, you know, if Morgan State, if you have the trade owned by Morgan Stanley, if Morgan Stanley goes under, which is not going to happen, very, very unlikely, but if they do, and you have a cash account, you still, and you own Apple, you still have that Apple share. But if you have a margin account, it gets a little bit dicier. Is that the same in crypto?

And I don’t even know if I’m right about that.

Fabrice: The, well, in crypto, many of the protocols out there are not, are just not bankruptcy remote. And so if that protocol goes under, you lose your assets. And so we’ve made sure that you own your own assets, regardless of what happens to us.

And you’re not doing margin with us, right? Like, so you may be borrowing on a third party, like Morpho, but you’re not doing it with us. We’re a primary, we’re a primary issuer.

Like you come to us for primary insurance or redemption.

Jack: Okay. Got it. And what kind of borrowing would people be doing with MT?

But would they be borrowing stable coins or would they be borrowing crypto or what?

Fabrice: So it depends what you want to be doing, right? Like if you’re super long on ETH or BTC, what you could do is you, instead of like, you deposit your MT, well, if you go to the right vault, so if we have the right liquidity vaults, depending on the rates, the easiest thing to do is you go to Morpho. Let’s say that people were in a bearish environment where DeFi rates are low.

You deposit MT bill, you borrow USDC or Tether at let’s say 2%, and then you buy MT bill at five and a quarter. And then you keep, and you can, because the US government, the volatility on T-bills is zero. And so you can do an LTV of maybe 90%.

So you put a thousand dollars, you borrow 900 bucks at two, I’m making up the rates because currently they’re high, but at 2%. With that, you buy MT bill that’s leading five and a quarter. You deposit $900 and then you borrow 810 at two and you keep looping it.

So you do a 10 to one leverage, let’s say we’re at 90%. And your five and a quarter becomes 15 or 20. So that’s one use case.

And you can get a long trade that’s extraordinarily profitable. Another use case is if you want to be a collateral for something, instead of you posting USDC or USDT as collateral, putting the MT bill as collateral is better because the value of your collateral is increasing over time because you’re getting the interest. So if you’re collateral for borrowing whatever, BDC, ETH, whatever, you’re still better off putting MT bill than USDC as collateral.

Jack: My understanding is that treasury bills are zero coupon instruments. In other words, if interest rates are 4%, you buy a one-year treasury bill. It’s not that it pays you annualized 4% every quarter or something.

You just buy it for 96 and you redeem it for a dollar. How does that aspect apply to MT bill? Does the same thing happen to where MT bill appreciates or is MT bill holders actually being paid interest unlike treasury bill holders?

Fabrice: So you have multiple ways of designing your token. You could be something called rebasing. So meaning you buy, it’s always worth one and the interest just means you get more of it, or it could be accumulating, which means that the interest accrues little by little and keeps compounding.

So we’ve, for a number of reasons, we’ve chosen to be accumulating. So the value just keeps accruing. So you have a dollar, it becomes a dollar five, it becomes a dollar 11 and it keeps going up basically.

So it’s increasing in value, accumulating in value.

Jack: So it’s the same as the treasury bill? Yes. Yeah.

So just every day, just increase it slightly in value as it is rolled up, pulled apart. Correct. Got it.

Interesting. Well, okay. So your next thing that you’re launching is M basis.

Anything you can reveal about your longer term plans for your longer term vision for Midas?

Fabrice: Yeah. Look, I think we’re at the very beginning of a transformation of the financial markets. The traditional financial markets need to be reinvented, right?

Like the way, imagine, it doesn’t make sense to me that in 2024, if I want to buy Apple stock and you want to sell Apple stock, we call our bankers, they execute the trade. There’s a custodian, a broker, a banker, and the settlement is T plus 72. And it only happens during business hours.

I mean, that makes no sense, right? Like why can’t you be doing it 24 seven with no intermediaries in real time? If I wire money to someone, there’s no real-time tracking.

And so creating tokenized assets as a means of transforming the financial world to world that is digital, digitized and happening on a real-time basis, I think is the long-term vision. We can easily tokenize bonds. We can easily tokenize stocks.

Now, does it actually make sense given in the West, you can easily go to Robinhood or E-Trade? Not necessarily. But from a long-term vision perspective, we need to reinvent the rails of traditional financial system such that it’s digital and operating 24 seven without all these layers of intermediaries and fees and crypto rails or a way to do it.

Now, payments, I suspect we’re not going to go down the crypto route. And I think we’re going to copy the examples of Brazil and Russia with PIX and UPI. Oh, Russia, India.

So India with UPI as a completely free real-time payment system that works between consumer and consumer, consumer and business, business and government, B2B. It’s like everything. And it’s free in real time.

And it’s extraordinary. And basically, the MasterCard Visa interchange tax has disappeared. And it’s led to an extraordinary innovation of like microtransactions, business models on microtransactions and a financial explosion and financial inclusion that is beautiful and magical that I cannot wait for it to happen in the West.

And so I think something like that is more likely to be displacing. So I think the payments rails will continue to be government controlled and will not be in the crypto rails. But when it comes to settlement of assets like bonds, et cetera, there’s no reason it couldn’t go in the crypto.

I mean, obviously, the incumbents really don’t want it, but it makes a lot of sense. So I do think we are going to be tokenized in addition to trying to take on the non-yield bearing stable coins. We’re going to tokenize other real world financial assets.

Jack: So you said you’re bullish on the tokenization of assets and settlements, which is what Midas is doing, but not on payments. So you don’t see this as payments and you don’t see crypto or stable coins playing a large role in the future of payments. I don’t want to put words in your mouth.

Fabrice: No, I’m not saying that, right? Like they’re amazing crypto adjacent payment applications like Dollar App. Dollar App has a crypto rail and they’re doing like over a billion in payments.

So they’re allowing you to like transfer money from the U.S. to Mexico and peso to dollar, et cetera, like the cheapest by far and cheaper than everything else from transfer wise, et cetera. And from that perspective, it’s revolutionary. I’m saying, but within country, so more things, payment for rails, what I don’t like in the West is everyone’s paying on credit cards with Visa and MasterCard and American Express, with a effective tax, the interchange rate of like, let’s say, 0.8% to 3%, depending on, you know, the country, the category, the merchant, the acquirer, et cetera. I suspect that if you can move that to a world where it’s zero, it would unleash extraordinary value. And there are two examples of countries where it’s happened. Now, could I build that on crypto, especially if I use something very cheap like Solana?

Like could Solana pay become an amazing payment mechanism? The answer is yes. And PayPal is doing that, right?

Exactly. So do I think it’s possible? I think the answer is absolutely yes.

And it’s just what I think through what are governments willing to give control up of and what I think is most likely to happen? I suspect that the more likely answer in terms of the outcome is that something like UPI or PICS, which is ultimately government controlled and regulated, is what happens in payments rather than a crypto rail payment system. I’m not saying can’t happen.

I’m just saying probabilistically, I suspect that’s not what’s going to happen, even though they will have a role to play and a meaningful role, especially when it comes to inter-country payments and exchanges and inter-currency systems. I mean, Dollar App, if you haven’t played, it’s 1L, D-O-L-A-R-A-P-P, is extraordinary. And by the way, the entire crypto rails is obfuscated.

You’re not aware that there is a crypto component to it. It’s just done for you, and it’s beautiful.

Jack: So UPI, Unified Payment Interface, would you say China also has that with UnionPay?

Fabrice: The Chinese equivalent, the big ones, which are actually private, or WePay, from Tencent, and Alipay from Alibaba. But the government hated them, and so they obviously shut down the IPO. And financials, I mean, so I’m an investment ant, a very disappointed investment ant.

So in China, it came about from the private side, but the government hated them and has been trying to do its best to kill them and replace them with their internal equivalent. But yeah, I would like something like that to exist in the US. A UnionPay type thing or a- Yeah, I mean, UPI.

Yeah, UPI, if we could copy and paste UPI or PIX for that matter, I’d be, yeah, extraordinarily delighted and happy. And the Fed has been kind of trying, a product called FedNow, but it’s only supported by regional banks, because obviously a lot of the banks don’t want to lose the interchange, which is a big chunk of the business model, and hasn’t reached public awareness yet. But there are, but it’s not consumer facing really yet.

So there are efforts in that direction, but I think it will take a decade or more to happen in the West.

Jack: So since their IPOs in the 2000s, Visa and MasterCard have been extraordinarily well-performing stocks as they have a high quality business. And if they continue, they likely will have a high quality business. It sounds to say like you think the best days of those companies are behind them?

Fabrice: Well, they are not necessarily because they have a lot of like regulatory capture and power, and I’m sure they’re going to fight this to the nail, right? Like this is the last thing they want to have happen. And the places where it happened, the penetration of credit cards was low, right?

So the reason I don’t think they fought it all that hard ultimately in Brazil and India is not that many people were wealthy enough to have credit cards and have good credit scores to justify having credit cards. And so you could build a completely brand new independent credit payment rails. Here where there’s an incumbent, two incumbents, I suspect it’s going to be very, very hard.

So if I was to take a bet, I’d say it doesn’t happen in the next decade and they remain the primary payment rail. So I’m definitely not short in the short term, neither of these, but I wouldn’t be an investor anyway. I prefer the stuff that goes from zero to a thousand, that stuff that’s already established.

Jack: Right. Just because you think you’re saying it would be a good thing for America if we had a UPI, but you think it’d be a good thing doesn’t mean that that’s necessarily what’s going to happen. Oh yeah.

Fabrice: There are a lot of things that would be good for America. We should have way more open immigration policy and immigration policy for both low skilled and high skilled, because it increases actually our national welfare and improves our demographics dramatically. We should have a much simpler tax system with a flat tax.

I mean, there’s so many things you should have that we don’t have. So there’s a difference between wishful thinking where I think will happen. I don’t think it’ll happen anytime soon.

Jack: So yeah. So your website is very easy to find, FabriceGrinda.com. Where can people find more information about Midas?

Fabrice: It’s Midas.app. So yeah, M-I-D-A-S.A-P-P. And if you want to learn about my venture fund, it’s FJLabs.com.

Jack: Got it. Fabrice, I just want to ask a question, moving away from crypto back to venture capital. I’ve interviewed and spoke with a lot of bankers from the banking perspective, what Silicon Valley Bank was like, the very large venture capital bank that collapsed over a year ago.

But I haven’t actually spoken, I don’t know that many venture capital people. I’m familiar with, there were rumors of every single person on venture capital is on Twitter and they’re in all those same chat rooms and they’re talking about it and they basically, word travels fast. But what was, I believe on Wednesday, Goldman announced that they were issuing the things and then speculation Wednesday night and the bank failed late morning, early afternoon of Friday.

So it happened really quickly. What was that 50 hour span like for you?

Fabrice: So we immediately pulled our funds. So we actually, because obviously we had more than 250K, the FDIC limit. And we were aware that doing that was an effort where else that that was likely to, the bank runners are going to lead the bank to fail.

But if we didn’t do it, obviously it’s a basic gain theoretical problem where the Nash equilibrium is a negative outcome where everyone pulls the money and as a result, good. So if no one pulled the money, it would survive. But if anyone, if people do and you don’t, you lose your money.

So everyone does it. And the Nash equilibrium is a negative outcome. So we pulled the money immediately.

So we were okay. But then we realized a lot of our portfolio companies had not pulled it on time. And by the time they tried, and so we had a few portfolio companies that had like a hundred percent of the balances there.

So emergency board meetings on Sunday for like, what do we do? We have to make payroll and we don’t have any money and we can’t raise money because it takes three, four, five, six months to raise money. So it was a pretty harrowing set of hours.

And by the way, all of that didn’t need to happen. What happened is the accounting rules for banks was changed such that if you intend to hold a security maturity, you don’t need to write to write a market. And so that’s what kept creating as rates started going down and the value of the bonds started going down, I’m sorry, rates going up and the value of bonds going down, that ever bigger increase in the difference between book value and market value.

And that was all driven by, I think, an accounting law change approved by Congress in like 2017 to 2018. If we just kept mark to market, that massive Delta and gap would not have happened, nor were that incentive to buy higher, riskier, higher rate bonds have existed in the first place. And so it was that basic, now, were the SVB guys prudent?

No, they should have been way more prudent. That said, was I a happy SVB customer? Yes.

I wasn’t happy with them because they were giving me higher rates on my checking average savings, et cetera. No, they’re just easier to work with. We all banked at SVB because they’re friendly and they’re easier to work with.

What does that mean, easier to work with? What does that mean? How quickly do you open a bank account?

If you need a wire to have it, how quickly do they wire it? If you ask a question, do they pick up the phone? Try to go open a bank account at Citibank and it’s a painful process of days and paperwork and try to talk to someone there and no one ever replies.

It’s like an anonymous person in India, somewhere at a call center may talk to you. Just someone who’s consumer centric and friendly. We didn’t bank with them because they gave us better rates.

We banked with them because they were customer friendly. Their NPS score, the experience was high. And in fact, I think we still bank with them because they’re still friendly and great to work with.

Jack: And so they failed, taken over by the FDIC. Their assets and franchise eventually was transferred to First Citizens Bank Shares. The ticker is FCNCA, which I do not own the stock, but if you look at the stock chart, benefit enormously from this gain.

So they now own Silicon Valley Bank and a lot of their entities. And so you and a lot of your portfolio companies still bank at Silicon Valley Bank, which is owned by FCNNCA. Is that accurate?

And do a lot of your colleagues who are other venture capitalists, is that also fair to say that they have stuck with the Silicon Valley Bank brand, even after it’s- That is accurate, but with a wrinkle that before, look, we never saw our job as like, should we be doing credit checks on the banks that we bank with?

Fabrice: No, we assume the banks are sound, right? And so we had all of our assets in one bank and we were non-multibanks. Now everyone in the venture world and everyone of our portfolio companies has multiple banking relationships.

And so we bank with JPMorgan Chase and Morgan Stanley. I mean, we have, now we have many bank accounts because we don’t want what happened here to happen ever again. And I’m glad that the FDIC decided to ensure the entire, all the deposits, because the reality is, again, I don’t think it’s our business to be looking at the balance sheet of banks and decide whether or not they’re sound.

We just want a place to park money that’s safe. Because again, we’re using it for cash management. We’re not doing any, we’re money losing companies, right?

Like, and as a result, we’re writing checks to employees, et cetera. We can’t be losing the assets we have under management. We’re not speculating with that money.

It’s literally, it’s in cash because we need to be writing checks every day, multiple checks every day and wires, et cetera. So we just want banks that we can send money with easily. And the traditional banks made sending wires too painful.

I mean, it’s that simple.

Jack: You can see that looking at Silicon Valley banks filings and investor presentations, the enormous amount of fundraising that occurred in 2020 and 2021 caused deposits to surge as money flooded into the bank accounts of VCs and VC backed companies. Then when the fundraising slowed down, there still was an influx, but just a lot less. And the deposits went down so much because venture cap, as you said, they are often or almost all the time burning money and losing money.

So their deposits would go down. Exactly.

Fabrice: Yeah. And by the way, banks in general, I mean, going back to the macro point, part of the reason I was worried about the macro is as rates go up, people just move money out of banks into T-bills and money market funds. And so the bank deposits, as we’d be at the specific reason it would go down, which is the companies are burning capital.

We’re not raising any more money. So obviously deposits are going down, but bank deposits writ large have been falling pretty dramatically at the same time as commercial real estate that have been defaulting. And so banks are also in their balance sheet is being ballooned by like these commercial real estate companies that are taking over.

And that’s why I was worried because I’m like, oh, lending is going to fall. And so it was one of the reasons I thought maybe we’d have a recession because of the higher rate environment, but consumer, because employment has remained strong and wage growth has remained strong, it hasn’t happened. So it’s been more than overcompensated, but yeah, you explained why deposits SVP fell, but frankly, deposits everywhere have been falling pretty dramatically because you’re better off being in T-bills and money market funds than in your bank checking account.

Jack: Right. So you say you were worried about a recession and now you’re less worried about it. I think a lot of folks, you’re definitely, I mean, Bloomberg economics had a 99% probability of a recession in the fall of 2022.

So yeah, most people, myself included, thought that and the recession has not arrived. Where are you thinking we are in the business cycle? Do you think, oh, the recession is still going to come, it just will come in 2025?

Or are you thinking, no, we are at the beginning of a new economic cycle and sky’s the limit?

Fabrice: There will eventually be a recession, but it doesn’t need to be related to this cycle specifically. It looks like right now, should we end up with price more under control, that we’re more likely to be heading for rate decreases than rate increases. And so, I mean, I’m not underwriting many rate decreases and small rate decreases in the future, but I could see us in a year’s time or a year and a half being at whatever 400 basis points instead of 525.

And I think absent a geopolitical accident, I think we just keep chugging along. I don’t think we’re going to have extraordinary growth, but I don’t see a recession either. That said, do I think there’s a real risk of an exogenous shock to the system from whatever China blockading Taiwan to what happens if Trump is elected to whatever?

Yes. And those are exogenous. But ultimately, employment remains strong, wage growth remains strong, and it seems to be overbalancing all the negatives we have in the system.

And maybe we end up clearing the bank balance sheets and the commercial real estate debt, et cetera. It’s going to take a while, by the way. But I look at the world in probabilistic terms, as you do.

And in 22, I think I was like 66% recession, and like, or let’s say 60% recession, 30% soft landing, 10% somehow we’re OK. And now I’m, I don’t know, 10%, 20% recession, and more likely just chug along as the majority case in soft landing and 20%, 30% probability. So it’s definitely changed my perspective.

But with this democracy sword of geopolitics, which I think could surprise us negatively at any time, but who knows when, why, et cetera. And you can’t live life worrying about it. And so I just keep chugging along and executing.

And again, the business cycle I care about the most is not the one I’m investing in today. It’s the exits in 5, 10, 7, 10 years when these companies mature. So in the venture space specifically, I actually think now is the very best time to be investing in venture.

Less competition, reasonable valuations, founders that are focusing on burn and unit economics, trying to solve big problems. So I’m beyond profoundly bullish on the venture space. And even if a recession happens, we gain share, we take share away from the less efficient offline world, and you grow, maybe you grow less fast, but you still grow.

So I’m beyond bullish.

Jack: And how bullish are you on the specific subsector of AI-based companies? Observers in the public markets will note that it is only a relatively small number of stocks that are, the market perceives as AI beneficiaries. And if you look at actually net income and revenue, that gets even smaller and really less, the Magnificent Seven is more than Magnificent One, NVIDIA, whose growth has just been incredible, and I believe unprecedented for any company sufficiently large.

But in the private markets, I don’t really know what it’s looking like. So can you just describe that environment a little bit? Earlier, you said that the AI sector was extremely hot and maybe slightly, slightly less hot.

So yeah, just describe that scenario as well as your views on it.