By Matias Barbero

“No more …. masks. Everything open too. School opens this week — Thursday! Did you ever? As if they couldn’t have waited till Monday!”

With multiple vaccines around the world, the COVID-19 pandemic seems to be coming to an end. The US for example is currently applying +3mm doses per day, and at this pace, it will take less than 3 months to cover 75% of the population.

The quote above belongs to a 15-year old, Violet Harris, who’s excited about the taming of the virus. Thing is… that quote was taken from a 1919 dairy announcing the end of the Spanish Flu which, in 1920, marked the beginning of one of the most exuberant, remarkable, and catastrophic eras in recent history.

The 1920s was an age of unprecedented change in almost all aspects of life. Ford made the most modern cars accessible for the masses for the first time; technological innovations like the radio and telephone changed the way people thought about entertainment and community; retail investors rushed to the stock market like never before; there was an explosion of consumerism. The list could go on.

Not only the pent-up energy after a draconian lockdown resembles what we are currently living, but swap some keywords from the paragraph above for Tesla, Zoom, social media, and Reddit and we could very well use it to describe what seems to be the beginning of our own version of the roaring 20s.

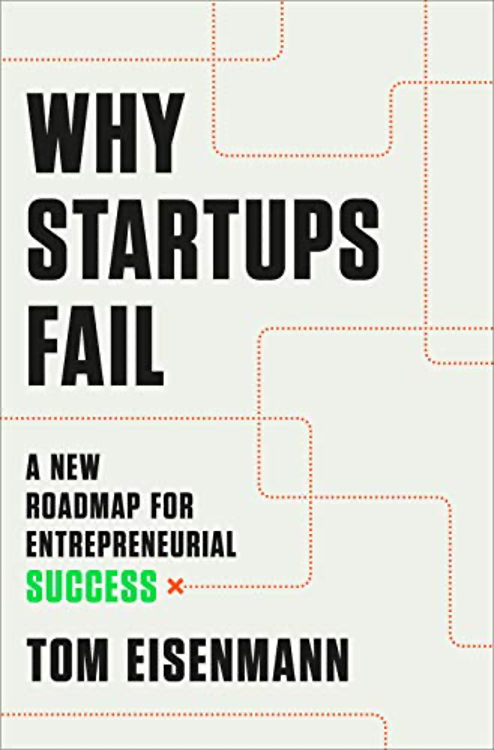

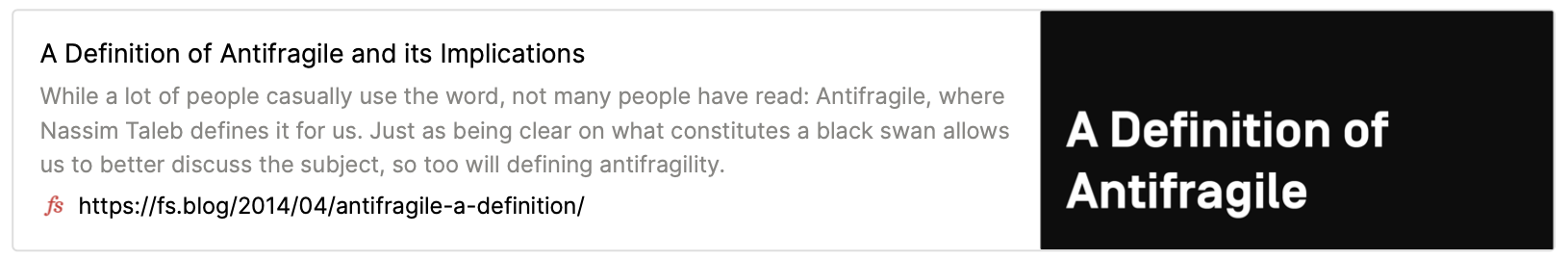

But we all know how things ended almost 100 years ago. The roar suddenly morphed into a painful moan and in 1929 burst the bubble and marked the start of the Great Depression. So far, this century’s 20s are by all means roaring (Figure 1), but are they also going to end up moaning like their predecessor?

Figure 1

Figure 1Killing a mosquito with a bazooka

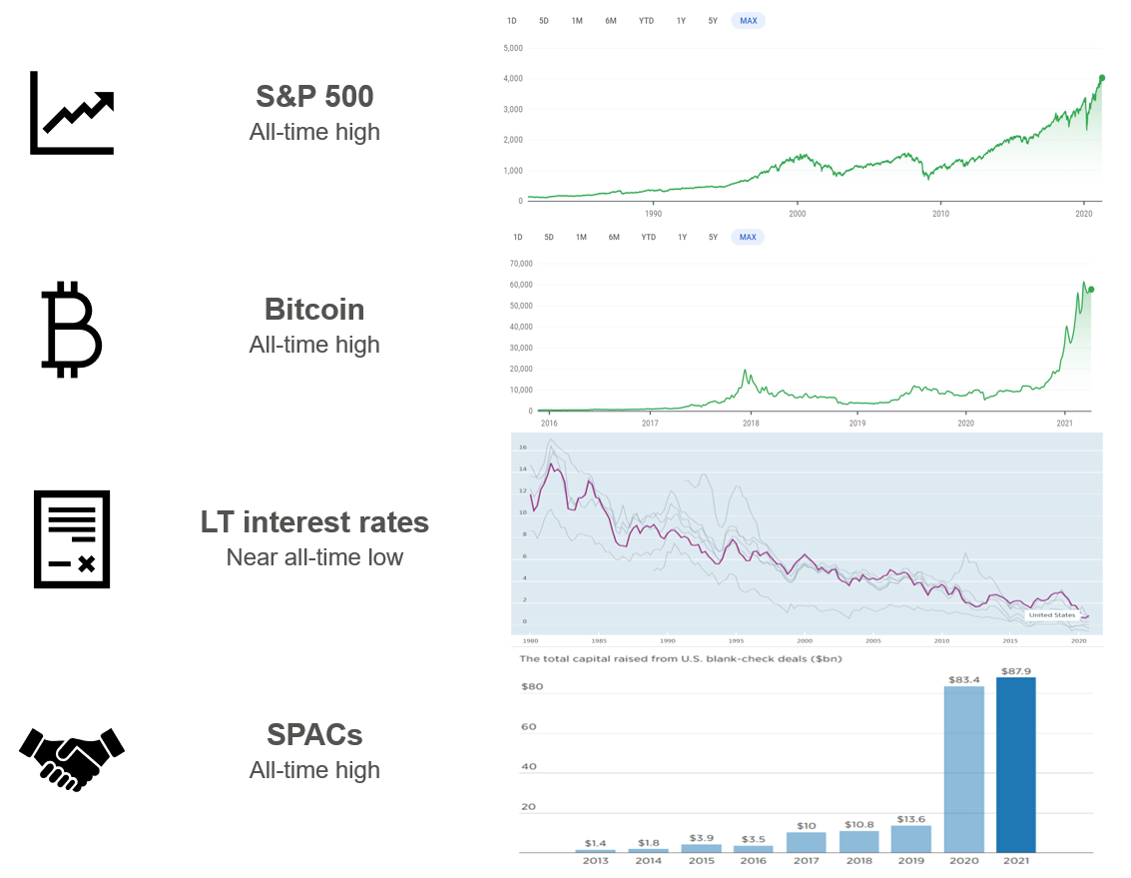

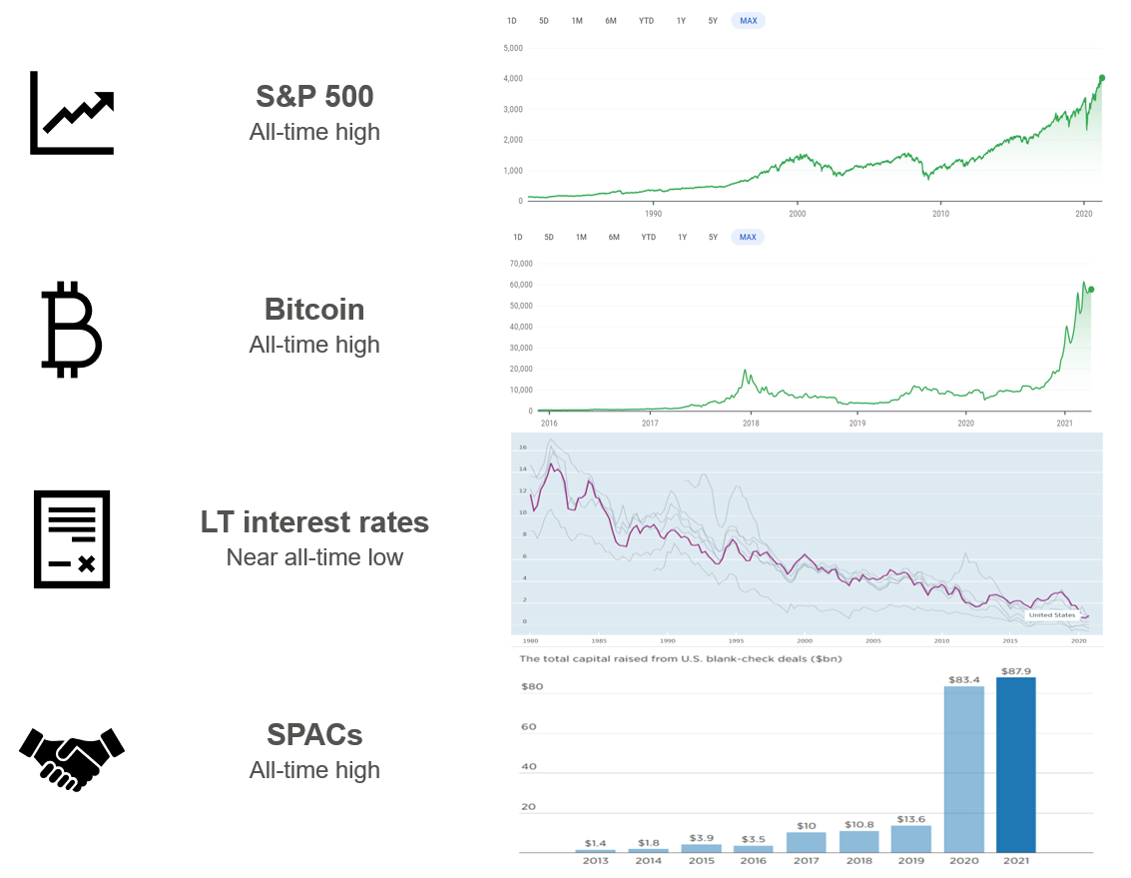

At the same time, and partly causing the above, government spending is off the charts. On March 27th of 2020 Trump passed an unprecedented act to combat Covid-19’s economic disaster: a $2.2 trillion stimulus bill which included loans for corporations, unemployment benefits, and the well-known $1,200 checks given to individual people. This was more than what Bush and Obama had each passed as a consequence of the great recession, COMBINED… and what they did was already unmatched by any other stimulus package in recent history. The Marshall Plan, for example, was a US$130bn program providing aid to Western Europe following the devastation of World War II (Figure 2).

In comes Biden and signs an additional $1.9 trillion stimulus into law, making the total budget assigned for Covid-19 relief a whopping $4.1 trillion. Now, only ~1 month after, Biden is looking to pass a $2 trillion infrastructure plan to “re-shape the economy”. The bill is already headed to Senate and is expected to be passed in August of this year.

It’s not my intention to judge on the utility or need of these individual plans but to point to the staggering amount of money that the government is spending. Do we need to push the printing machine to this extent? Take a look again at Figure 1; are we re-building the economy just like previous administrations did after catastrophic world wars or recessions? Or are we fueling the bubble, or worse, creating new bubbles everywhere?

Figure 2

Figure 2If you think our roaring twenties may moan…

I will not waste your time by making pointless predictions about what will happen next or when. Instead, I would like to present a couple of options in case you were wondering what to do or how to be prepared for a scenario like this.

Yes, fiat money depreciates over time and suffers the effects of inflation. The discussion above on the government going brrrr with the money printing machine will only worsen this condition. In the long run, if you just hold cash, you’re going to see your purchasing power deteriorate through dilution of the currency. But fiat money, particularly the US dollar, is still used for virtually all transactions you will encounter in your daily life today and is, arguably, one of the best assets to hold during periods of a market downturn. So, if a crisis does hit, you may want to have some cash reserves that will a) not be subject to the swings of the market, and b) will enable you to opportunistically buy your favorite stock at a steep discount and quickly reduce your cash position thereafter.

This may vary based on personal situations, but aiming to have 20% cash or more of your assets could be a smart move. Our own Fabrice Grinda suggests this approach and has a great piece on the everything bubble that I highly recommend.

An alternative along the same vein would be to pick a different currency other than the US dollar. The Swiss Franc has historically been used as safe heaven given the stability of the Swiss government and its financial system. So you may want to diversify your cash holdings and own some Swiss Francs too.

2. Let’s get physical

Real estate. After the great recession of ’08/’09, we came to associate economic crisis with real estate crisis but that’s not necessarily always true. Investing in real estate has always been a synonym of inflation hedge. That’s one positive point. How real estate will perform as an asset class during a crisis will depend on the nature of the crisis itself. But considering investing in land, farms, and high-quality apartment buildings could hold up better than most alternatives, are less volatile, and may result in a winning strategy.

Legendary media mogul, John Malone, has mentioned in several recent interviews that he worries about the current frothy markets and that the way he’s personally insulating himself is by buying forest land, farms, and high-quality apartment buildings. And he’s not the only one… ever heard of Bill The Farmer? Me neither, but Bill Gates is now officially the largest farm owner of the United States.

3. Cryptocurrencies

I will make this a short sub-section given I basically laid out the case for crypto in point number 1. Owning bitcoin and other cryptocurrencies are a hedge against inflation but also against current governmental and financial institutions. This is a deep rabbit hole and could write many dedicated posts on it. If you don’t have exposure to crypto yet, I’d assign a certain % of your overall portfolio and follow Balaji’s advice to put 50% on Bitcoin and 50% on Ethereum. If you already do, then you’re probably a convert and can get more sophisticated with the choice of assets : ) Crypto would fit the ‘risky asset’ bucket mentioned later in the post and could also be hedged using put options (see below).

4. The antifragile option

I love the ‘antifragile’ term coined by Nassim Nicholas Taleb. It’s such a powerful concept and extremely relevant to the topics we’re discussing today. In a nutshell, being antifragile is gaining from disorder. A crystal is fragile (hates shocks), a rock is robust (indifferent to shocks), Hydra, the Greek mythological creature, is antifragile: when you cut one head off, two grow back in its place. So what if we can actually benefit from the burst of a bubble?

A. CDS

In early 2020, billionaire investor Bill Ackman pulled what some called the ‘single best trade of all time’ turning $27mm into $2.6bn in a matter of weeks. He basically used financial options to bet against the American economy thinking the then incipient Covid virus would have a greater economic impact than it was priced in by the markets at that time.

But how? You may ask. Ackman used a combination of CDS (Credit Default Swaps). Here’s a refresher by Margot Robbie for those who need it. You could buy CDS for a company, a country, or other entity. In this case, Ackman bought CDS on US Investment Grade Bonds, European Investment Grade Bonds, and US High Yield Bonds. Think about CDS as buying fire insurance for your house. You pay a regular fee and get reimbursed if your house burns down. He initiated the trades when these indexes were trading near all-time tight levels (cheap premiums) and sold them once he saw the government was rushing with firehoses to contain the Covid fire.

Small caveat: banks typically require long bureaucratic processes before you can place trades on instruments such as CDS and will most likely not pay attention to you unless you have $50mm with them. I know. Don’t kill the messenger.

B. Put options

If you’re just a mere mortal like myself, armed with a Robinhood account and not much else, the strategy below is one I really like to keep investing in the markets while hedging ‘fat tail’ risks using put options. There’s a detailed explanation of this strategy used by Universa hedge fund in this article, and I will list a step-by-step in the simplest way I can:

- Each month, set aside 0.5% of your total exposure. If you have, say, $100k invested in the S&P then you will need to spend $500 per month on this strategy

- Buy put options of the market you are trying to hedge from. In this case, it would be S&P put options but the same could also apply to hedge against whatever exposure you have (e.g., Apple stock, bitcoin, etc.).

- Should I buy any put option? No. Buy ~2-month put options that are about 30% out-of-the-money. That is, if the S&P is currently trading at a symbolic price of $10 you will want to buy put options expiring 2 months from today at a strike price of $7. We are going after “cheap” options that will be highly valuable if the market plummets

- Repeat. Every month you should roll your options and purchase new puts with 2-3 months expiration dates and ~30% discount with fresh $500 and whatever proceeds you have from selling your existing options

The reason this strategy is so hard to implement consistently is because 99% of the time it doesn’t work (if the stock market doesn’t crash your options will be sold each month for almost nothing)… but when it works, it works big time. You take small hits every month (just $500 in our example) but you’re likely more than compensating with one large win if the crisis does come (enter Bill Ackman’s example from before).

It’s the opposite of eating like a bird and pooping like an elephant.

The [insert adjective here] 20s

It’s April of 2021. We’re living through and building our own version of the “roaring 20s”. Time will tell which adjective is the one we’re supposed to be using here. So far, some of the similarities with its predecessor are striking. I will not pretend to know when or if the ‘bubble’ will burst. The best way to avoid a bad hangover is not even going to the party in the first place, but this party has proven to be a particularly fun one to attend (figure 1). The options from the section above are some alternatives that we have at our disposal to alleviate the headache if the party suddenly comes to an end. If you’re inclined to pick ‘terrible’ as your adjective for our 20s and are really worried about the current state of the markets, then you could use one or a combination of the options above to protect your portfolio. If instead, you are thinking of a synonym of ‘roaring’ and believe this party is yet to be over, then you can combine your choice of ‘risky’ assets (e.g., stocks) with one or more of the choices from above (barbell strategy: high-risk assets on one end and one or more protective alternatives on the other). As for my choice of adjective, I’m going to play it safe and allow for both an exciting and a painful outcome. I shall call it the moaning 20s.

Matias is an investor at FJ Labs. Previously, he was an M&A investment banking associate at JPMorgan. Before that, he held different strategy, marketing, and finance roles. Originally from Argentina, Matias holds an MBA from Duke University, where he graduated with honors as a Fuqua Scholar. You can follow him on Twitter at @matiasbarbero13

Further Reading:

Nothing in this post is financial advice. The goal of this post is to have a conceptual discussion around the topics covered here and generating awareness of the options available to people looking to diversify and/or prepare themselves for a potential shock in the near future. The financial instruments covered in this post are highly volatile and could lead to large losses if not used responsibly.