FJ Labs gets deal flow from 4 sources:

1. Other VCs

2. Entrepreneurs in our network

3. Cold inbound messages

4. Outbound outreach

It is my understanding that many VCs, particularly junior ones, spend most of their time reaching out to startups they may want to invest in. They run scripts on LinkedIn to identify tech companies whose employee count is growing rapidly, have associates attend meetups and cold call startups that sound interesting.

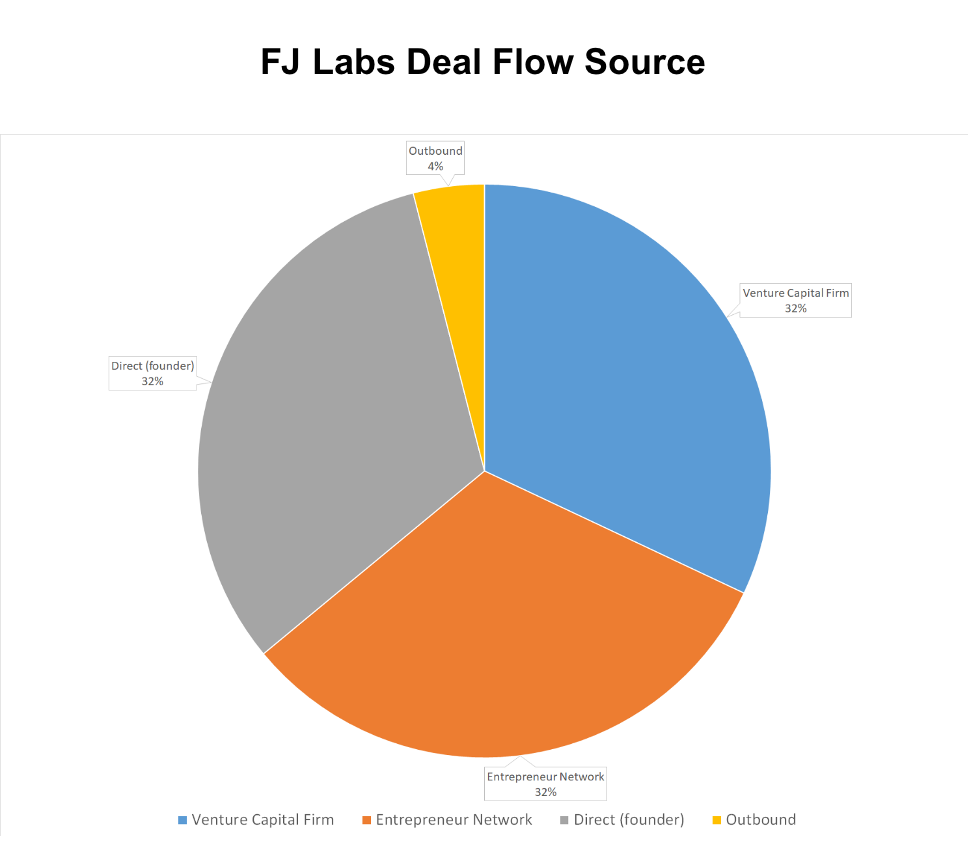

We are very privileged that we do not have to do this. We are once again helped by our focus on marketplaces. Given our domain expertise, most entrepreneurs who are building a marketplace want us involved in their startups. As a result, most of our work is reviewing inbound deal flow. Every week we receive around 100 deals and review around 50 of them. In 2019 for instance, we evaluated 2,542 companies which averages out to 49 per week. 32% of the deals we review come from other VCs, 32% comes from our entrepreneur network, 32% from cold inbound messages and only 4% from companies we reach out to directly.

1. Deal Flow from other VCs

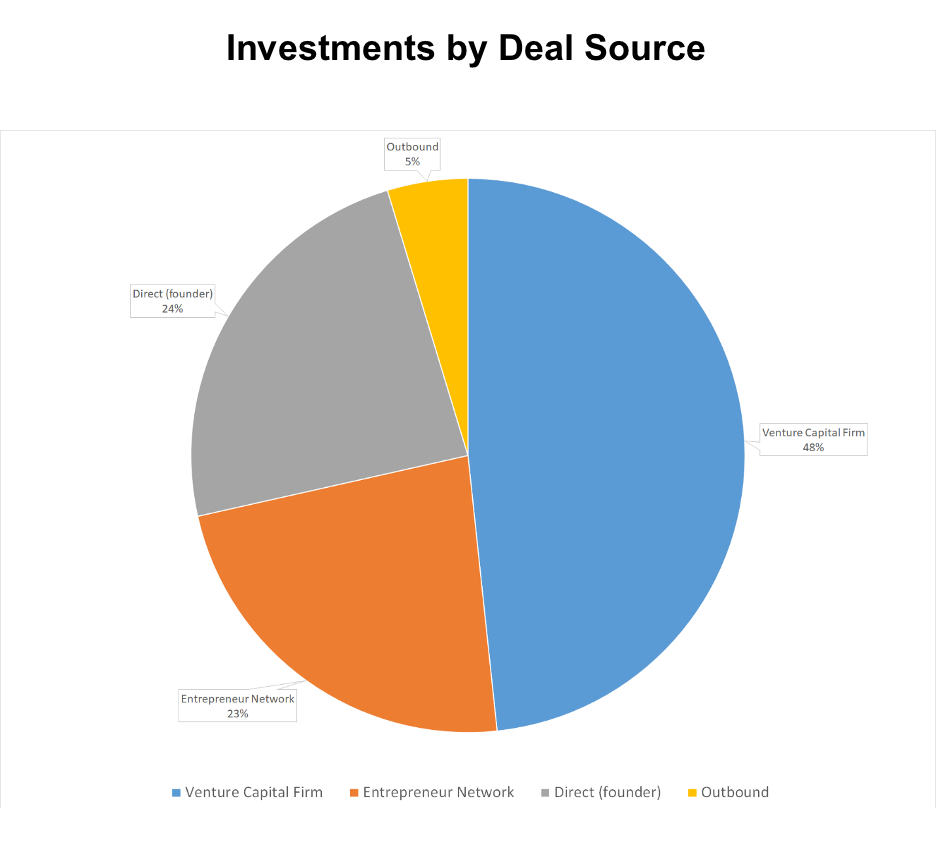

48% of the deals we invest in come from other VCs, highlighting the higher quality of this deal flow source in general. The reason we get so many deals from other VCs stems from FJ Labs’ investment strategy. We do not lead or take board seats; we write small checks and have no minimum ownership requirement. As a result, we do not compete with VCs for allocation. Instead, they see us as friendly, value-added investors given our specificity and expertise when it comes to marketplaces.

We do deal flow sharing calls with around 100 VCs every 8 weeks covering almost every stage and geography. We have a tailored approach where we present the right VCs to the right startups. The VCs love this because they get differentiated, tailored deal flow. The entrepreneurs love this because they get curated meetings with top VCs. We love this because the startups we care about get funded. Those VCs also invite us to co-invest with them in the marketplace deals they are evaluating, not only to get our perspective on the opportunity, but also to help the startup once the investment is made.

2. Deal flow from entrepreneurs in our network

At this point we have invested in over 600 startups with 1,400 founders. These founders frequently come back to us when they raise money for their next startups (always a good sign that we are friendly, helpful investors), and introduce us to their friends and employees who become entrepreneurs.

This is also part of the reason we offer FJ Labs founders the opportunity to co-invest alongside us in our Entrepreneurs Fund, a micro fund that we manage on AngelList. Our founders can diversify their exposure across the FJ Labs portfolio and are further incentivized to bring us their great deal flow in the process because they can share in the upside.

This is the deal flow source that leads to most of our non-marketplace investments because if you were a successful entrepreneur for us in the past, we will back you regardless of what you build. For instance, this is how we ended up investing in Archer, an electric VTOL aircraft startup. We previously backed Brett Adcock and Adam Goldstein in their labor marketplace startup Vettery which was sold to Adecco. We were excited to back them in their new startup despite our lack of domain expertise in electric self-flying aircraft.

3. Deal flow from cold inbound messages

I suspect that for most VCs, cold inbound emails are auto deleted or sent to a black hole where they are never reviewed. We take the time to review all messages sent to us and review deals that are appropriate.

In full transparency, this is the typically our lowest quality deal flow channel, and accounts for most of the difference between the 100 deals we receive every week and the 50 that we review mostly because we are sent many deals that are potentially compelling but completely out of scope for us: biotech, hardware, even offline investment opportunities.

The real number of “deals” we get is over 100, but unless you put enough information in your message to us to evaluate if we want to review the deal, we cannot even consider it as an opportunity. It is shocking the number of weekly messages we get that just say: “I have a great startup; do you want to review a deck?”

But the reason we continue to keep this channel open is there have been diamonds in the rough that have led to some phenomenally successful investments. A surprisingly high 24% of our investments come from cold inbound outreach by the founders. Amazing companies such as SmartAsset and Meliuz (which seems to be considering an IPO) came from cold inbound messages.

Most cold inbound deals come to my Linkedin or email, but I also receive a fair amount on Facebook, Instagram, and Twitter. We used to have a startup submission form on my blog, but I pulled it down because the quality was too low.

We are not that hard to get an intro to, but if you want to reach out to us cold, the best way is to contact me on LinkedIn or by email. Make sure you tell us what you are building, how much traction you have and attach a deck.

4. Outbound outreach

Because we are drinking at the firehose of our inbound deal flow, we do not spend much time reaching out to startups. Our outreach emanates from the brainstorms and deep dives that we do. Twice a year, I invite my FJ Labs colleagues to my house in Turks & Caicos to think through ideas that do not exist that we should create or convince entrepreneurs to build. On average we come up with over 100 ideas each time (over 200 ideas per year!). Also, during the year different team members do sector analysis in line with their interests: logistics, proptech, etc. These exercises uncover a fair number of startups we were not aware of and reach out to.

Conclusion

This post is more for your information to share how we operate rather than meant to have a specific so-what. However, it should be helpful for entrepreneurs thinking about how to reach out to us. Likewise, if you are a new venture capitalist, my recommendation would be for you to build a brand around a certain sector or category such that people want you in those deals so you can allocate less of your time to outbound outreach.